Market-timing strategies are a crucial aspect of investing and trading, aimed at capitalizing on market opportunities by predicting price movements. These strategies seek to optimize returns and minimize risks by determining when to enter or exit an investment position. Fundamental analysis-based strategies rely on economic indicators such as GDP growth, inflation, and interest rates to assess the overall health of the economy and forecast market trends. Investors use this information to time their investments in specific sectors or assets. Investors and traders analyze companies' earnings reports and financial statements to gauge their performance and future prospects. This information helps them identify undervalued or overvalued stocks and make informed decisions on when to buy or sell. Monitoring industry trends and developments can provide valuable insights into market direction. Investors can capitalize on emerging trends and time their investments accordingly to benefit from potential growth opportunities. Technical analysts use moving averages to identify trends and potential entry and exit points. This strategy involves calculating the average price of an asset over a specific period to smooth out short-term fluctuations and highlight the underlying trend. Support and resistance levels are price points at which an asset's price tends to reverse or consolidate. Traders use these levels to predict potential price movements and time their trades accordingly. Chart patterns and trendlines help traders identify potential price breakouts, reversals, or continuation patterns. By recognizing these patterns, traders can make informed decisions on when to enter or exit a position. Oscillators and momentum indicators, such as the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD), help traders identify overbought or oversold conditions in the market. These indicators can signal potential reversals or trend continuation, enabling traders to time their trades accordingly. Investor sentiment surveys measure the overall mood of the market, providing insights into potential market trends. Sentiment analysis-based strategies can help investors capitalize on shifts in market sentiment to time their investments effectively. Analyzing news and social media sentiment can help traders gauge market sentiment and identify potential market-moving events. This information can assist in making informed decisions on when to enter or exit a position. Contrarian strategies involve taking positions that go against the prevailing market sentiment. This approach can be profitable if executed correctly, as markets can sometimes overreact to news or trends, creating opportunities for contrarian investors. Before implementing market-timing strategies, investors should set clear objectives and determine their risk tolerance to make informed decisions on which strategies to use. Selecting the most suitable market-timing strategies and techniques involves considering factors such as investment horizon, risk tolerance, and market expertise. Defining clear entry and exit points is essential for successful market-timing strategies, as it helps minimize the impact of emotional decision-making. Backtesting involves applying market-timing strategies to historical market data to assess their performance. This process can help identify potential weaknesses and areas for improvement. Incorporating market-timing strategies alongside other investment approaches, such as long-term value investing or passive index investing, can provide diversification benefits and improve overall portfolio performance. Investors can leverage various technology tools and platforms to assist in market-timing decision-making, including charting software, trading algorithms, and market news alerts. Market-timing strategies can lead to higher returns by capitalizing on short-term market fluctuations and trends. By identifying potential market reversals or downturns, market-timing strategies can help investors manage risk and protect their capital. Market-timing strategies enable investors to adapt their investment approach based on changing market conditions, increasing their chances of success. Incorporating market-timing strategies alongside other investment approaches can provide diversification benefits and enhance overall portfolio performance. Predicting market movements accurately and consistently can be challenging, even for experienced investors. Frequent trading associated with market-timing strategies can result in higher trading costs, such as commissions and fees, as well as increased tax liabilities due to short-term capital gains. Market-timing strategies may lead to emotional decision-making, as investors may be tempted to make impulsive trades based on short-term market fluctuations. Market-timing strategies can underperform long-term investing strategies, as attempting to time the market consistently can prove difficult, leading to missed opportunities. Market-timing strategies are diverse approaches that involve fundamental analysis, technical analysis, and sentiment analysis to predict market movements and optimize investment decisions. While these strategies can potentially yield higher returns and help manage risks, they also come with challenges such as accurate prediction difficulties, higher trading costs, emotional decision-making, and potential underperformance. Effective implementation involves developing a clear plan, backtesting, combining market-timing strategies with other investment approaches, and leveraging technology.Market-Timing Strategies Overview

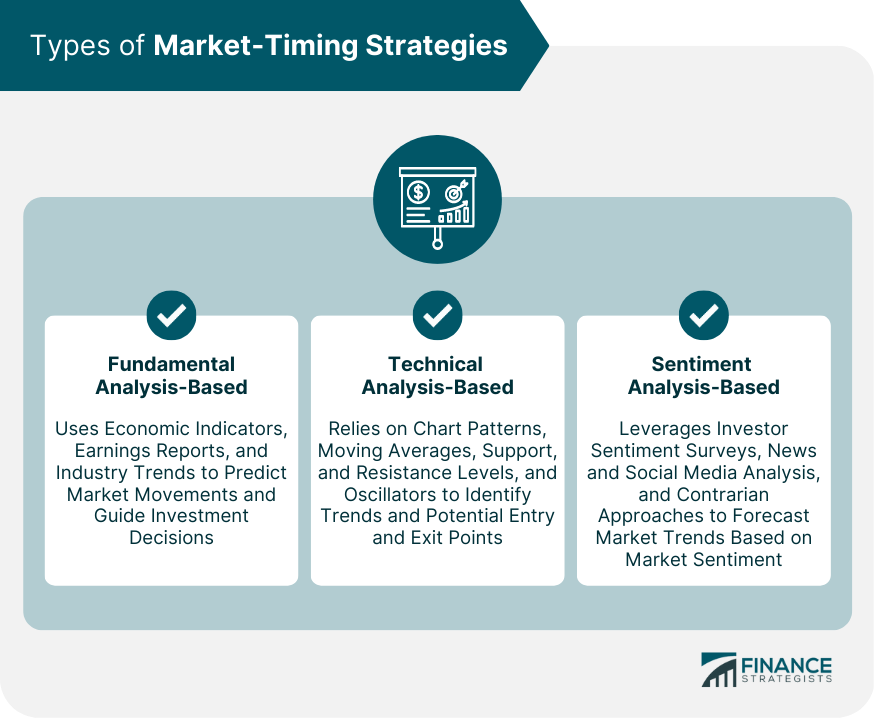

Types of Market-Timing Strategies

Fundamental Analysis-Based Strategies

Economic Indicators

Earnings Reports and Financial Statements

Industry Trends and Developments

Technical Analysis-Based Strategies

Moving Averages

Support and Resistance Levels

Chart Patterns and Trendlines

Oscillators and Momentum Indicators

Sentiment Analysis-Based Strategies

Investor Sentiment Surveys

News and Social Media Analysis

Contrarian Approaches

Implementing Market-Timing Strategies

Developing a Market-Timing Plan

Setting Objectives and Risk Tolerance

Choosing Appropriate Strategies and Techniques

Establishing Entry and Exit Points

Backtesting and Evaluation of Market-Timing Strategies

Combining Market-Timing Strategies With Other Investment Approaches

Using Technology and Tools to Assist in Market-Timing Decision-Making

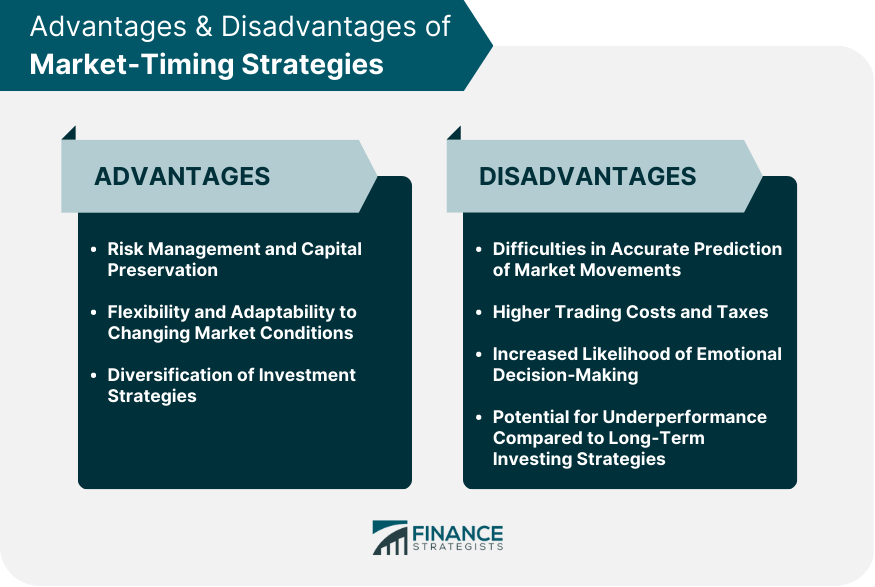

Advantages of Market-Timing Strategies

Potential for Higher Returns

Risk Management and Capital Preservation

Flexibility and Adaptability to Changing Market Conditions

Diversification of Investment Strategies

Disadvantages of Market-Timing Strategies

Difficulties in Accurate Prediction of Market Movements

Higher Trading Costs and Taxes

Increased Likelihood of Emotional Decision-Making

Potential for Underperformance Compared to Long-Term Investing Strategies

Final Thoughts

Market-Timing Strategies FAQs

The main types of market-timing strategies include fundamental analysis-based strategies, technical analysis-based strategies, and sentiment analysis-based strategies. Each type uses different methods to predict market movements and time investment decisions accordingly.

Market-timing strategies have the potential to improve investment returns by capitalizing on short-term market fluctuations and trends. However, accurately predicting market movements consistently can be challenging, and some investors may find that long-term investing strategies provide better results.

Common challenges associated with market-timing strategies include difficulties in accurately predicting market movements, higher trading costs, and taxes, increased likelihood of emotional decision-making, and potential underperformance compared to long-term investing strategies.

To effectively implement market-timing strategies, investors should develop a clear plan that includes setting objectives, determining risk tolerance, choosing appropriate strategies and techniques, and establishing entry and exit points. Additionally, investors can benefit from backtesting and evaluating their strategies, combining market-timing strategies with other investment approaches, and using technology and tools to assist in decision-making.

Some disadvantages of using market-timing strategies include difficulties in accurately predicting market movements, higher trading costs, and taxes, increased likelihood of emotional decision-making, and potential underperformance compared to long-term investing strategies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.