Interval funds are a type of closed-end fund with a unique structure that allows for periodic liquidity. They offer a mix of professional management, portfolio diversification, and limited liquidity to investors. Originating in the 1990s, interval funds have evolved as a hybrid investment option. They combine features of both open-end and closed-end funds, offering investors access to less liquid asset classes with managed liquidity events. Some key features of interval funds include a diversified investment portfolio, professional management, and periodic liquidity. These features make them an attractive option for long-term investors seeking exposure to less liquid asset classes. Interval funds can be categorized into three main types based on their underlying assets. In this section, we will discuss equity-based, fixed income-based, and multi-asset interval funds. Equity-based interval funds primarily invest in stocks. They provide investors with exposure to a diversified stock portfolio, targeting capital appreciation and income generation. Fixed income-based interval funds focus on bonds and other fixed income securities. They seek to provide investors with income and capital preservation through a diversified bond portfolio. Multi-asset interval funds invest in a mix of asset classes, including stocks, bonds, and alternative investments. They aim to provide investors with a balanced risk-return profile through strategic asset allocation. Interval funds offer several advantages, such as professional management, portfolio diversification, liquidity management, and tax efficiency. In this section, we will delve into these advantages. Interval funds are managed by investment professionals who make informed decisions on portfolio allocation. This allows investors to access expert insights and potentially achieve higher returns than self-managed investments. Investing in interval funds can help investors diversify their portfolios by providing exposure to less liquid asset classes. This diversification can lead to reduced overall portfolio risk and improved long-term returns. Interval funds offer periodic liquidity through managed liquidity events, allowing investors to redeem a portion of their shares at predetermined intervals. This feature provides a balance between liquidity and long-term investment potential. Interval funds can be tax-efficient, as they do not require frequent trading of assets. This can result in lower capital gains taxes and a more favorable tax treatment for investors. Despite their benefits, interval funds also have some drawbacks, such as limited liquidity, redemption fees, potential for underperformance, and management and operational risks. We will discuss these disadvantages in this section. Interval funds have limited liquidity compared to open-end funds, as they only offer redemption opportunities at specific intervals. This can make it challenging for investors who require more frequent access to their invested capital. Some interval funds may charge redemption fees or impose restrictions on the amount of shares that can be redeemed during a liquidity event. These limitations can discourage investors who seek more flexibility in managing their investments. Interval funds, like any other investment, can underperform their benchmarks or peers. This risk can be magnified if the fund's management makes poor investment decisions or fails to capitalize on market opportunities. Interval funds are subject to management and operational risks, including the risk of human error, technology failures, and fraud. These risks can negatively impact the fund's performance and investors' returns. Interval funds are subject to regulatory oversight by the Securities and Exchange Commission (SEC) and must adhere to the Investment Company Act of 1940. In this section, we will discuss the regulatory environment and required disclosures and reporting for interval funds. The SEC oversees interval funds to ensure compliance with federal securities laws. This oversight helps protect investors by ensuring transparency, fairness, and accuracy in the management and operations of interval funds. Interval funds are regulated under the Investment Company Act of 1940, which sets forth requirements related to governance, disclosures, and investment practices. This legislation aims to protect investors and promote the stability of the investment management industry. Interval funds must provide investors with regular disclosures and reports, including prospectuses, financial statements, and shareholder reports. These documents help investors make informed decisions and monitor their investments. In this section, we will compare interval funds to other investment options, such as mutual funds, exchange-traded funds (ETFs), and closed-end funds (CEFs). Mutual funds are open-end funds that provide daily liquidity to investors. While they offer more frequent access to capital, they may not provide the same exposure to less liquid asset classes as interval funds. ETFs are traded on stock exchanges and offer real-time liquidity during market hours. Although they provide greater flexibility than interval funds, they may not offer the same level of portfolio diversification and professional management. CEFs are similar to interval funds in that they are closed-end structures; however, they trade on stock exchanges and offer market-driven liquidity. While they share some characteristics with interval funds, CEFs may have different investment objectives and strategies. When selecting and investing in interval funds, investors should consider their investment objectives, risk-return profile, and fees and expenses. In this section, we will discuss evaluating interval funds and accessing them through various channels. Before investing, it is essential to evaluate the fund's investment objectives, risk-return profile, and fees and expenses. Understanding these factors can help investors make informed decisions and select funds that align with their investment goals. Investors can access interval funds through direct purchases, brokerage platforms, or financial advisors. Each of these channels offers different levels of support, cost, and convenience, depending on the investor's preferences and needs. In summary, interval funds are a unique investment vehicle that offers a mix of professional management, portfolio diversification, and periodic liquidity. While they have certain advantages, they also come with risks and limitations that investors should consider before investing. The future outlook for interval funds will likely depend on market conditions, investor preferences, and regulatory developments.What Are Interval Funds?

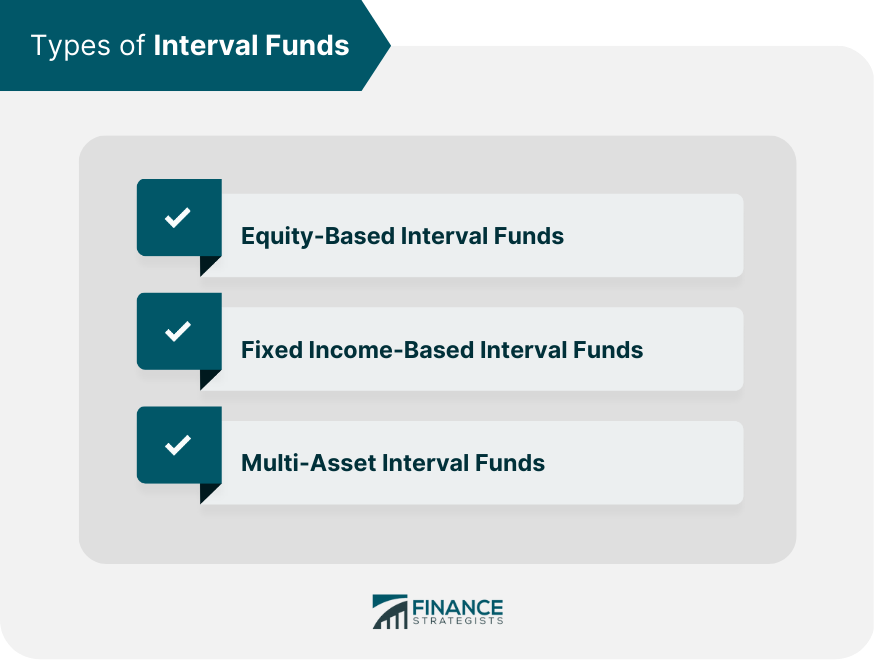

Types of Interval Funds

Equity-Based Interval Funds

Fixed Income-Based Interval Funds

Multi-Asset Interval Funds

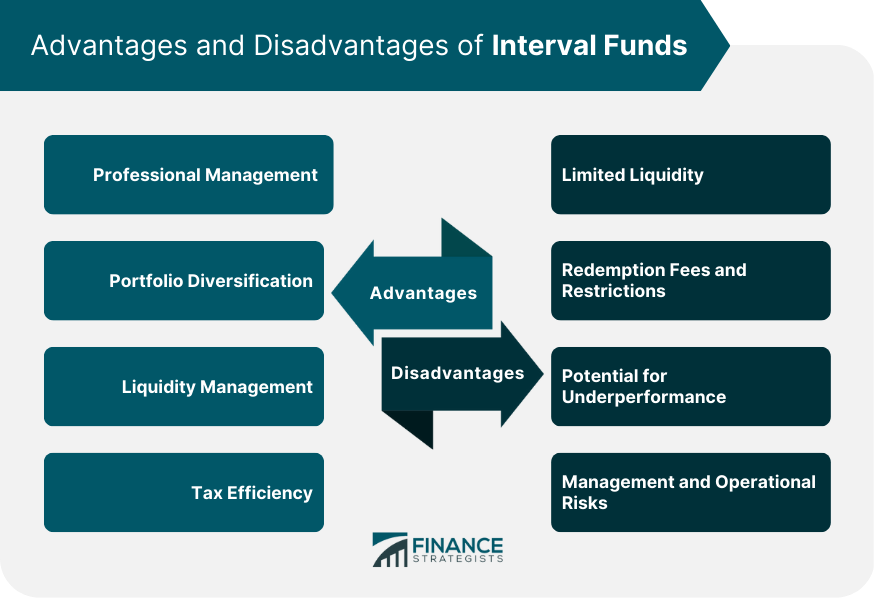

Advantages of Interval Funds

Professional Management

Portfolio Diversification

Liquidity Management

Tax Efficiency

Disadvantages of Interval Funds

Limited Liquidity

Redemption Fees and Restrictions

Potential for Underperformance

Management and Operational Risks

Regulatory Environment

Securities and Exchange Commission (SEC) Oversight

Investment Company Act of 1940

Required Disclosures and Reporting

Comparing Interval Funds to Other Investment Options

Mutual Funds

Exchange-Traded Funds (ETFs)

Closed-End Funds (CEFs)

Selecting and Investing in Interval Funds

Evaluating Interval Funds

Accessing Interval Funds

Conclusion

Interval Funds FAQs

Interval Funds are a type of closed-end fund that offers periodic liquidity to investors, usually every three to twelve months.

Unlike mutual funds, Interval Funds do not redeem shares on a daily basis. Instead, they offer periodic liquidity to investors through tender offers or other mechanisms.

Interval Funds offer the potential for higher returns, as they invest in illiquid assets such as private equity, real estate, and debt. They also provide some liquidity to investors, which can be beneficial for those seeking a more flexible investment.

Interval Funds often come with higher fees than traditional mutual funds, and their lack of daily liquidity can be a drawback for some investors. Additionally, their illiquid holdings can pose risks during economic downturns.

It's important to carefully consider your investment goals and risk tolerance before investing in Interval Funds. Consulting with a financial advisor can help you determine if these funds align with your investment objectives.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.