An Appraisal Management Company (AMC) is a business entity that serves as a bridge between appraisers and lenders in a real estate transaction. Tasked with overseeing the appraisal process, AMCs are engaged in various functions including the recruitment, vetting, and management of appraisers, along with ensuring adherence to regulatory standards. The core purpose of AMCs is to facilitate impartial and unbiased appraisals by establishing a 'buffer' between lenders and appraisers. They aim to promote fair lending practices and uphold the integrity of the appraisal process. In the real estate industry, the role of AMCs add a layer of compliance, aiding in the enforcement of federal regulations designed to maintain objectivity in property appraisals. By managing a network of certified appraisers, AMCs bring efficiency and scalability to the appraisal process, making them a vital cog in the real estate industry's machinery. The inception of AMCs in the real estate market can be traced back to the housing crisis of the late 2000s. In an attempt to prevent a similar catastrophe in the future, the Home Valuation Code of Conduct (HVCC) was established in 2009. It led to a surge in the establishment and utilization of AMCs to ensure appraiser independence and integrity. The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 further solidified the place of AMCs in the real estate industry by strengthening regulations around appraisals and reinforcing the need for AMCs. The regulatory framework that governs AMCs is a blend of both federal and state laws. The federal laws, particularly those instituted under the Dodd-Frank Act, provide a broad regulatory outline. These regulations mandate appraiser independence and define acceptable practices for AMCs. At the state level, each state has its own set of laws and regulations governing the operation of AMCs. These can include licensing requirements, operational guidelines, and reporting obligations. One of the primary roles of an AMC is to assemble and manage a pool of qualified and certified appraisers. They are responsible for verifying credentials, assessing competency, and managing the performance of these professionals. This ensures that all appraisals conducted under the AMC meet the necessary qualifications and competency levels. AMCs are entrusted with the task of ensuring that all appraisals are carried out in accordance with applicable laws and professional standards. They are expected to enforce compliance with the Uniform Standards of Professional Appraisal Practice (USPAP) and other regulatory requirements. An AMC also plays a pivotal role in maintaining the quality of appraisals. This involves implementing rigorous quality control processes, conducting regular reviews of appraisals, and addressing any issues or discrepancies that may arise. AMCs serve as a conduit for communication between various parties in the appraisal process, including lenders, appraisers, and clients. This can involve facilitating the exchange of information, resolving disputes, and ensuring smooth coordination throughout the appraisal process. By managing a network of qualified appraisers and streamlining the appraisal process, AMCs can greatly enhance efficiency. They can handle large volumes of appraisals, facilitate quick turnarounds, and provide a single point of contact for appraisal-related matters, making the process more manageable for lenders and clients. One of the key benefits of AMCs is their role in minimizing potential conflicts of interest. By acting as a buffer between lenders and appraisers, they help ensure that appraisals are conducted impartially, thereby promoting fair lending practices. AMCs bring an added layer of transparency to the appraisal process. Through their robust quality control processes, they ensure that appraisals are accurate, reliable, and compliant with regulations. This increased transparency can bolster confidence among lenders and clients in the appraisal process. By employing a strict vetting process for appraisers and maintaining stringent quality control measures, AMCs can help improve the quality and accuracy of appraisals. This can result in more reliable appraisals and better decision-making for lenders and clients. There are concerns that some AMCs may pay appraisers less than customary and reasonable fees, which can adversely impact the quality of appraisals and potentially lead to a shortage of qualified appraisers. While AMCs are intended to ensure appraiser independence, there are concerns that they may inadvertently restrict this independence. Some critics argue that the pressure to meet turnaround times and the fear of not receiving future assignments can influence an appraiser's work. The rise of AMCs has raised concerns about the potential impact on small independent appraisers. With more and more lenders opting to work with AMCs, independent appraisers may find it difficult to compete. While AMCs can bring several benefits, relying solely on them for appraisals can also present risks. For instance, if an AMC fails or faces regulatory action, it could disrupt the appraisal process for lenders and clients who rely exclusively on that AMC. Both federal and state laws regulate AMCs to ensure fair and ethical practices. These laws often focus on appraiser independence, AMC registration and oversight, and procedures for reporting and addressing violations. Most states require AMCs to be registered and licensed to operate. The licensing requirements may include meeting specific standards of practice, demonstrating financial stability, and adhering to strict ethical guidelines. If AMCs fail to comply with applicable laws and regulations, they can face enforcement and disciplinary actions. This could range from fines and penalties to suspension or revocation of their license. Appraisal Management Companies are essential intermediaries in the real estate industry, serving as a link between lenders and appraisers. These companies provide various services, including managing a network of qualified appraisers and ensuring compliance with regulations. AMCs streamline the appraisal process by managing a network of qualified appraisers and coordinating appraisal assignments. They ensure compliance with regulatory requirements and industry standards, promoting consistency and objectivity. AMCs play a vital role in maintaining efficiency, transparency, and impartiality in the appraisal process by utilizing technology and data analytics. However, they are often subject to criticism and controversy, particularly regarding issues such as appraiser compensation, independence, and their impact on smaller independent appraisers.What Is an Appraisal Management Company (AMC)?

History and Background of AMCs

Emergence of AMCs in the Real Estate Market

Regulatory Framework and Guidelines for AMCs

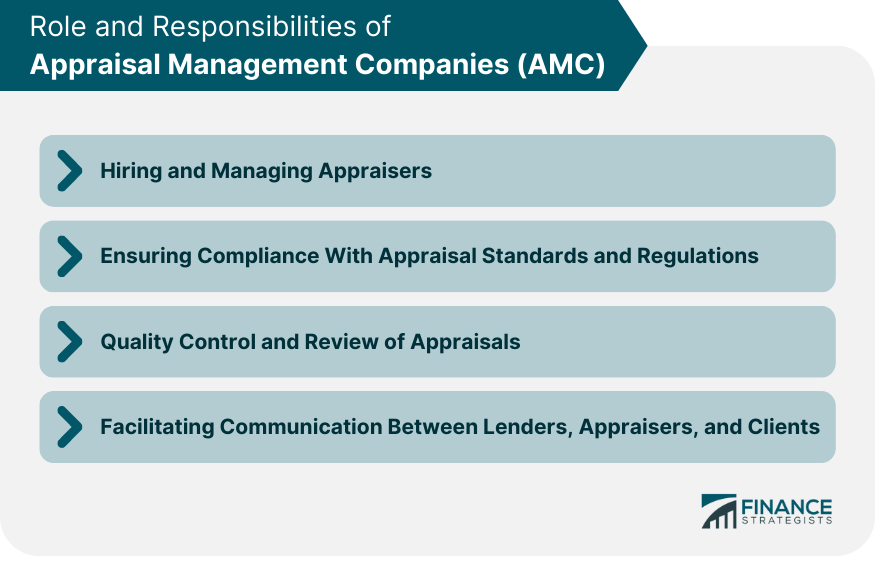

Role and Responsibilities of AMCs

Hiring and Managing Appraisers

Ensuring Compliance With Appraisal Standards and Regulations

Quality Control and Review of Appraisals

Facilitating Communication Between Lenders, Appraisers, and Clients

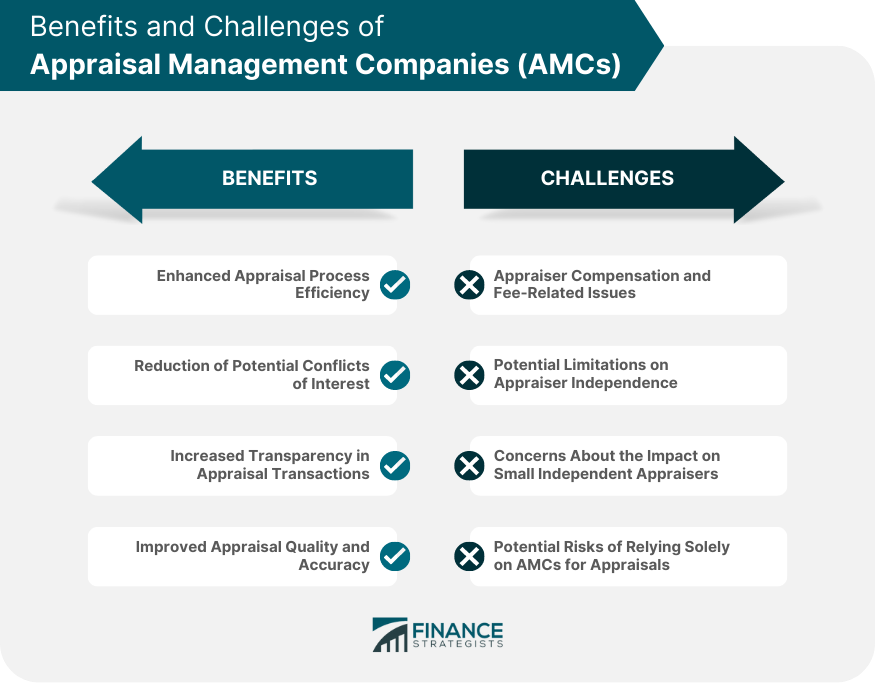

Benefits of Using AMCs

Enhanced Appraisal Process Efficiency

Reduction of Potential Conflicts of Interest

Increased Transparency in Appraisal Transactions

Improved Appraisal Quality and Accuracy

Challenges and Criticisms of AMCs

Appraiser Compensation and Fee-Related Issues

Potential Limitations on Appraiser Independence

Concerns About the Impact on Small Independent Appraisers

Potential Risks of Relying Solely on AMCs for Appraisals

Regulation and Oversight of AMCs

State and Federal Regulations Governing AMCs

Licensing and Registration Requirements for AMCs

Enforcement and Disciplinary Actions

Final Thoughts

Appraisal Management Company (AMC) FAQs

An Appraisal Management Company (AMC) is a business entity that oversees the appraisal process in a real estate transaction. It serves as a bridge between appraisers and lenders, managing a network of appraisers and ensuring adherence to regulatory standards.

AMCs are important because they help ensure that appraisals are carried out impartially and without any conflict of interest. They bring efficiency and scalability to the appraisal process and aid in the enforcement of federal regulations designed to maintain objectivity in property appraisals.

Criticisms of AMCs include concerns about appraiser compensation, potential limitations on appraiser independence, the impact on small independent appraisers, and the risks of relying solely on AMCs for appraisals.

AMCs are regulated at both the federal and state levels. They are required to comply with applicable laws and regulations, and most states require AMCs to be registered and licensed to operate.

Benefits of using an AMC include enhanced efficiency in the appraisal process, reduction of potential conflicts of interest, increased transparency in appraisal transactions, and improved appraisal quality and accuracy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.