OTC Pink, also known as the Pink Sheets, is a marketplace for trading over-the-counter (OTC) stocks, primarily serving as a trading platform for securities not listed on standard exchanges. Its purpose is to provide a platform for small and financially distressed companies that can't meet the stringent listing requirements of larger exchanges. The history of OTC Pink dates back to 1913 when the National Quotation Bureau started listing these stocks on pink-colored sheets, hence the name. With the advent of digital technology, these pink sheets evolved into an electronic marketplace, now managed by the OTC Markets Group. Despite its role in the financial system, the OTC Pink is known for its relaxed admission criteria and lesser transparency, presenting both opportunities and risks for investors. Trading on OTC Pink is somewhat different from trading on organized exchanges. The transactions take place directly between the buyer and the seller, often with the help of market makers. These market makers stand ready to buy and sell securities at publicly quoted prices, creating a market for these otherwise illiquid securities. Electronic Communication Networks (ECNs) are used to facilitate OTC trades, providing a virtual trading floor where market participants can interact. OTC Pink marketplace lists a wide array of securities, including stocks, warrants, ADRs (American Depositary Receipts), and foreign securities. The issuers are usually small to medium-sized companies, sometimes foreign firms, that have difficulty meeting the listing requirements of major exchanges. OTC Pink operates from Monday through Friday, excluding holidays, with the same trading hours as the New York Stock Exchange (NYSE), from 9:30 AM to 4:00 PM Eastern Time. The admission criteria for listing on OTC Pink are relatively loose compared to other OTC markets. Companies do not need to file with the SEC, although they must remain compliant with federal securities laws. While the SEC does not directly supervise the activities on the OTC Pink, it does enforce federal securities laws applicable to companies listed on it. Companies on OTC Pink are not required to provide regular financial reports. However, this lack of transparency can increase risks for investors, as it makes it more challenging to make informed investment decisions. The OTC Pink market is considered riskier than other markets due to its lack of transparency and lower liquidity. Investors are advised to exercise caution, conduct thorough research, and consider seeking advice from financial professionals. OTCQB, also known as the Venture Market, has stricter listing requirements than OTC Pink, including a minimum bid price, annual verification process, and more comprehensive company management certification. OTCQX is the top tier of the OTC markets, offering the most investor-friendly companies with high financial standards. Unlike OTC Pink, OTCQX firms must provide audited financial statements. OTC Pink has the lowest transparency and reporting requirements of the three tiers. In contrast, OTCQB and OTCQX require companies to meet higher financial standards and more rigorous disclosure requirements. OTC Pink plays a significant role in the financial system by providing a platform for securities that may not have sufficient liquidity on major exchanges. Liquidity refers to the ease with which an asset can be bought or sold without significantly impacting its price. Many smaller or less well-known companies may not meet the listing requirements of major exchanges, making it challenging for their securities to be traded on those platforms. OTC Pink, a marketplace operated by the OTC Markets Group, serves as an accessible platform for small companies and foreign firms that do not meet the listing criteria of larger exchanges such as the New York Stock Exchange (NYSE) or NASDAQ. These smaller and foreign companies may face challenges in meeting the stringent requirements set by major exchanges, which can include high market capitalization, certain financial thresholds, or regulatory obligations. However, OTC Pink provides an alternative avenue for these companies to trade their securities and access capital. OTC Pink offers a unique set of investment opportunities that can help investors diversify their portfolios. Unlike major exchanges where large-cap stocks dominate, OTC Pink includes a wide range of securities, including micro-cap stocks, penny stocks, and other less liquid or speculative investments. By participating in the OTC Pink market, investors have the opportunity to allocate a portion of their portfolio to these alternative investments. The global financial crisis of 2008 had a significant impact on OTC Pink and the companies listed on this platform. The crisis, triggered by the subprime mortgage meltdown and subsequent credit crunch, led to a widespread panic among investors, causing a sharp decline in stock prices across various markets. High Return Potential: OTC Pink stocks can offer significant returns, especially for early investors in successful small-cap companies. Access to Unique Opportunities: The platform lists many small and foreign companies not found on traditional exchanges, offering unique investment opportunities. Portfolio Diversification: Investing in these securities can help diversify an investment portfolio, potentially enhancing returns and reducing risk. Lack of Transparency: OTC Pink companies aren't required to provide regular financial reports, making it challenging for investors to make informed decisions. Higher Risk: The market is known for higher volatility and less liquidity, leading to increased investment risk. Potential for Fraud: Due to limited oversight, the OTC Pink market is more susceptible to fraudulent activities, such as "pump and dump" schemes. OTC Pink, an essential component of the financial ecosystem, offers an accessible marketplace for smaller and foreign entities that may not qualify for listing on larger exchanges. While providing unique investment opportunities and potential for high returns, it carries inherent risks due to lower transparency and liquidity, and susceptibility to fraudulent activities. The mechanics of trading involve direct buyer-seller transactions, facilitated by market makers and ECNs. Despite its relaxed admission criteria, listed companies must adhere to federal securities laws. Investors are urged to conduct thorough research and possibly seek professional advice before investing in this market. Understanding OTC Pink's dynamics, potential risks, and future trends is crucial for both businesses seeking capital and investors looking for unique opportunities.What Is OTC Pink?

Mechanics of OTC Pink Trading

Trading Processes

Securities Exchanged

Trading Hours and Sessions

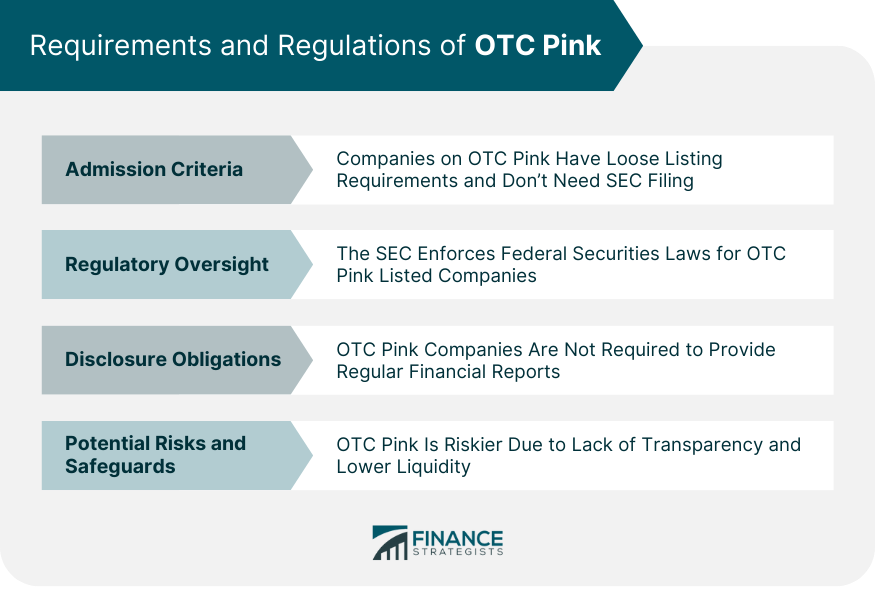

Requirements and Regulations of OTC Pink

Admission Criteria

Regulatory Oversight

Disclosure Obligations

Potential Risks and Safeguards

Key Differences Between OTC Pink and Other OTC Markets

Comparison With OTCQB

Comparison With OTCQX

Differences in Transparency and Reporting Standards

Role of OTC Pink in the Financial System

Liquidity Provision

Accessibility for Small and Foreign Companies

Risk Diversification Opportunities

Impact of Economic Events on OTC Pink

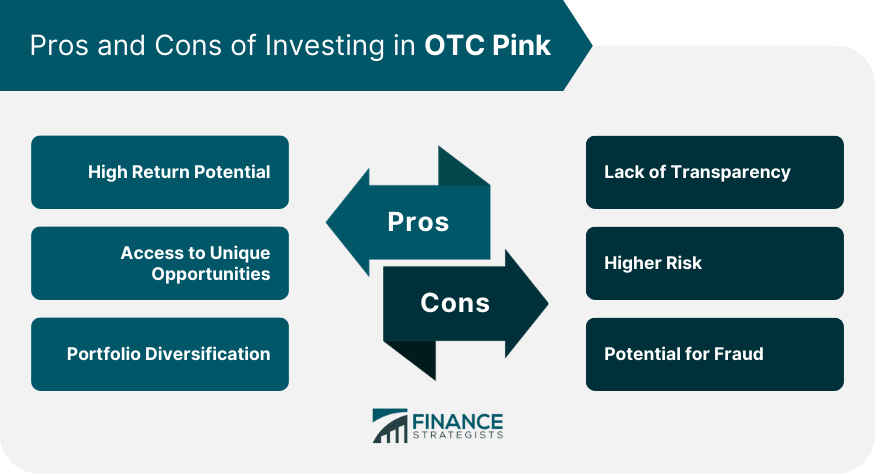

Pros and Cons of Investing in OTC Pink

Pros

Cons

Conclusion

OTC Pink FAQs

OTC Pink, also known as the Pink Sheets, is the lowest tier of the three marketplaces for trading over-the-counter stocks. It is a decentralized market where securities not listed on standard exchanges are traded directly between two parties.

The OTC Pink marketplace lists a wide variety of securities, including stocks, warrants, American Depositary Receipts (ADRs), and foreign securities. The issuers are typically small to medium-sized companies or foreign firms that have difficulty meeting the listing requirements of major exchanges.

The key differences lie in listing requirements, transparency, and reporting standards. OTC Pink has the most lenient requirements and least transparency compared to OTCQB and OTCQX. OTCQB and OTCQX require companies to meet higher financial standards and provide more comprehensive disclosures.

Investing in OTC Pink is riskier due to limited transparency, less liquidity, and a higher chance of price manipulation. There's also the potential for fraudulent activities due to the information asymmetry on this platform.

The future of OTC Pink will likely evolve with advancements in technology, regulatory measures, and the global financial landscape. Technological innovations could make trading more efficient and transparent, while regulatory changes may enhance investor protection. Globalization might lead to an increase in foreign companies listing on OTC Pink, providing more diversification opportunities for investors.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.