After-hours trading refers to the buying and selling of securities outside of the standard trading hours of a stock exchange. "After-hours trading" is the time after the major stock exchanges close, during which some trading still occurs. After-hours trading begins at 4 PM US Eastern Time and can run as late as 8 PM. Transactions can still occur before and after these times, allowing for extended trading opportunities. This trading is conducted through electronic communication networks, or ECNs, rather than traditional stock exchanges, like the NYSE, or New York Stock Exchange. This type of trading can occur due to various reasons, including different time zones or the release of significant news after the market has closed. After-hours trading is available for investors to utilize when news breaks after the close of the regular trading session which occurs between 9:30 AM and 4 PM Eastern Time. For example, if a company's earnings report is released after hours, it may prompt investors to buy or sell a stock. Although a spike in volume may occur initially with the release of news, trading volume will usually thin out as the session progresses, often by 6 PM. While the standard trading hours cater to a significant portion of the market, extended hours sessions accommodate those looking to trade outside these times. There are mainly two sessions: the pre-market session, which happens before the regular market opens, and the post-market session, which occurs after the regular market closes. The exact timing of these sessions can vary depending on the specific stock exchange and the brokerage facilitating the trade. Historically, institutional investors primarily engaged in after-hours trading due to their extensive resources and sophisticated trading technology. However, with the rise of electronic communication networks (ECNs), individual retail investors have now gained more access to trade outside of standard hours. These platforms match buy and sell orders for users during extended hours, allowing a more diverse set of participants in after-hours trading. To engage in after-hours trading, one usually requires access to an electronic communication network or ECN. Many brokerages now offer their clients access to these platforms. However, the type of securities available for trading and the exact hours of operation can differ among brokers. Investors interested in after-hours trading should first ensure that their brokerage offers the necessary facilities and then familiarize themselves with the specific details and restrictions. Investors who cannot trade during regular hours due to work commitments or other constraints can still participate in the market. This extended access ensures that they don't miss out on potential investment opportunities. Significant news events, such as earnings announcements or economic data releases, often occur outside of regular trading hours. After-hours trading allows investors to react immediately to such news, rather than waiting for the market to open the next day. This responsiveness can be crucial, especially if the news is expected to significantly impact stock prices. Engaging in after-hours trading allows investors to broaden their portfolio and take advantage of unique opportunities not available during regular hours. For instance, certain foreign assets or specific types of trades might only be accessible during extended hours, providing an avenue for enhanced portfolio diversification. After hours trading comes with some drawbacks. Because there are less participants during after hours trading, investors will deal with "thin markets." Fewer participants translates to less liquidity, and less liquidity can create more volatility. The inefficiency created by fewer participants also creates a larger "bid-ask spread," or a bigger gap between what buyers are willing to pay and sellers are willing to sell for. Paying slightly more when buying and receiving less when selling, along with the illiquidity and volatility created by fewer market participants, are drawbacks of after hours trading. After-hours trading can often be characterized by heightened volatility compared to standard trading hours. With fewer participants and reduced trading volumes, stock prices may experience more significant fluctuations. A single large trade can have a substantial impact on a stock's price, leading to rapid gains or losses. Traders should approach with caution and be prepared for sudden price swings that might not reflect the stock's value during regular hours. Liquidity, which refers to the ease with which an asset can be bought or sold without affecting its price, tends to decrease during after-hours trading. With fewer traders and investors active after standard market hours, it can be harder to execute trades at desired price points. This lack of liquidity can lead to wider bid-ask spreads, making trading more expensive and potentially less profitable. Trading after-hours often means doing so with limited information at one's disposal. Most companies release news and earnings reports during this period to ensure that all investors get the information simultaneously. However, with analysts and financial news outlets typically less active, interpreting the full implications of such releases can be challenging. As a result, traders might make decisions based on incomplete data, increasing their risk. One popular strategy for after-hours traders is to capitalize on "earnings plays." This approach involves trading stocks based on companies' quarterly earnings reports. Since these reports often come out after regular trading hours, there can be significant price movements as investors react to the news. By anticipating how a stock might move based on its earnings relative to expectations, traders can position themselves to profit. Overnight trading is a strategy where traders hold positions after the market closes and sell them when it reopens the next day. The idea behind this approach is to benefit from any positive momentum built during after-hours trading, which could continue into the next trading day. While this can be profitable, it's essential to keep in mind the inherent risks of holding positions overnight, particularly the uncertainty of market conditions the following day. Given the propensity for companies and governments to release significant news after regular market hours, many after-hours traders specialize in news-driven trading. This strategy involves quickly acting on fresh news, whether it's a product announcement, a geopolitical event, or a regulatory change. Speed and efficiency are of the essence here, as the first reactions to news can often result in the most substantial price movements. After-Hours Trading encompasses the buying and selling of securities outside standard market hours, allowing investors to respond swiftly to news events and extend their trading opportunities. This trading window, occurring from 4 PM to as late as 8 PM US Eastern Time, offers both advantages and risks. The flexibility it provides benefits those with time constraints, while immediate reactions to after-hours news and portfolio diversification are notable perks. However, the risks of increased volatility, limited liquidity, and trading with limited information must be carefully considered. Strategies such as earnings plays, overnight trading, and news-driven approaches offer avenues for potential gains but require cautious execution. Participants should remain attentive to market dynamics, utilizing sound strategies to navigate the unique challenges and opportunities presented by this specialized trading environment.After-Hours Trading Definition

How Does After-Hours Trading Work?

Extended Hours Sessions

Participants in After-Hours Trading

Trading Platforms and Access

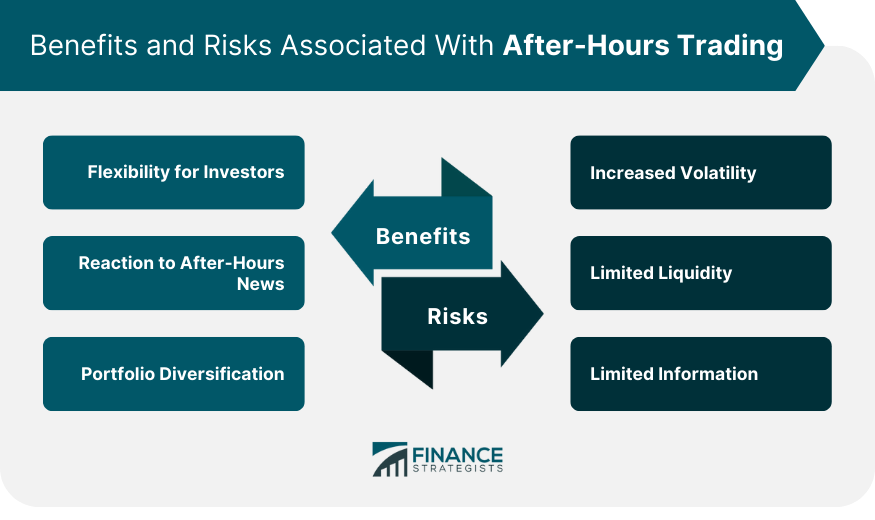

Benefits of After-Hours Trading

Flexibility for Investors

Reaction to After-Hours News

Portfolio Diversification

Risks Associated With After-Hours Trading

Increased Volatility

Limited Liquidity

Limited Information

Strategies for After-Hours Trading

Earnings Plays

Overnight Trading

News-Driven Trading

Conclusion

After-Hours Trading FAQs

After hours trading is the time after the major stock exchanges close, during which some trading still occurs.

After hours begins at 4:00 PM EST and can run as late as 8:00 PM EST.

During after hours trading, trading is conducted through electronic communication networks, or ECNs, rather than traditional stock exchanges.

Fewer participants translates to less liquidity, and less liquidity can create more volatility.

After-hours trading is available for investors to take advantage of breaking news after the close of the regular trading session which occurs between 9:30 AM and 4 PM Eastern Time.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.