An opening cross is a mechanism used by stock exchanges to establish a single opening price for stocks, incorporating buy and sell orders from multiple market participants. The purpose of the opening cross is to create a fair and transparent market opening by consolidating order flow and providing improved price discovery. This process helps to establish an equilibrium price for securities at the beginning of the trading day, thereby mitigating the effects of overnight news and market events. The opening cross plays a significant role in wealth management by ensuring a stable and efficient market opening. By establishing a single opening price, investors and traders can execute their investment strategies with a higher level of confidence. Moreover, the opening cross aids in minimizing market volatility, as well as mitigating the impact of large order imbalances at the beginning of the trading session. This stability is essential for investors who rely on stable market conditions to make informed decisions for their investment portfolios. The opening cross has its roots in the early days of stock exchanges when trading was conducted in physical auction markets. Traders would gather at a central location and participate in an open outcry system to buy and sell shares. The opening cross has since evolved, adapting to advancements in technology and the shift toward electronic trading platforms. Today, the opening cross is facilitated by sophisticated algorithms that consolidate orders from market participants to determine a single opening price. The primary purpose of the opening cross is to facilitate a fair and orderly market opening by establishing a single, transparent price for securities at the start of the trading session. This is achieved through the aggregation of buy and sell orders from various market participants. By bringing together the diverse range of market participants' orders, the opening cross helps to match supply and demand, thereby facilitating efficient price discovery and minimizing market volatility. In the pre-market preparation phase, stock exchanges provide a venue for market participants to submit their buy and sell orders before the market opens. During this time, investors can analyze the order book to gauge market sentiment and make necessary adjustments to their investment strategies. Exchanges may also disseminate relevant information, such as corporate news or economic data releases, that could influence trading decisions during the upcoming session. During the order collection phase, market participants can submit, modify, or cancel their orders. Exchanges typically have a designated time window for accepting orders to be considered in the opening cross. The order book accumulates buy and sell orders for each security, with participants indicating the quantity of shares they wish to trade and the price at which they are willing to transact. In the price determination phase, the exchange's matching algorithm consolidates the orders submitted during the order collection phase. The algorithm then calculates a single opening price for each security that maximizes the total volume of shares traded while minimizing the remaining order imbalance. This opening price is determined by identifying the price at which the highest number of shares can be executed without any significant order imbalances. Once the opening price has been determined, the exchange proceeds to execute trades at the established price. Buy and sell orders that match the opening price are executed, and the shares are transferred between the respective parties. The executed trades are then cleared and settled, ensuring that all parties receive the appropriate shares and funds. The opening cross promotes improved price discovery by aggregating orders from a wide range of market participants, resulting in a single, transparent opening price. This process allows investors to gain a clear understanding of the market sentiment for each security, helping them make informed trading decisions. The opening cross contributes to improved liquidity by matching a large number of buy and sell orders at the beginning of the trading session. As a result, investors can more easily execute their trades, minimizing the impact of their transactions on market prices. This increased liquidity ultimately leads to tighter bid-ask spreads and reduced transaction costs for market participants. By establishing a single opening price for each security, the opening cross ensures an orderly and efficient start to the trading session. This mechanism helps minimize market volatility and prevents significant price discrepancies that may arise due to overnight news or market events. Consequently, the opening cross promotes a stable trading environment and fosters investor confidence. The opening cross enables the execution of large block trades without causing substantial price fluctuations. By consolidating orders from multiple market participants, the opening cross process effectively absorbs the impact of sizable transactions, preventing abrupt price movements that could disrupt market stability. One of the concerns surrounding the opening cross is the potential for market manipulation. Market participants with considerable resources may attempt to artificially influence the opening price by submitting large orders or engaging in strategic trading behavior. However, exchanges typically have surveillance and monitoring systems in place to detect and prevent such practices. Despite the opening cross's primary function of minimizing market volatility, some critics argue that it can occasionally exacerbate price fluctuations. In cases where the order book is imbalanced or dominated by a few large orders, the opening cross may result in significant price movements that could create a ripple effect throughout the trading session. The process of aggregating orders for the opening cross may inadvertently reveal sensitive information about market participants' trading intentions. This information could be exploited by other investors, potentially leading to unfair advantages or disadvantaging those whose information has been exposed. Exchanges and market participants must comply with numerous regulations regarding the opening cross process. Failure to adhere to these rules may result in fines or other penalties. Moreover, changes in regulatory requirements can create challenges for exchanges and investors as they adapt their processes and systems to accommodate new rules. The New York Stock Exchange (NYSE) utilizes the opening cross mechanism to determine the opening price for each security. The NYSE opening cross involves a designated market maker (DMM) responsible for collecting orders and managing the auction process. The DMM uses an electronic system to match buy and sell orders and determine the opening price based on supply and demand. NASDAQ, an electronic stock exchange, also employs the opening cross mechanism. NASDAQ's opening cross process involves the use of a sophisticated algorithm that aggregates orders and determines the opening price for each security. This system ensures a fair and orderly market opening and helps reduce price volatility. The opening cross mechanism is not limited to equity markets; it can also be applied to fixed income securities, such as bonds. The opening cross in fixed income markets helps establish an equilibrium price for bonds at the beginning of the trading session, enabling market participants to execute their transactions efficiently. Derivatives, including futures and options, can also benefit from the opening cross mechanism. The opening cross helps determine the initial price levels for derivative contracts, ensuring a fair and orderly market opening for these financial instruments. Transparency and disclosure are critical to maintaining a fair and efficient opening cross process. Exchanges should clearly communicate the rules and procedures surrounding the opening cross to all market participants, providing them with the necessary information to make informed trading decisions. Exchanges should actively monitor and surveil the opening cross process to detect any irregularities or signs of market manipulation. Implementing robust surveillance systems can help identify suspicious trading activity and ensure the integrity of the opening cross mechanism. Both exchanges and market participants must comply with applicable regulatory requirements governing the opening cross process. Adhering to these rules can help maintain a fair and efficient market opening, promoting investor confidence and fostering overall market stability. Opening Cross refers to a specific period at the beginning of the trading day when buy and sell orders are matched to establish an opening price for a security or asset. It plays a crucial role in setting the tone for market activity and determining the initial value of securities. The process of Opening Cross involves various stages. It begins with pre-market preparation, including data analysis and trading strategy formulation. During the order collection phase, orders are accepted and categorized. The price determination phase matches buy and sell orders, leading to the establishment of the opening price. Finally, the execution and clearing phase executes trades and settles transactions. To ensure efficiency and integrity, several best practices are recommended for Opening Cross. These include transparency and disclosure, monitoring and surveillance mechanisms, and compliance with regulatory requirements. Adhering to these practices helps maintain a fair and transparent market environment. Opening Cross holds significant importance for investors and market participants. It enhances price discovery by establishing a fair and transparent opening price. Improved liquidity allows for efficient execution of trades and minimizes transaction costs. Moreover, Opening Cross facilitates efficient market opening, enabling smooth and orderly trading. It also aids in facilitating large block trades, catering to the needs of institutional investors.What Is an Opening Cross?

Background of Opening Crosses

History and Evolution

Purpose and Function

Process of Opening Crosses

Pre-market Preparation

Order Collection Phase

Price Determination Phase

Execution and Clearing Phase

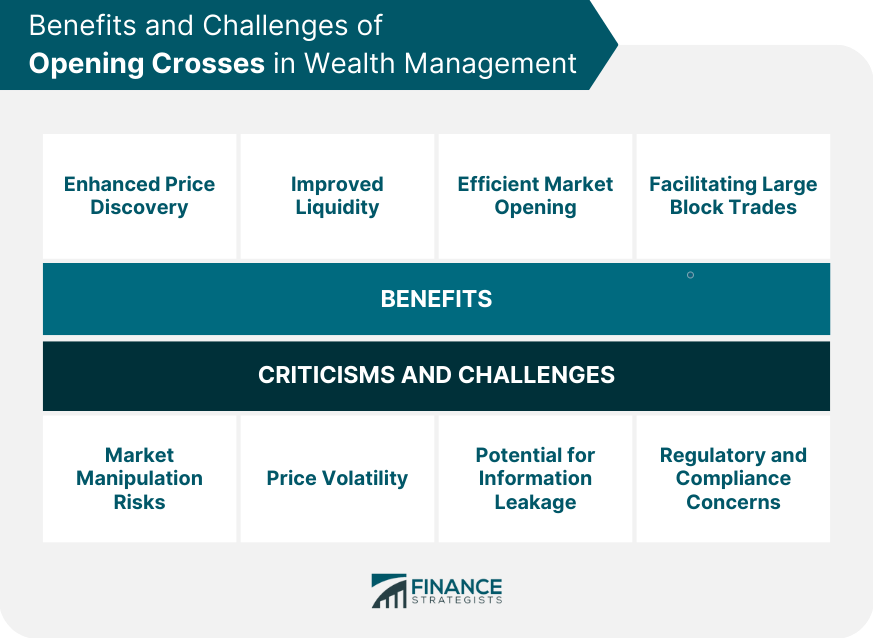

Benefits of Opening Crosses

Enhanced Price Discovery

Improved Liquidity

Efficient Market Opening

Facilitating Large Block Trades

Criticisms and Challenges

Market Manipulation Risks

Price Volatility

Potential for Information Leakage

Regulatory and Compliance Concerns

Examples and Case Studies

NYSE Opening Cross

NASDAQ Opening Cross

Fixed Income Securities

Derivatives

Best Practices for Opening Crosses

Transparency and Disclosure

Monitoring and Surveillance

Compliance With Regulatory Requirements

Conclusion

Opening Cross FAQs

The primary purpose of the opening cross is to establish a single, transparent opening price for securities at the start of the trading session, promoting efficient price discovery and minimizing market volatility.

The opening cross benefits investors by providing improved price discovery, increased liquidity, and a more stable market opening, enabling them to execute their investment strategies with greater confidence.

Some challenges associated with the opening cross include potential market manipulation risks, price volatility, information leakage, and regulatory compliance concerns.

While many stock exchanges utilize the opening cross mechanism, its implementation may vary across different exchanges. The primary goal, however, remains the same – to establish a single, transparent opening price for securities.

Best practices for the opening cross include promoting transparency and disclosure, implementing robust monitoring and surveillance systems, and adhering to regulatory requirements.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.