Duration risk is the potential loss that an investor faces due to changes in interest rates. It is a measure of the sensitivity of a bond's price to changes in interest rates and is an important concept in finance and investment. Duration risk is an essential concept in finance and investment as it provides a measure of risk and potential loss. It is particularly important for investors who seek to maximize returns while managing risk. Duration risk can help investors identify potential downside risks and make informed decisions about asset allocation, risk management, and investment strategies. Duration risk is also a critical measure in evaluating the performance of bond funds or investment managers, as it indicates how much an investment or portfolio is exposed to changes in interest rates. By understanding duration risk, investors can assess the potential risks associated with a particular investment or portfolio and make more informed decisions. Duration is a measure of the sensitivity of a bond's price to changes in interest rates. It is a measure of the average time it takes for the cash flows from a bond to be received by the investor and is expressed in years. The duration of a bond can be calculated by taking the weighted average of the present value of its cash flows, where the weights are the proportion of the present value of each cash flow to the total present value of all the cash flows. The duration of a bond is directly related to changes in interest rates. The longer the duration, the more sensitive the bond's price is to changes in interest rates. This is because longer-duration bonds have more future cash flows, which are subject to greater uncertainty about future interest rates. There are two types of duration risk: Price Duration Risk and Reinvestment Duration Risk. Price duration risk is the potential loss that an investor faces due to changes in interest rates and its impact on the price of a bond. As interest rates rise, the price of a bond will generally fall, leading to potential losses for investors holding the bond. Reinvestment duration risk is the potential loss that an investor faces due to changes in interest rates and its impact on the reinvestment of coupon payments. As interest rates fall, the yield on reinvested coupon payments will generally decline, leading to potential losses for investors. There are various causes of duration risk, including the following: Interest rate volatility is a key driver of duration risk. As interest rates fluctuate, the price of bonds will generally rise or fall, leading to potential gains or losses for investors. Macroeconomic factors, such as inflation and economic growth, can also impact interest rates and duration risk. For example, rising inflation may lead to higher interest rates and greater duration risk. Company-specific factors, such as creditworthiness or financial performance, can also impact duration risk. For example, a company with a lower credit rating may have a higher cost of debt and greater duration risk. Below are some details on how duration risk can be managed. Duration risk is an important tool for managing risk in bond investments and portfolios. By understanding the potential duration risk associated with an investment, investors can make informed decisions about asset allocation and risk management strategies. Duration limits and guidelines can be used to manage risk and minimize potential losses. For example, investors may set a maximum duration limit for their portfolio, beyond which they will reduce their exposure to longer-duration bonds. Hedging strategies, such as interest rate swaps or options contracts, can also be used to manage duration risk. For example, interest rate swaps can be used to manage the interest rate risk of a bond portfolio by exchanging fixed-rate cash flows for variable-rate cash flows. Below are some details on how portfolios can be managed to reduce the impact of duration risk. Duration risk can play a role in portfolio construction and asset allocation. By considering the potential duration risk associated with an investment or asset, investors can create a more diversified and risk-managed portfolio. Duration risk can also have an impact on portfolio performance, as it can affect the overall return of the portfolio. Investors should consider the potential duration risk associated with an investment or asset when evaluating its potential returns. Duration can also be used to inform asset allocation decisions. By understanding the potential duration risk associated with different asset classes, investors can make informed decisions about the allocation of their investment portfolio. Duration risk is an essential concept in finance and investment, providing a measure of potential risk and loss. It is important for investors to understand duration risk and its implications for investment decision-making and risk management. Duration risk can inform investment decision-making, asset allocation, and risk management strategies. By understanding duration risk, investors can make informed decisions about their investment portfolios and manage potential risks effectively. There are many potential areas for further study in the field of duration risk. For example, future research could explore the impact of duration risk on different bond sectors, the effectiveness of different risk management strategies, and the role of duration risk in behavioral finance.What Is Duration Risk?

Understanding Duration

Calculation of Duration

Relationship Between Duration and Interest Rates

Types of Duration Risk

Price Duration Risk

Reinvestment Duration Risk

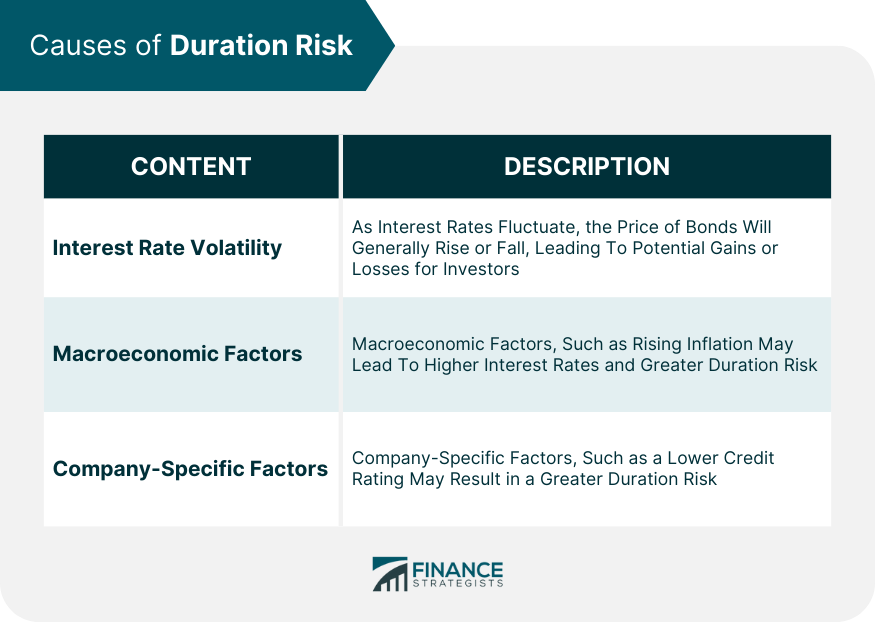

Causes of Duration Risk

Interest Rate Volatility

Macroeconomic Factors

Company-Specific Factors

Duration Risk Management

Role of Duration Risk in Risk Management

Duration Limits and Guidelines

Hedging Strategies for Duration Risk

Duration Risk and Portfolio Management

Duration Risk in Portfolio Construction

Impact of Duration Risk on Portfolio Performance

Duration and Asset Allocation

Conclusion

Duration Risk FAQs

Duration risk is the potential for an investment's value to decrease due to fluctuations in interest rates.

Duration measures how sensitive an investment's price is to changes in interest rates. The longer the duration, the more sensitive it is to interest rate changes.

The two main types of duration risk are interest rate risk and reinvestment risk. Interest rate risk refers to changes in interest rates, while reinvestment risk refers to changes in the rate of return on reinvested income.

Investors can manage duration risk by diversifying their portfolios, adjusting the duration of their investments, and using hedging strategies such as interest rate swaps or options.

No, duration risk is not the same as credit risk. Duration risk is related to interest rate changes, while credit risk is related to the borrower's ability to repay the debt.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.