Other Real Estate Owned (OREO) refers to real property owned by a banking institution but is not directly related to its business. This property typically reaches the bank's hands via foreclosure after a borrower defaults on a loan where the property was used as collateral. When a borrower defaults on their mortgage loan, and foreclosure ensues, the bank may repossess the property. If the property is not sold at auction, it becomes part of the bank's OREO inventory, effectively moving it from being a loan asset to a real estate asset on the bank's books. Understanding OREO can help you identify potential real estate investment opportunities, as banks often aim to sell these properties quickly. OREO (Other Real Estate Owned) is reported as a non-earning asset on a bank's balance sheet and is considered a liability as these properties do not generate income. Banks must determine and report the fair value of the OREO properties, which often involves appraisals and assessments to establish current market value. The value reported in OREO should not exceed the fair value of the properties. When an OREO property is sold, the bank reports the sale and any gain or loss in its income statement. The gain or loss is the difference between the carrying amount of the property and the selling price minus any costs to sell. Banks must also establish and maintain an allowance for losses on OREO properties, reflecting estimated losses due to decreases in fair value post-acquisition. Regular evaluations of the adequacy of the allowance and necessary adjustments are required. Compliance with OREO financial reporting requirements ensures transparency and accuracy in a bank's financial statements and provides a realistic view of the bank's financial health. Excessive OREO assets can indicate potential problems with a bank's lending practices. Other Real Estate Owned (OREO) can significantly impact bank performance in various ways: Financial Burden: OREOs can be financially burdensome as they often involve costs such as property taxes, maintenance costs, and insurance. These costs can negatively affect a bank's profitability if the property remains unsold for an extended period. Resource Allocation: Managing OREOs requires significant resources, including time and personnel. These resources might otherwise be used in the core banking business, negatively impacting overall bank performance. Impact on Balance Sheet: OREOs are non-earning assets and, thus, can negatively affect a bank's balance sheet. They can increase the bank's risk-weighted assets without generating income, reducing its return on assets (ROA). Regulatory Concerns: High levels of OREOs can be a red flag for regulators, who may see it as an indicator of poor lending practices. Increased regulatory scrutiny can pose additional challenges for the bank. Market Perception: Large amounts of OREOs can affect the bank's reputation. Investors, customers, and the market, in general, may perceive the bank as having poor loan underwriting standards. It can negatively impact the bank's stock price and overall market performance. Several elements contribute to the valuation of OREO properties, such as: The geographical location of a property significantly influences its value. Properties in prime locations or areas with high demand will likely be valued higher than those in less desirable areas. The physical state of the property, including its age, structural integrity, and need for repairs or renovations, plays a crucial role in its valuation. Properties in excellent condition will generally attract a higher value. The local real estate market dynamics, including supply and demand trends, also impact an OREO property's valuation. Property properties might be valued higher in a seller's market where demand outpaces supply. Conversely, in a buyer's market, property values may be lower. The expected time to sell a property can influence its valuation. If a bank plans to sell an OREO property quickly, it might be valued lower to attract buyers. On the other hand, if there's no urgency, the bank might price it higher, awaiting market conditions to improve. The costs associated with maintaining an OREO property, such as taxes, insurance, upkeep, and selling costs like real estate agent commissions, influence its net value on the bank's books. Valuing OREO assets also presents several challenges: Determining the accurate market value of an OREO property can be complicated. Banks must consider multiple factors, some of which can be subjective or variable. Estimating the costs associated with holding and selling a property can be tricky as they can vary based on several factors. For example, maintenance costs can fluctuate depending on the property's condition, and selling costs can vary based on how quickly the bank wants to sell the property. Local laws, regulations, and market conditions can also challenge the valuation of OREO properties. For instance, zoning laws affect a property's use and, therefore, its value. Market conditions, like a downturn, can also depress property values. The valuation of OREO properties requires careful consideration of multiple influencing factors and necessitates tackling several inherent challenges. This valuation is essential, as it directly impacts a bank's financial statements and its ability to manage and mitigate potential losses associated with OREO assets. The following are risks associated with OREOs: Valuation Risks: Banks must accurately determine the market value of OREO properties to avoid overstating assets. This requires regular property appraisals and market trend analysis. Holding Costs: OREO properties incur maintenance, insurance, and tax costs. Banks need to manage these expenses effectively to minimize the financial impact. Disposition Risks: Selling OREO properties can be challenging and time-consuming, especially in a sluggish real estate market. Effective marketing and sales strategies are crucial. Regulatory Compliance: Banks must adhere to OREO management regulations, such as foreclosure procedures, property maintenance, and reporting requirements. Non-compliance can lead to fines and reputational damage. Operational Risks: Managing OREO properties demands significant administrative effort, increasing the risk of operational errors. Proper personnel training and procedural controls help mitigate this risk. When it comes to managing Other Real Estate Owned (OREO) properties, banks have several disposal strategies at their disposal to mitigate risk and maximize return. These strategies include the following: Direct Sale: The most straightforward disposal strategy is to sell the property directly through a real estate agent or individually. This approach can provide the quickest return, but it might only sometimes yield the highest price. Auction: Banks often use auctions to dispose of OREO properties quickly. While this might not bring in the highest possible price, it can significantly speed up the sales process and help manage inventory levels. Renting: If the market is not favorable for selling, banks may choose to rent OREO properties. This approach generates a steady income stream while market conditions improve. Seller Financing: In this scenario, the bank provides a mortgage to the buyer, effectively turning the OREO property back into a performing loan. This strategy can be particularly effective in markets where traditional financing is difficult. Partnerships or Joint Ventures: Banks can partner with real estate investors or developers to improve and sell the property, potentially increasing the property's value and the bank's return. Each strategy comes with its own set of considerations, and the best approach may depend on factors such as market conditions, the bank's financial situation, and the specific properties in question. The status and implications of Other Real Estate Owned (OREO) can vary considerably depending on the stage of economic cycles: Expansion Phase: During periods of economic expansion, loan default rates typically decrease as borrowers are more capable of fulfilling their financial obligations. Consequently, the number of OREOs may reduce, positively impacting the bank's balance sheet. Peak Phase: As the economy peaks, overvaluation of properties may occur. If a downturn follows, banks may be left with overvalued OREOs, leading to significant write-downs when the true property values are realized. Recession Phase: In an economic downturn, default rates generally rise, leading to an increase in foreclosures and, subsequently, more OREOs. Maintaining and managing these properties could become a financial burden for banks. Trough Phase: In the trough, or the lowest point of a cycle, banks may find it challenging to dispose of OREOs due to low property values and a lack of buyers. This could lead to a rise in holding costs and negatively affect the bank's financial position. Recovery Phase: As the economy begins to recover, property values may start to increase. Banks may find it easier to sell OREOs, which could lead to a reduction in non-performing assets and an improvement in the bank's financial condition. OREOs can both benefit and challenge banks depending on the economic cycle's phase, making effective management of OREOs crucial. Understanding Other Real Estate Owned (OREO) is essential for investors and banks. OREO properties, acquired through foreclosure are reported as non-earning assets on a bank's balance sheet. Valuation involves considering factors such as location, condition, market trends, timeframe, maintenance, and selling costs. OREO assets can impact a bank's financial health, including profitability, resource allocation, balance sheet, and regulatory scrutiny. Market perception is crucial, as large amounts of OREOs can harm a bank's reputation and stock price. Challenges in valuation include accurate estimation, holding and selling costs, and legal and market considerations. Risks associated with OREOs include valuation risks, financial burdens, disposition risks, regulatory compliance, and operational risks. Disposal strategies include direct sale, auction, renting, seller financing, or partnerships. The implications of OREOs vary in different economic cycles, impacting the bank's financial position. Effective OREO management is crucial for financial stability and mitigating potential losses.What Is Other Real Estate Owned (OREO)?

OREO in the Banking Sector

Financial Statements

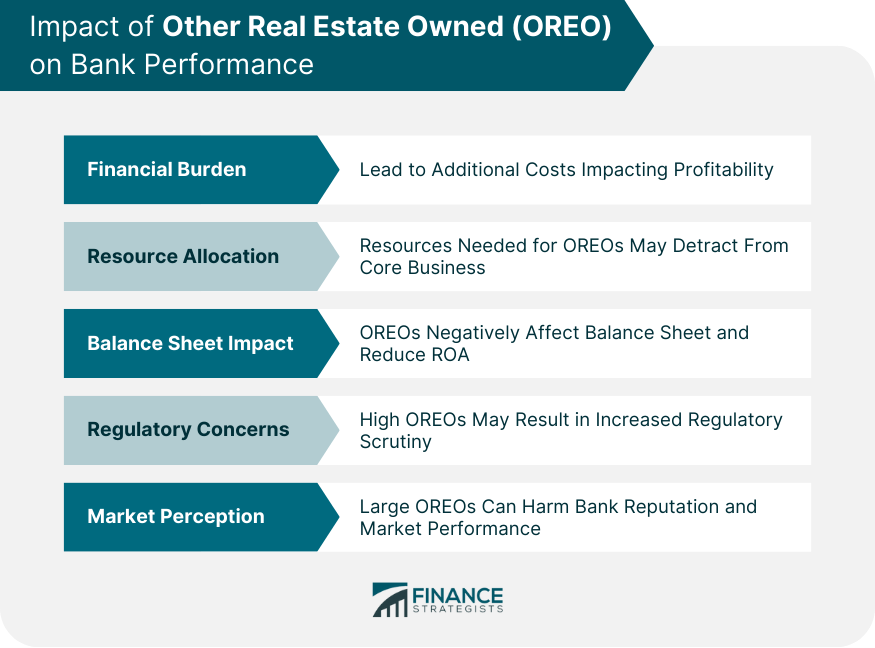

Impact on Bank Performance

OREO Valuation

Factors Influencing OREO Valuation

Location of the Property

Condition of the Property

Local Real Estate Market Trends

Timeframe for Selling

Costs of Maintenance and Selling

Challenges in Valuing OREO Assets

Accurate Market Value Estimation

Estimating Holding and Selling Costs

Legal and Market Considerations

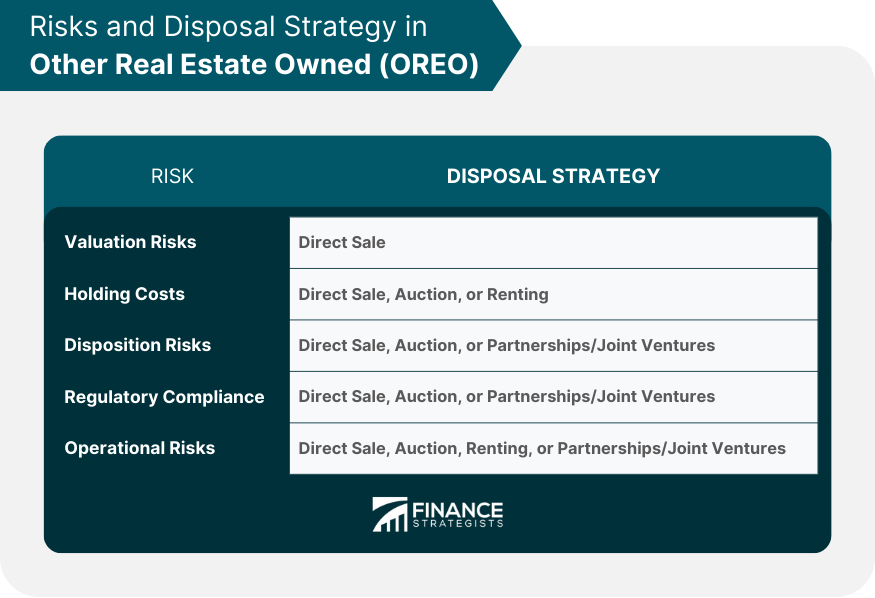

Risks Associated With OREO

OREO Disposal Strategies

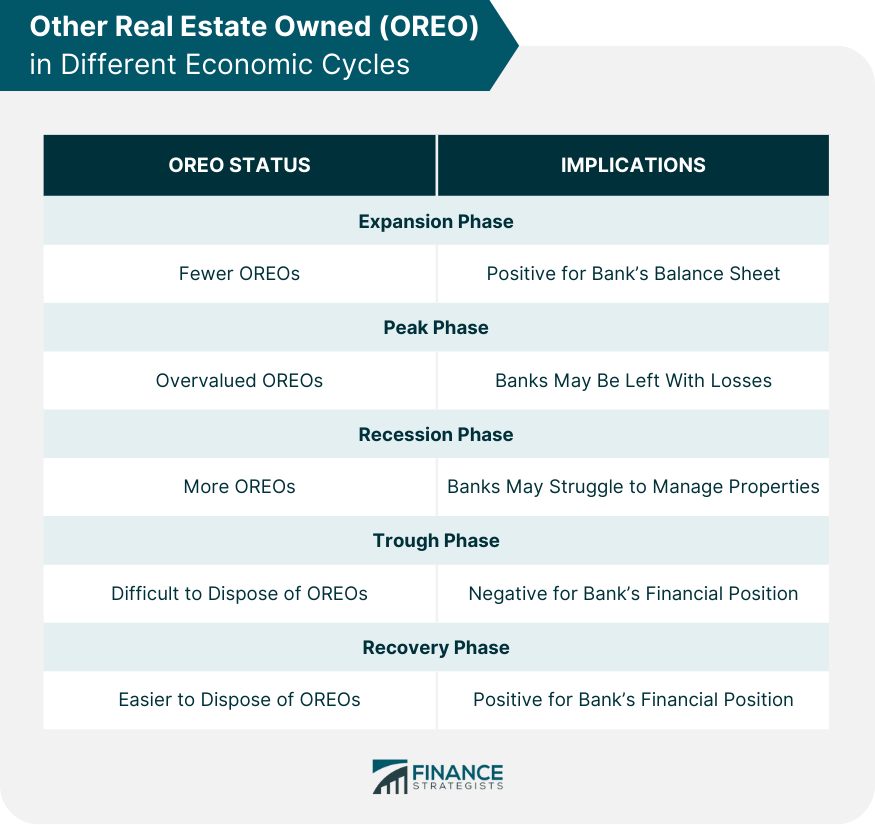

OREO in Different Economic Cycles

Final Thoughts

Other Real Estate Owned (OREO) FAQs

An OREO property is real estate owned by a bank but not directly related to its business.

A property becomes OREO when a borrower defaults on a loan and the bank repossesses and fails to sell the property at auction.

OREO properties affect a bank's financial statement by increasing non-earning assets and potential loss provisions. They also contribute to higher administrative costs.

Banks often sell OREO properties at a discount, hold public auctions, or use real estate agents to expedite sales. In some cases, they may offer seller financing to prospective buyers.

During economic downturns, the number of OREO properties tends to rise due to increased loan defaults. Conversely, OREO volumes typically decrease in a growing economy as loan default rates lower and property values rise.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.