Whisper numbers represent an unofficial earnings per share (EPS) estimate circulating among professional traders and analysts on Wall Street. These figures are often based on intuition, experience, and internal data, offering a unique perspective on a company's prospective financial performance. Whisper numbers are significant because they often provide alternative insights that can potentially outpace or counter the consensus estimates. These alternative views can assist wealth managers in refining investment strategies, identifying potential risks, and exploiting opportunities for gains. Due to their private nature, whisper numbers can sometimes reveal a different story about a company's anticipated financial results, influencing trading decisions in the process. Whisper Numbers operate on the premise that certain individuals or sources may possess unofficial or non-public information that can provide insights into a company's upcoming earnings performance. These whispers, often based on industry knowledge, insider information, or market rumors, may deviate from the consensus estimates provided by analysts. Wealth managers actively seek out and analyze these whispers to gain a potential informational edge in their investment decisions. By incorporating Whisper Numbers into their analysis, wealth managers aim to gauge the market's expectation and potential reaction to earnings releases, identify potential earnings surprises, adjust portfolio allocations, and manage risk. While the use of Whisper Numbers can provide additional perspectives and potentially uncover opportunities, it is important to critically evaluate and corroborate the information from reliable sources to mitigate the risks associated with unverified or inaccurate whispers. Analysts and industry experts have significant sway over whisper numbers. Their in-depth understanding of a company, its industry, and the broader market conditions can lead to informed speculations that diverge from the consensus. If a company's stock has been performing particularly well or poorly, this can color the expectations of traders and analysts, leading to whisper numbers that deviate from consensus estimates. Various company-specific factors such as recent news releases, changes in management, or new product launches can influence whisper numbers. For instance, if a company announces a groundbreaking new product, this might elevate whisper numbers in anticipation of increased sales. In wealth management, whisper numbers can serve as a valuable benchmark against consensus estimates. This comparison can give investors a more rounded view of a company's expected performance, helping to guide investment decisions. Whisper numbers can also aid in identifying potential earnings surprises. If a whisper number significantly deviates from the consensus estimate, it could indicate that a company is likely to either significantly beat or miss its expected earnings. Wealth managers can use whisper numbers to adjust portfolio allocations. If the whisper number for a certain stock is significantly higher than the consensus estimate, it might signal a buying opportunity, prompting a higher allocation to that stock. Despite their usefulness, whisper numbers are not without limitations. Their unofficial and speculative nature can lead to questions about their reliability and accuracy. They are not subject to the same checks and balances as official estimates, which can result in misinformation. The private nature of whisper numbers also raises concerns about potential manipulation and biases. There's a risk that insiders could skew whisper numbers in their favor, creating a misleading picture of a company's expected performance. While whisper numbers can provide valuable insights, it's important for wealth managers to balance these with other sources of information. Relying solely on whisper numbers could lead to skewed investment decisions and increased risk. One of the key ethical considerations when using whisper numbers is the risk of insider trading. Since whisper numbers often circulate among a limited group of insiders, there's a risk that they could be based on confidential information. Wealth managers must ensure that their use of whisper numbers complies with all relevant regulatory requirements. This includes rules around insider trading, market manipulation, and fair dealing. Whisper numbers should be used in a manner that promotes transparency and fairness in wealth management practices. This means ensuring that investment decisions are made in the best interests of clients, without undue influence from unofficial and potentially biased information sources. A whisper number is an unofficial, often confidential, earnings estimate that circulates among professional traders and analysts. It offers an alternative view on a company's prospective financial performance, which can influence investment decisions. Whisper numbers can provide valuable insights for wealth management strategies, assisting in benchmarking against consensus estimates, identifying potential earnings surprises, and adjusting portfolio allocations. Their use comes with ethical considerations such as the risk of insider trading, the need for regulatory compliance, and the importance of promoting transparency and fairness in wealth management practices. Whisper numbers can be utilized by wealth managers to enhance their strategies by benchmarking against consensus estimates, identifying potential earnings surprises, and making appropriate adjustments to portfolio allocations.What Is a Whisper Number?

How Whisper Numbers Work

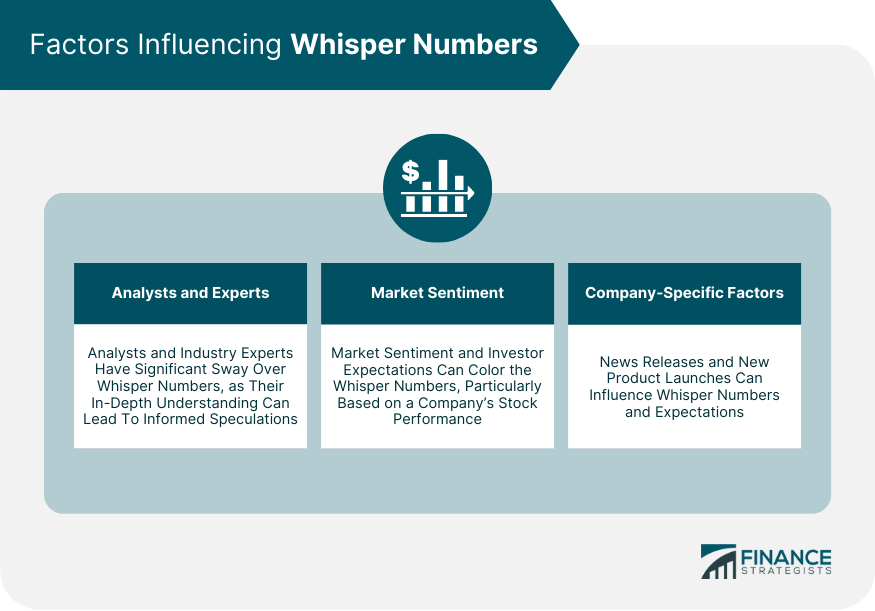

Factors Influencing Whisper Numbers

Analysts and Industry Experts

Market Sentiment and Investor Expectations

Company-Specific Factors

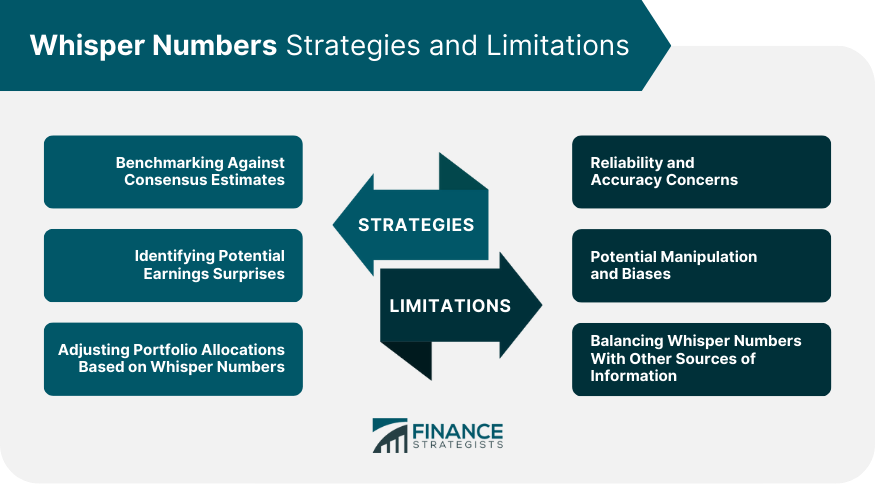

Whisper Numbers Strategies

Benchmarking Against Consensus Estimates

Identifying Potential Earnings Surprises

Adjusting Portfolio Allocations Based on Whisper Numbers

Limitations of Whisper Numbers

Reliability and Accuracy Concerns

Potential Manipulation and Biases

Balancing Whisper Numbers With Other Sources of Information

Ethical Considerations in Using Whisper Numbers

Insider Trading and Confidential Information

Compliance With Regulatory Requirements

Transparency and Fairness in Wealth Management Practices

Conclusion

Whisper Number FAQs

A whisper number is an unofficial earnings per share (EPS) estimate that circulates among professional traders and analysts on Wall Street.

While consensus estimates are an average of analysts’ predictions widely disseminated in the public domain, whisper numbers are usually informed speculation, confidential in nature and circulate in the more private corners of Wall Street.

Factors that influence whisper numbers include inputs from analysts and industry experts, market sentiment and investor expectations, and company-specific factors.

Limitations of whisper numbers include concerns about their reliability and accuracy, potential manipulation and biases, and the need to balance whisper numbers with other sources of information.

Ethical considerations when using whisper numbers in wealth management include the risk of insider trading, the need to comply with all relevant regulatory requirements, and the importance of promoting transparency and fairness in wealth management practices.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.