A tenancy-at-will refers to a type of rental agreement in which a tenant occupies a property with the landlord's permission, but without a fixed term or formal lease agreement. It is a flexible arrangement that allows either party to terminate the tenancy at any time, without specific notice or cause. Tenancy-at-will holds significance in certain situations where a short-term, non-committal arrangement is preferred by both the landlord and tenant. This type of tenancy is commonly used when the tenant and landlord have a casual or less formal relationship, or when the property is intended for temporary or transitional use. It's important for both parties to clearly understand and agree upon the terms of the tenancy-at-will, including rent payment, maintenance responsibilities, and the process for termination, to ensure a smooth and amicable rental experience. Tenancy-at-will is a voluntary agreement entered into by both the landlord and the tenant. It requires mutual consent and understanding of the arrangement, as neither party is obligated to continue the tenancy beyond their preference. Unlike other types of tenancies, a tenancy-at-will lacks a specific duration. It continues until either party decides to terminate the tenancy, allowing for a more flexible rental arrangement. Both the landlord and the tenant have the right to terminate the tenancy-at-will at any time, without providing advance notice or specific reasons. This flexibility provides an advantage for individuals or businesses that may need to adjust their living or business arrangements quickly. Tenancy-at-will offers fewer legal protections compared to formal lease agreements. Since it is a more informal arrangement, tenants may have limited legal recourse in case of disputes or conflicts with the landlord. A tenancy-at-will can be established through either an oral or written agreement between the landlord and tenant. While a written agreement is recommended to clarify terms and conditions, an oral agreement can still create a tenancy-at-will relationship. The payment of rent in a tenancy-at-will can vary depending on the agreement between the landlord and tenant. It may be based on a monthly, weekly, or other agreed-upon intervals. The terms of rent payment should be clearly communicated and understood by both parties. The responsibilities for property maintenance in a tenancy-at-will are typically determined by the agreement between the landlord and tenant. The tenant may be responsible for basic upkeep and minor repairs, while major repairs and maintenance may fall under the landlord's purview. Clear communication and understanding of maintenance responsibilities are essential for a smooth tenancy. Tenancy-at-will offers flexibility for both landlords and tenants. Landlords have the freedom to make changes to their property, such as selling or renovating it, without being bound by a long-term lease. Tenants can also adjust their living arrangements quickly based on their changing needs or circumstances. Both the landlord and tenant can terminate the tenancy-at-will swiftly and without formalities. This can be advantageous when circumstances change unexpectedly or when either party wishes to pursue other opportunities or options. Tenancy-at-will does not require a long-term commitment from either party. This can be beneficial for tenants who may have short-term housing needs or landlords who want to maintain flexibility with their property. Tenancy-at-will does not provide the same stability as a long-term lease agreement. Tenants may face uncertainty about the duration of their stay, which can make it challenging to plan for the future or establish a sense of permanence. Compared to formal lease agreements, tenants in a tenancy-at-will have fewer legal protections and rights. This can leave them more vulnerable to potential disputes or unfavorable actions by the landlord. Since either party can terminate the tenancy-at-will without notice, tenants may face the risk of abrupt eviction if the landlord decides to end the agreement. This lack of notice can disrupt living arrangements and create difficulties in finding alternative housing options. A tenancy-at-will differs from a tenancy for a fixed term, where both the landlord and tenant commit to a specific duration. Tenancy-at-will offers more flexibility for early termination, while a fixed-term tenancy provides stability and security for the agreed-upon period. Tenancy-at-sufferance occurs when a tenant remains in the rental property without the landlord's consent after the expiration of a lease. Unlike tenancy-at-will, tenancy-at-sufferance is not voluntary and lacks the same legal protections. Rent control often applies to long-term lease agreements, providing tenants with certain protections and limitations on rent increases. Tenancy-at-will is typically exempt from rent control regulations. For wealth management purposes, tenancy-at-will can be considered as part of a diversified real estate portfolio. Including properties with flexible rental arrangements can provide opportunities to adapt to market changes and optimize income streams. Tenancy-at-will carries inherent risks, such as potential abrupt termination or lack of legal protections. Wealth managers should carefully evaluate these risks and implement appropriate risk management strategies, such as maintaining a balanced portfolio and considering the potential impact of tenancy-at-will arrangements on overall cash flow. Tenancy-at-will can present investment opportunities for individuals seeking short-term rental income or those looking to capitalize on properties with potential for higher rental yields. Conducting thorough market research and due diligence is essential when considering tenancy-at-will properties as investment options. Tenancy-at-will is a flexible rental arrangement that lacks a fixed term and allows for quick termination by either the landlord or the tenant. It is characterized by its month-to-month This type of arrangement is often used for short-term housing needs, transitional periods, or when there is a less formal relationship between the tenant and landlord. It offers advantages such as flexibility, quick termination options, and no long-term commitment. However, it also has disadvantages, including a lack of stability, limited legal recourse, and potential for abrupt termination. By carefully considering these factors and implementing appropriate risk management strategies, individuals can effectively incorporate tenancy-at-will into their overall wealth management strategy.What Is a Tenancy-At-Will?

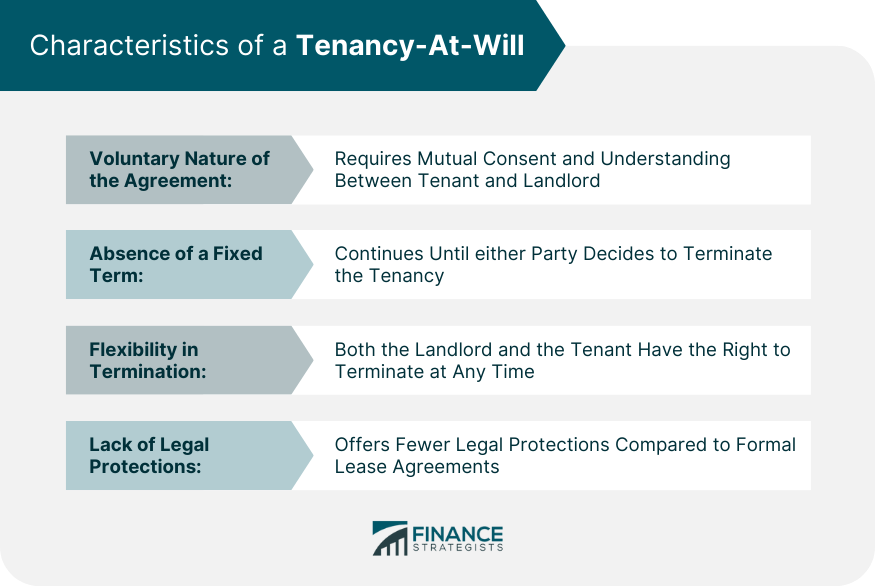

Characteristics of a Tenancy-At-Will

Voluntary Nature of the Agreement

Absence of a Fixed Term

Flexibility in Termination

Lack of Legal Protections

Key Features of a Tenancy-At-Will

Oral or Written Agreement

Rent Payment Arrangements

Property Maintenance Responsibilities

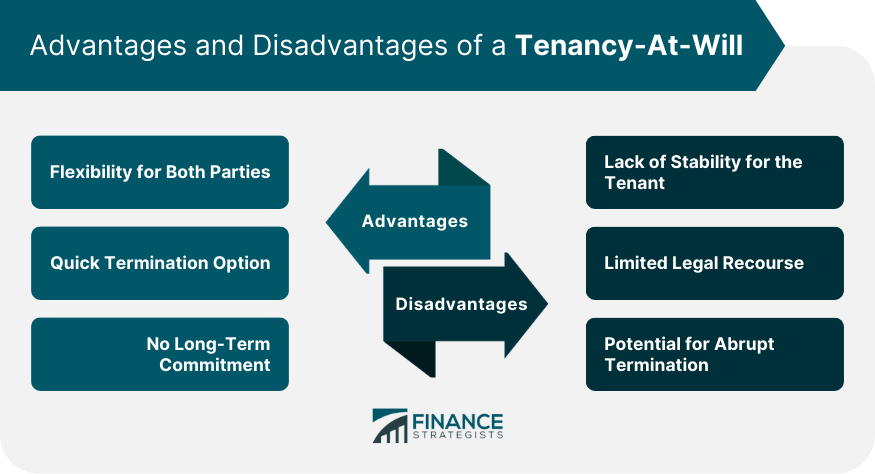

Advantages of a Tenancy-At-Will

Flexibility for Both Parties

Quick Termination Option

No Long-Term Commitment

Disadvantages of a Tenancy-At-Will

Lack of Stability for the Tenant

Limited Legal Recourse

Potential for Abrupt Termination

Tenancy-At-Will vs Other Types of Tenancy

Tenancy for a Fixed Term

Tenancy-At-Sufferance

Tenancy With Rent Control

Considerations for Wealth Management

Portfolio Diversification

Risk Management Strategies

Real Estate Investment Opportunities

Final Thoughts

Tenancy-At-Will FAQs

A tenancy-at-will is a flexible rental arrangement without a specific duration, allowing either party to terminate the tenancy at any time. In contrast, a fixed-term lease involves a specific time period agreed upon by the landlord and tenant, providing stability and security for the duration of the lease.

No, tenants in a tenancy-at-will typically have fewer legal protections compared to those with a formal lease agreement. This lack of legal protections can leave tenants more vulnerable to potential disputes or unfavorable actions by the landlord.

In a tenancy-at-will, the landlord has the freedom to increase the rent at any time, although local laws and regulations may impose certain limitations. The absence of rent control regulations generally allows landlords more flexibility in adjusting rent prices.

In a tenancy-at-will, either the landlord or tenant can terminate the agreement without specific notice or cause. However, it is recommended for both parties to communicate their intention to terminate to avoid potential conflicts or misunderstandings.

Yes, a tenancy-at-will can be converted into a formal lease agreement if both the landlord and tenant agree to the new terms and conditions. This conversion can provide more stability and legal protections for both parties, offering a longer-term commitment and security.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.