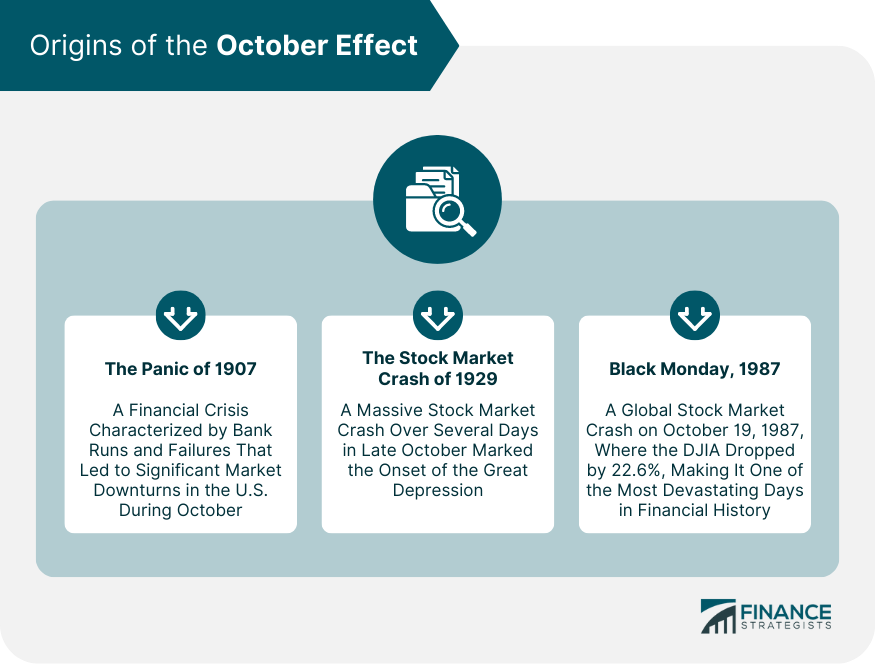

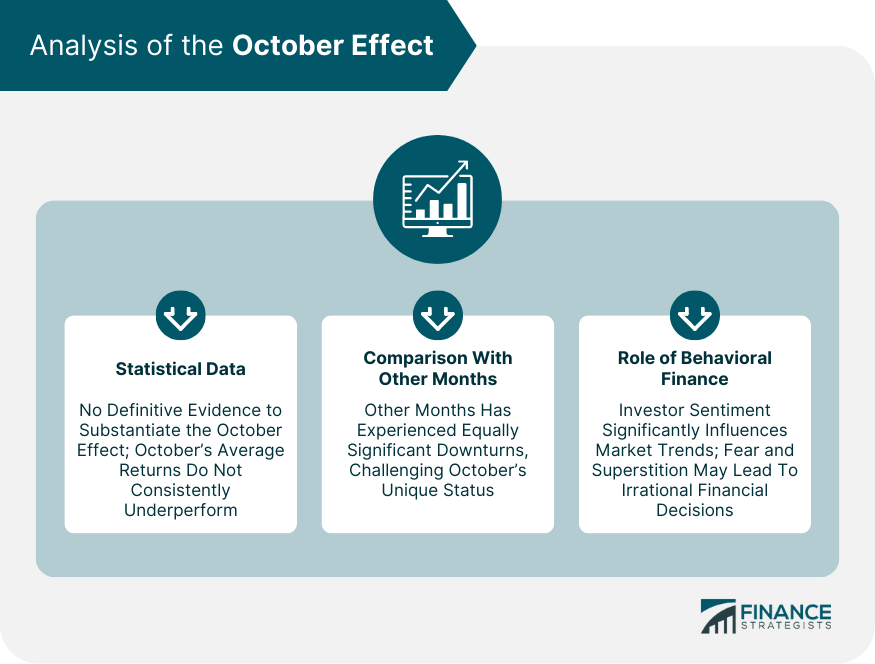

The October Effect is a unique, albeit controversial, term that has gained momentum in the world of finance. Often, it refers to the theory that stock markets are more likely to decline during October, hence giving it an eerie reputation among investors. The belief stems from historical market crashes that took place during October, which contributed to a perceived pattern. While there isn't definitive empirical evidence to substantiate this phenomenon, it plays a significant role in shaping investor behavior and market sentiment. At the intersection of finance and psychology, the October Effect serves as a potent example of how market perceptions can impact real-world trading. Historical crashes and financial downturns have led to the widespread belief in the October Effect. Some of the most notable include: The Panic of 1907, also known as the 1907 Bankers' Panic, was a financial crisis in the United States that occurred in October. It was characterized by a series of bank runs and failures, leading to significant market downturns. Perhaps the most infamous event linked to the October Effect is the 1929 stock market crash. This event, often regarded as the precursor to the Great Depression, saw a dramatic fall in stock prices on Wall Street over several days in late October. On October 19, 1987, stock markets around the world crashed in a domino effect, making it one of the most devastating days in financial history. The Dow Jones Industrial Average (DJIA) dropped by a shocking 22.6%. These events collectively gave rise to the perception of October as a jinxed month, thus creating an undercurrent of fear and anxiety among investors. Examining the October Effect requires the scrutiny of financial data, a comparison of October's performance with other months, and an understanding of behavioral finance. A thorough analysis of stock market data does not unequivocally support the October Effect. While there have been significant market downturns in October, the monthly average returns do not suggest October as being distinctly unfavorable for investors. When compared to other months, October does not consistently rank as the worst month for stock returns. Often, other months have displayed equally significant market downturns. Behavioral finance plays a critical role in the October Effect. This field of study suggests that investor sentiment and psychology significantly influence the stock market, often leading to irrational financial decisions based on fear or superstition. Despite its debatable statistical validity, the October Effect impacts investor behavior and decision-making. The mere belief in the October Effect can cause anxiety among investors, leading to potentially hasty decisions. Investors may sell stocks in fear of a crash, indirectly influencing market fluctuations. Fear and panic are powerful psychological factors that can influence decision-making. During October, these elements can become heightened, possibly leading to self-fulfilling prophecies where the fear of a market downturn triggers a sell-off, subsequently causing a dip in the market. Skepticism regarding the October Effect arises due to contradictory research findings and the theory's reliance on superstition over rational decision-making. Many financial analysts and scholars express skepticism regarding the October Effect. Critics argue that the effect is more perception than reality and that any pattern might merely be random or coincidental. Several studies show conflicting results when scrutinizing the October Effect. Some research indicates that other months have experienced more or equally significant downturns, thus challenging the unique status given to October. The October Effect stands as a compelling concept in financial lore, symbolizing the intriguing interplay between investor sentiment and market trends. Born from the ashes of major historical crashes like the Panic of 1907, the 1929 stock market crash, and Black Monday in 1987, the theory posits an increased likelihood of market downturns during October. Yet, an objective analysis paints a nuanced picture. While significant declines have indeed been observed in October, the month doesn't consistently emerge as the worst performer when scrutinizing long-term data. It's imperative to consider this broader context, acknowledging the influence of behavioral finance and psychology. Ultimately, the October Effect underscores the delicate balance between respecting market patterns and ensuring that decisions are driven by rational analysis rather than fear or superstition. October Effect Overview

Origins of the October Effect

The Panic of 1907

The Stock Market Crash of 1929

Black Monday in 1987

Analysis of the October Effect

Statistical Data Regarding the October Effect

Comparisons With Other Months

Role of Behavioral Finance

Psychological Impact of the October Effect

Impact on Investor Behavior

Role of Fear and Panic in Decision-Making

Criticisms and Counter-Arguments to the October Effect

Skepticism About the Existence of the October Effect

Research Showing Conflicting Results

Conclusion

October Effect FAQs

The October Effect refers to the theory that stocks are more likely to decline during the month of October. This belief primarily stems from several historical market crashes that occurred during this month, such as the Panic of 1907, the Stock Market Crash of 1929, and Black Monday in 1987.

The statistical evidence supporting the October Effect is mixed and subject to interpretation. While it's true that several significant market crashes occurred in October, a comprehensive analysis of average monthly returns does not suggest October is consistently the worst month for stocks.

Even though its statistical validity is debatable, the October Effect can influence investor behavior. The belief in this phenomenon can lead to increased anxiety and potentially prompt hasty or fear-based decision-making, such as selling off stocks in anticipation of a downturn.

Critics of the October Effect argue that it is more perception than reality. Some suggest that the phenomenon may be a result of confirmation bias, where investors give undue importance to the major crashes that occurred in October, neglecting other significant downturns in different months.

The October Effect underscores the tension between rational and superstition-based investing. While it's important to consider historical trends and market patterns, relying solely on a belief like the October Effect could lead to potentially detrimental investment decisions. Investors are advised to base their strategies on comprehensive research and rational decision-making.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.