Bearer shares are a type of equity security wholly owned by the person or entity holding the physical stock certificate. The issuing firm neither registers the stock owner nor tracks ownership transfers. The certificate holder is the presumed owner, and these shares are therefore said to be owned by the "bearer". This is in contrast to registered shares, where the company records the owner's name and other details, and any transfer of ownership must be recorded. One of the main characteristics of bearer shares is the ease with which they can be transferred, usually by simply delivering the physical document. However, this characteristic, along with the anonymity they can provide, has also led to their use in illegal activities such as tax evasion and money laundering. As a result, many jurisdictions have enacted regulations to limit or prohibit the use of bearer shares. The primary feature of bearer shares is their transferability. Ownership changes upon physical delivery of the share certificates without any need for formal registration. Bearer shares provide a high level of anonymity. Since the owner's name is not recorded, the shareholder's identity remains confidential unless the owner reveals it. Like other shares, bearer shares entitle the holder to dividends the company declares and voting rights at the company's general meetings. Bearer shareholders enjoy limited liability protection, meaning their personal assets are shielded from the company's debts. This feature, combined with anonymity, makes bearer shares a tool for asset protection. Bearer shares can be transferred quickly and simply, providing flexibility for investors. This feature is particularly beneficial in complex transactions involving multiple parties or jurisdictions. For shareholders who value privacy, bearer shares offer confidentiality. Individuals and entities can shield their identities, assets, and transactions. Bearer shares facilitate participation in international markets, enabling investors to hold and transfer shares across borders without registering. In countries with political instability or a high risk of asset confiscation, bearer shares provide a layer of protection by concealing ownership details. The anonymity of bearer shares makes them prone to misuse for illicit activities such as fraud, tax evasion, and money laundering. Bearer shares can obscure who owns and controls a company. This lack of transparency can hinder corporate governance and accountability. Regulatory oversight of bearer shares is challenging due to their anonymous nature. It's difficult to track their movement and ascertain true ownership. Due to their association with illicit activities, bearer shares can deter investors and damage a company's reputation. To combat misuse, some jurisdictions now require disclosing beneficial ownership or reporting of bearer share transfers. Some countries have imposed restrictions on the issuance and transfer of bearer shares. These can include limiting the types of entities that can issue them or requiring a mandatory conversion to registered shares. Several jurisdictions have abolished bearer shares altogether, requiring all existing bearer shares to be converted into registered shares. These measures typically aim to enhance corporate transparency and curb illicit activities. Global regulatory bodies have worked together to establish standards for exchanging information related to bearer shares, promoting international cooperation in the fight against tax evasion and money laundering. Bearer shares have been declining due to increased regulatory scrutiny and the associated reputational risks. More companies and jurisdictions are moving away from this form of equity security. These include nominee shareholdings and various types of trusts, which can provide some of the benefits of bearer shares, such as privacy and ease of transfer while complying with transparency and accountability requirements. Technological advancements, such as blockchain technology, are providing new ways to manage share ownership. Digital shares can offer some advantages of bearer shares, such as easy transferability while allowing for greater transparency and regulatory oversight. The decline of bearer shares could impact offshore financial centers, many of which have relied on issuing these instruments to attract business. These jurisdictions may need to adapt their legal and regulatory frameworks to accommodate new types of ownership structures. Once a popular jurisdiction for bearer shares, Switzerland phased them out in 2015. This move was part of broader efforts to enhance corporate transparency and align with international standards. All existing bearer shares had to be converted into registered shares, with few exceptions. The British Virgin Islands, a well-known offshore financial center, eliminated bearer shares in 2005. The jurisdiction introduced a mandatory conversion of all bearer shares into registered shares, demonstrating its commitment to combating illicit activities. The Panama Papers leak in 2016 shed light on the widespread misuse of bearer shares for tax evasion and money laundering. The scandal highlighted the need for greater transparency and regulation of these instruments. Bearer shares are a type of equity security that grants ownership rights to the physical holder of the share certificates. Unlike registered shares, the owners' names are not recorded, providing anonymity and ease of transfer. While offering certain advantages such as flexibility, privacy, and access to international markets, Bearer shares have faced increasing scrutiny due to their potential misuse for fraudulent activities, lack of transparency, and challenges in regulation. They have played a significant historical role in the global financial system, but their popularity is decreasing due to growing regulatory pressures and reputational risks. Given the current trends, the future of bearer shares is one of further decline. More jurisdictions are likely to impose stricter regulations or abolish bearer shares entirely, and companies may opt for alternative ownership structures that offer both privacy and compliance with transparency requirements. Technological advancements, such as blockchain, could also influence the future of share ownership, providing digital solutions that balance ease of transfer with regulatory oversight.What Are Bearer Shares?

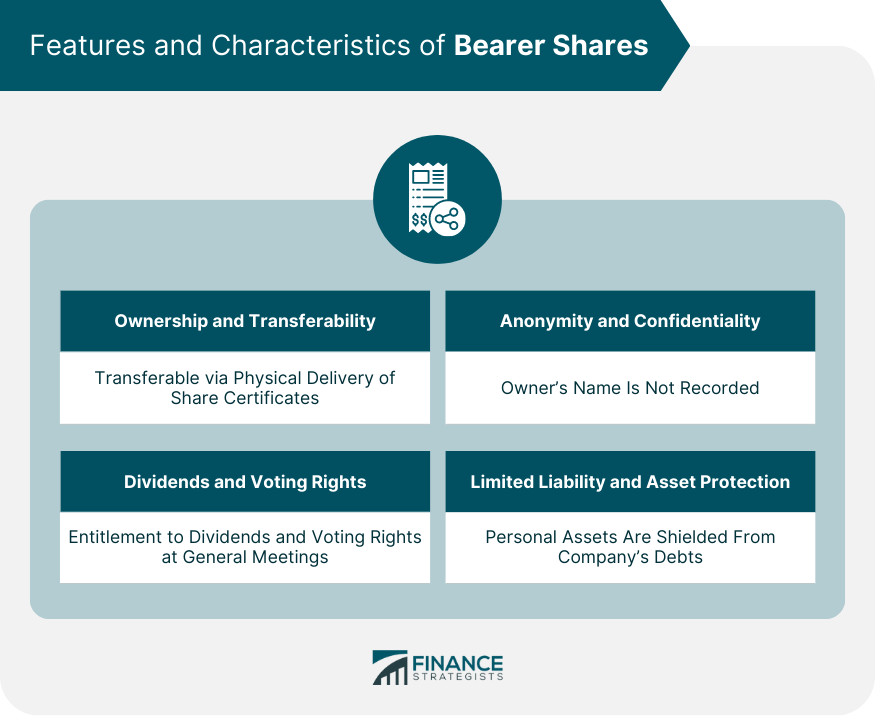

Features and Characteristics of Bearer Shares

Ownership and Transferability

Anonymity and Confidentiality

Dividends and Voting Rights

Limited Liability and Asset Protection

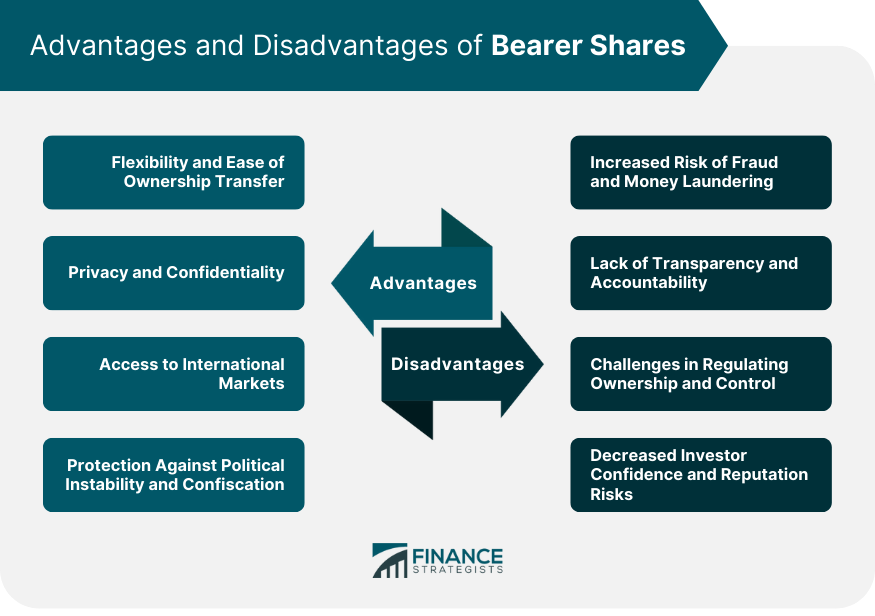

Advantages of Bearer Shares

Flexibility and Ease of Ownership Transfer

Privacy and Confidentiality

Access to International Markets

Protection Against Political Instability and Confiscation

Disadvantages of Bearer Shares

Increased Risk of Fraud and Money Laundering

Lack of Transparency and Accountability

Challenges in Regulating Ownership and Control

Decreased Investor Confidence and Reputation Risks

Global Regulatory Approaches to Bearer Shares

Disclosure and Reporting Requirements

Restrictions and Limitations

Conversion and Abolition Measures

International Cooperation and Exchange of Information

Recent Developments and Future Trends

Decreasing Popularity and Increasing Scrutiny

Emergence of Alternative Ownership Structures

Technological Advancements and Digital Solutions

Potential Impact on Offshore Financial Centers

Case Studies and Examples

Switzerland

British Virgin Islands

Panama Papers and the Exposure of Bearer Share Misuse

Conclusion

Bearer Shares FAQs

Bearer shares are stock or equity ownership types where the physical share certificates represent ownership. The person holding the certificates is considered the owner without the need for registration.

Bearer shares are transferred by physically delivering the share certificates to the new owner. There is no formal registration process involved in transferring ownership.

Yes, bearer shares provide a high level of anonymity. The owner's name is not recorded, allowing shareholders to maintain confidentiality unless they choose to disclose their ownership.

Bearer shares offer flexibility and ease of ownership transfer, provide privacy and confidentiality, facilitate access to international markets, and offer protection against political instability and asset confiscation.

Bearer shares carry an increased risk of fraud and money laundering, lack transparency and accountability, and present challenges in regulating ownership and control. They may decrease investor confidence and pose reputation risks.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.