The OTCQB, often referred to as the "Venture Market," is a tier of the over-the-counter (OTC) markets operated by the OTC Markets Group. Its purpose is to provide a trading platform for early-stage and developing companies from the United States and international markets. The OTCQB was established as a middle ground between the OTC Pink markets, which lack financial standards and transparency, and the OTCQX markets, which enforce high financial standards and require a high level of transparency. OTCQB requirements include meeting certain financial and operational standards and providing a safer and more reliable market environment for investors. Over the years, the OTCQB has played a crucial role in helping smaller, entrepreneurial companies gain access to capital and public visibility. Companies need to meet specific financial and operational requirements to list on the OTCQB. These include a minimum stock price, certain total assets, and net income. Companies are also required to meet management requirements, ensuring responsible corporate governance. The OTCQB also has stringent compliance and corporate governance standards, which include maintaining a board of directors and being up-to-date with SEC filings. Companies listed on the OTCQB must meet certain reporting standards, including regular reporting to the SEC or a U.S. banking regulator. The process for becoming OTCQB-certified involves meeting the aforementioned requirements and undergoing an annual verification and management certification process. Companies listed on the OTCQB are required to undergo an annual certification to verify officers and directors, shares outstanding, shareholders, and financials. Being listed on the OTCQB provides companies with increased visibility and exposure to a broader range of investors. This enhanced visibility can attract potential shareholders, analysts, and institutional investors who may not have been aware of or able to invest in the company previously. The OTCQB listing provides companies with a public trading platform, making it easier for them to access capital from a wider investor base. This access to capital is vital for companies to fund their growth initiatives, such as expanding operations, investing in research and development, or acquiring new assets or technologies. Meeting the requirements for OTCQB listing can enhance a company's credibility in the eyes of investors, brokers, and market makers. The stringent listing standards and ongoing compliance obligations of the OTCQB demonstrate a company's commitment to transparency and good corporate governance, which can instill confidence and trust among potential investors. The OTCQB has reporting standards that require listed companies to provide detailed financial information and disclosure. This transparency in financial reporting helps investors make more informed investment decisions by providing them with access to reliable and up-to-date information about the company's performance, financial health, and key operational metrics. For many smaller companies, the OTCQB can serve as a stepping stone to larger exchanges once they have achieved sufficient growth and meet the listing criteria of major exchanges. A successful track record on the OTCQB, along with increased visibility and credibility, can attract the attention of larger exchanges and facilitate the transition to a more prominent trading platform. While OTCQB provides better liquidity than Pink markets, it may still be lower than on larger exchanges, which can impact the ease of buying and selling securities. Lower liquidity means there may be fewer buyers and sellers in the market, resulting in wider bid-ask spreads and potentially making it more challenging to execute trades at desired prices. Investors should consider the potential impact of lower liquidity when trading OTCQB securities and carefully evaluate the market conditions and their investment objectives. Although OTCQB has more stringent requirements than Pink markets, it's still more susceptible to fraudulent activities compared to major exchanges. The relative ease of listing on OTCQB compared to larger exchanges, combined with potentially limited regulatory oversight, can create an environment where fraudulent or misleading companies may attempt to take advantage of investors. Investors should exercise caution, conduct thorough due diligence, and seek information from reliable sources before making investment decisions in OTCQB-listed securities. Stocks listed on the OTCQB can be subject to high volatility, posing a potential risk for investors. The combination of lower liquidity, potentially higher speculative trading activity, and market dynamics can lead to significant price swings in OTCQB securities. This volatility can create both opportunities and risks for investors, as prices can fluctuate rapidly, potentially resulting in significant gains or losses. Investors should carefully assess their risk tolerance and be prepared for increased price volatility when considering investments in OTCQB-listed securities. OTCQB-listed companies often have limited analyst coverage, which may impact their visibility and investment decisions. Unlike larger exchanges where numerous analysts and financial institutions provide research and analysis on listed companies, OTCQB-listed firms may receive less attention from analysts, making it harder for investors to access comprehensive and independent analysis. Less regulatory oversight compared to larger exchanges may expose investors to higher risks. While OTCQB has certain listing requirements and regulatory standards, they may not be as extensive or stringent as those imposed by major exchanges. This reduced regulatory oversight can increase the risk of potential fraudulent activities, inadequate financial disclosures, or non-compliance with securities laws. Investors can buy OTCQB stocks through any broker that provides access to OTC markets. They can place buy orders for specific OTCQB securities through their broker's trading platform, similar to how they would purchase stocks listed on major exchanges. The OTCQB operates in standard trading hours from 9:30 a.m. to 4:00 p.m. Eastern Time. During this time, investors can actively trade OTCQB stocks and execute buy or sell orders. It's important to note that trading hours may vary depending on the broker and any specific limitations or extended hours they offer. Market makers play a crucial role in the OTCQB, providing bid and ask quotes and maintaining market liquidity. These entities facilitate trading by being willing to buy or sell OTCQB securities at quoted prices, thereby ensuring that there are market participants available to execute trades and maintain a functioning market. The OTCQB utilizes electronic quotation and trading systems, which improve the efficiency and transparency of trades. These systems allow investors to access real-time quotes and execute trades electronically, enhancing the overall trading experience and reducing manual processes associated with paper-based transactions. The OTCQB spread is the difference between the highest price that a buyer is willing to pay for an asset and the lowest price that a seller is willing to accept. It represents the transaction costs and liquidity characteristics of OTCQB securities. Investors should be aware of the spread when buying or selling OTCQB stocks, as a wider spread can impact the cost of executing trades and potentially result in higher transaction costs. Role of the Financial Industry Regulatory Authority (FINRA): FINRA plays a crucial role in overseeing broker-dealers involved in OTC trading, ensuring compliance with securities laws and regulations. Role of the Securities and Exchange Commission (SEC): The SEC regulates the OTCQB and ensures it operates in a fair and efficient manner. OTC Markets Group's Responsibility: The OTC Markets Group is responsible for operating the OTCQB and ensuring it meets its aim of providing a transparent and regulated marketplace. Penalties for Non-compliance: Companies that fail to comply with OTCQB requirements can face penalties, including fines, suspensions, and being delisted. The OTCQB plays a vital role as an intermediary platform in the OTC markets, offering a valuable venue for early-stage and growing enterprises to trade their shares. Its listing requirements and compliance standards foster an environment that strikes a balance between accessibility for smaller companies and transparency for investors. The benefits of listing on the OTCQB include enhanced visibility, access to capital, and potential credibility in the marketplace. However, it's crucial for investors to be mindful of potential risks such as lower liquidity, market volatility, and limited analyst coverage. The regulation from bodies such as FINRA and SEC, along with oversight from the OTC Markets Group, helps maintain a fair and efficient market.OTCQB Overview

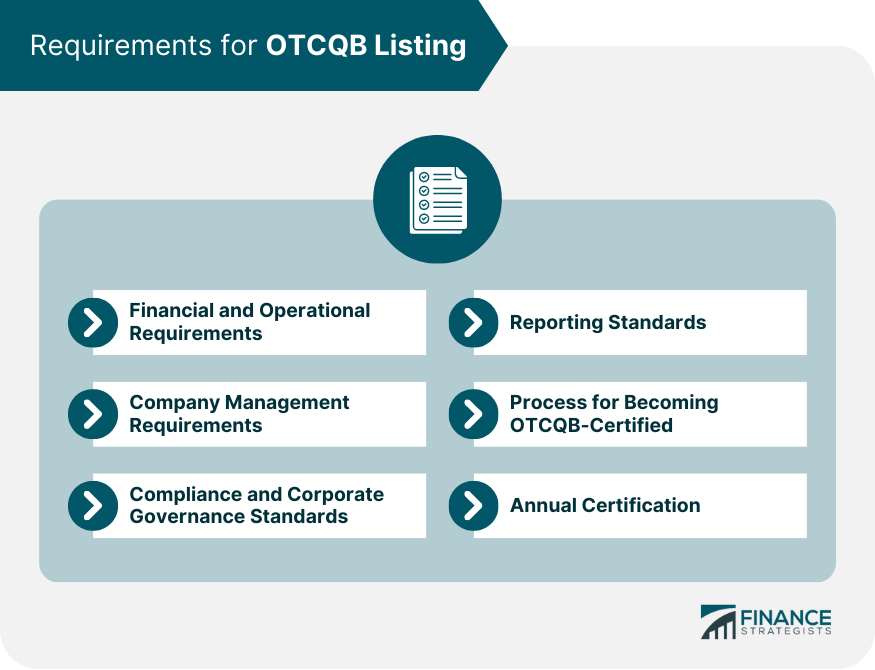

Requirements for OTCQB Listing

Financial and Operational Requirements

Company Management Requirements

Compliance and Corporate Governance Standards

Reporting Standards

Process for Becoming OTCQB-Certified

Annual Certification

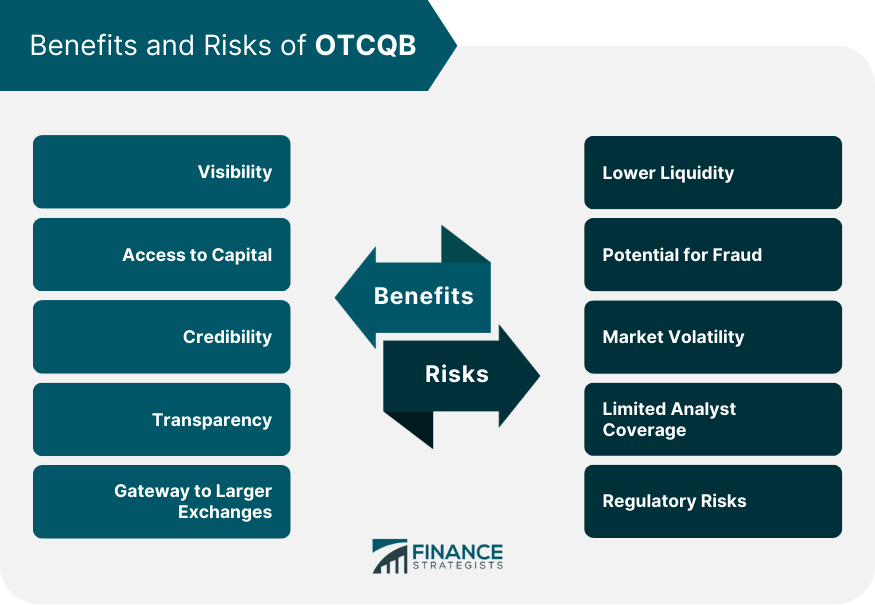

Benefits of OTCQB

Visibility

Access to Capital

Credibility

Transparency

Gateway to Larger Exchange

Risks of OTCQB

Lower Liquidity

Potential for Fraud

Market Volatility

Limited Analyst Coverage

Regulatory Risks

OTCQB Trading Mechanics

Buying OTCQB Stock

Trading Hours

Market Makers and Their Role

Electronic Quotation and Trading Systems

The OTCQB Spread

Regulation and Oversight of OTCQB

Conclusion

OTCQB FAQs

The OTCQB is a tier of the over-the-counter (OTC) market that is operated by the OTC Markets Group. It's known as the Venture Market, providing a platform for early-stage and developing companies in the U.S. and international markets to trade their stocks.

Companies must meet specific financial and operational requirements, such as a minimum stock price, certain total assets, and net income. They must also meet compliance and corporate governance standards, adhere to reporting standards, undergo an annual verification and management certification process, and meet certain company management requirements.

The OTCQB operates during standard trading hours, which are from 9:30 a.m. to 4:00 p.m. Eastern Time.

The benefits include enhanced visibility to investors, improved liquidity, and increased trust and credibility. However, the risks include lower liquidity compared to major exchanges, the potential for fraud, and less regulatory oversight compared to more regulated markets.

The OTCQB market is regulated by several entities, including the Financial Industry Regulatory Authority (FINRA), which oversees broker-dealers involved in OTC trading, and the Securities and Exchange Commission (SEC), which ensures that the market operates in a fair and efficient manner. The OTC Markets Group, the operator of the OTCQB, also has a responsibility to ensure the transparency and efficiency of the market.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.