"Zombie Title" refers to a financial scenario where a property is stuck in limbo, not fully owned by either the homeowner, who believes they've lost it, or the bank, which hasn't completed the foreclosure process. This term gained prominence during the 2008 global financial crisis when many homeowners, unable to keep up with mortgage payments, deserted their properties expecting the bank to foreclose. However, if the bank doesn't finalize the foreclosure for various reasons, the property remains in this "zombie" state. Unknowingly, the homeowner might still be legally responsible for property taxes and maintenance, leading to potential financial and legal issues. Zombie Titles can negatively impact neighborhoods, property values, financial institutions, homeowners, and the broader housing market, particularly complicating recovery after a downturn as such properties often depreciate and pull down the values of nearby homes. Zombie Titles emerged as a noteworthy issue in the aftermath of the 2008 housing crisis. During this period, many homeowners defaulted on their mortgages due to financial instability. These homeowners often vacated their homes, believing the bank would proceed with foreclosure. However, in many instances, the foreclosure process was not completed, leading to the emergence of Zombie Titles. The foreclosure crisis created fertile ground for the rise of Zombie Titles. When homeowners could no longer afford their mortgage payments, they left their homes, expecting the banks to foreclose. Yet, for several reasons, including the high costs associated with foreclosure and the glut of properties banks already had on their books, banks sometimes halted the foreclosure process. The abandoned property, still technically owned by the original homeowner, thereby became a Zombie Title. Foreclosure is an intricate legal process that unfolds over multiple stages. Understanding each stage is crucial to comprehending how Zombie Titles come into being. The foreclosure process kicks off when a homeowner fails to make their mortgage payments for a specified period, often three months. At this point, the lender issues a Notice of Default, formally starting the foreclosure process. This notice indicates the amount owed and gives the borrower a certain period to settle the arrears. The period following the Notice of Default and before the official foreclosure auction is known as pre-foreclosure. During this period, homeowners have the opportunity to pay off their debt or negotiate a loan modification with their lender. If successful, the foreclosure process may be halted. If the homeowner fails to rectify the default or negotiate alternative terms with the lender during the pre-foreclosure period, the lender schedules a foreclosure sale or auction. At this sale, the property is sold to the highest bidder, often aiming to cover the remaining loan balance. If the property does not sell at auction, it becomes a real estate-owned (REO) property, meaning the bank or lender takes ownership. The lender may then seek to sell the property through a real estate agent to recoup their losses. While it seems logical that lenders would follow through with the foreclosure process to recoup their losses, various factors may lead them to abandon the process, giving birth to Zombie Titles. Foreclosure comes with significant costs, including legal fees, property maintenance, and eventual sales expenses. If the property's value has substantially depreciated or if the property requires extensive repairs, the costs of foreclosing, maintaining, and selling the property may outweigh the potential return. Consequently, the lender may opt to halt the foreclosure process. During a housing crisis, lenders can be inundated with a large number of foreclosures. Processing all these foreclosures requires extensive resources and can be time-consuming. If a lender lacks the necessary resources, they may choose to abandon the foreclosure process on some properties. Lenders might also abandon foreclosures due to concerns about potential liabilities associated with property ownership, such as environmental hazards or structural issues. By leaving the property in the original homeowner's name, they can avoid these potential pitfalls. In all these instances, the property ends up in a state of limbo — the original owner assumes they no longer own it, but the lender has not taken official ownership, creating the phenomenon known as Zombie Titles. The unsuspecting homeowners affected by Zombie Titles often face severe financial and legal consequences. Despite leaving their homes, they remain liable for property taxes, homeowner association fees, and other municipal charges associated with the property. Failure to meet these obligations can lead to fines or even potential jail time. Moreover, because the foreclosure is not finalized, it becomes challenging for these individuals to repair their credit and reenter the housing market. Zombie Titles also have broad ramifications for communities. As properties are left abandoned and unmaintained, they often become eyesores or havens for criminal activities, leading to neighborhood blight. This situation, in turn, can lower the property values in the entire community, affect local tax revenues, and drain municipal resources. The legal landscape surrounding Zombie Titles is complicated. While the original owners remain legally responsible for the property, they often lack the necessary resources or awareness to manage these responsibilities. This can lead to a host of issues, from disputes over liabilities and fines to potential lawsuits. The prevalence of Zombie Titles can contribute to housing market instability. They can artificially inflate the number of available properties in the market and distort real estate pricing. In turn, this can deter potential homeowners and investors, impeding the recovery and growth of the housing market. At the federal level, laws like the Fair Debt Collection Practices Act (FDCPA) and the Real Estate Settlement Procedures Act (RESPA) provide some protections to homeowners facing foreclosure. However, they do not directly address the issue of Zombie Titles. State laws vary widely, with some offering more protection than others. For instance, some states require lenders to provide notice when they decide not to proceed with foreclosure. Other states have enacted legislation to expedite the foreclosure process, reducing the likelihood of creating Zombie Titles. Agencies like the CFPB have a critical role in monitoring and addressing Zombie Titles. They provide guidance to homeowners and hold financial institutions accountable for unfair practices. However, the issue of Zombie Titles often falls between the cracks of existing regulations, signaling a need for more targeted policies and enforcement. Legal remedies for homeowners affected by Zombie Titles can include filing a quiet title action, which is a lawsuit seeking a court order declaring the homeowner free from the obligations of the property. Additionally, bankruptcy can sometimes be used as a tool to force the completion of foreclosure. Policy changes could go a long way in preventing Zombie Titles. These might include requiring banks to notify homeowners if they decide not to proceed with foreclosure or to maintain properties for which they have started the foreclosure process. Banks and other lenders also have a crucial role to play. By ensuring transparent communication with borrowers, promptly completing foreclosures, and adequately maintaining foreclosed properties, financial institutions can help prevent the creation of Zombie Titles. Moreover, offering loan modifications and other forms of assistance can keep homeowners in their homes, thereby averting foreclosures in the first place. Zombie Titles describe a situation where a property is in limbo; homeowners think they've lost it to foreclosure, but the lender hasn't finalized the process, keeping the title in the homeowner's name. This often results from the lender halting or abandoning the foreclosure due to financial constraints, an overwhelming number of foreclosures, or liability concerns. The implications of Zombie Titles are significant, leading to potential financial and legal problems for homeowners, contributing to neighborhood decay, and distorting the housing market dynamics. However, the impact can be mitigated with strategies such as legal remedies for homeowners, policy changes, and increased transparency from financial institutions. Given the issue's complexity, it's crucial to seek professional advice when dealing with a Zombie Title or to understand how to safeguard assets and navigate potential financial hurdles. Wealth management services can offer vital guidance in such scenarios.What Are Zombie Titles?

Emergence of Zombie Titles

Historical Context of Zombie Titles

Relationship Between Foreclosure Crisis and Zombie Titles

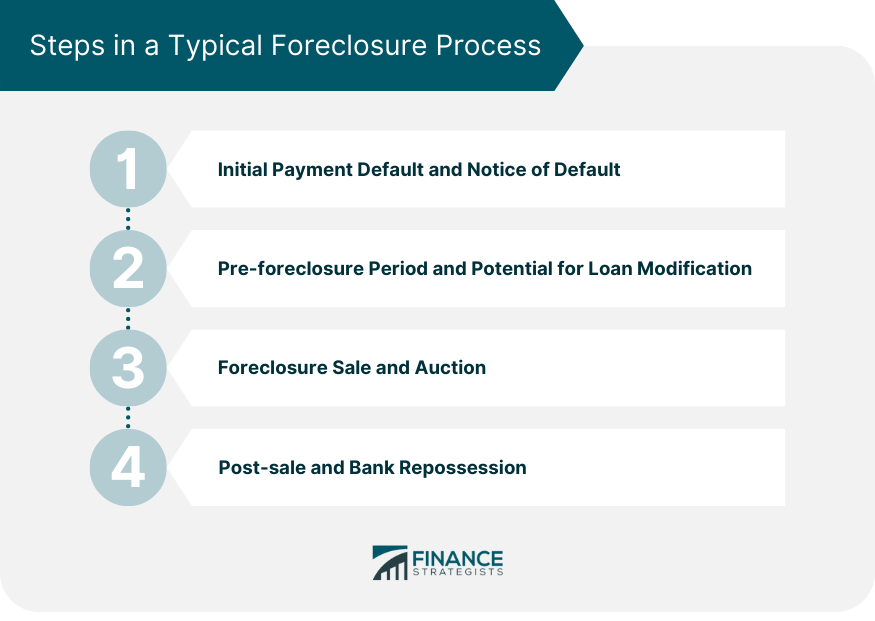

Steps in a Typical Foreclosure Process

Initial Payment Default and Notice of Default

Pre-foreclosure Period and the Potential for Loan Modification

Foreclosure Sale and Auction

Post-sale and Bank Repossession

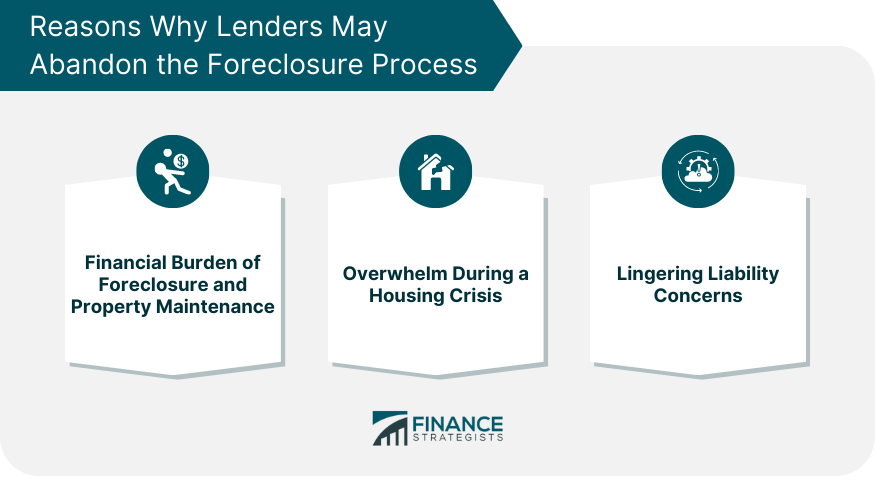

Reasons Why Lenders May Abandon the Foreclosure Process

Financial Burden of Foreclosure and Property Maintenance

Overwhelm During a Housing Crisis

Lingering Liability Concerns

Implications of Zombie Titles

Effect on Homeowners

Neighborhoods and Property Values

Legal Implications

Housing Market Instability

Legal and Regulatory Framework Around Zombie Titles

Federal Laws

State Laws and Variations in Regulation

Role of the Consumer Financial Protection Bureau (CFPB) and Other Agencies

Possible Solutions and Strategies to Address Zombie Titles

Potential Legal Remedies for Homeowners

Policy Recommendations

Role of Financial Institutions

Final Thoughts

Zombie Titles FAQs

A Zombie Title refers to a property where the homeowner believes they've lost the property to foreclosure, but the bank or lender has not completed the foreclosure process. The title remains in the homeowner's name, leaving them with ongoing legal and financial responsibilities.

A property becomes a Zombie Title when the foreclosure process is halted or abandoned by the lender, often due to financial reasons, an overwhelming number of foreclosures, or concerns about potential liabilities. The property remains in the homeowner's name, despite the homeowner believing they no longer own it.

Homeowners affected by Zombie Titles may face significant financial and legal consequences. They remain liable for property taxes, homeowner association fees, and other municipal charges and may also face difficulties repairing their credit and reentering the housing market.

Homeowners can address Zombie Titles through legal remedies like filing a quiet title action or bankruptcy to force the completion of foreclosure. Additionally, they can engage with wealth management services for guidance and support in navigating this complex situation.

Strategies to prevent the creation of Zombie Titles include policy changes requiring banks to notify homeowners if they decide not to proceed with the foreclosure and lenders promptly completing foreclosures, adequately maintaining foreclosed properties, and offering loan modifications.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.