General Public Distribution (GPD) pertains to the release or sharing of information, products, or services to the overall populace without exclusion. It serves the purpose of disseminating information widely, ensuring transparency, equity, or market saturation. For instance, in the context of government programs, GPD ensures critical resources like food, healthcare, or emergency alerts are accessible to all. For businesses, GPD can mean product distribution for maximum reach. GPD is significant as it allows access and benefit from important information or resources. GPD can be viewed as a public service, a marketing strategy, or a commitment to transparency and can influence how readers perceive and engage with an organization or government. Three main actors participate in the general public distribution process: the government, distributors (such as brokers or investment banks), and end consumers. Government: Typically represented by regulatory bodies like the Securities and Exchange Commission in the U.S., provides rules and guidelines to ensure fair and transparent distribution. Distributors: As the middlemen between companies and the public, execute the distribution process. They offer advice on the timing and pricing of the securities, handle marketing efforts, and process orders from investors. End Consumers or Individual Investors: Are the recipients of the distributed securities. They buy the securities with the expectation of earning a return through dividends or capital appreciation. The General Public Distribution process is a critical influencer in the financial markets, significantly impacting stock prices, market capitalization, volatility, and investor confidence. Fluctuations in Stock Prices: As new securities reach the public through a GPD event, the balance of supply and demand can oscillate, leading to price adjustments. Increase Market Capitalization: When the released securities are met with substantial demand, it can spark an upward movement in the stock's price, driving an increase in the firm's market capitalization. Increase Market Volatility: The period surrounding the distribution often witnesses an escalated trading volume, inducing price swings and fluctuations. Affect Investor Confidence: A successful GPD, marked by a positive public reception and a resultant upward trend in stock prices, can enhance investor sentiment, inviting more participation in the market. IPOs are perhaps the most recognized form of securities distribution. Companies going public for the first time use this method to raise capital. In an IPO, investment banks play a crucial role, acting as underwriters. They help the company prepare the necessary documentation, set the offering price, and find initial investors. Unlike an IPO, in a direct listing, companies sell shares directly to the public without the help of underwriters. This method reduces costs associated with underwriting fees and provides a quicker route to the public market. However, it may not be suitable for companies that need to raise new capital, as there's no guarantee of funds being raised. Private placements involve selling securities to a select group of investors rather than the general public. This method can be faster and more cost-effective than a public distribution, as it circumvents many regulatory requirements. However, it limits the pool of potential investors. Determining the right price for securities in a GPD is a complex task. If priced too high, the securities might not attract enough investors, leading to an unsuccessful distribution. Conversely, if priced too low, the company might not raise the desired amount of capital. Companies must comply with stringent regulations when conducting a GPD. Non-compliance can lead to penalties, reputational damage, and even the cancellation of the distribution. General market conditions can impact the success of a GPD. For instance, during an economic downturn, investors might be hesitant to invest, making it harder for the company to sell its securities. Technological advancements and regulatory changes are reshaping the GPD landscape. Increasing digitization is simplifying the process of buying and selling securities, making the market more accessible to individual investors. Simultaneously, regulatory changes aim to provide greater protection to investors. For example, the increased scrutiny of companies' financial disclosures ensures investors have access to reliable information. Moving forward, we could see more innovations, such as the use of blockchain for tokenized securities, further democratizing access to financial markets. In developing economies, GPD can play a critical role. It can mobilize domestic savings, finance business expansion, and contribute to economic growth. However, it also presents challenges, such as a lack of financial literacy and weak regulatory frameworks, which need to be addressed for GPD to be effective. General Public Distribution (GPD) is an integral process in finance, allowing companies to offer securities to the public, thus raising capital. Key players in this process include the government, distributors, and end consumers, each crucial to the success of GPD. The impact of GPD on financial markets is considerable, potentially influencing stock prices, market volatility, and investor confidence. While GPD carries risks, such as pricing, regulatory, and market challenges, it holds great potential in shaping economies and financial markets. Recent trends indicate that technological advancements and regulatory changes are continually reshaping GPD, with potential future innovations like blockchain technology poised to democratize access further. Understanding GPD is crucial for all stakeholders, from investors to companies and anyone interested in financial market dynamics.General Public Distribution (GPD) Overview

Key Players in GPD

Role of GPD in Financial Markets

Comparison Between GPD and Other Distribution Methods

Initial Public Offerings (IPOs)

Direct Listings

Private Placements

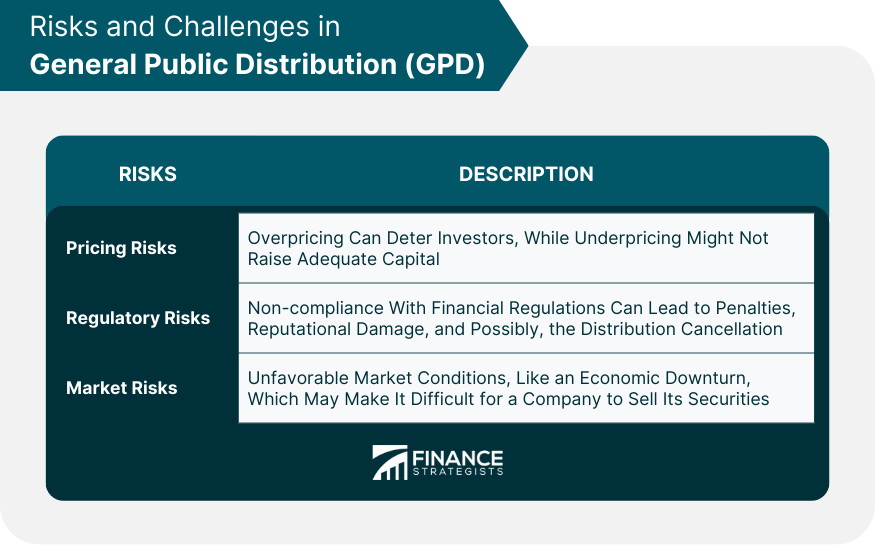

Risks and Challenges in GPD

Pricing Risks

Regulatory Risks

Market Risks

Current Trends and the Future of GPD

Role of GPD in Developing Economies

The Bottom Line

General Public Distribution (GPD) FAQs

General Public Distribution (GPD) refers to the process of releasing or disseminating information, products, or services to the general public without exclusion. It can be applied in various contexts, from government programs ensuring the accessibility of resources to business strategies for product distribution.

The main actors in the GPD process are the government, distributors (such as brokers or investment banks), and end consumers or individual investors. The government sets regulatory guidelines, distributors handle the distribution process, and end consumers are the recipients of the distributed information, products, or services.

GPD can significantly impact financial markets, affecting factors such as stock prices, market capitalization, market volatility, and investor confidence. This is because the release of new securities or information can shift the supply and demand balance, influence market participation, and impact investor sentiment.

GPD presents certain risks, including pricing risks, regulatory risks, and market risks. Pricing risks involve setting the right price for the securities being distributed. Regulatory risks involve ensuring compliance with financial regulations, while market risks are related to prevailing economic conditions that could influence the success of the distribution.

The future of GPD is being shaped by technological advancements and regulatory changes. Increasing digitization is simplifying securities trading, making markets more accessible. Regulatory changes aim to offer more protection to investors. Innovations like blockchain for tokenized securities are also poised to democratize financial markets further.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.