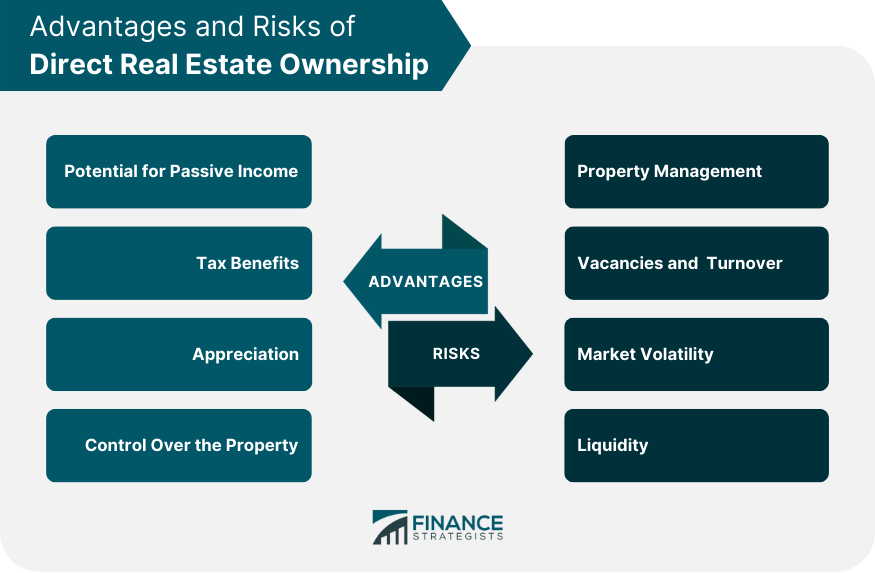

Direct real estate ownership refers to the process of purchasing and owning physical properties, such as residential, commercial, or industrial buildings, with the intent of generating income and building wealth. This form of investment allows individuals to have direct ownership and control over their real estate assets, rather than indirect investing through real estate investment trusts (REITs) or other financial instruments. Direct real estate ownership can be an important aspect of an individual's overall investment strategy. By offering diversification, potential cash flow, and long-term appreciation, direct real estate ownership can help build wealth and create a stable income source, particularly for investors seeking to diversify their portfolios or establish a passive income stream. Single-family homes are residential properties designed to house a single family. These properties are typically standalone structures with their own yards and can be an attractive investment option for those looking to generate rental income. Investing in single-family homes can provide a relatively stable income source, as these properties are often in high demand among renters seeking a more traditional living situation. Additionally, single-family homes can offer the potential for property appreciation over time, as they are generally considered a desirable and sought-after type of real estate. Multi-family properties are residential buildings designed to house multiple families or households, such as duplexes, triplexes, or apartment complexes. Investing in multi-family properties can provide investors with a higher income potential than single-family homes, as the multiple units can generate rental income from multiple tenants simultaneously. Moreover, multi-family properties can offer economies of scale, as expenses such as maintenance and property management can be spread across multiple units, potentially leading to increased efficiency and cost savings. Commercial properties are buildings used for business purposes, such as retail stores, office spaces, or restaurants. Investing in commercial real estate can offer investors the opportunity to generate income through leasing space to businesses or other commercial tenants. Commercial properties can provide a more stable income source than residential properties, as commercial tenants often sign long-term leases and may be less susceptible to market fluctuations. Additionally, investing in commercial properties can provide potential tax benefits and appreciation opportunities. Industrial properties are buildings used for manufacturing, warehousing, or distribution purposes. Investing in industrial real estate can offer investors a unique opportunity to generate income from businesses requiring specialized facilities or infrastructure. Industrial properties can provide a stable income source due to the specialized nature of the facilities and the long-term leases often signed by tenants. Additionally, industrial properties can offer potential appreciation and tax benefits, as well as diversification within an investor's real estate portfolio. One of the primary advantages of direct real estate ownership is the potential to generate passive income through rental payments from tenants. This steady stream of income can provide financial stability, help cover expenses, and contribute to long-term wealth-building efforts. Moreover, as property values and rental rates increase over time, investors can benefit from growing cash flow, which can serve as a hedge against inflation and provide long-term financial stability. Direct real estate ownership offers a variety of tax benefits, such as deductions for mortgage interest, property taxes, and depreciation. Additionally, real estate owners can potentially defer capital gains taxes through strategies like 1031 exchanges. These tax advantages can help investors reduce their overall tax liability, increase their cash flow, and ultimately boost their investment returns. Direct real estate ownership also offers the potential for property appreciation, as property values tend to increase over time. This appreciation can contribute to long-term wealth-building efforts, as investors can potentially profit from substantial capital gains when they sell their properties. Furthermore, appreciation can a hedge against inflation, as the value of real estate assets typically grows in line with or outpaces theprovide rate of inflation, helping to preserve an investor's purchasing power. Direct real estate ownership allows investors to have full control over their properties, including decision-making related to property management, maintenance, and tenant selection. This level of control can enable investors to maximize their investment returns by implementing strategies and improvements tailored to their specific goals and objectives. Moreover, direct real estate owners can personally ensure that their properties are well-maintained and managed, which can contribute to higher tenant satisfaction, lower vacancy rates, and ultimately, better investment performance. One of the primary risks associated with direct real estate ownership is the need for effective property management. Managing a property requires time, effort, and expertise, and property owners must be prepared to address issues such as tenant disputes, maintenance concerns, and rent collection. Inadequate property management can lead to high vacancy rates, tenant turnover, and reduced rental income, negatively impacting investment returns. Direct real estate ownership can be susceptible to vacancies and tenant turnover, which can lead to lost rental income and increased expenses related to marketing, tenant screening, and property maintenance. To minimize these risks, property owners must carefully select and manage their tenants and strive to maintain a high level of tenant satisfaction to reduce turnover and maintain a steady stream of rental income. Direct real estate ownership can be subject to market volatility, as property values and rental rates can fluctuate based on local economic conditions, supply and demand dynamics, and other factors. To mitigate the risks associated with market volatility, investors should carefully research and monitor local market trends, diversify their real estate holdings across different property types and geographic areas, and maintain a long-term investment perspective. Real estate is considered a relatively illiquid asset, as it can take time to sell a property and convert it into cash. This lack of liquidity can pose a challenge for investors who may need to access their capital quickly in the event of an emergency or other unexpected financial need. To address liquidity concerns, investors should maintain a diversified investment portfolio that includes more liquid assets, such as stocks or bonds, and consider maintaining an emergency fund to cover unexpected expenses. Location is a critical factor to consider when purchasing a property for direct real estate ownership. The location of a property can greatly impact its value, appreciation potential, and rental demand. Investors should research local market trends, neighborhood characteristics, and economic indicators to identify areas with strong growth potential and to minimize risk. Understanding local market conditions is essential for direct real estate owners. Investors should analyze factors such as population growth, job growth, and housing supply to assess the potential demand for rental properties in a given area. By identifying markets with strong fundamentals and high demand, investors can potentially reduce risks and maximize their investment returns. Selecting the right financing option is crucial for successful direct real estate ownership. Investors should carefully consider their financing options, including traditional mortgages, hard money loans, or private lenders, to find the best fit for their investment strategy and financial situation. Understanding the terms, costs, and potential risks associated with different financing options can help investors make more informed decisions and optimize their investment returns. Direct real estate owners must decide whether to manage their properties personally or hire a professional property management company. Both options have their pros and cons, and investors should consider factors such as their experience, time commitment, and management capabilities when making this decision. Effective property management is critical to the success of a real estate investment, and selecting the right management option can greatly impact the performance of a property and its long-term investment returns. Direct real estate ownership offers several advantages, including the potential for passive income, tax benefits, appreciation, and control over the property. However, it also comes with risks such as property management challenges, vacancies and turnover, market volatility, and liquidity concerns. By carefully considering these factors, investors can make more informed decisions and better manage the risks associated with direct real estate ownership. For those considering direct real estate ownership, it's important to carefully evaluate factors such as location, market conditions, financing options, and property management options. By conducting thorough research, setting clear investment goals, and implementing a well-defined strategy, investors can increase their chances of success and potentially build long-term wealth through direct real estate ownership.What Is Direct Real Estate Ownership?

Types of Direct Real Estate Ownership

Single-Family Homes

Multi-Family Properties

Commercial Properties

Industrial Properties

Advantages of Direct Real Estate Ownership

Potential for Passive Income

Tax Benefits

Appreciation

Control Over the Property

Risks of Direct Real Estate Ownership

Property Management

Vacancies and Turnover

Market Volatility

Liquidity

Factors to Consider in Direct Real Estate Ownership

Location

Market Conditions

Financing Options

Property Management Options

Bottom Line

Direct Real Estate Ownership FAQs

Direct real estate ownership refers to the act of owning a physical property for investment or personal use purposes.

The most common types of direct real estate ownership include single-family homes, multi-family properties, commercial properties, and industrial properties.

Direct real estate ownership has potential for passive income, tax benefits, appreciation, and control over the property.

Risks include property management, vacancies and turnover, market volatility, and liquidity.

Consider location, market conditions, financing options, and property management options before investing in direct real estate ownership.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.