A swap rate, often synonymous with the term "fixed rate", is the fixed interest rate that the payer of an interest rate swap wants in exchange for the uncertainty of having to pay a short-term (floating) rate of interest. It is a vital concept in the world of finance, where parties 'swap' their interest obligations with each other. This 'swap' can be based on interest rates, currencies, or commodities, thus leading to various types of swaps such as interest rate swaps, currency swaps, or commodity swaps. Swap rates allow parties to manage their exposure to fluctuating interest rates or exchange rates, thus serving as an effective risk management tool. Furthermore, they form the backbone of the swap market, which is a major part of the global financial system, helping to increase market liquidity and enhancing the functioning of financial markets. In an interest rate swap, two parties exchange or 'swap' interest rate payments. One party will pay a fixed interest rate (the swap rate), and the other party will pay a floating interest rate, usually linked to a reference rate such as LIBOR. The principal amount (also known as the 'notional amount') on which the interest payments are calculated is not exchanged, only the interest payments are swapped. A currency swap involves two parties exchanging principal and interest payments in different currencies. The swap rate in a currency swap is the fixed interest rate agreed upon in the foreign currency. This type of swap helps businesses, financial institutions, and governments manage their foreign exchange exposure. Commodity swaps involve the exchange of a floating commodity price, such as the price of oil or grain, for a fixed price over a specified period. The fixed price is the swap rate. Commodity swaps are often used by corporations to hedge against price fluctuations in raw materials that they need for their operations. Regardless of the type of swap, the swap rate is central to the agreement. It represents the fixed rate being exchanged and is thus a crucial element in determining the potential profitability of the swap for each party. It serves as the benchmark for the terms of the agreement, dictating the cash flows to be exchanged. Financial institutions, particularly banks and swap dealers, play a pivotal role in setting swap rates. They quote swap rates based on various factors such as the current and expected future interest rates, the credit quality of counterparties, and their own profit margins. These rates can vary from institution to institution, depending on their risk tolerance and market view. Swap rates are primarily influenced by the general conditions of financial markets. They can rise during periods of economic uncertainty or market stress, reflecting an increase in risk premiums. Other factors, such as changes in central bank policies, can also affect swap rates. For instance, if a central bank raises its key interest rate, swap rates are likely to increase. The calculation of swap rates is a complex process that involves sophisticated mathematical models and requires an understanding of financial markets. These rates are typically calculated as the difference between the fixed rate of the swap and the expected future floating rates over the swap's term. Swap rates play an essential role in pricing financial instruments, particularly derivative contracts. They are used as discount rates to calculate the present value of expected future cash flows. They help in accurately pricing complex derivatives and structured products, thus providing more reliable and consistent prices in the market. The valuation of derivatives, especially interest rate derivatives like interest rate swaps, options, and forward rate agreements, is heavily influenced by swap rates. Changes in swap rates directly affect the value of these derivatives. Therefore, understanding and monitoring swap rates is crucial for traders and investors dealing with these derivatives. Swap rates also significantly impact the bond market. They form the basis of the risk-free rate, which is a fundamental component in the pricing and valuation of bonds. A rise in swap rates generally results in a decrease in bond prices and vice versa. Interest rate swaps, with their predetermined swap rates, are a widely-used tool for managing interest rate risk. Companies and institutions exposed to the risk of rising interest rates can enter into an interest rate swap, agreeing to pay a fixed rate (the swap rate) and receive a floating rate. This allows them to lock in their future interest cost, thereby reducing their risk. Currency swaps, with their agreed swap rates, allow entities to manage their currency risk. By swapping cash flows in different currencies, companies can effectively hedge their foreign exchange risk. This can be particularly useful for multinational corporations and global investment funds. Commodity swaps enable businesses to manage the risk associated with commodity price fluctuations. By agreeing to pay a fixed price (the swap rate) and receiving a floating price linked to the commodity's market price, companies can stabilize their future commodity costs. Central banks often use swap arrangements as a tool of monetary policy. By entering into swap agreements, central banks can provide liquidity in foreign currencies to their domestic financial institutions. The swap rate in these agreements is a key determinant of the cost of this liquidity provision. Swap rates can also influence exchange rates and capital flows. A higher swap rate in a currency makes that currency more attractive to investors, potentially leading to an appreciation of the currency and an increase in capital inflows. A swap rate is a crucial component in a swap agreement, representing the fixed interest rate to be exchanged. Swap rates provide a means to manage exposure to fluctuating interest rates, exchange rates, or commodity prices, thereby reducing risk and enhancing financial stability. Swap rates serve as a benchmark for determining the profitability and cash flows of swap agreements, and they are used as discount rates in pricing complex derivatives and structured products. Financial institutions, central banks, and market conditions all contribute to the determination of swap rates, which are calculated based on mathematical models and expected future rates. Furthermore, swap rates have significant implications for risk management strategies. Interest rate swaps allow companies and institutions to hedge against interest rate risk by agreeing to fixed rates, reducing uncertainty and locking in future interest costs. Currency swaps enable entities to mitigate currency risk by swapping cash flows in different currencies, providing a useful tool for multinational corporations. Commodity swaps allow businesses to manage the risk associated with commodity price fluctuations, stabilizing their future commodity costs. Moreover, swap rates are employed by central banks in their monetary policy through swap arrangements, providing liquidity in foreign currencies to domestic financial institutions. The impact of swap rates extends to exchange rates and capital flows, as higher swap rates in a currency attract investors, potentially leading to currency appreciation and increased capital inflows. Swap rates are a complex topic and managing them effectively requires a deep understanding of financial markets and risk management principles. It is advisable to seek professional guidance when dealing with swaps and swap rates. Whether you are a corporate treasurer managing your company's risks, an investor looking for opportunities in the derivatives market, or a policymaker seeking to understand the implications of swap rates for monetary policy, professional advice can be invaluable.What Is a Swap Rate?

Understanding Swap Rate Mechanics

Interest Rate Swaps

Currency Swaps

Commodity Swaps

The Role of Swap Rates in Different Types of Swaps

Determining the Swap Rate

Role of Financial Institutions

Market Conditions Influencing the Swap Rate

Calculation Methodologies

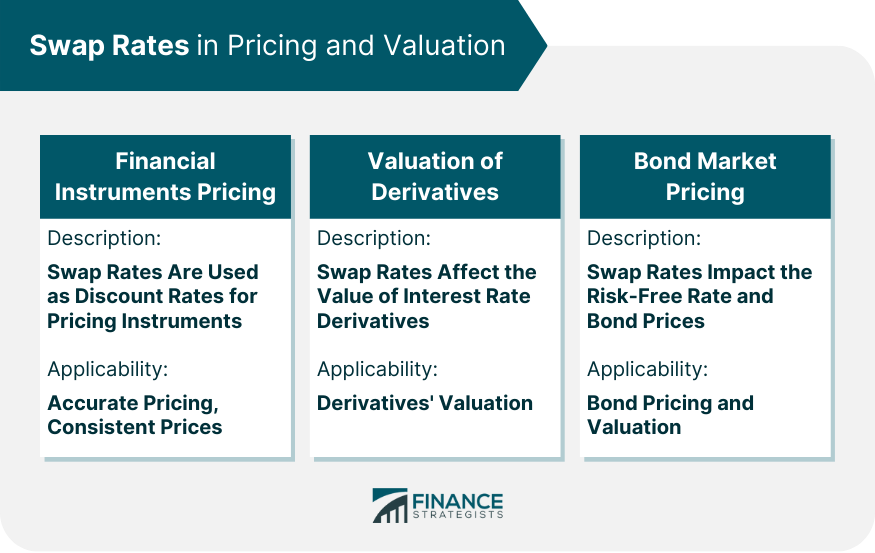

Swap Rates in Pricing and Valuation

Role in Financial Instruments Pricing

Impact on the Valuation of Derivatives

Influence on Bond Market Pricing

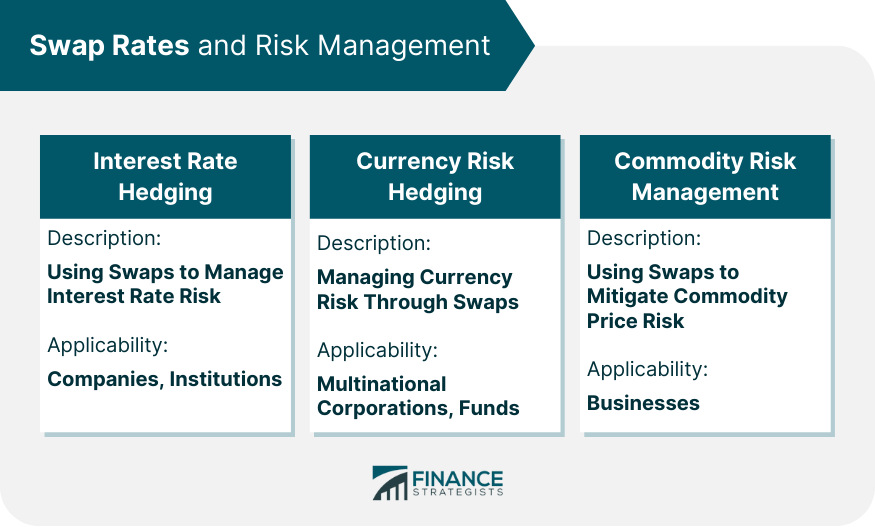

Swap Rate and Risk Management

Hedging Interest Rate Risk Using Swap Rates

Mitigating Currency Risk via Swap Rate

Use in Commodity Risk Management

Swap Rates in Monetary Policy

Central Banks and Swap Rates

The Impact on Exchange Rates and Capital Flows

Final Thoughts

Swap Rate FAQs

A swap rate, also known as the fixed rate of an interest rate swap, is the rate at which the cash flows of an interest rate swap are discounted. In the most common type of swap agreement, one party agrees to pay a fixed interest rate on a nominal principal amount, and in return, receives a floating interest rate from another party.

Swap rates function through an agreement between two parties. In an interest rate swap, one party agrees to pay a fixed rate (the swap rate) on a predetermined nominal amount for a set period. In return, this party receives payments from the other party that are based on a floating interest rate (like LIBOR). The net result is an exchange of cash flows, allowing both parties to 'swap' their respective interest rate exposures.

Swap rates have a variety of applications, mainly in risk management, trading, and speculation. Financial institutions and corporations may use swaps to hedge against interest rate fluctuations, effectively locking in a fixed rate. Traders might use swaps to speculate on future interest rate movements. Furthermore, swap rates also play a crucial role in pricing fixed-income securities and derivatives.

Swap rates can significantly influence the financial market. They are indicative of the overall health of the economy, reflecting market expectations of future interest rates and inflation. Changes in swap rates can affect the pricing of fixed-income securities and derivatives, impacting investment strategies. They can also influence the costs of borrowing for corporations and financial institutions.

Numerous factors can affect swap rates, including the creditworthiness of the parties involved in the swap agreement, the prevailing market interest rates, the time to maturity of the swap, and the overall economic conditions. A higher credit risk or a longer maturity typically leads to a higher swap rate, while lower market interest rates can reduce the swap rate.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.