A strategic benchmark is a standard or reference point against which the performance of an investment portfolio or a business can be measured. Benchmarks provide a frame of reference to evaluate the success of investment strategies and business operations, enabling investors and managers to make informed decisions. Strategic benchmarks play a crucial role in both investment and business, as they help identify areas of strength and weakness, drive improvement, and foster accountability. Benchmarks allow investors and business managers to monitor progress, make data-driven decisions, and measure the effectiveness of their strategies. The main objectives of using strategic benchmarks are to evaluate performance, identify opportunities for improvement, and guide decision-making. By comparing performance against a benchmark, investors, and managers can gain valuable insights into the success of their strategies and identify areas where adjustments may be necessary. There are various types of strategic benchmarks that can be used to measure performance in investment and business. This section will discuss market benchmarks, custom benchmarks, absolute return benchmarks, peer group benchmarks, and risk-adjusted benchmarks. Market benchmarks are indices that represent the overall performance of a specific market or market segment. They provide a broad view of market performance and serve as a common reference point for comparing the performance of individual investments or portfolios. Custom benchmarks are tailored to the specific needs and objectives of an investor or business. They allow for a more accurate and relevant comparison of performance, as they take into account the unique characteristics and goals of the investment or business being evaluated. Absolute return benchmarks measure the performance of an investment or business against a predetermined target, such as a specific rate of return. These benchmarks focus on the absolute performance of the investment or business, rather than comparing it to the performance of other investments or businesses. Peer group benchmarks compare the performance of an investment or business to that of a group of similar investments or businesses. This type of benchmark provides valuable insights into relative performance and can help identify best practices and areas for improvement. Risk-adjusted benchmarks take into account the level of risk associated with an investment or business when measuring performance. By considering risk, these benchmarks provide a more accurate and meaningful comparison of performance across different investments or businesses with varying risk profiles. Choosing the right strategic benchmark is essential for accurately measuring performance and making informed decisions. Selecting a benchmark that aligns with the investment objectives of the portfolio or business is crucial. A well-aligned benchmark will provide a meaningful comparison of performance and help ensure that the investment strategy is on track to achieve its goals. The time horizon of the investment or business plays a significant role in selecting the appropriate benchmark. A benchmark should reflect the investment or business's time horizon to provide a relevant comparison of performance over the same period. Risk tolerance is another important factor to consider when selecting a strategic benchmark. A benchmark that accounts for the risk tolerance of the investor or business will provide a more accurate representation of performance and help guide decision-making. Asset allocation and diversification are essential components of a successful investment strategy. Selecting a benchmark that reflects the asset allocation and diversification strategy of the investment portfolio or business helps ensure that the benchmark provides a relevant and meaningful comparison of performance. Strategic benchmarks play a crucial role in guiding investment decisions, as they help investors and managers identify areas where adjustments may be necessary. By comparing performance against a benchmark, investors and managers can make informed decisions about rebalancing their portfolios or changing their investment strategies to achieve their objectives. Strategic benchmarking is a valuable tool in business management, helping businesses evaluate their performance and identify areas for improvement. Strategic benchmarks can be used to evaluate a business's performance relative to its competitors, providing insights into the competitive landscape and highlighting areas where the business excels or lags behind its peers. This information is valuable for informing strategic decisions and identifying opportunities for growth and improvement. Benchmarking can be used to identify best practices and drive process improvement within a business. By comparing a business's processes and performance against industry benchmarks or the performance of competitors, managers can identify areas for improvement and implement changes to enhance efficiency and effectiveness. Strategic benchmarks are often used to evaluate the financial performance of a business, comparing key financial metrics against industry standards or the performance of competitors. This information can help managers identify areas where the business is underperforming and develop strategies to improve financial performance. Benchmarking can also be used to identify market trends and opportunities, providing valuable insights into the changing business environment. By monitoring industry benchmarks and the performance of competitors, businesses can identify emerging trends and capitalize on opportunities to drive growth and improve performance. While strategic benchmarks can provide valuable insights and guidance, there are also limitations and challenges associated with their use. Benchmark selection bias occurs when a benchmark is chosen that does not accurately reflect the characteristics of the investment portfolio or business being evaluated. This can lead to misleading performance comparisons and uninformed decision-making. Tracking error refers to the difference in performance between an investment portfolio or business and its benchmark. Excessive tracking errors can indicate that the benchmark is not an appropriate fit for the investment portfolio or business or that the investment strategy is not being effectively executed. Inappropriate comparisons can occur when a benchmark is used to evaluate the performance of an investment portfolio or business that is not directly comparable. This can lead to misleading conclusions about the success of the investment strategy or business operations. A focus on short-term performance can be a limitation of using strategic benchmarks, as it may encourage investors and managers to make decisions based on short-term fluctuations in performance rather than long-term objectives. This can lead to suboptimal decision-making and a reduced focus on sustainable growth. Implementing strategic benchmarks effectively is essential for maximizing their benefits and overcoming their limitations. Regularly reviewing and updating benchmarks is essential to ensure their continued relevance and accuracy. As market conditions change and investment portfolios or businesses evolve, benchmarks should be updated to reflect these changes and ensure meaningful performance comparisons. Using multiple benchmarks can provide a more comprehensive view of performance and help mitigate the limitations associated with any single benchmark. By considering a range of benchmarks, investors and managers can gain a deeper understanding of their investment portfolio or business's performance and make more informed decisions. Aligning benchmarks with the expectations of stakeholders, such as investors, customers, or employees, is essential for ensuring the relevance and usefulness of benchmark comparisons. Benchmarks should be selected and communicated in a way that meets the needs and expectations of these stakeholders. While benchmarking can provide valuable insights and guidance, it is also essential to balance benchmarking with innovation. Focusing too heavily on benchmark comparisons can stifle creativity and limit a business's ability to innovate and adapt to changing market conditions. Striking the right balance between benchmarking and innovation is crucial for driving long-term growth and success. Strategic benchmarks are critical for investment and business management. They offer insights into performance and help guide decision-making, driving improvements and achieving long-term objectives. Though strategic benchmarks have limitations, best practices such as regular review, incorporating multiple benchmarks, aligning with stakeholder expectations, and balancing with innovation can overcome these challenges. Strategic benchmarks are essential tools for driving performance and growth in investment and business management by providing a clear frame of reference for evaluating performance and guiding decision-making. Seeking professional wealth management services is recommended to make the most of strategic benchmarks, as wealth management professionals offer expert guidance on selecting and implementing appropriate benchmarks to achieve long-term objectives.What Are Strategic Benchmarks?

Types of Strategic Benchmarks

Market Benchmarks

Custom Benchmarks

Absolute Return Benchmarks

Peer Group Benchmarks

Risk-Adjusted Benchmarks

Selecting the Appropriate Strategic Benchmark

Alignment With Investment Objectives

Time Horizon

Risk Tolerance

Asset Allocation and Diversification

Guiding Investment Decisions

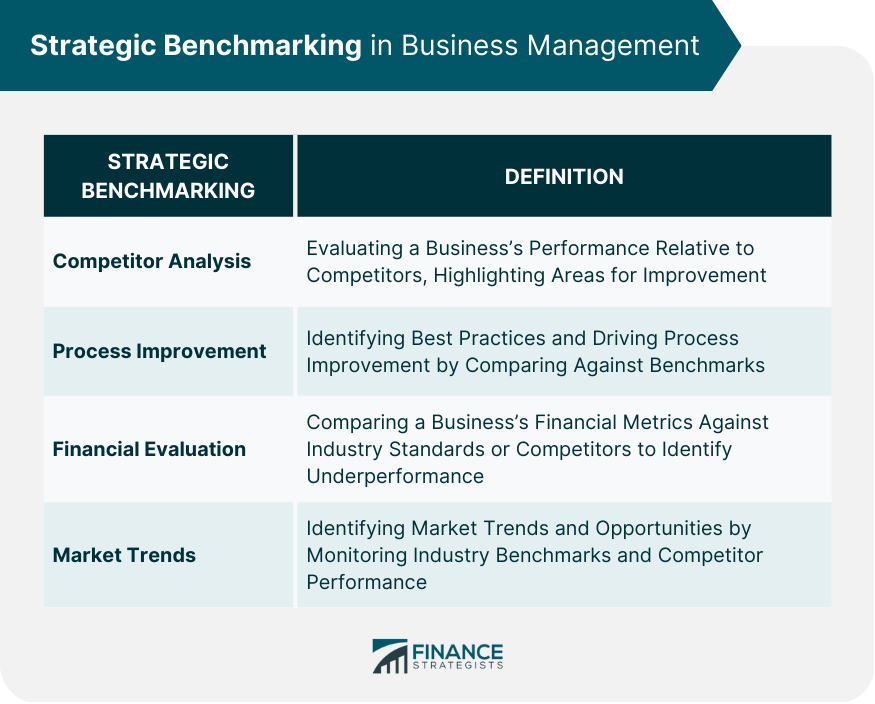

Strategic Benchmarking in Business Management

Competitor Analysis

Process Improvement

Financial Performance Evaluation

Identifying Market Trends and Opportunities

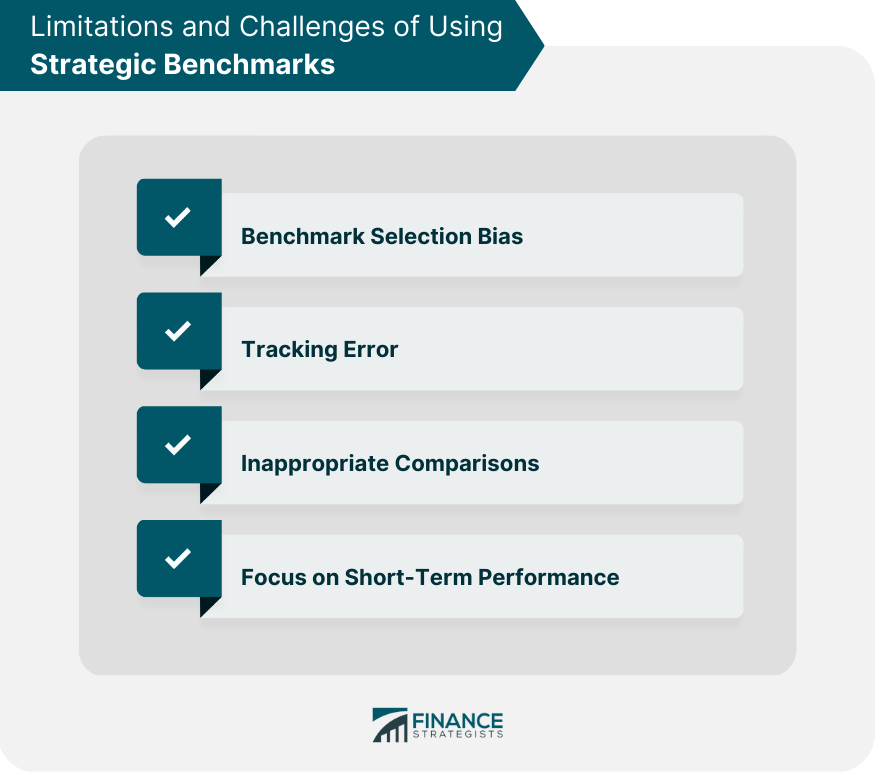

Limitations and Challenges of Using Strategic Benchmarks

Benchmark Selection Bias

Tracking Error

Inappropriate Comparisons

Focus on Short-Term Performance

Best Practices for Implementing Strategic Benchmarks

Regular Benchmark Review and Updates

Incorporating Multiple Benchmarks

Aligning Benchmarks With Stakeholder Expectations

Balancing Benchmarking With Innovation

Final Thoughts

Strategic Benchmarks FAQs

A strategic benchmark is a standard or reference point against which the performance of an investment portfolio or a business can be measured. It enables investors and managers to make informed decisions, identify areas of strength and weakness, and foster accountability.

There are various types of strategic benchmarks, including market benchmarks, custom benchmarks, absolute return benchmarks, peer group benchmarks, and risk-adjusted benchmarks. Each has its unique benefits and limitations, and the selection of the appropriate benchmark depends on various factors such as alignment with investment objectives, time horizon, risk tolerance, and asset allocation.

Strategic benchmarking can be used in business management for competitor analysis, process improvement, financial performance evaluation, and identifying market trends and opportunities. By comparing a business's performance against relevant benchmarks, managers can identify areas for improvement and develop strategies to drive growth and improve performance.

Limitations of using strategic benchmarks include benchmark selection bias, tracking error, inappropriate comparisons, and a focus on short-term performance. These limitations can be overcome by implementing best practices such as regular benchmark review and updates, incorporating multiple benchmarks, aligning benchmarks with stakeholder expectations, and balancing benchmarking with innovation.

Wealth management professionals can provide expert guidance on selecting and implementing appropriate benchmarks, offering tailored investment advice and business management strategies to help investors and managers achieve their long-term objectives. Seeking professional wealth management services can help investors and business managers make the most of strategic benchmarks and drive performance improvements.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.