The opening bell, originating from the traditional practice of ringing a physical bell to start daily trading activities on global securities exchanges, denotes the commencement of a trading day. Even though technological evolution has shifted trading to electronic platforms, the bell's symbolic function has persisted. It represents the onset of a day ripe with potential for financial gains, losses, and impactful market news. Moreover, the bell ringing ceremony often celebrates significant financial events like a company's initial public offering (IPO). Apart from its symbolism, the opening bell has practical significance, marking the point at which trading orders can be executed and when peak market liquidity and volatility are frequently anticipated. The history of the opening bell is closely tied to the New York Stock Exchange (NYSE), one of the world's oldest and largest stock exchanges. The NYSE has had an opening bell since its inception, with the tradition dating back to the 1870s. The ringing of the bell was initially a practical necessity. Before the era of digital clocks and electronic trading, the bell was used to ensure that all traders knew exactly when the market was open for trading. Today, the tradition continues, albeit more symbolically. The NYSE invites a guest of honor to ring the opening bell, often a CEO of a newly listed company or a dignitary or celebrity promoting a charitable cause. The event is broadcast live on major financial news networks, attracting viewers worldwide and kicking off a day of trading on Wall Street. The opening bell ceremony has evolved significantly over time, especially in recent decades. In the early days, the bell was a simple brass bell that was rung at the start of the trading day. As time went on, the ceremony grew in stature and significance. Today, the bell-ringing ceremony is a significant event that celebrates milestones and newsworthy events. Companies celebrating their IPO often get the honor of ringing the bell, as do individuals or organizations marking significant achievements or milestones. The event is often used as a media opportunity, with extensive coverage ensuring that the opening bell and the day's trading session kick off amid high visibility. The process that leads to the opening bell begins well before the bell actually rings. Before the market opens, pre-market trading takes place. During this time, traders and investors can place orders, although volume tends to be lower, and prices may not reflect the full market sentiment. The pre-market orders play a crucial role in determining the opening price for individual securities. The opening price is not merely the closing price of the previous trading session; instead, it is determined by the balance of supply and demand as expressed in these pre-market orders. Many exchanges, including the NYSE, use a mechanism known as the opening auction to determine the opening price. This process involves matching buy and sell orders from the pre-market session. The price at which the greatest number of shares can be traded is chosen as the opening price. The opening auction ensures a fair and transparent process for price discovery at the market open. It allows traders and investors to react to news and information that emerged after the market's close on the previous day, ensuring the opening price reflects the latest sentiment. Market makers play a crucial role in the process of the opening bell. On exchanges like the NYSE, market makers, also known as designated market makers (DMMs), have the responsibility of facilitating the opening auction. They do this by managing the order book and ensuring that buy and sell orders are matched as effectively as possible. Market makers also have an obligation to maintain fair and orderly markets. If there is an imbalance of buy and sell orders, they may step in to buy or sell shares from their own accounts to stabilize the price. This role is particularly important during periods of high market volatility, ensuring that trading can begin smoothly even under challenging conditions. The timing of the opening bell varies from one exchange to another due to differing time zones and trading hours. The NYSE, for instance, rings its opening bell at 9:30 a.m. Eastern Time, marking the start of its trading day. Across the pond, the London Stock Exchange (LSE) commences its trading day at 8:00 a.m. local time, while in Asia, the Tokyo Stock Exchange (TSE) opens its trading session at 9:00 a.m. local time. These varied opening times reflect the global nature of the financial markets, with trading activities moving across different regions throughout the day. Time zones play a significant role in global trading. They ensure that financial markets around the world operate effectively and continuously. As one major exchange is closing for the day, another is opening, providing a near-seamless 24-hour cycle of trading opportunities for investors globally. The varied timings of the opening bell across exchanges worldwide allow traders to react to financial news and developments as they occur around the clock. For instance, an economic announcement in Asia could impact European markets as they open, and subsequently influence the U.S. market when it opens. Despite differing time zones, different stock exchanges do not specifically coordinate their opening bells. Instead, they set their trading hours based on their local time zone and market practice. However, market participants – including international brokers and investors – often need to align their activities across multiple exchanges, taking into account the various opening and closing times. The advent of electronic trading has transformed the financial markets, making them more accessible and efficient. Despite this, the opening bell has retained its significance. Although orders can now be placed electronically before the market opens, the opening bell still marks the point at which these orders can be executed and full liquidity is available in the market. The rise of electronic trading has also allowed for extended trading hours, including pre-market and after-market sessions. However, these sessions tend to have lower liquidity and may exhibit higher volatility, reinforcing the importance of the official market opening time signified by the opening bell. In electronic exchanges, the opening bell is not a physical bell but a designated point in time when the market officially opens. The opening auction process is automated, with buy and sell orders being matched by computer algorithms. Despite the lack of a physical bell, the opening time is clearly defined, and the principles of price discovery at market open remain the same. The opening bell can often be a time of heightened market activity and volatility. This is because the opening bell marks the point at which all orders placed in the pre-market session can be executed. It's also the time when news and events that have occurred since the previous day's market close are fully factored into prices. The period immediately following the opening bell can often set the trend for the day's trading session. Market participants closely watch the price movements in the opening minutes to gauge the overall market sentiment. Sharp upward or downward movements can indicate strong buying or selling pressure, which may influence trading decisions for the rest of the day. That said, it's important to remember that countless other factors can impact market trends throughout the trading day. The opening bell signifies the start of a trading day on the world's securities exchanges, offering traders a fair and orderly marketplace. It is a global phenomenon that serves as a critical barometer of economic health and investor sentiment, occurring at different times across time zones. Understanding the opening bell – what it represents, how it works, and its timing – is essential for anyone interested in financial markets. Its continued relevance in an increasingly digital trading world underscores its symbolic and practical importance. For those seeking to navigate the complexities of the market, wealth management services can provide valuable guidance and insight. These professionals can help interpret market signals, such as the opening bell, and align your investment strategy accordingly. Reach out to a trusted financial advisor to harness the potential of the markets and turn your financial goals into reality.What Is the Opening Bell?

History of the Opening Bell

New York Stock Exchange (NYSE) and Its Opening Bell Tradition

Evolution of the Opening Bell Ceremony

Process of the Opening Bell

Pre-market Trading

Determining the Opening Price

Opening Auction and How It Works

Role of Market Makers in the Opening Bell

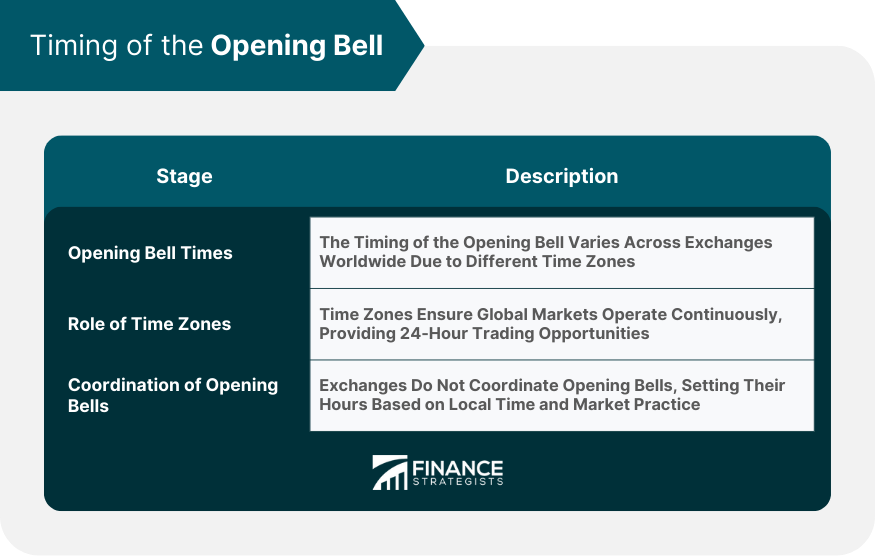

Timing of the Opening Bell

Opening Bell Times in Different Exchanges Worldwide

Role of Time Zones in Global Trading

How Different Stock Exchanges Coordinate Their Opening Bells

Opening Bell in Electronic Trading

Impact of Electronic Trading on the Opening Bell

How the Opening Bell Works in Electronic Exchanges

Opening Bell and Market Volatility

How the Opening Bell Affects Market Activity

Opening Bell and Market Trends

Final Thoughts

Opening Bell FAQs

The opening bell signifies the start of the official trading day on a stock exchange. It is called so because, traditionally, a physical bell was rung to denote the start of trading activities.

The opening bell is important because it marks the beginning of the official trading day when full liquidity is available in the market. It also represents a period of price discovery when news and developments since the market's last close are incorporated into stock prices.

The timing of the opening bell depends on the stock exchange. For instance, the opening bell of the New York Stock Exchange is at 9:30 a.m. Eastern Time.

In electronic trading, the opening bell is not a physical bell but a designated moment when the market officially opens. Buy and sell orders are matched automatically through computer algorithms.

Yes, trading can occur before the opening bell during what's known as the pre-market session. However, this period typically has lower liquidity and can exhibit higher volatility.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.