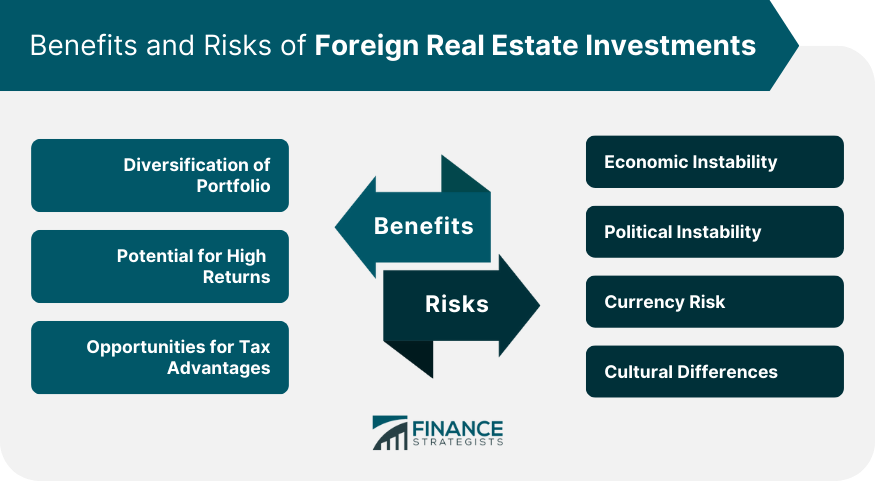

Foreign real estate investments involve purchasing and managing properties located outside of an investor's home country. This can include residential, commercial, or industrial properties, and investors can acquire these assets through direct ownership, partnerships, or real estate investment trusts (REITs). Foreign real estate investments can offer several potential benefits for investors, including diversification, higher returns, and tax advantages. In an increasingly globalized world, investing in international properties can provide exposure to new markets, contribute to a well-rounded investment portfolio, and offer unique opportunities for growth and wealth accumulation. Investing in foreign real estate can help investors diversify their portfolio by providing exposure to different markets and economies. This diversification can help reduce overall portfolio risk, as downturns in one market may be offset by growth in another. Foreign real estate investments can offer the potential for higher returns than domestic investments, particularly in emerging markets or areas experiencing rapid economic growth. By carefully selecting properties in promising locations, investors may be able to achieve significant capital appreciation and rental income. Investing in foreign real estate may provide tax advantages for investors, depending on their home country's tax laws and the tax regulations of the foreign country. For example, some countries offer tax incentives to attract foreign investors, while others have lower property taxes or capital gains taxes compared to an investor's home country. Proper planning and professional advice can help investors maximize these potential tax benefits. Economic instability in a foreign country can pose significant risks for real estate investors. Fluctuations in economic growth, employment rates, and inflation can impact property values and rental income, potentially leading to lower returns or even losses on investments. Political instability can also create risks for foreign real estate investors. Changes in government policies, political unrest, or even conflicts can negatively impact property values and the overall investment environment. It's essential for investors to carefully assess the political stability of a country before investing in its real estate market. Investing in foreign real estate exposes investors to currency risk, as fluctuations in exchange rates can impact the value of investments and returns. An appreciation of the investor's home currency relative to the foreign currency can lead to lower returns or losses, while depreciation can result in higher returns. Cultural differences can present challenges for foreign real estate investors. Understanding local customs, language, and business practices is crucial for successfully navigating the foreign property market and managing investments. Misunderstandings or cultural missteps can lead to legal disputes, financial losses, or damaged relationships with local partners. Thorough market analysis and research are essential when considering foreign real estate investments. Investors should study local property markets, economic indicators, demographic trends, and infrastructure developments to identify promising investment opportunities and make informed decisions. Understanding local regulations and laws is crucial for foreign real estate investors. This may include property ownership laws, zoning regulations, taxes, and other legal requirements that can impact the acquisition, management, and sale of properties. Consulting with local professionals, such as attorneys or real estate agents, can help investors navigate these complexities. Securing financing for foreign real estate investments can be challenging, as local banks may be hesitant to lend to foreign investors, and international banks may have stringent lending requirements. Exploring various financing options, such as local banks, international lenders, or private financing, can help investors find the best solution for their needs. Effective property management is critical for the success of foreign real estate investments. Investors need to consider how they will manage their properties, including tenant relations, maintenance, and legal compliance. Hiring a local property management company can be a viable solution for investors who are not able to oversee their properties personally. Europe is a popular destination for foreign real estate investors due to its diverse property markets, strong economies, and rich cultural history. Key investment destinations include the United Kingdom, Germany, France, Spain, and Portugal, which offer a range of investment opportunities from residential properties to commercial and industrial assets. Asia's rapidly growing economies and expanding middle class make it an attractive destination for foreign real estate investments. Countries like Japan, South Korea, Singapore, and Hong Kong are established investment hubs, while emerging markets such as Thailand, Vietnam, and the Philippines offer the potential for high returns and capital appreciation. South America has seen increased interest from foreign real estate investors, driven by its growing economies and improving infrastructure. Countries like Brazil, Argentina, and Colombia offer diverse investment opportunities ranging from residential and commercial properties to agricultural and industrial assets. The United States and Canada are popular destinations for foreign real estate investments due to their stable economies, strong property markets, and relatively transparent legal systems. Investors can find a wide variety of investment opportunities, including residential, commercial, and industrial properties in both urban and rural settings. Africa is an emerging market for foreign real estate investments, with countries like South Africa, Kenya, and Nigeria showing promising potential. The continent offers unique investment opportunities in residential, commercial, and agricultural properties, as well as infrastructure development projects. Foreign real estate investments offer numerous benefits, including portfolio diversification, the potential for high returns, and tax advantages. However, investors must also consider the risks associated with these investments, such as economic instability, political instability, currency risk, and cultural differences. Investing in foreign real estate can be a rewarding and profitable venture for those who are well-prepared and diligent in their research and planning. By carefully considering the benefits and risks, assessing market conditions, and seeking professional guidance, investors can successfully navigate the complexities of international property markets and capitalize on the unique opportunities they present.Definition of Foreign Real Estate Investments

Benefits of Foreign Real Estate Investments

Diversification of Portfolio

Potential for High Returns

Opportunities for Tax Advantages

Risks of Foreign Real Estate Investments

Economic Instability

Political Instability

Currency Risk

Cultural Differences

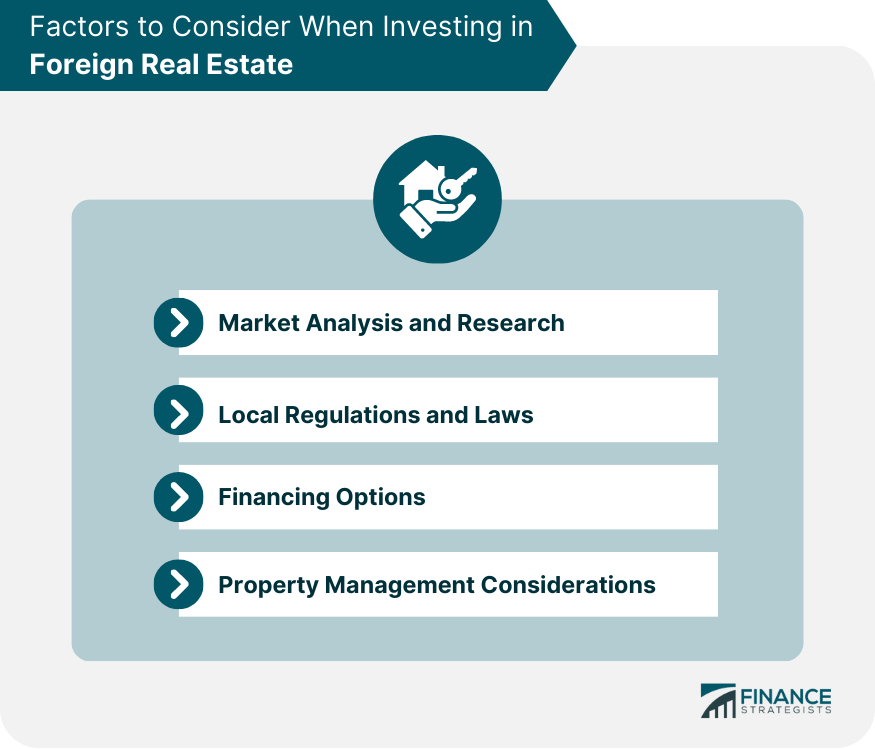

Factors to Consider When Investing in Foreign Real Estate

Market Analysis and Research

Local Regulations and Laws

Financing Options

Property Management Considerations

Popular Destinations for Foreign Real Estate Investments

Europe

Asia

South America

North America

Africa

Bottom Line

Foreign Real Estate Investments FAQs

Foreign real estate investments refer to investing in properties located outside of one's country of residence.

Foreign real estate investments provide portfolio diversification, the potential for high returns, and opportunities for tax advantages.

Foreign real estate investments carry risks such as economic and political instability, currency risk, and cultural differences.

Factors to consider when investing in foreign real estate include market analysis, local regulations and laws, financing options, and property management considerations.

Popular destinations for foreign real estate investments include Europe, Asia, South America, North America, and Africa.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.