Operation Twist is a monetary policy strategy employed by central banks, notably the Federal Reserve, with the purpose of lowering long-term interest rates to stimulate economic growth. The policy involves the central bank buying long-term government bonds and simultaneously selling an equal amount of shorter-term bonds. This "twist" in the maturity structure aims to flatten the yield curve, thereby reducing borrowing costs for long-term loans, such as mortgages. For investors and those in financial markets, understanding Operation Twist is important as it can influence bond yields, mortgage rates, and overall economic conditions. The policy was first used in the U.S. in the 1960s and more recently in 2011-2012 during the aftermath of the global financial crisis. Its effectiveness remains a topic of debate among economists, making it a key concept in discussions surrounding monetary policy strategies. In any economy, the central bank plays a critical role in implementing monetary policies like Operation Twist. Central banks can influence interest rates, regulate the money supply, and stabilize the economy through tools such as open market operations, reserve requirements, and interest on reserves. Operation Twist's primary objective is to manipulate long-term and short-term interest rates. By buying long-term bonds, central banks push their prices up and reduce their yields. This lowers long-term interest rates, making borrowing cheaper and incentivizing businesses to invest and consumers to spend. Simultaneously, selling short-term bonds raises their yields, effectively raising short-term interest rates. Operation Twist involves a precise buying and selling process. Central banks enter the open market to purchase long-term bonds, injecting money into the economy. At the same time, they sell an equivalent amount of short-term bonds, absorbing money from the economy. This ensures that the overall money supply remains stable, unlike in quantitative easing, where the money supply increases. Operation Twist significantly impacts the bond market. When the central bank purchases long-term bonds, it increases demand, leading to higher bond prices and lower yields. Conversely, selling short-term bonds increases their supply, leading to lower prices and higher yields. One of the primary aims of Operation Twist is to lower long-term interest rates, including mortgage rates. This encourages homeownership, stimulates the housing market, and indirectly drives economic growth. Lower long-term interest rates can boost the stock market. When borrowing becomes cheaper, businesses can invest more, leading to higher profits and potentially higher stock prices. Additionally, lower yields on bonds may make stocks more attractive, drawing investors to the stock market. In theory, Operation Twist should have a neutral effect on inflation and deflation because it doesn't change the money supply. However, by encouraging borrowing and investment, it might slightly increase demand and potentially cause some inflation. Operation Twist might have a complex effect on the dollar. On the one hand, higher short-term rates could attract foreign investors, strengthening the dollar. On the other hand, lower long-term rates might reduce foreign demand for long-term US bonds, weakening the dollar. Finally, Operation Twist can impact investor sentiment. The central bank's intervention may boost confidence, particularly during economic downturns, by demonstrating a proactive approach to economic stimulation. Although similar, Operation Twist and quantitative easing have key differences. Quantitative easing involves buying long-term bonds but does not include selling short-term bonds, which leads to an increase in the money supply. On the other hand, Operation Twist is a more neutral strategy as it doesn't directly increase the money supply. Operation Twist saw its modern revival in 2011-2012 when the Federal Reserve initiated it in response to a sluggish recovery from the 2008 financial crisis. It aimed to further lower long-term interest rates after they had already reached near-zero levels. The goal was to stimulate borrowing and spending and ultimately speed up economic recovery. The effectiveness of Operation Twist is a topic of debate among economists. Some studies suggest that the Federal Reserve's 2011-2012 Operation Twist managed to reduce long-term interest rates. However, its impact on the broader economy, including GDP growth and unemployment, is less clear. Looking forward, Operation Twist may serve as a valuable tool for central banks navigating low-interest-rate environments. As interest rates worldwide remain low, traditional monetary policy tools like rate cuts become less effective, potentially increasing the relevance of strategies like Operation Twist. While the term Operation Twist is predominantly used in the context of the US, similar strategies have been adopted internationally. The European Central Bank, for example, has utilized variations of this policy to stimulate the European economy. The Bank of Japan has also implemented a form of Operation Twist. This came as part of a broader yield curve control policy, which aimed to maintain a specific shape of the yield curve to stimulate the economy. In 2019 and 2020, the Reserve Bank of India undertook a version of Operation Twist. It aimed to manage the country's yield curve, stimulate economic growth, and control inflation. It marked an important moment as a developing economy applied a policy tool typically associated with developed economies. While some evidence suggests Operation Twist can reduce long-term interest rates, its broader economic impacts are less clear. Furthermore, it may have unintended consequences, such as creating distortions in the bond market or providing false signals to market participants. Critics argue that while Operation Twist may have short-term benefits, such as boosting investor sentiment, its long-term effects are questionable. This is because it doesn't directly increase the money supply or lead to an expansionary fiscal policy, which is typically associated with long-term economic growth. Many economists and financial experts remain skeptical about Operation Twist. They argue that it simply reshapes the yield curve without addressing fundamental economic issues. Moreover, in a low-interest-rate environment, it may have a limited impact. Operation Twist, a monetary policy tool used to alter interest rates, plays a pivotal role in economic stimulation. By strategically buying long-term bonds and selling short-term bonds, it aims to lower long-term interest rates, spurring borrowing and investment. This tool can significantly influence various economic elements, including the bond market, mortgage rates, and potentially even the stock market. However, it's not without controversy. Critics question its overall effectiveness, arguing that while it may reshape the yield curve, its long-term economic impacts are less certain, with potential unintended consequences and market distortions. Despite these debates, Operation Twist remains a valuable and notable strategy in the arsenal of central banks, used as a response to specific economic conditions and challenges.Operation Twist Overview

Understanding Operation Twist

Role of Central Banks

Influence on Long-Term and Short-Term Interest Rates

Description of the Buying and Selling Process

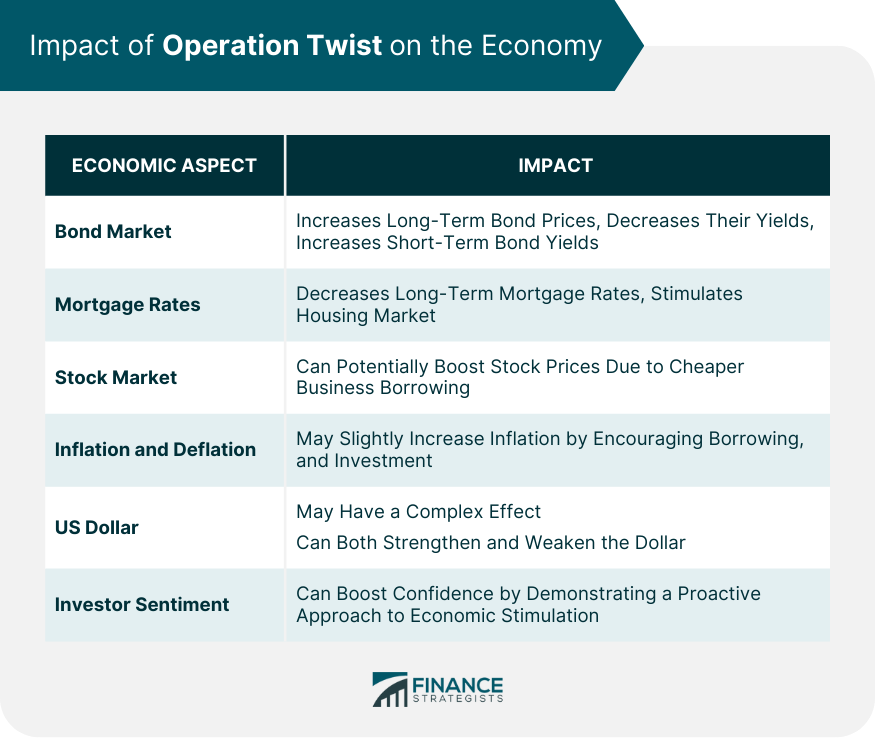

Impact of Operation Twist on the Economy

Bond Market

Mortgage Rates

Stock Market

Inflation and Deflation

US Dollar

Investor Sentiment

Operation Twist in the Modern Economy

Comparison of Operation Twist to Quantitative Easing

Federal Reserve's Implementation in 2011 and 2012

Analysis of Effectiveness

Possible Future Implications and Uses

International Instances of Operation Twist

European Central Bank

Bank of Japan

Reserve Bank of India

Criticisms and Controversies of Operation Twist

Effectiveness and Unintended Consequences

Long-Term vs Short-Term Impacts

Skepticism From Economists and Financial Experts

Final Thoughts

Operation Twist FAQs

Operation Twist is a monetary policy tool used by central banks to manipulate long-term and short-term interest rates. It involves buying long-term bonds to lower their yields and simultaneously selling short-term bonds to increase their yields. The aim is to "twist" the yield curve; thus, it's called Operation Twist.

Operation Twist impacts the economy in several ways. It can lower long-term interest rates, including mortgage rates, encouraging borrowing and investment. It can also influence the stock market, potentially boosting stock prices as businesses invest more due to lower borrowing costs. However, its effects on inflation, deflation, and the value of the dollar are more complex and can vary.

Both Operation Twist and quantitative easing involve the purchase of long-term bonds to lower their yields. However, unlike quantitative easing, Operation Twist also involves selling short-term bonds to raise their yields. This means that, unlike quantitative easing, Operation Twist does not increase the overall money supply.

Yes, Operation Twist was implemented by the Federal Reserve in 2011-2012 to stimulate economic recovery after the 2008 financial crisis. Other central banks, including the European Central Bank, the Bank of Japan, and the Reserve Bank of India, have also used similar strategies.

Critics argue that while Operation Twist can lower long-term interest rates, its broader impacts on the economy are unclear. There are concerns about unintended consequences, such as distortions in the bond market. Furthermore, some argue that it may only have short-term benefits and question its effectiveness in the long term.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.