The Deposit at Custodian (DWAC) is a method used in the transfer of new shares or securities between the Depository Trust Company (DTC) and a broker-dealer's bank or custodian. Essentially, DWAC is a fast, electronic method for depositing securities directly into an investor's account. This method is advantageous because it avoids the need for physical certificates to be issued, eliminating a time-consuming and potentially risky step in the transaction process. In a DWAC transaction, the shareholder's broker receives the shares digitally, and the certificate never needs to be printed or mailed. DWAC reduces the risk of loss or damage to physical certificates, cuts down the time involved, and minimizes costs. Traditional stock transfers can take several weeks to complete, but with DWAC, transactions can be completed within a few days. This swiftness is crucial in financial markets, where prices fluctuate constantly and timing is everything. The DWAC process begins when an investor makes a request to their broker to deposit shares into their account. Instead of the broker needing to obtain a physical certificate, the transfer agent electronically credits the shares to the investor's account through the DTC. The DTC then verifies the details of the transaction with the transfer agent. After approval, the shares are electronically credited to the investor's account. This makes the process much quicker than the traditional method of transferring physical certificates. The key parties in a DWAC transaction include the investor, the broker, the custodian (usually a bank), the transfer agent, and the DTC. Each has a unique role to play. The investor initiates the process by requesting the deposit of shares. The broker then liaises with the transfer agent to start the DWAC process. The transfer agent electronically transfers the shares to the DTC. The DTC, as the ultimate custodian, verifies the transaction and credits the shares to the investor's account. For a company to utilize DWAC, several requirements must be met. Firstly, the company’s shares must be DTC-eligible. This means that the company must be approved by the DTC for their shares to be deposited electronically. In addition, the company must have a transfer agent that is a participant of the DTC's FAST (Fast Automated Securities Transfer) program. This agent is responsible for maintaining and transferring the company's securities. Compliance and regulatory considerations mainly involve following the rules and guidelines set forth by the DTC and the Securities and Exchange Commission (SEC). These rules are designed to protect investors and maintain the integrity of the market. For instance, the DTC requires companies to comply with certain operational procedures to ensure the security of the DWAC process. Non-compliance could result in the company being denied access to DWAC services. Traditional methods of stock transfers involve the physical delivery of stock certificates, which can take weeks to process. On the other hand, DWAC transactions can often be completed within a few days. This is particularly beneficial in volatile markets, where a delay of a few days can lead to a significant change in the value of the shares. The fast process ensures that investors can capitalize on market conditions more promptly. Another benefit of DWAC is the reduction in paperwork and administrative costs. Physical stock certificates require significant manual handling, including printing, mailing, storing, and tracking. By moving to an electronic format, the DWAC method eliminates these steps and reduces the costs associated with them. This is a significant advantage for both broker-dealers and investors, leading to more streamlined operations and lower costs. With DWAC, investors no longer need to worry about the safekeeping and handling of physical stock certificates. This not only reduces the risk of loss or damage to these documents but also makes the process of buying and selling shares more convenient. If a company isn't DTC-eligible or if its eligibility is revoked, its shares may become more difficult to trade, potentially affecting liquidity. Such a situation could deter investors, which in turn could negatively impact the company's share price. Therefore, maintaining DTC eligibility is crucial for companies wishing to provide liquidity to their shareholders. As DWAC transactions can be completed quickly, they can contribute to the volatility of a company's share price, particularly for smaller, less liquid stocks. Rapid buying and selling of shares can lead to significant price swings, which could potentially affect investor confidence and the overall stability of the market. Lastly, there's a risk related to regulatory compliance. If a company fails to adhere to the DTC’s or the SEC's guidelines, it may lose its DTC eligibility, making its shares harder to trade electronically. This could result in lower liquidity and could potentially lead to a decrease in the company's share price. Hence, adherence to regulations is crucial for companies using the DWAC process. To initiate a DWAC transaction, the shareholder must first provide their broker with the necessary information about the shares they want to deposit. This includes details such as the number of shares, the name of the issuer, and the type of security. The broker will then contact the issuer's transfer agent to ensure that the shares are eligible for a DWAC deposit. If the shares are eligible, the broker will then prepare the necessary documentation for the transaction. The next step involves the submission of the DWAC request to the custodian, which is usually a bank or similar institution. The custodian will verify the information provided and initiate the electronic transfer of the shares. The custodian then sends a confirmation to the broker, who will then inform the shareholder that the shares have been deposited into their account. The final step in the DWAC process is the verification and approval of the transaction by the DTC. Once the DTC receives the deposit request from the custodian, it will verify the details with the transfer agent. If everything checks out, the DTC will approve the transaction and credit the shares to the shareholder's account. The DTC will then notify the broker of the completion of the transaction, and the broker will confirm this with the shareholder. Compared to traditional stock transfers, DWAC offers several advantages. For one, it eliminates the need for physical stock certificates, reducing the risk of loss or damage and the administrative costs associated with handling these certificates. Furthermore, DWAC transactions are typically much quicker than traditional transfers. This speed can be especially advantageous in fast-moving markets, allowing investors to act more promptly based on market conditions. Deposit at Custodian (DWAC) is a financial process that allows electronic transfers of securities between broker-dealers and the Depository Trust Company (DTC). It eliminates the need for physical stock certificates and streamlines the transfer process. The DWAC process involves preparing the necessary documentation, submitting a request to the custodian, and undergoing a verification and approval process. It ensures the secure and efficient transfer of securities electronically, enhancing speed and convenience for investors. DWAC offers several benefits, including enhanced efficiency and speed of transactions, reduction in paperwork and administrative costs, and increased accessibility for investors. However, there are also potential risks such as liquidity concerns, market volatility, and the need for regulatory compliance. It is important for participants to carefully evaluate these risks and implement appropriate safeguards.What Is Deposit at Custodian (DWAC)?

Overview of DWAC Process

Requirements for DWAC

Eligibility Criteria for Participating in DWAC

Compliance and Regulatory Considerations

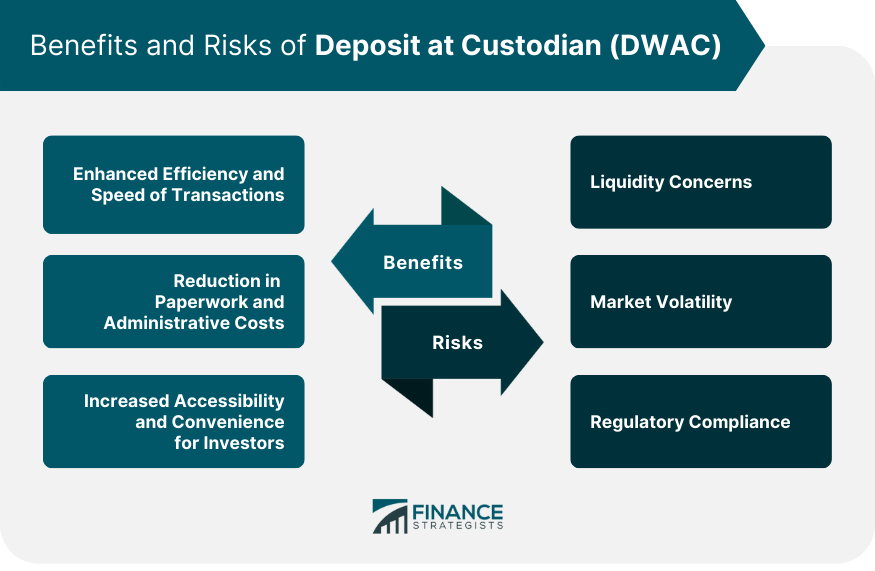

Benefits of DWAC

Enhanced Efficiency and Speed of Transactions

Reduction in Paperwork and Administrative Costs

Increased Accessibility and Convenience for Investors

Potential Risks of DWAC

Liquidity Concerns

Market Volatility

Regulatory Compliance

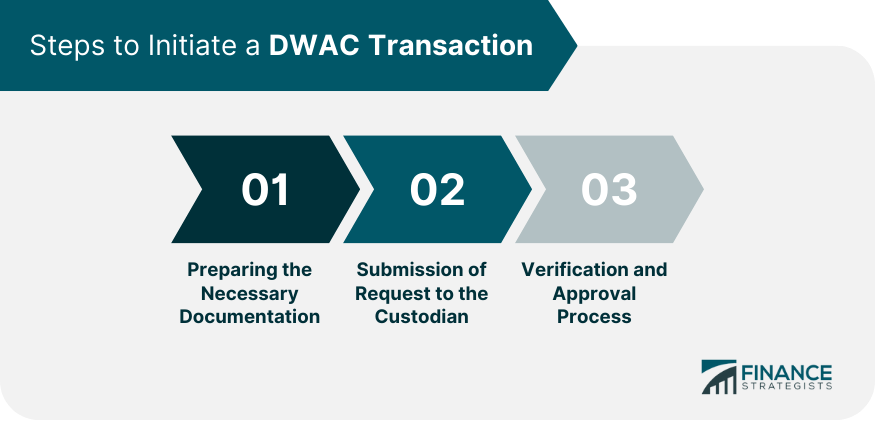

Steps to Initiate a DWAC Transaction

Preparing the Necessary Documentation

Submission of Request to the Custodian

Verification and Approval Process

DWAC vs Traditional Stock Transfers

Conclusion

Deposit at Custodian (DWAC) FAQs

DWAC, or Deposit at Custodian, is an electronic method used to transfer new shares or securities from the Depository Trust Company to an investor's account via their broker-dealer's bank or custodian.

DWAC provides enhanced efficiency and speed of transactions, reduction in paperwork and administrative costs, and increased accessibility and convenience for investors.

Risks associated with DWAC include liquidity concerns, market volatility, and the need for regulatory compliance.

A DWAC transaction is initiated when an investor requests their broker to deposit shares into their account. The broker liaises with the transfer agent to start the DWAC process, and the shares are electronically transferred to the DTC, which then credits the shares to the investor's account.

Compared to traditional stock transfers, DWAC transactions are faster and more efficient as they eliminate the need for physical stock certificates. However, DWAC requires that the shares be DTC-eligible and can contribute to market volatility.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.