A stop-limit order is a specific type of trading directive that combines the features of stop orders and limit orders. When used in stock or cryptocurrency trading, this tool helps investors ensure more control over their trade execution. A stop-limit order comes into play when a certain stop price is reached. Once the stop price is triggered, the stop-limit order becomes a limit order to buy or sell at a specified limit price or better. It provides traders with a high level of control but also requires more precision than other types of orders. The stop price is the price at which a stop-limit order is activated. When the market reaches the stop price, the stop-limit order becomes a limit order. It's important to note that the stop price is a trigger, not a guarantee of trade execution. Once the stop price is reached, the limit price dictates the minimum price at which you are willing to sell or the maximum price at which you are willing to buy. This component provides traders with control over the price range for their transactions. The execution of a stop-limit order occurs when market conditions meet both the stop price and the limit price. The stop price activates the order, and the limit price sets the parameters for the transaction. However, due to market volatility, there's no absolute guarantee the order will be executed, even when the stop price is reached. It allows investors to have more control over their trade execution in the financial markets. When a stop-limit order is placed, it involves two key components: the stop price and the limit price. The stop price is the predetermined price at which the stop-limit order is activated. Once the market reaches the stop price, the stop-limit order is triggered and becomes a limit order. It's important to note that the stop price acts as a trigger, but it doesn't guarantee trade execution. The limit price, on the other hand, sets the minimum price at which you are willing to sell or the maximum price at which you are willing to buy. It provides traders with control over the price range for their transactions. After the stop price is reached and the order becomes a limit order, it can only be executed at or better than the limit price specified. Stop-limit orders give investors a high degree of control over their trade entries and exits. By specifying the stop and limit price, investors can dictate the price range they are willing to trade within. This feature makes stop-limit orders an effective tool for managing risks and securing profits. Stop-limit orders can provide protection against sudden and unexpected price movements. By setting a stop price, an investor can limit their loss or protect their profit in case the market moves against their position. Stop-limit orders offer flexibility in executing trades. They allow traders to be precise about the price conditions under which they enter or exit the market. This can be particularly useful in volatile market conditions where prices can change rapidly. One of the drawbacks of stop-limit orders is the risk of partial execution. If the market price reaches the stop price, but only a portion of the order can be executed within the limit price, the rest of the order may remain unfilled. Another limitation is the risk of the order not being filled at all. If the market price reaches the stop price but never hits the limit price, the order won't be executed. This can result in missed trading opportunities. In volatile market conditions, stop-limit orders may not provide the intended results. If prices are moving rapidly, the limit price may be bypassed, resulting in the order remaining unexecuted. One strategy involves using stop-limit orders for profit-taking. Traders can set the stop price at a level that secures their desired profit, with the limit price serving as the lowest acceptable level to sell the asset. Stop-limit orders can also be used for loss mitigation. By setting the stop price at the maximum loss a trader is willing to bear and the limit price at a level just below, traders can limit their losses if the market moves against their position. A trailing stop-limit order is a dynamic version of a stop-limit order. It adjusts the stop price at a fixed amount below the market price, allowing traders to secure profit while limiting potential losses. For instance, an investor wants to buy a stock currently priced at $50 but believes it's overvalued. They could place a stop-limit order with a stop price of $45 and a limit price of $46. If the stock price falls to $45, the order becomes a limit order, and the investor is willing to buy the stock as long as it's priced at $46 or less. In a selling scenario, consider a trader who owns a stock currently trading at $100. The trader could place a stop-limit order to limit a potential loss with a stop price of $95 and a limit price of $94. If the stock price falls to $95, the order is activated, and the stock will be sold as long as the price is $94 or above. In cryptocurrency trading, a trader who bought Bitcoin at $10,000 may want to lock in profits at $15,000 but is not willing to sell for less than $14,500. In this case, they could place a stop-limit order with a stop price of $15,000 and a limit price of $14,500. A stop-limit order is a specific type of trading directive that combines the features of stop orders and limit orders. It provides investors with the ability to define a stop price and a limit price, offering more control over trade execution in the financial markets. The advantages of stop-limit orders include control over entry and exit points, protection against unexpected price movements, and flexibility in order execution. Traders can set specific stop and limit prices to define their desired price range, manage risks, and secure profits. However, stop-limit orders also have limitations. There is a potential for partial execution, where only a portion of the order gets filled, as well as a risk of the order not being filled at all if the market doesn't reach the limit price. To maximize the benefits of stop-limit orders, traders can employ various strategies such as top-limit orders for profit-taking, utilizing them for loss mitigation, and employing trailing stop-limit orders for dynamic risk management.What Is a Stop-Limit Order?

Key Components of a Stop-Limit Order

Stop Price

Limit Price

Execution

How Does a Stop-Limit Order Work

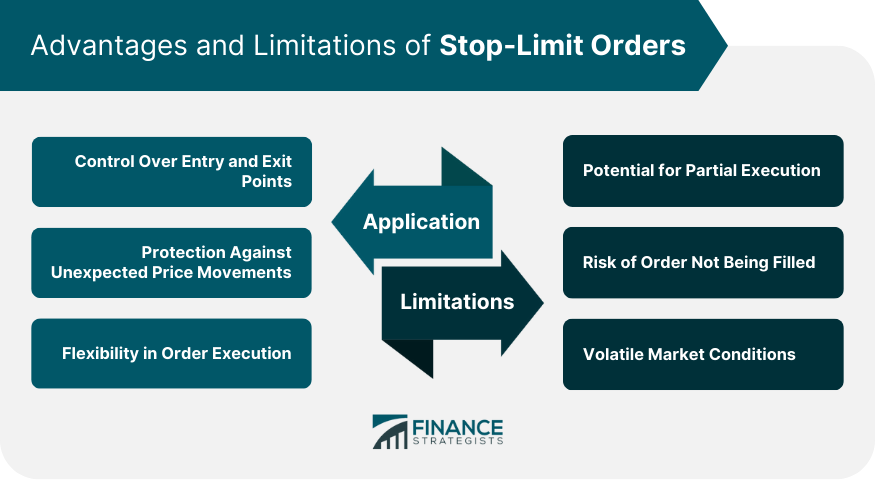

Advantages of Stop-Limit Orders

Control Over Entry and Exit Points

Protection Against Unexpected Price Movements

Flexibility in Order Execution

Limitations of Stop-Limit Orders

Potential for Partial Execution

Risk of Order Not Being Filled

Volatile Market Conditions

Strategies for Using Stop-Limit Orders

Profit-Taking

Loss Mitigation

Trailing

Examples of Stop-Limit Order Scenarios

Buying Stocks

Selling Stocks

Cryptocurrency Trading

Conclusion

Stop-Limit Order FAQs

Yes, stop-limit orders can be used in various types of markets, including stock markets, forex markets, and cryptocurrency markets. However, it's crucial to understand how they work and their potential risks before using them.

No, there is no guarantee that your stop-limit order will be executed. If the market price doesn't reach your stop price, or if it surpasses your limit price without filling the order, your stop-limit order may not be executed.

A stop order becomes a market order once the stop price is reached, meaning it will be executed at the best available price in the market. On the other hand, a stop-limit order becomes a limit order once the stop price is reached, meaning it will only be executed at the limit price or better.

The costs associated with stop-limit orders depend on the brokerage firm. Some brokers may charge a higher fee for stop-limit orders compared to regular market orders or limit orders due to their complexity.

A trailing stop-limit order is a type of stop-limit order where the stop price is adjusted as the market price moves. It allows traders to secure profits while limiting potential losses, making it a useful tool in volatile markets.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.