Net change refers to the difference between the beginning and ending balances of a financial metric over a specified period. It is commonly used to measure the overall change or performance of an asset, market index, or financial indicator. Net change plays a vital role in financial analysis by providing insights into the financial health of a company. It allows investors, analysts, and other stakeholders to evaluate the business's performance and growth potential.. The concept of net change is applicable to a wide range of financial aspects, including revenues, expenses, assets, liabilities, equity, and cash flows. By analyzing net change, it becomes easier to monitor the progress or decline of a company's financial performance and identify patterns or trends that might indicate the company's future prospects. Revenue is a primary factor that impacts net change. It refers to the income generated from the sale of goods or services by a business. When revenue increases, the net change is likely to be positive, indicating growth. Conversely, a decline in revenue may result in a negative net change, signaling potential problems or stagnation. An organization's ability to increase revenue can be influenced by various factors, including market demand, pricing strategies, product or service offerings, and competition. By monitoring net change in revenue, businesses can adjust their strategies to maximize growth potential. Expenses are another crucial factor that affects net change. They represent the costs incurred by a business in its operations, such as wages, rent, utilities, and materials. An increase in expenses can lead to a negative net change if not matched by a corresponding growth in revenue. To improve net change, businesses must manage their expenses effectively. This can involve cutting unnecessary costs, improving operational efficiency, or finding ways to increase revenue to offset the additional expenses. Investments, such as acquisitions or the purchase of new equipment, can also impact net change. While they may require significant upfront costs, these investments can lead to long-term benefits, such as increased revenue or reduced expenses. However, the net change resulting from investments can vary depending on factors such as the success of the investment and the time horizon considered. Therefore, businesses must carefully evaluate the potential benefits and risks of their investments to ensure a positive net change. Financing activities, including issuing stocks, borrowing funds, or repaying debts, can also influence net change. These activities can either provide additional capital for growth or reduce financial obligations, leading to a positive net change. On the other hand, financing activities such as dividend payments or debt repayments can result in a negative net change if they exceed the funds generated through operations or investments. To maintain a healthy net change, businesses must carefully balance their financing activities to support growth without incurring excessive debt. The formula for calculating net change is relatively simple: Net Change = Ending Balance - Beginning Balance This formula can be applied to various financial metrics, such as revenues, expenses, assets, liabilities, or cash flows, to understand the changes in a business's financial position over time. To illustrate the calculation of net change, consider a company with a beginning revenue of $100,000 and an ending revenue of $150,000 for the year. Using the formula mentioned earlier: Net Change = $150,000 - $100,000 Net Change = $50,000 In this example, the company experienced a positive net change of $50,000 in revenue, which indicates growth during the specified period. This information can be valuable to stakeholders when assessing the company's financial performance and potential for future growth. A positive net change represents an increase in a financial metric over a given period. This increase may be attributed to factors such as higher revenues, lower expenses, successful investments, or favorable financing activities. A consistently positive net change can be an encouraging sign for stakeholders, suggesting that the company is growing and potentially generating value for shareholders. However, it is essential to analyze the underlying factors contributing to the positive net change to ensure that the growth is sustainable and not the result of temporary or one-time events. A negative net change signifies a decrease in a financial metric over a specified period. This decline may result from factors such as lower revenues, higher expenses, unsuccessful investments, or unfavorable financing activities. A consistently negative net change can be a cause for concern, indicating potential issues with the company's performance or financial stability. When faced with a negative net change, stakeholders should investigate the contributing factors to determine if the decline is temporary or indicative of more significant problems that may require intervention. A zero net change indicates that there has been no change in a financial metric over a given period. This outcome could suggest that a business is maintaining its financial position, with neither growth nor decline. While a zero net change might not be cause for immediate concern, it could signal stagnation or a lack of growth opportunities. In such cases, it is crucial for businesses to examine their strategies and operations to identify potential areas for improvement or growth. The balance sheet is a snapshot of a company's financial position at a specific point in time. Net change is significant in analyzing the balance sheet as it helps stakeholders understand how the company's assets, liabilities, and equity have evolved over time. By comparing the net changes in these financial components, stakeholders can assess the company's overall financial health and stability. For instance, a positive net change in assets accompanied by a stable or decreasing liabilities net change might suggest a strong financial position, while a negative net change in equity could signal potential issues. The income statement provides an overview of a company's revenues, expenses, and profits or losses over a specified period. Net change is crucial in evaluating the income statement as it helps stakeholders gauge the company's profitability and performance. By analyzing the net changes in revenues and expenses, stakeholders can assess whether the company is growing its profits or facing challenges that might impact its financial health. The cash flow statement illustrates a company's cash inflows and outflows from operating, investing, and financing activities during a specific period. Net change is vital in analyzing the cash flow statement as it offers insights into the company's ability to generate and manage cash. A positive net change in cash flows from operations, for example, indicates that the company can generate cash through its core business activities, which is essential for meeting financial obligations and supporting growth. One limitation of net change analysis is that it may not fully capture the impact of non-cash items, such as depreciation, amortization, or stock-based compensation. These items can affect a company's financial statements without directly impacting cash flows, which may result in a distorted view of the company's financial performance. To mitigate this limitation, stakeholders should consider additional financial metrics and ratios that take non-cash items into account when analyzing net change. Net change analysis can also be affected by timing differences, such as seasonal fluctuations in revenues or expenses. These timing differences can cause temporary variations in net change that may not accurately represent the company's long-term performance. To address this limitation, stakeholders should consider analyzing net change over multiple periods or using rolling averages to smooth out the effects of timing differences. External factors, such as economic conditions, industry trends, or regulatory changes, can also impact net change. These factors are often beyond the control of the company and can significantly influence its financial performance. As a result, it is crucial for stakeholders to consider the broader context when interpreting net change to ensure they have a comprehensive understanding of the company's performance. Net change analysis is a valuable tool for evaluating a company's financial performance. By examining the net changes in various financial metrics, stakeholders can identify trends and patterns that may indicate the company's future prospects. This information can be instrumental in making investment decisions or evaluating management performance. Net change analysis can also be useful in budgeting and forecasting processes. By analyzing historical net changes, businesses can identify trends and patterns that may inform their future financial plans. This information can help companies set realistic goals, allocate resources effectively, and monitor progress toward their objectives. Net change analysis plays a critical role in the decision-making processes of businesses and investors. By providing insights into the financial health of a company, net change analysis can inform decisions regarding strategy, resource allocation, and risk management. For instance, a consistently negative net change in revenues might prompt a company to reevaluate its product offerings or market strategy, while a positive net change in cash flows could support decisions to invest in growth opportunities. Net change represents the difference between the beginning and ending balances of a financial metric over a specified period. It helps businesses and investors understand the fluctuations in financial accounts and make informed decisions based on the trends. Numerous factors can affect net change, including revenue, expenses, investments, and financing activities. By analyzing these factors, stakeholders can gain insights into the company's financial performance and identify areas for improvement or growth. However, it is essential to consider the limitations of net change analysis, such as non-cash items, timing differences, and external factors, to ensure a comprehensive understanding of a company's financial performance. By using net change analysis in conjunction with other financial metrics and ratios, businesses and investors can make informed decisions and effectively evaluate a company's financial health, growth potential, and overall performance.What Is Net Change?

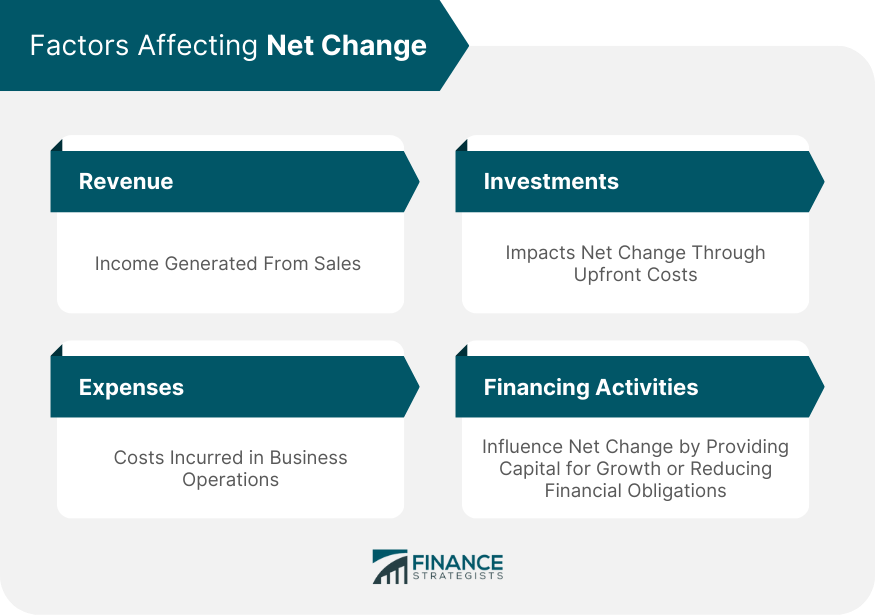

Factors Affecting Net Change

Revenue

Expenses

Investments

Financing Activities

Calculation of Net Change

Formula for Net Change

Example Calculation

Interpreting Net Change

Positive Net Change

Negative Net Change

Zero Net Change

Significance of Net Change in Financial Statements

Balance Sheet

Income Statement

Cash Flow Statement

Limitations of Net Change Analysis

Non-cash Items

Timing Differences

External Factors

Uses of Net Change Analysis

Financial Performance Evaluation

Budgeting and Forecasting

Decision-Making Processes

Conclusion

Net Change FAQs

Net Change refers to the difference between two financial values or variables, indicating the overall increase or decrease in a specific context.

Net Change is influenced by various factors such as revenue, expenses, investments, and financing activities.

Net Change is typically calculated by subtracting the initial value from the final value of a variable or by comparing two periods' values.

Net Change provides valuable insights into the overall financial performance and health of an entity, as it reflects the cumulative effect of various financial activities.

Net Change analysis may have limitations due to non-cash items, timing differences, and external factors that may affect the accuracy and interpretation of the results.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.