A turnkey property refers to a real estate investment that is fully renovated, furnished, and ready for immediate occupancy or rental. It is a property that requires minimal or no additional work or improvements upon purchase. Turnkey properties are often marketed to investors seeking hassle-free real estate investments that can generate immediate income. Turnkey properties play a significant role in wealth management as they offer potential benefits such as passive income generation, portfolio diversification, professional property management, and risk mitigation. Understanding the key factors, benefits, and potential risks associated with turnkey properties is crucial for making informed wealth management decisions. Location is a critical factor in turnkey property investment. Investors should conduct thorough market analysis to identify areas with high rental demand, potential for property appreciation, and favorable economic conditions. Understanding the local market dynamics helps ensure that the turnkey property aligns with wealth management objectives. The condition and quality of a turnkey property are essential considerations. Investors should assess the property's structural integrity, renovation quality, and the use of high-quality materials and finishes. A well-maintained and aesthetically pleasing turnkey property is more likely to attract reliable tenants and maintain long-term value. Investors should evaluate the cash flow potential and return on investment (ROI) of a turnkey property. This involves analyzing rental rates, vacancy rates, and operating expenses to determine the property's income-generating potential. A positive cash flow and attractive ROI contribute to the property's value in wealth management strategies. Tax implications are an important factor in turnkey property investment. Investors should understand the tax regulations and incentives specific to the property's location. This includes considerations such as property taxes, depreciation benefits, and potential deductions. Proper tax planning can optimize the financial outcomes of turnkey property investments. Turnkey properties provide a reliable source of passive income. The property is ready for immediate rental, allowing investors to start generating rental income without the need for extensive renovations or finding tenants. This steady income stream can contribute to overall wealth management strategies and financial goals. Investing in turnkey properties offers portfolio diversification benefits. Real estate investments have the potential to perform differently from other asset classes such as stocks or bonds, providing a way to spread risk and reduce exposure to market volatility. Including turnkey properties in an investment portfolio can help achieve a balanced and diversified portfolio. Turnkey properties often come with the benefit of professional property management services. This relieves investors of the day-to-day management responsibilities, including tenant screening, rent collection, property maintenance, and dealing with tenant inquiries or issues. Professional property management ensures the property is well-maintained and maximizes rental income potential. Turnkey properties can help mitigate certain risks associated with real estate investing. By investing in properties that are already renovated and in good condition, investors reduce the likelihood of unexpected expenses or major repairs. Additionally, the reliance on professional property management can minimize risks associated with tenant management and property upkeep. Market volatility is a risk in turnkey property investment. Real estate markets can experience fluctuations in property values, rental demand, or economic conditions. Investors should carefully analyze market trends, consider long-term growth potential, and be prepared for potential market downturns or shifts in rental demand. While professional property management can mitigate some risks, challenges in property management can still arise. Investors should carefully select reliable property management companies or individuals with a track record of successful property management. Effective communication and periodic evaluations of property management performance are important for mitigating these risks. Vacancy and tenant turnover can impact the cash flow of turnkey properties. Investors should consider factors such as rental demand, local economic conditions, and property features that attract and retain reliable tenants. Implementing effective marketing and tenant retention strategies can help minimize the risks associated with extended vacancies or frequent tenant turnover. Turnkey property investments are subject to various regulatory and legal considerations. Investors should be aware of local laws and regulations governing rental properties, landlord-tenant relationships, and property maintenance requirements. Complying with these regulations is crucial to avoid legal issues and potential financial liabilities. Investors should conduct thorough research and due diligence when acquiring turnkey properties. This includes analyzing market trends, identifying suitable locations, and evaluating the reputation and track record of sellers and developers. Researching comparable properties and their rental performance provides valuable insights into the potential returns and risks of the investment. Investors should carefully select turnkey properties that align with their wealth management goals. This involves considering factors such as location, property type, market demand, and potential for rental income and appreciation. Once a suitable property is identified, the acquisition process involves negotiations, contract review, and securing financing if necessary. Before finalizing the purchase, investors should conduct a thorough inspection and evaluation of the turnkey property. This includes assessing the property's condition, verifying renovation quality, and reviewing property documentation. Engaging professional inspectors or contractors can provide expert insights into any potential issues or deficiencies. Investors should consider various financing options available for turnkey property investments. This may include traditional mortgage loans, private financing, or partnerships with other investors. Exploring different financing avenues and securing favorable terms is essential to optimize the financial outcomes of the investment. Investors can benefit from long-term appreciation and equity building through turnkey property investments. By carefully selecting properties in areas with growth potential and implementing strategies to increase property value, investors can build equity and potentially realize significant capital gains over time. Including turnkey properties in an investment portfolio diversifies risk and reduces exposure to other asset classes. Real estate investments have historically demonstrated lower correlation with other investment types, providing a level of stability and risk reduction. This diversification strategy contributes to overall wealth management objectives. Turnkey properties offer the advantage of generating consistent cash flow and passive income. By investing in properties with positive cash flow potential, investors can secure a steady income stream that contributes to wealth management goals, including retirement planning, debt reduction, or funding other investments. A turnkey property refers to a fully renovated and ready-to-occupy real estate investment, which offers benefits such as passive income generation, portfolio diversification, and risk mitigation in wealth management. Understanding the key factors, including location, property condition, cash flow, and tax implications, is crucial for successful turnkey property investments. Turnkey properties offer valuable opportunities in wealth management, providing immediate income generation, portfolio diversification, professional property management, and risk mitigation. By considering location and market analysis, property condition and quality, cash flow and return on investment, and tax implications, investors can leverage turnkey properties to achieve their wealth management objectives. Strategies such as long-term appreciation and equity building, portfolio diversification, and cash flow generation through turnkey properties contribute to overall wealth management success.What Is a Turnkey Property?

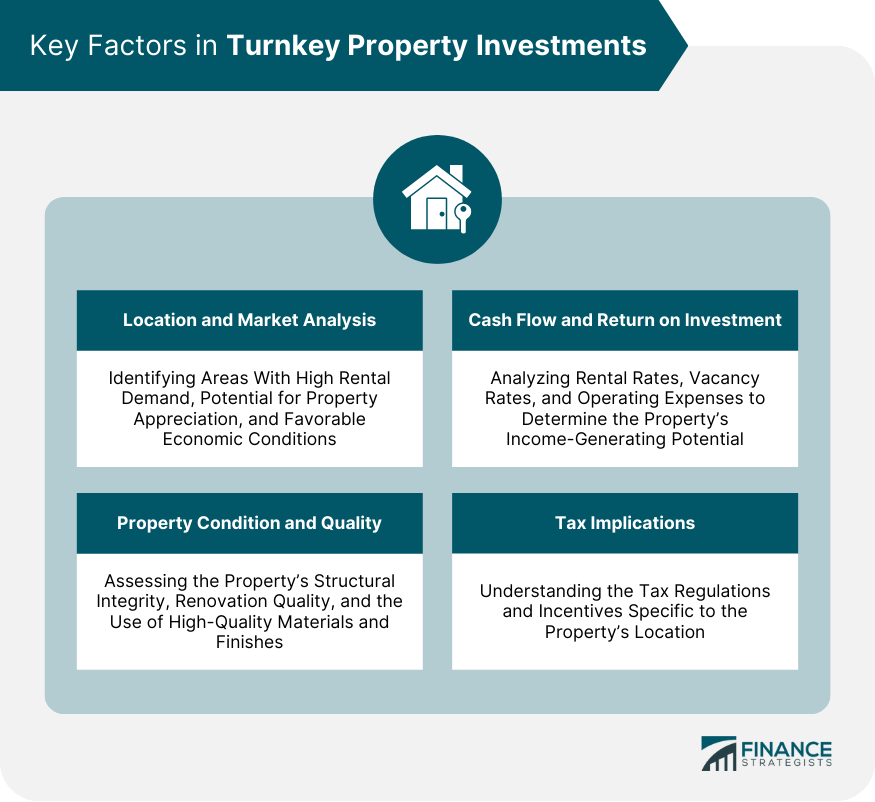

Key Factors in Turnkey Property Investments

Location and Market Analysis

Property Condition and Quality

Cash Flow and Return on Investment

Tax Implications

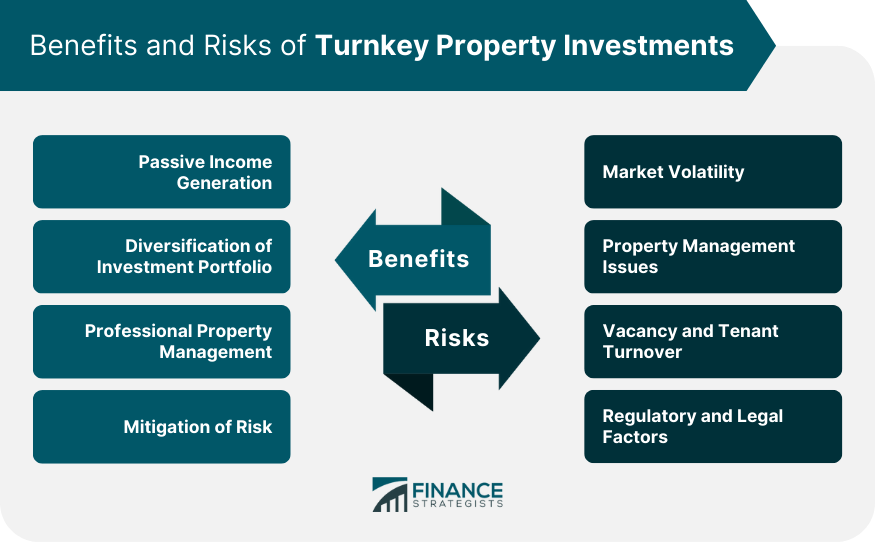

Benefits of Turnkey Properties

Passive Income Generation

Diversification of Investment Portfolio

Professional Property Management

Mitigation of Risk

Potential Risks and Challenges in Turnkey Property Investments

Market Volatility

Property Management Issues

Vacancy and Tenant Turnover

Regulatory and Legal Factors

Steps Involved in Acquiring a Turnkey Property

Research and Due Diligence

Property Selection and Acquisition

Property Inspection and Evaluation

Considering Financing Options

Strategies for Wealth Management Through Turnkey Properties

Long-Term Appreciation and Equity Building

Portfolio Diversification and Risk Reduction

Cash Flow Generation and Passive Income

Conclusion

Turnkey Property FAQs

A turnkey property refers to a real estate investment that is fully renovated, furnished, and ready for immediate occupancy or rental. It requires minimal or no additional work or improvements upon purchase, providing investors with a hassle-free investment opportunity.

Turnkey properties offer benefits such as passive income generation, diversification of investment portfolios, professional property management services, and risk mitigation. These advantages contribute to overall wealth management strategies and financial goals.

Risks in turnkey property investment include market volatility, property management issues, vacancy and tenant turnover, and regulatory and legal factors. Investors should carefully assess these risks and implement strategies to mitigate them effectively.

Acquiring a turnkey property involves research and due diligence, property selection and acquisition, property inspection and evaluation, and exploring financing options. Each step is crucial to ensure a successful investment.

Strategies for wealth management through turnkey properties include focusing on long-term appreciation and equity building, portfolio diversification and risk reduction, and cash flow generation through rental income. These strategies align with wealth management objectives and contribute to overall financial success.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.