Marketability discounts, also known as the lack of marketability discounts, refer to the reduction in the value of an ownership interest in a business due to the limited ability to sell the interest quickly and easily. This discount is typically applied to ownership interests in privately-held companies, which often face greater challenges in finding buyers and completing transactions compared to publicly traded companies. The purpose of applying a marketability discount is to accurately reflect the value of an ownership interest in a business considering its limited marketability. This discount is commonly used in business valuations for purposes such as mergers and acquisitions, shareholder disputes, estate planning, and tax reporting. Ownership interests in privately-held companies often have limited liquidity due to the absence of an active market for these interests, making it difficult for owners to sell their stakes at a fair market value. Privately-held companies do not have publicly traded shares, which means there is no readily available market to buy or sell these interests. The lack of an active market can result in lengthy and complex negotiations to sell an ownership interest. Ownership interests in private companies may be subject to legal or contractual restrictions on transferability, which can hinder the ability of an owner to sell their interest. Potential buyers may have limited access to the financial and operational information of a privately-held company, which can make it difficult to assess the company's performance and value. Selling an ownership interest in a private company can be time-consuming and costly due to factors such as negotiations, due diligence, and legal fees. These factors can contribute to the marketability discount applied to the value of the interest. The guideline public company method is a market-based approach that compares the subject company to publicly traded companies in the same industry. This method takes into account the marketability discount by adjusting the valuation multiples derived from the public company comparables. The precedent transaction method is another market-based approach that compares the subject company to similar companies involved in past transactions. This method considers the marketability discount by adjusting the transaction multiples based on the marketability of the ownership interests involved in each transaction. The market approach is a broader valuation method that incorporates both the guideline public company and precedent transaction methods. This approach adjusts valuation multiples for the marketability discount, considering the factors that contribute to the discount in each case. The income approach, which includes methods such as discounted cash flow (DCF) and capitalized earnings, can also incorporate a marketability discount. This is achieved by adjusting the discount rate or capitalization rate to reflect the limited marketability of the ownership interest. One way to estimate the marketability discount is by analyzing comparable transactions involving ownership interests with similar marketability characteristics. The difference in valuation multiples between these transactions can provide an indication of the appropriate discount. Market data, such as studies and surveys on marketability discounts in specific industries, can also be useful in estimating the marketability discount. This information can help determine the typical range of discounts applied in similar situations. Examining industry norms and practices can provide insights into the typical marketability discounts applied in a particular industry. This can help ensure that the applied discount is consistent with market expectations and reflects the economic reality of the ownership interest. Quantitative models, such as option pricing models or regression analysis, can be used to estimate the marketability discount by considering various factors that affect the marketability of an ownership interest. These models can provide a more systematic and data-driven approach to estimating the discount. The application of a marketability discount can significantly reduce the value of an ownership interest in a privately-held company, reflecting the challenges and risks associated with selling the interest. The marketability discount can influence negotiation dynamics in transactions involving ownership interests with limited marketability, as it can affect the bargaining power of sellers and potential buyers. Marketability discounts can have important implications for taxation and estate planning purposes, as the discounted value of an ownership interest may result in lower tax liabilities or estate valuations. Accurate estimation of the marketability discount is essential to ensure fairness in business transactions involving ownership interests with limited marketability, as it helps to ensure that the value assigned to these interests accurately reflects their true marketability. Proper estimation and application of the marketability discount can help businesses and individuals comply with legal and regulatory requirements related to business valuations, such as tax reporting and estate planning regulations. Applying an appropriate marketability discount helps to provide a more accurate reflection of the economic reality of an ownership interest in a business, taking into account the various factors that contribute to the discount. The concept of marketability discount plays a crucial role in business valuation, as it helps to accurately reflect the value of ownership interests with limited marketability. By considering the various factors that contribute to the discount, such as liquidity, transferability, and access to information, valuations can provide a more accurate representation of the economic reality of an ownership interest. The proper estimation and application of the marketability discount are essential for ensuring fairness in business transactions, compliance with legal and regulatory requirements, and accurate reflection of economic reality. By carefully considering the factors contributing to the discount and using appropriate valuation methods, businesses and individuals can achieve more accurate and reliable valuations for ownership interests with limited marketability.What Is a Marketability Discount?

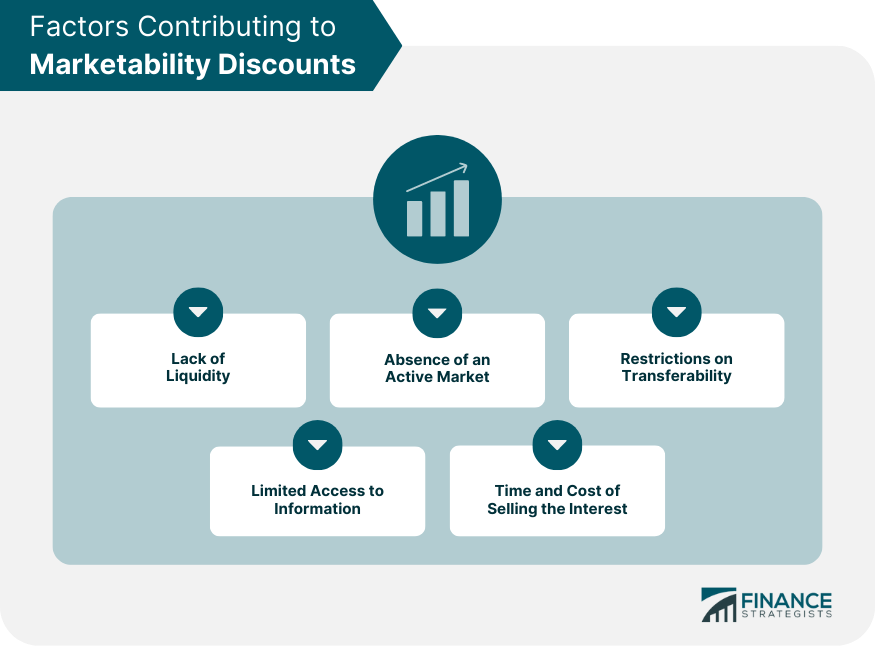

Factors Contributing to Marketability Discounts

Lack of Liquidity

Absence of an Active Market

Restrictions on Transferability

Limited Access to Information

Time and Cost of Selling the Interest

Valuation Methods Incorporating Marketability Discounts

Guideline Public Company Method

Precedent Transaction Method

Market Approach

Income Approach

Estimating Marketability Discounts

Analyzing Comparable Transactions

Reviewing Market Data

Assessing Industry Norms

Employing Quantitative Models

Impact of Marketability Discounts on Valuation

Reducing the Value of Ownership Interests

Affecting Negotiation Dynamics

Implications for Taxation and Estate Planning

Importance of the Accurate Estimation of Marketability Discounts

Fairness in Business Transactions

Compliance With Legal and Regulatory Requirements

Accurate Reflection of Economic Reality

Conclusion

Marketability Discount FAQs

A marketability discount is a reduction in the value of an asset due to the difficulty of selling that asset quickly and at a fair price.

A marketability discount is applied because assets that are difficult to sell can be less attractive to potential buyers. This reduction in demand can lower the value of the asset, and therefore, investors may require a discount to compensate for the additional risk and uncertainty associated with a less liquid investment.

The marketability discount is typically estimated by comparing the value of a restricted or illiquid asset with the value of a similar, but more liquid asset. The difference between the two values represents the discount applied to the restricted or illiquid asset.

The size of a marketability discount can vary depending on a variety of factors, including the liquidity of the asset, the size and concentration of the market for the asset, and the length of time required to sell the asset. Other factors that may impact the discount include the cost of sale and any legal or regulatory restrictions on the transfer of the asset.

One way to mitigate the impact of a marketability discount is to increase the liquidity of the asset. For example, publicly traded stocks are generally more liquid than private equity investments. Another way to mitigate the impact of the discount is to obtain a formal valuation from a qualified appraiser, which can help to ensure that the impact of the marketability discount is accurately reflected in the value of the asset. Finally, investors may choose to diversify their portfolio to reduce the overall impact of any individual marketability discount.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.