The Over-The-Counter (OTC) Market refers to a decentralized marketplace where financial instruments, such as stocks, bonds, derivatives, and commodities, are traded directly between two parties without the oversight of a centralized exchange. The OTC market provides a platform for companies unable to meet the stringent requirements for listing on a standard exchange, thereby promoting greater inclusivity in financial trading. It allows for easier access and more flexible trading terms, accommodating a broad range of market participants. Furthermore, it serves a vital role in the global economy, providing liquidity and risk management opportunities across various sectors. However, this market also entails certain risks, including counterparty and liquidity risks, underscoring the need for diligent risk management strategies. Technological advancements continue to shape the OTC landscape, introducing efficiency, transparency, and new possibilities. Trading in the OTC market is fundamentally different from exchange trading. It involves two parties dealing directly with each other without the intermediary of a centralized exchange. This direct dealing could occur via phone, email, or other electronic means, fostering an efficient trading environment. In certain cases, parties may also enlist the help of OTC brokers who facilitate transactions and offer liquidity, making the OTC market an intriguing blend of self-regulation and broker-based trading. A plethora of financial instruments are traded over-the-counter, including stocks, bonds, derivatives, and commodities. OTC stocks often belong to smaller companies that cannot meet exchange listing requirements. Bonds and other debt instruments, often issued by governments or corporations, are also traded over-the-counter. The OTC derivatives market is vast, with instruments like swaps and options offering participants the chance to hedge risks or speculate on future price movements. Lastly, commodities like gold or oil often find their place in the OTC markets, providing a platform for direct transactions. Pricing in the OTC market is largely dictated by the bid-ask spread, reflecting the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask). Liquidity and volatility also significantly influence the OTC market's pricing dynamics. Illiquid or highly volatile instruments may witness wider bid-ask spreads, reflecting higher transaction costs and risk premiums. The OTC market, despite its decentralized nature, is not unregulated. The Financial Industry Regulatory Authority (FINRA) oversees the OTC market in the U.S., maintaining transaction transparency and fairness. Similarly, the Securities and Exchange Commission (SEC) plays a vital role in regulating OTC securities, ensuring compliance with securities laws. Globally, OTC markets are regulated by local financial authorities and international bodies like the International Organization of Securities Commissions (IOSCO). Participants in the OTC market are subject to various compliance requirements, including timely disclosure of financial information, adherence to fair trade practices, and the prevention of fraud and manipulative practices. Despite its unique opportunities, the OTC market is not devoid of risks. Counterparty risk, or the risk of the other party defaulting, is significantly higher in the OTC market due to the lack of a centralized clearinghouse. Without a central authority guaranteeing trades, participants are exposed to the potential default of their trading counterparties, which can result in financial losses. Liquidity risk arises due to the potential difficulty in finding a buyer or seller for a particular OTC instrument, which can lead to larger bid-ask spreads and potentially higher transaction costs. The decentralized nature of the OTC market and the limited number of participants compared to major exchanges can result in lower liquidity, making it more challenging to execute trades at desired prices. Operational risk, including system failures or human errors, is also prevalent in the OTC market due to its reliance on the operational efficiency of individual participants. The absence of centralized systems and standardized processes increases the potential for operational disruptions, which can impact trade execution and settlement processes. Legal and regulatory risks arising from non-compliance with regulations or the occurrence of fraudulent activities are also a significant concern in the OTC market. The lack of stringent regulatory oversight compared to major exchanges can make the OTC market more susceptible to fraudulent practices and non-compliant behavior, exposing investors to potential financial and legal consequences. Lastly, market risk, stemming from broad market fluctuations, affects the OTC market just like any other financial market. Changes in economic conditions, geopolitical events, or investor sentiment can lead to increased volatility and price fluctuations in OTC instruments, potentially impacting the value of investments. The Over-The-Counter (OTC) market, a decentralized trading hub, provides diverse opportunities for a wide range of financial instruments. Its unique structure, distinct from standard exchanges, caters to participants who benefit from direct, flexible transactions. Nonetheless, the potential for substantial reward comes with risks, including counterparty, liquidity, and operational risks, emphasizing the necessity for careful risk management. Regulatory bodies at national and international levels oversee the OTC market, ensuring transparency and fairness. In a global context, the OTC market stands resilient, crucially maintaining liquidity during crises and adapting to regional variations. The transformative impact of technology, from electronic trading to blockchain and beyond, underscores the OTC market's dynamic nature, promising a future of enhanced efficiency and novel possibilities. What Is an Over-The-Counter Market?

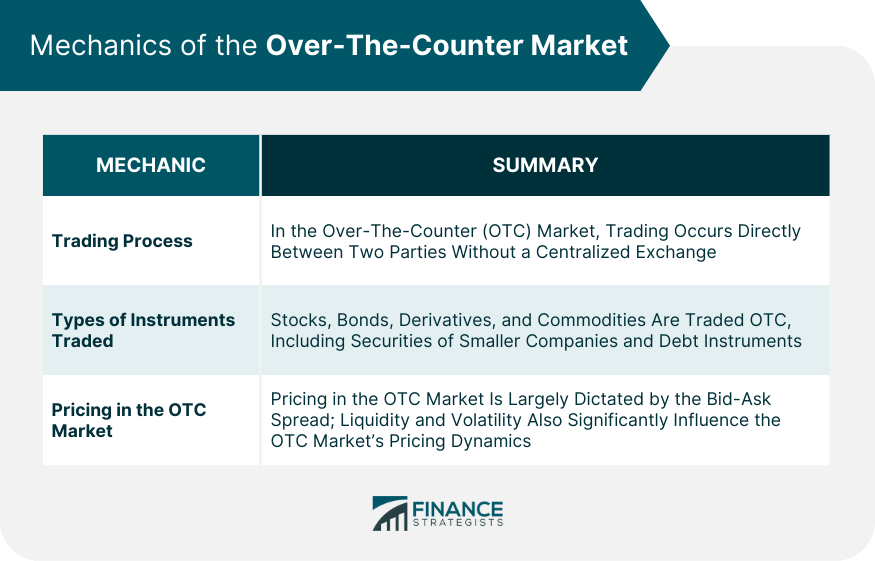

Mechanics of the Over-The-Counter Market

Trading Process

Types of Instruments Traded

Pricing in the Over-The-Counter Market

Regulation of the Over-The-Counter Market

Risks in the Over-The-Counter Market

Counterparty Risk

Liquidity Risk

Operational Risk

Legal and Regulatory Risks

Market Risk

Conclusion

Over-The-Counter Market FAQs

The Over-the-Counter (OTC) Market is a decentralized marketplace where participants trade financial instruments directly with each other instead of through a centralized exchange. This market facilitates the trading of various instruments, including stocks, bonds, derivatives, and commodities.

Despite its decentralized nature, the OTC market is regulated by various bodies. In the U.S., the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC) oversee its operations. At an international level, the market is regulated by local financial authorities and international organizations like the International Organization of Securities Commissions (IOSCO).

The OTC market presents several risks, including counterparty risk (the risk of the other party defaulting), liquidity risk (difficulty in finding a buyer or seller), operational risk (system failures or human errors), legal and regulatory risks (from non-compliance with regulations), and market risk (from broad market fluctuations).

Technology has significantly influenced the OTC market. The advent of electronic trading has streamlined transactions and enhanced transparency. Emerging technologies like blockchain and distributed ledger technology (DLT) promise to improve transparency further, expedite settlement, and reduce counterparty risk. Future advancements like artificial intelligence and machine learning also offer exciting potential applications.

A wide range of financial instruments are traded in the OTC market, including stocks, bonds, derivatives (such as swaps and options), and commodities like gold or oil.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.