Vacation rental investing has become an increasingly popular strategy for generating passive income in the real estate market. Vacation rental investing can be an attractive investment option for those who are looking for a source of passive income, as well as those who enjoy traveling themselves and want to own a vacation property that they can use for personal vacations as well. Before diving into vacation rental investing, it is crucial to conduct thorough market research to identify high-demand locations, assess local regulations and restrictions, and analyze market trends and seasonality. This information will help you make informed decisions about where and when to invest. Determining your initial investment budget is a critical step in vacation rental investing. You will also need to estimate income and expenses, taking into account property management fees, taxes, and maintenance costs. Evaluating financing options, such as traditional mortgages or investor-specific loans, will help you secure the necessary funds for your investment. A strong team of professionals is essential for a successful vacation rental investment. This may include real estate agents with local market knowledge, property managers to oversee day-to-day operations, and maintenance and repair professionals to keep the property in top condition. When selecting a vacation rental property, consider the different types of properties available, such as single-family homes, condominiums, and multi-unit buildings. Each type of property offers unique benefits and challenges, so it is important to weigh the pros and cons based on your investment goals. A property's location, amenities, and features will play a significant role in its appeal to potential guests. Additionally, assess the property's condition and any necessary improvements to ensure that it meets your standards and expectations. Once you have identified a suitable property, make a competitive offer and conduct thorough due diligence, including property inspections. Finally, secure financing and close the deal with the help of your real estate agent and legal advisor. Furnishing and decorating your vacation rental is essential to creating a comfortable and inviting space for guests. Ensure that you also implement safety and security measures and obtain any required local permits and licenses. To attract guests and maximize bookings, list your vacation rental on popular platforms, such as Airbnb and VRBO. Use professional photography and engaging descriptions to showcase your property. Develop a pricing strategy that takes into account market rates, seasonality, and promotions. Effective communication and customer service is vital for managing bookings and maintaining positive guest relations. Establish clear check-in and check-out procedures, and be prepared to handle any guest issues or emergencies that may arise during their stay. Regular maintenance and repairs will keep your vacation rental in excellent condition and minimize the likelihood of costly repairs. Manage utilities and expenses efficiently, and stay up-to-date with local regulations to ensure compliance. Continuously evaluate your property's performance and adjust your strategies as needed to optimize your return on investment. As a vacation rental investor, it is important to have an exit strategy in place. Options include holding the property long-term to benefit from appreciation, refinancing or leveraging equity to invest in additional properties, or selling the property if market conditions are favorable. Vacation rental investing have become increasingly popular in recent years as a way for individuals to generate passive income and diversify their investment portfolio. However, like any investment, there are both pros and cons to consider before making a decision. High Potential Rental Income: Vacation rentals can generate higher rental income than traditional long-term rentals, particularly in popular tourist destinations. Flexibility: Owners of vacation rentals have the flexibility to use the property for personal use during non-peak times while still generating income during peak season. Appreciation Potential: Vacation rental properties located in desirable locations may appreciate in value over time, providing a long-term investment opportunity. Tax Benefits: Rental property owners may be eligible for tax deductions on expenses related to the property, including mortgage interest, property taxes, and maintenance costs. Rental Demand: The increasing popularity of vacation rentals has led to a higher demand for these types of properties, particularly in popular tourist destinations. High Upfront Costs: The initial investment in a vacation rental property can be substantial, including the down payment, closing costs, and furnishings. Seasonal Fluctuations: Rental income for vacation properties can be highly seasonal, with the majority of revenue generated during peak tourist season. Property Management: Vacation rental properties require regular upkeep, cleaning, and maintenance, which can be time-consuming and expensive. Legal Regulations: Some cities and states have laws regulating short-term rentals, which can restrict or limit the operation of vacation rental properties. Market Saturation: As vacation rental investing grows in popularity, competition among rental properties may increase, leading to lower occupancy Vacation rental investing can be a profitable and flexible investment option for generating passive income in the real estate market. However, to make a successful investment, potential investors should conduct thorough market research, financial planning, and build a reliable team to support the investment process. Additionally, investors must identify suitable properties, evaluate property characteristics, negotiate and close deals, market the rental property effectively, manage bookings and guest relations, and maintain the property to ensure a positive return on investment. Pros of vacation rental investing include high potential rental income, flexibility, appreciation potential, tax benefits, and rental demand. However, investors should also consider the cons, such as high upfront costs, seasonal fluctuations, property management requirements, legal regulations, and market saturation. With proper planning and research, vacation rental investing can be a valuable addition to an investment portfolio.What Is Vacation Rental Investing?

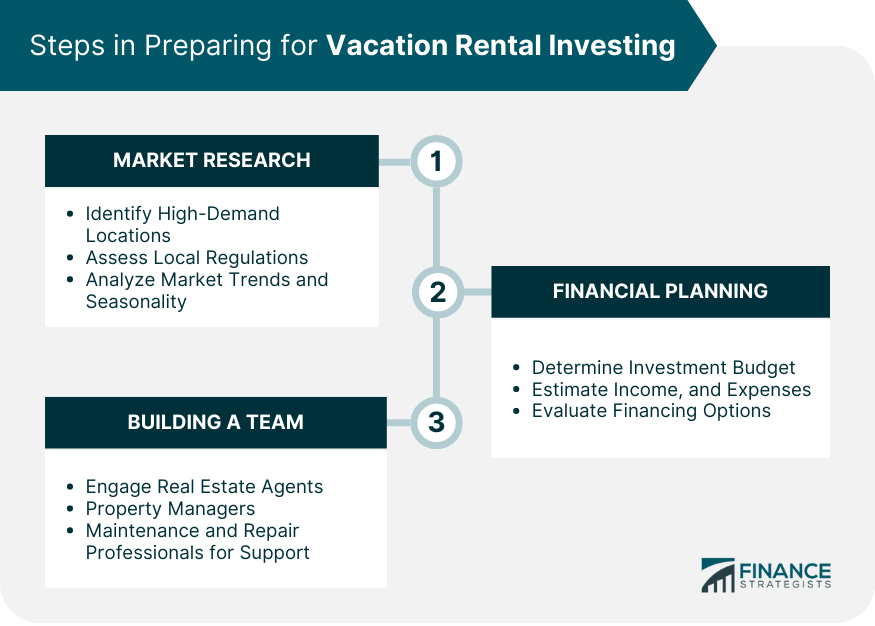

Preparing for Vacation Rental Investing

Market Research

Financial Planning

Building a Team

Property Selection and Acquisition in Vacation Rental Investing

Identifying Potential Properties

Evaluating Property Characteristics

Negotiating and Closing the Deal

Property Management and Marketing in Vacation Rental Investing

Setting up the Vacation Rental

Marketing the Vacation Rental

Managing Bookings and Guest Relations

Ongoing Property Maintenance and Management

Exit Strategies and Potential Returns

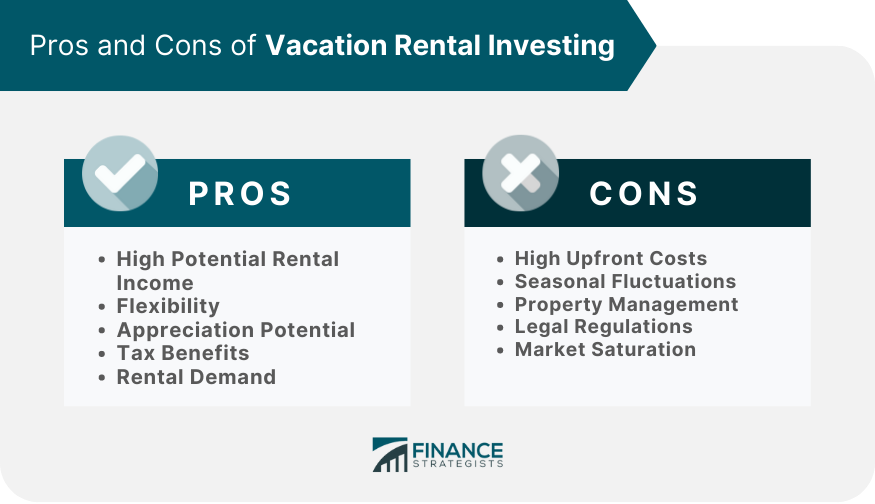

Pros and Cons of Vacation Rental Investing

Pros

Cons

Conclusion

Vacation Rental Investing FAQs

Vacation rental investing involves purchasing properties specifically to rent out to travelers and tourists on a short-term basis. Unlike traditional real estate investing, which often focuses on long-term residential or commercial tenants, vacation rental investing aims to generate income through frequent, short-term bookings.

To identify profitable locations, conduct thorough market research to determine areas with high demand for vacation rentals. Factors to consider include tourist attractions, local amenities, accessibility, and seasonal trends. Additionally, assess local regulations and restrictions that may impact your ability to rent out your property.

Key factors to consider when selecting a property for vacation rental investing include property type (single-family home, condominium, or multi-unit building), location, amenities, and features. The property's condition and any necessary improvements should also be taken into account to ensure it meets the expectations of potential guests.

Effective marketing strategies for vacation rental properties include listing on popular platforms like Airbnb and VRBO, using professional photography and engaging descriptions, and developing a pricing strategy based on market rates and seasonality. Promotions and discounts may also be used to attract guests and increase bookings during off-peak periods.

As a vacation rental property owner, you will need to manage bookings and guest relations, maintain the property through regular maintenance and repairs, manage utilities and expenses, and stay up-to-date with local regulations. Additionally, evaluating your property's performance and adjusting your strategies as needed will help optimize your return on investment.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.