A Triple Net Lease (NNN) is a type of lease agreement commonly used in commercial real estate, where the tenant assumes responsibility for property expenses in addition to the base rent. In an NNN lease, the tenant is typically responsible for paying property taxes, property insurance, and property maintenance costs, in addition to their rent obligations. Triple Net Leases play a significant role in wealth management as they offer potential benefits such as steady income streams, reduced landlord expenses, and lower management and operational responsibilities. Understanding the key components, advantages, and risks associated with Triple Net Leases is crucial for effective wealth management decisions. Under a Triple Net Lease, the tenant assumes responsibility for property taxes, which includes paying any taxes levied on the property by local authorities. This component ensures that the tenant bears the financial burden associated with property taxes, relieving the landlord of this expense. Triple Net Leases require tenants to carry and pay for property insurance, protecting both the tenant's business and the landlord's investment. The tenant is responsible for obtaining and maintaining adequate insurance coverage, including general liability and property insurance. In a Triple Net Lease, the tenant is responsible for property maintenance costs, which may include expenses related to repairs, utilities, landscaping, and other ongoing maintenance. By shifting these costs to the tenant, the landlord can minimize their operational expenses and focus on property ownership and management. While the tenant is responsible for certain property expenses, the ownership and legal title of the property typically remain with the landlord. The tenant is granted the right to use the property for their business operations, subject to the terms and conditions outlined in the lease agreement. Under a Triple Net Lease, the tenant often assumes responsibility for structural maintenance and repairs, ensuring that the property remains in good condition throughout the lease term. This can include major repairs, renovations, or upgrades necessary to maintain the property's functionality and appearance. Triple Net Leases typically outline specific administrative responsibilities, such as record-keeping, compliance with laws and regulations, and lease-related documentation. These administrative duties may be shared between the tenant and landlord, depending on the terms of the lease agreement. Triple Net Leases provide a reliable and steady income stream for landlords. The tenant's responsibility for property expenses, in addition to the base rent, ensures a consistent cash flow, making it easier for landlords to manage their finances. By shifting the burden of property expenses to the tenant, Triple Net Leases significantly reduce the landlord's operational costs. Landlords can avoid the financial responsibility of property taxes, insurance premiums, and maintenance expenses, allowing them to allocate resources to other investment opportunities or wealth management strategies. Triple Net Leases relieve landlords of many day-to-day management and operational tasks associated with owning a property. Since the tenant is responsible for maintenance, repairs, and other property-related matters, landlords can focus on broader wealth management strategies and overall portfolio management. One of the key risks in Triple Net Lease investments is tenant creditworthiness. Landlords should carefully evaluate the financial strength and stability of potential tenants to mitigate the risk of tenant default or non-payment. The location and market conditions can impact the success and profitability of Triple Net Lease investments. Factors such as population growth, economic stability, and local market trends should be considered when selecting properties for investment to ensure sustained tenant demand and potential appreciation. The lease term and renewal options play a crucial role in Triple Net Lease investments. Landlords should carefully negotiate lease terms to balance the stability of a long-term lease with the potential flexibility of shorter lease terms. Additionally, evaluating renewal options and the potential for rental rate increases is essential to secure long-term income streams. Incorporating Triple Net Leases into an investment portfolio can provide diversification benefits. By investing in different properties and locations, investors can spread risk and potentially enhance overall portfolio stability and returns. Engaging professionals such as real estate attorneys, property managers, and financial advisors can provide valuable insights and expertise to assess property value, tenant creditworthiness, and lease terms. Regularly assessing and analyzing Triple Net Lease properties is critical to ensure their continued financial performance and alignment with wealth management goals. Monitoring tenant performance, conducting property inspections, and evaluating market conditions can help identify potential risks or opportunities for optimization. Triple Net Lease investments have specific tax implications. Landlords may be able to claim depreciation on the property, allowing them to deduct a portion of its value over time. Additionally, capital gains taxes may apply when the property is sold, potentially impacting the overall tax liability of the investment. Rental income generated from Triple Net Lease investments is typically classified as passive income for tax purposes. Landlords should consider the tax implications of passive income, including potential deductions and the applicable tax rates, when evaluating the overall tax liability associated with Triple Net Lease investments. A triple net lease is a complex commercial lease arrangement that requires careful consideration and understanding. It places significant financial responsibilities on the tenant, including the payment of operating expenses in addition to the base rent. While this type of lease offers advantages such as predictable cash flow and reduced management obligations for property owners, it also comes with risks such as tenant defaults and the potential for fluctuating operating expenses. To navigate these challenges, property owners should employ strategies such as thorough tenant screening, negotiating favorable lease terms, and conducting regular property inspections. Tenants, on the other hand, must assess their financial capability to meet the additional financial obligations and carefully review the terms of the lease. A comprehensive understanding of the components, advantages, risks, and appropriate strategies is crucial for both landlords and tenants when entering into a triple net lease agreement to optimize the benefits of this arrangement.What Is a Triple Net Lease (NNN)?

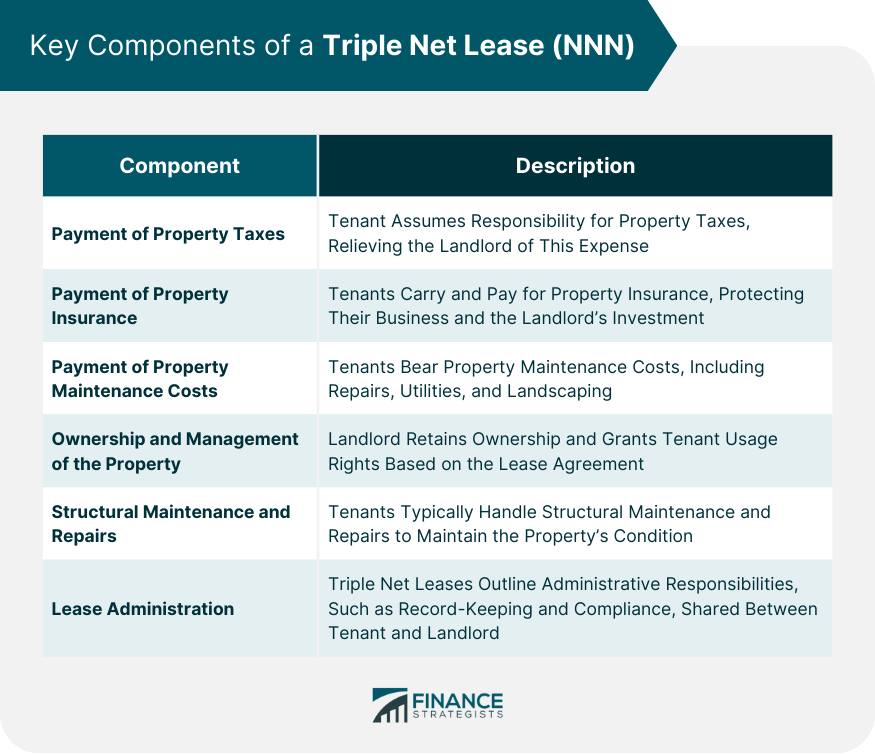

Key Components of a Triple Net Lease

Payment of Property Taxes

Payment of Property Insurance

Payment of Property Maintenance Costs

Ownership and Management of the Property

Structural Maintenance and Repairs

Lease Administration

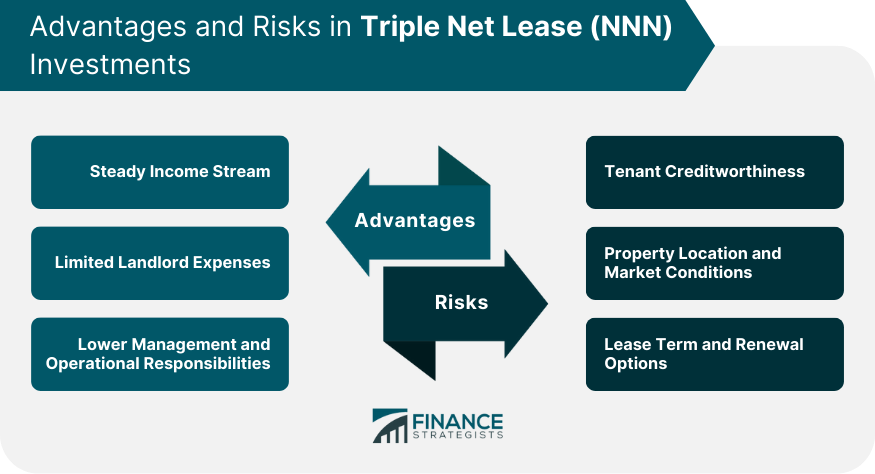

Advantages of a Triple Net Lease

Steady Income Stream

Limited Landlord Expenses

Lower Management and Operational Responsibilities

Risks and Considerations in Triple Net Lease Investments

Tenant Creditworthiness

Property Location and Market Conditions

Lease Term and Renewal Options

Strategies for Wealth Management Using a Triple Net Lease

Diversification of Investment Portfolio

Professional Due Diligence

Regular Property Assessment and Analysis

Tax Implications of Triple Net Lease Investments

Depreciation and Capital Gains

Passive Income and Tax Liability

Conclusion

Triple Net Lease (NNN) FAQs

A Triple Net Lease (NNN) is a lease agreement commonly used in commercial real estate where the tenant assumes responsibility for property expenses in addition to the base rent. This includes paying property taxes, property insurance, and property maintenance costs.

Triple Net Leases provide a steady income stream, reduce landlord expenses, and lower management and operational responsibilities. They offer reliable cash flow, lower operational costs, and allow landlords to focus on broader wealth management strategies.

Risks in Triple Net Lease investments include tenant creditworthiness, property location and market conditions, and lease term and renewal options. Evaluating these factors helps mitigate the risk of tenant default, maximize property value, and secure long-term income streams.

Strategies for wealth management using Triple Net Leases include diversification of investment portfolios, conducting professional due diligence, and regularly assessing and analyzing properties. These strategies help manage risk, optimize returns, and align with wealth management goals.

Triple Net Lease investments have tax implications related to depreciation and capital gains. Landlords may be able to claim depreciation deductions over time, and capital gains taxes may apply upon the sale of the property. Understanding these implications is crucial in evaluating the overall tax liability of Triple Net Lease investments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.