A Follow-on Offering, also known as a Secondary Offering, is a financial process where an already public company issues additional securities in the market. This action is typically taken to raise more capital, decrease debt, or fund new projects. Follow-on offerings directly impact shareholders as they can dilute existing shares, potentially affecting the share price. Yet, they may also lead to company growth, offering long-term benefits. Investors must carefully consider the purpose of the follow-on and how it might shape the company's future. This mechanism is common in the context of corporate finance, where strategies for capital accumulation and growth expansion are vital for a firm's sustainability and success. In a traditional follow-on offering, companies work with underwriters to sell additional shares to investors. This process is similar to an IPO, albeit with less publicity. A bought deal occurs when an underwriter or syndicate of underwriters purchases all additional shares from a company, intending to resell them to the public. This arrangement reduces the risk for the issuing company but might result in lower proceeds if the shares are sold at a discount. An at-the-market offering is a strategy where the company sells shares directly into the secondary trading market at prevailing market prices. This approach allows companies to avoid the cost and time involved in standard follow-on offerings. In a competitive offering, multiple underwriting firms compete to offer the best terms to the company. This process helps the company get the best deal possible. In a rights offering, the company offers existing shareholders the right to purchase additional shares at a discount to the current market price, usually to maintain their proportionate ownership in the company. Several parties play a critical role in a follow-on offering. These include the issuing company, the underwriters, investors, and regulatory bodies. The Issuing Company: Decides to issue additional shares, determining the offering's timing and purpose. Underwriters: facilitate the offering process, guiding the issuing company, setting the price, marketing the offering, and selling the shares. Investors: purchase the additional shares, providing the company with the capital it seeks. Regulatory Bodies: like the SEC, ensure that the offering complies with all relevant laws and regulations, protecting investor interests. Regulatory and Legal Considerations in Follow-on Offering: these are subject to various legal and regulatory considerations. The company first assesses its need for additional capital, considering factors like current financial position, growth plans, market conditions, and investor sentiment. The company then selects an underwriting firm or a syndicate of firms to aid in the offering. The underwriters guide the company through the offering process, help set the price, and may guarantee the sale of the offered shares. The company must file a registration statement with the Securities and Exchange Commission (SEC) detailing the offering. This document includes financial statements, information about the company's business, and details about how the raised capital will be used. The company and underwriters conduct a roadshow to market the offering to potential investors. Following this, the underwriters recommend a price for the offering based on investor demand and market conditions. The underwriters sell the shares to investors, and the proceeds, minus the underwriting fees, go to the company. After the offering, the company must maintain transparent communication with its investors, providing regular financial updates and other disclosures. Allow Companies to Raise Additional Capital to Fund Growth: By raising additional capital, companies can catalyze their growth trajectory, fueling expansion projects or reducing their debt burden, thereby strengthening their financial standing. Increase the Company’s Market Exposure: Follow-on offerings create a platform for companies to amplify their visibility in the market. This elevated market exposure can enhance the company's reputation, making it a more attractive investment proposition. Enhancing Reputation Among Investors: Heightened reputation can drive demand for shares, facilitating a robust investor base Dilute Existing Shareholders’ Ownership: This dilution potentially lowers the value of each share, and consequently, the shareholders' percentage of company ownership decreases. The Market May Also Become Over-Saturated: When a company issues more shares than the market can absorb, it can result in an oversupply. This oversaturation may cause the share price to drop, negatively impacting the company's market value. Underpricing Risk: If the shares in a follow-on offering are priced too low, the company could raise less capital than it potentially could have. This underpricing risk represents missed financial opportunities, hindering the company's intended growth or debt reduction plans. In the U.S., the SEC regulates follow-on offerings. Companies must file a registration statement, including a prospectus providing detailed information about the offering. FINRA oversees the actions of broker-dealers involved in the offering, ensuring they adhere to fair and ethical practices. In other countries, different regulatory bodies oversee follow-on offerings, each with its own set of rules and requirements. Follow-on offerings can significantly impact market dynamics, influencing stock prices, market perception, and industry trends. A follow-on offering can lead to a drop in the stock's price due to the dilution of existing shares. However, if the market perceives the use of proceeds positively, it may boost the stock price. A well-executed follow-on offering can improve the market perception of a company, while a poorly executed one can harm it. Follow-on offerings can also signal industry trends, with companies in growing sectors often conducting them to fund expansion. While both IPOs and follow-on offerings involve selling shares to raise capital, there are key differences. Both involve selling shares to public investors, engaging underwriters, and complying with SEC regulations. However, IPOs involve a company's first sale of shares to the public and require more extensive disclosures than follow-on offerings. IPOs can raise substantial capital and create publicity, but they are costly and time-consuming. Follow-on offerings can raise additional capital more quickly and with less publicity, but they risk diluting existing shareholders. The decision between an IPO and a follow-on offering depends on factors like the company's capital needs, its stage of development, market conditions, and the potential impact on existing shareholders. Technological advancements are streamlining the follow-on offering process, making it easier for companies to reach potential investors. For instance, digital platforms can simplify the roadshow process through virtual presentations. Globalization and the growth of emerging markets are providing companies with new opportunities for follow-on offerings. Companies can now access investors worldwide, increasing their potential capital pool. The COVID-19 pandemic has accelerated certain trends, like the increased use of technology in follow-on offerings. It has also led to greater market volatility, affecting the timing and success of follow-on offerings. Follow-on offerings provide publicly traded companies a crucial avenue to raise additional funds post-IPO, catering to various needs like growth, debt reduction, and project funding. Different types, such as traditional, bought deals, at-the-market, competitive, and rights offerings, offer diverse strategic approaches to capital accumulation. While these offerings can increase market exposure and raise significant capital, potential risks include shareholder dilution, share oversaturation, and underpricing. The process is comprehensive, from initial planning to post-offering responsibilities, involving key players like underwriters, investors, and regulatory bodies. Technological advancements, globalization, and post-COVID trends are reshaping follow-on offerings, making this financial mechanism increasingly dynamic. Understanding follow-on offerings helps both businesses and investors navigate the financial landscape effectively, fostering informed decision-making and growth.What Is a Follow-on Offering?

Types of Follow-on Offerings

Traditional

Bought Deal

At-The-Market

Competitive

Rights

Key Participants in a Follow-on Offering

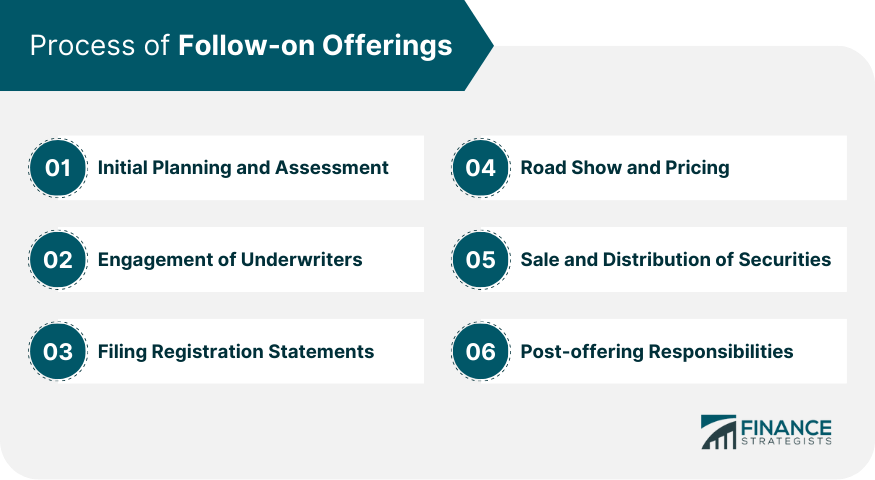

Process of Follow-on Offerings

Initial Planning and Assessment

Engagement of Underwriters

Filing Registration Statements

Road Show and Pricing

Sale and Distribution of Securities

Post-offering Responsibilities

Pros and Cons of Follow-on Offerings

Pros for Companies

Cons for Companies

US Securities and Exchange Commission (SEC) Requirements

Role of the Financial Industry Regulatory Authority (FINRA)

International Regulatory Frameworks

Impact of Follow-on Offerings on Market Dynamics

Influence on Stock Prices

Market Perception and Sentiment

Effects on Industry Trends

Follow-on Offering Versus Initial Public Offering (IPO)

Similarities and Differences

Pros and Cons Comparison

Decision Factors

Future Trends and Developments in Follow-on Offerings

Role of Technology and Digital Platforms

Impact of Globalization and Emerging Markets

Future of Follow-on Offerings Post-COVID-19

Final Thoughts

Follow-on Offering FAQs

Follow-on offerings are a financial mechanism where a publicly traded company issues additional securities to raise capital. This can be for various purposes, such as funding growth, reducing debt, or initiating new projects. These offerings directly impact shareholders as they can dilute existing shares, potentially affecting the share price.

There are several types of follow-on offerings, including traditional follow-on offerings, bought deal follow-on offerings, at-the-market offerings, competitive offerings, and rights offerings. Each of these types has distinct features and is used under different circumstances depending on the company's needs and market conditions.

The process of a follow-on offering includes initial planning and assessment, engagement of underwriters, filing registration statements, conducting a roadshow and pricing, sale and distribution of securities, and post-offering responsibilities. Each of these steps plays a crucial role in ensuring the success of the offering.

Follow-on offerings allow companies to raise additional capital, increase their market exposure, and enhance their reputation among investors. However, they also carry risks, such as diluting existing shareholders' ownership, over-saturating the market with shares, and the risk of underpricing the offering.

Future trends in follow-on offerings include the increasing role of technology and digital platforms, which are streamlining the process and reaching potential investors more effectively. Globalization is expanding the investor pool by allowing companies to reach investors worldwide. Additionally, the COVID-19 pandemic has increased market volatility, which impacts the timing and success of follow-on offerings.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.