A Follow-On Public Offer, or FPO, is when an already listed company decides to issue new shares to investors. The purpose of an FPO can vary, from raising additional capital for expansion or paying off existing debts to offering liquidity to existing shareholders. Despite being similar in nature, there are notable differences between an FPO and an Initial Public Offer (IPO). While an IPO refers to the process of a company going public for the first time, an FPO is carried out by companies already listed on a stock exchange. The FPO presents a good opportunity for the company to raise funds without accruing additional debt. This equity fundraising method is particularly favored by companies that have a good track record and have established trust among investors. For the investors, it's a chance to buy into a company whose operations and financial health they are already familiar with, potentially reducing the investment risk compared to investing in an IPO. In a dilutive FPO, a company issues new shares, which are added to the existing number of shares in circulation. This increases the total number of outstanding shares, potentially reducing the earnings per share and causing dilution for existing shareholders. In contrast, a non-dilutive FPO involves the sale of shares held by existing shareholders, such as promoters or private equity investors. This doesn’t affect the total number of shares in circulation and therefore doesn’t lead to dilution. A range of stakeholders plays key roles in an FPO. These include the issuing company, investment bankers, underwriters, and regulatory bodies. The issuing company is the organization that decides to raise capital through the FPO. They are responsible for initiating the process, preparing the necessary documentation, and ensuring compliance with regulatory requirements. Investment bankers act as intermediaries between the issuing company and potential investors. They help in preparing the offer document, determining the offer price, and marketing the shares to investors. Underwriters provide a guarantee that they will purchase any unsold shares in the FPO. This ensures that the company is able to raise the desired capital, regardless of investor interest. Regulatory bodies, like the Securities and Exchange Commission (SEC) in the U.S. or the Securities and Exchange Board of India (SEBI) in India, oversee the process to ensure compliance with the applicable laws and regulations. They review the offer documents, approve the FPO, and monitor the process. The FPO process involves several key steps: The first step in an FPO is for the company to determine how much capital it wants to raise. This will dictate the number of shares to be issued. Once the offer size is determined, the company must seek approval from the regulatory body. This involves submitting an offer document detailing the purpose of the FPO, the company's financials, and other relevant information. The issuing company, with the help of investment bankers, then determines the price at which the shares will be offered. This can be a fixed price or a price range, depending on the method chosen. Once the price is set, the company, along with the investment bankers, conducts a roadshow to market the FPO to potential investors. This involves presentations to institutional investors, analysts, and brokers to generate interest in the FPO. In the book-building process, bids are collected from investors at various prices within the price band. Based on these bids, the final issue price is determined. Once the final price is set, shares are allocated to investors. Priority may be given to certain categories of investors, such as institutional investors. Finally, the new shares are listed on the stock exchange and begin trading. This marks the completion of the FPO process. An FPO can offer several benefits to a company: One of the primary reasons a company may choose to undertake an FPO is to raise additional capital. This could be for a variety of purposes, such as funding expansion plans, investing in new projects, or acquiring other businesses. Companies can also use the proceeds from an FPO to reduce their debt. This can improve the company's financial health and may be viewed favorably by investors. Capital raised from an FPO can also be used to expand the business into new markets or diversify its product portfolio. An FPO can help to improve the public perception of a company. It signals that the company is growing and can generate interest from new investors. In the case of a non-dilutive FPO, existing shareholders can sell their shares, providing them with liquidity. While an FPO can offer several benefits, it also comes with its share of risks and challenges: In the case of a dilutive FPO, the issue of new shares can lead to the dilution of existing shareholders' equity. Market volatility can impact the success of an FPO. If market conditions are unfavorable, it may be difficult to attract investors, and the share price may suffer. The FPO process must comply with various laws and regulations. Any non-compliance can result in penalties and damage to the company's reputation. Determining the right price for the shares can be challenging. If the price is set too high, it may deter investors; if it's too low, the company may not raise as much capital as it could have. Current global economic trends, such as low-interest rates, have made raising capital through equity more attractive. As a result, many companies are turning to FPOs as a way to fund their growth strategies. In recovering economies, FPOs can help companies to capitalize on growth opportunities and recover from economic downturns. FPOs can influence market sentiment. A successful FPO can boost investor confidence, while a failed FPO can have the opposite effect. Changes in regulations can impact the FPO process. For example, regulatory bodies could implement new rules to enhance transparency or investor protection. Technology is reshaping the financial sector, and the FPO process is no exception. From blockchain technology to artificial intelligence, these innovations can streamline the FPO process and improve efficiency. In the future, we may see new trends and innovations in FPOs. This could include things like the use of alternative pricing methods, the growth of FPOs in certain sectors, or the rise of international FPOs. Follow-On Public Offers (FPOs) represent a significant financial instrument for publicly listed firms, allowing them to raise capital by issuing new shares. Available in two forms: dilutive, where new shares increase the total circulation, and non-dilutive, where existing shareholders sell their shares, FPOs cater to various company needs. The process, from offer size determination to listing and trading of shares, requires meticulous planning. FPOs offer numerous benefits like additional capital, debt reduction, improved public perception, and liquidity for shareholders, though challenges like shareholder equity dilution and market volatility are present. Amid evolving economic scenarios, FPOs contribute significantly to growth strategies and recovering economies. With prospective regulatory changes and technology reshaping the financial sector, the future of FPOs might see more efficiency, transparency, and novel trends, potentially revolutionizing this vital financial tool.Definition of Follow-On Public Offer (FPO)

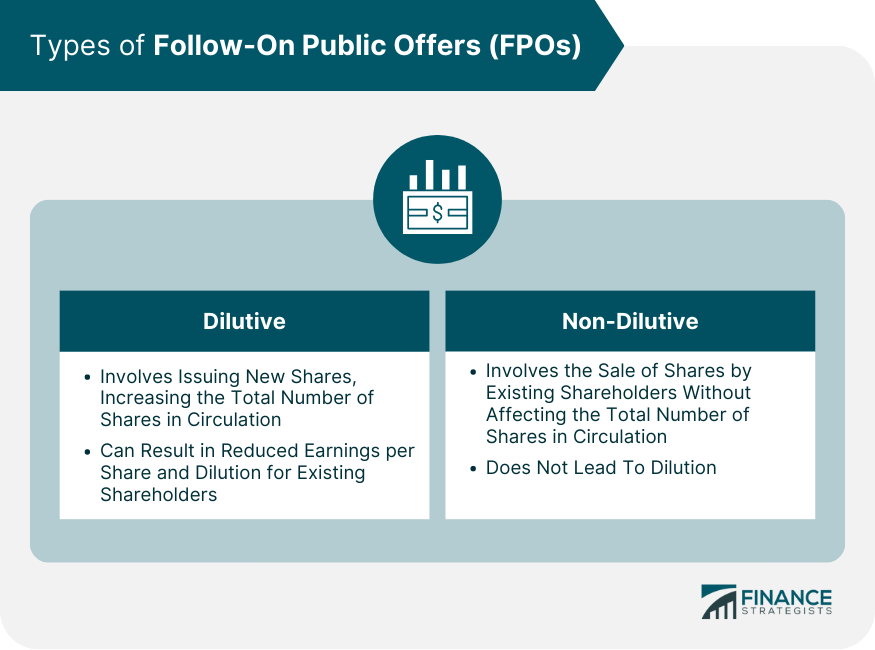

Types of FPOs

Dilutive FPO

Non-Dilutive FPO

Key Stakeholders in FPOs

The Issuing Company

Investment Bankers

Underwriters

Regulatory Bodies

The FPO Process

Determination of Offer Size

Regulatory Approvals

Price Determination

Roadshow and Marketing

Book Building Process

Allocation of Shares

Listing and Trading

Importance and Benefits of FPOs

Raising Additional Capital

Debt Reduction

Expansion and Diversification

Improving Public Perception

Offering Liquidity to Existing Shareholders

Risks and Challenges Associated With Follow-On Public Offers

Dilution of Existing Shareholder Equity

Market Volatility

Regulatory and Legal Risks

Challenges in Pricing

Role of FPOs in the Current Economic Scenario

Impact of Global Economic Trends on FPOs

Role of FPOs in Recovering Economies

Influence of FPOs on Market Sentiment

Future of FPOs

Potential Changes in the Regulatory Environment

Impact of Technology on the FPO Process

Expected Trends and Innovations in FPOs

Final Thoughts

Follow-On Public Offer (FPO) FAQs

A Follow-On Public Offer (FPO) is a method by which a publicly listed company issues new shares to investors to raise additional capital. This is different from an Initial Public Offer (IPO), where a company offers shares to the public for the first time.

There are two types of FPOs: dilutive and non-dilutive. A dilutive FPO is when the company issues new shares, thereby increasing the total number of shares in circulation and potentially reducing the earnings per share. A non-dilutive FPO, on the other hand, involves the sale of shares by existing shareholders, which doesn't impact the total number of shares in circulation.

The FPO process involves several steps, including the determination of offer size, seeking regulatory approvals, price determination, roadshow and marketing, the book-building process, allocation of shares, and finally, listing and trading of the new shares on the stock exchange.

An FPO can offer several benefits to a company, such as raising additional capital for expansion, debt reduction, improving public perception, and offering liquidity to existing shareholders. However, it's important to note that an FPO also comes with its own set of risks and challenges.

The future of FPOs is likely to be influenced by potential changes in the regulatory environment and the impact of technology. Advances in technology, such as blockchain and AI, may streamline the FPO process and improve efficiency. Furthermore, regulatory changes may enhance transparency and investor protection. Additionally, new trends and innovations may emerge, such as alternative pricing methods and the growth of FPOs in certain sectors.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.