The low-volatility factor refers to the tendency of stocks with lower price fluctuations to outperform their higher-volatility counterparts over the long term, particularly on a risk-adjusted basis. Low-volatility stocks are typically characterized by their stable earnings, cash flows, and dividends, as well as their presence in defensive industries. They often demonstrate lower sensitivity to market movements, as indicated by their low beta values. Incorporating the low-volatility factor into a portfolio management strategy can help investors achieve several objectives, such as reducing portfolio volatility, improving risk-adjusted returns, and preserving capital. This factor is particularly relevant in the context of Modern Portfolio Theory, which emphasizes the importance of diversification and risk management in constructing efficient portfolios. A key characteristic of low-volatility stocks is their low beta values, which signify a lower correlation with market movements. A stock with a beta value of less than 1 is considered to have lower volatility than the overall market, while a beta value greater than 1 indicates higher volatility. Low-volatility stocks typically exhibit consistent and stable earnings and cash flows. This financial stability contributes to their lower price fluctuations and provides a buffer against economic downturns. Many low-volatility stocks belong to defensive industries, such as utilities, consumer staples, and healthcare. These industries tend to be less cyclical and more resistant to economic fluctuations, providing a stable foundation for the low-volatility factor. Low-volatility stocks often pay regular dividends, providing income to investors and helping to support their share prices during market downturns. Companies with low debt levels and high-quality management are more likely to exhibit low-volatility characteristics, as they face fewer financial risks and are better equipped to navigate challenging market conditions. There are several strategies for incorporating the low-volatility factor into a portfolio, including: 1. Minimum Variance Portfolio: This strategy involves selecting stocks that collectively minimize the portfolio's overall volatility. 2. Equal Weight Portfolio: This approach assigns equal weight to each stock in the portfolio, reducing the impact of individual stock volatility. 3. Risk-Parity Portfolio: This strategy seeks to allocate capital to stocks based on their risk contribution, such that each stock contributes equally to the portfolio's overall volatility. The main advantages of low-volatility factor investing include: 1. Reduced Portfolio Volatility: By allocating capital to lower-volatility stocks, investors can reduce their portfolio's overall volatility and exposure to market downturns. 2. Improved Risk-Adjusted Returns: Low-volatility strategies have been shown to outperform their higher-volatility counterparts on a risk-adjusted basis, offering investors more attractive returns for the same level of risk. 3. Capital Preservation: Low-volatility strategies can help investors preserve their capital during periods of market stress, as lower-volatility stocks tend to outperform during market downturns. Despite its potential benefits, low-volatility factor investing also presents several limitations: 1. Potential Underperformance in Strong Bull Markets: Low-volatility strategies may underperform during periods of strong market growth, as higher-volatility stocks tend to capture more of the upside during these times. 2. Interest Rate Sensitivity: Low-volatility stocks, particularly those in interest rate-sensitive sectors like utilities, can be negatively affected by rising interest rates, which may result in underperformance compared to the broader market. 3. Sector and Stock Concentration Risks: Low-volatility strategies may inadvertently lead to concentration in certain sectors or stocks, increasing the risk of underperformance if these sectors or stocks underperform. Investors can gain exposure to the low-volatility factor through passive investment products, such as: 1. Low-Volatility ETFs: These exchange-traded funds track low-volatility indices, providing diversified exposure to low-volatility stocks. 2. Low-Volatility Index Funds: Similar to ETFs, index funds provide access to a basket of low-volatility stocks by tracking a low-volatility index. Active management strategies can also be employed to capture the low-volatility factor, including: 1. Stock Picking: Investors can identify and select individual low-volatility stocks based on their own research and analysis. 2. Portfolio Rebalancing: Regularly rebalancing a portfolio to maintain its target low-volatility allocation can help to capture the benefits of the low-volatility factor over time. 3. Tactical Asset Allocation: Investors can adjust their exposure to the low-volatility factor based on market conditions, economic indicators, or other factors. The low-volatility factor can play an important role in asset allocation, helping to diversify risk and enhance risk-adjusted returns. Incorporating low-volatility stocks into a portfolio can provide a defensive anchor during market downturns, while also potentially reducing the portfolio's overall volatility. Low-volatility factor investing can complement other factor strategies, such as value, momentum, quality, and size. Combining these factors in a portfolio can help to further diversify risk and improve performance across different market environments. When constructing a portfolio that includes the low-volatility factor, investors should consider factors such as risk tolerance, investment horizon, and return objectives. For example, more risk-averse investors with a longer investment horizon may allocate a larger portion of their portfolio to low-volatility stocks, while more aggressive investors with shorter time horizons may choose a smaller allocation. Evaluating the performance of a low-volatility strategy requires assessing both absolute and relative performance, as well as risk-adjusted metrics, such as the Sharpe ratio. These measures can help investors determine whether their low-volatility strategy is meeting their objectives and providing the desired risk-adjusted returns. Assessing the risks associated with a low-volatility strategy involves conducting portfolio stress testing, scenario analysis, and risk-budgeting techniques. These methods can help investors identify potential vulnerabilities in their low-volatility portfolios and develop strategies to mitigate these risks. Incorporating the low-volatility factor into a portfolio management strategy can offer investors a range of benefits, including reduced portfolio volatility, improved risk-adjusted returns, and capital preservation during market downturns. By focusing on stocks with characteristics such as low beta values, stable earnings, defensive industries, dividend payments, and low debt levels, investors can build more resilient and efficient portfolios. However, it is crucial to be aware of the potential limitations and risks associated with low-volatility strategies, such as underperformance in strong bull markets, interest rate sensitivity, and sector or stock concentration risks. Investors should carefully consider their individual risk tolerance, investment horizon, and return objectives when constructing their portfolios and employing strategies like minimum variance, equal weight, or risk-parity approaches. Ongoing performance evaluation and risk management, including the use of metrics like the Sharpe ratio and stress testing techniques, can help ensure that a low-volatility strategy remains aligned with investors' goals and objectives. Ultimately, the low-volatility factor can play a significant role in asset allocation and complement other factor strategies, contributing to a well-diversified and efficient portfolio.Definition Low-Volatility Factor

Importance in Portfolio Management

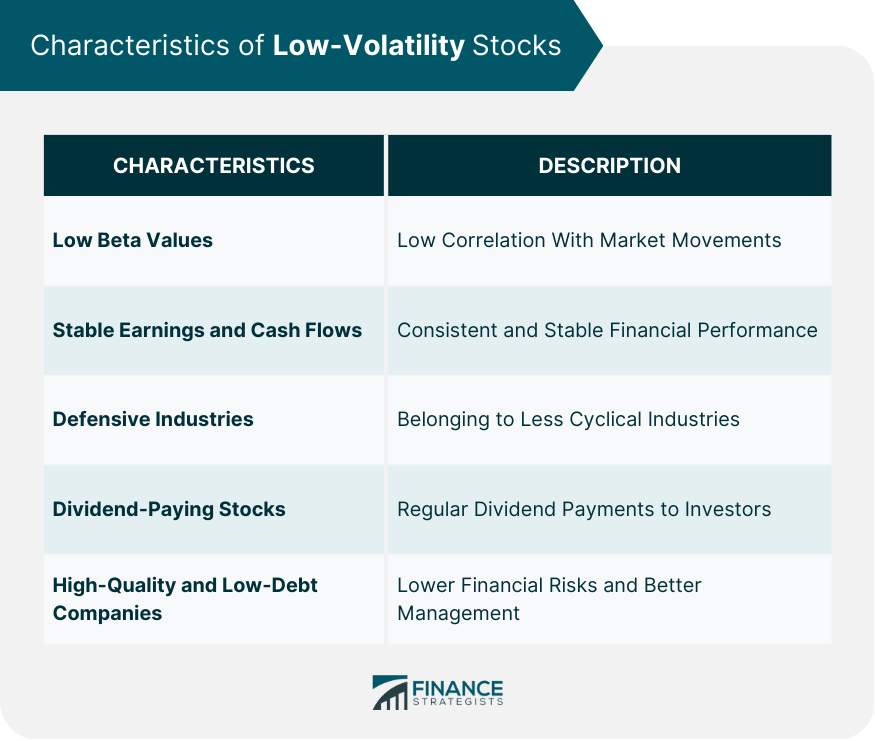

Characteristics of Low-Volatility Stocks

Low Beta Values

Stable Earnings and Cash Flows

Defensive Industries

Dividend-Paying Stocks

High-Quality and Low-Debt Companies

Low-Volatility Factor Investing

Strategies

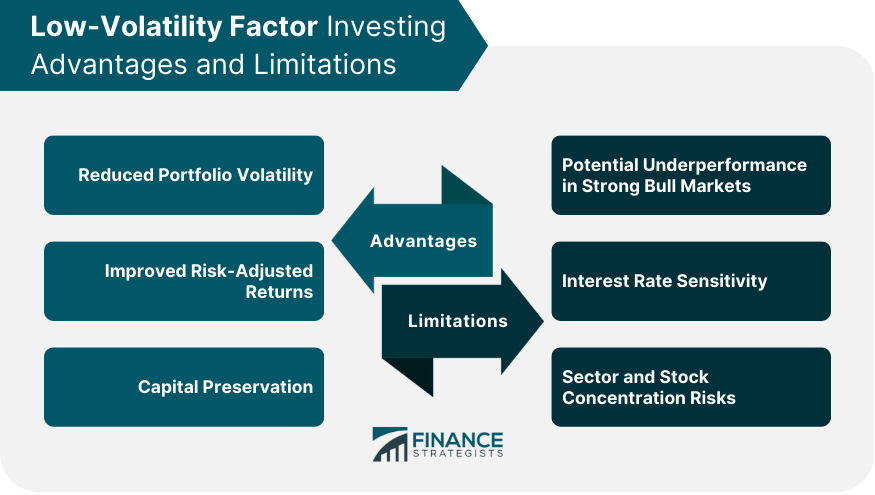

Advantages

Limitations

Implementing Low-Volatility Strategies

Passive Investment Products

Active Management

Low-Volatility Factor in a Diversified Portfolio

Role in Asset Allocation

Complementing Other Factor Strategies

Portfolio Construction Considerations

Performance Evaluation and Risk Management

Performance Measurement

Risk Assessment

Conclusion

Low-Volatility Factor FAQs

The low-volatility factor refers to the tendency of stocks with lower price fluctuations to outperform their higher-volatility counterparts over the long term, particularly on a risk-adjusted basis. It is important in portfolio management because it helps reduce portfolio volatility, improve risk-adjusted returns, and preserve capital during market downturns.

Investors can identify low-volatility stocks by looking for characteristics such as low beta values, stable earnings and cash flows, presence in defensive industries, dividend payments, and low debt levels. These stocks typically exhibit lower price fluctuations and provide a buffer against economic downturns.

Common strategies for implementing the low-volatility factor include a minimum variance portfolio, equal weight portfolio, and risk-parity portfolio. These strategies focus on selecting stocks that minimize overall portfolio volatility or allocate capital based on risk contribution.

The low-volatility factor can complement other factor strategies such as value, momentum, quality, and size, by diversifying risk and improving performance across different market environments. Combining these factors in a portfolio can help achieve a more balanced risk-return profile.

Potential limitations and risks of low-volatility factor investing include underperformance during strong bull markets, sensitivity to interest rate changes, and sector or stock concentration risks. Investors should be aware of these limitations and carefully assess their individual risk tolerance, investment horizon, and return objectives when constructing a low-volatility portfolio.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.