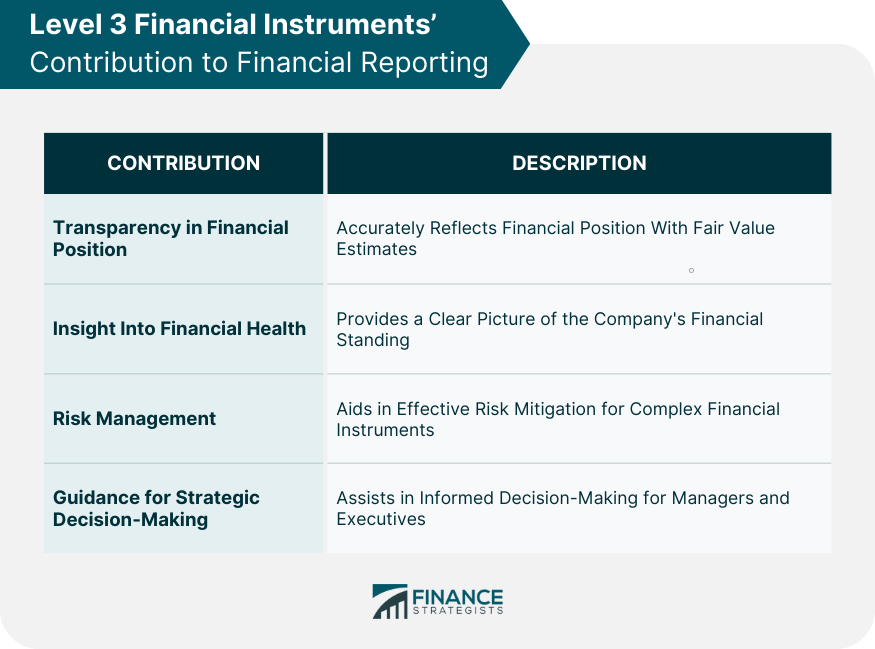

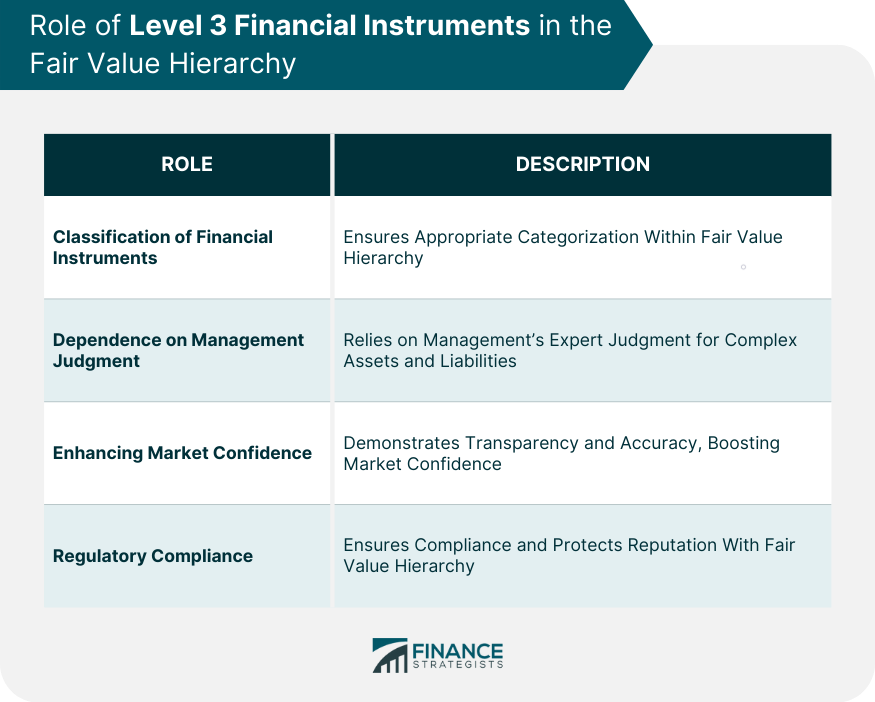

Level 3 financial instruments are an integral part of the financial markets. Named so because of their position in the fair value hierarchy, these instruments represent the most complex and difficult-to-value assets and liabilities that companies may hold on their balance sheets. Level 3 items have no observable market prices and cannot be accurately measured using data from current market transactions. Instead, their values are derived from sophisticated mathematical models and significant unobservable inputs, contributing to their complexity. One prominent example of Level 3 financial instruments is collateralized debt obligations (CDOs). CDOs are a type of structured asset-backed security whose value is derived from a portfolio of fixed-income assets. Another example includes complex derivative contracts such as credit default swaps. These instruments are often designed for specific client needs and need a broad market, making their valuation simple. Level 3 assets are typically investments that are held by firms such as hedge funds, mutual funds, and insurance companies. These assets are often highly illiquid, meaning they can only be easily sold or exchanged for cash with a substantial loss in value. Examples include private equity investments, real estate investments held for growth, and certain types of derivatives. On the other side of the balance sheet, Level 3 liabilities represent obligations where the fair value is not directly observable. An example could be a bespoke derivative contract where the payout depends on complex conditions, and there's no active market to help assess its worth. While Level 3 assets and liabilities are both characterized by their lack of observable market prices, they represent different sides of the balance sheet. Assets represent ownership that can be turned into cash, while liabilities represent obligations that must be paid. However, both require unobservable inputs to determine their fair value, and both can significantly impact a company’s financial status and risk profile. The significance of Level 3 accounting stretches across different facets of financial management, with its primary importance being its contribution to financial reporting and its integral role in the fair value hierarchy. These two broad aspects can be further elaborated as follows: 1. Transparency in Financial Position: Level 3 accounting plays a crucial role in accurately reflecting a firm's financial position. Estimating the fair value of complex assets and liabilities, it provides a comprehensive view of the organization's financial status, thereby enhancing transparency. 2. Insight Into Financial Health: Investors and stakeholders heavily rely on financial reports to gauge the health and stability of a company. Level 3 accounting facilitates this by reporting the value of complex, illiquid assets and liabilities, providing a clear picture of the company's financial standing. 3. Risk Management: The risk associated with Level 3 financial instruments can be substantial due to their complexity. By showcasing these risks in financial reports, Level 3 accounting helps implement risk mitigation strategies, thereby aiding in effective risk management. 4. Guidance for Strategic Decision-Making: The information provided by Level 3 accounting helps in strategic decision-making. Understanding the true value of Level 3 assets and liabilities can guide managers and executives in making informed decisions regarding investments, asset management, and other critical areas. 1. Classification of Financial Instruments: The fair value hierarchy classifies financial instruments based on the reliability and objectivity of the inputs used to value them. As the most complex tier in this hierarchy, Level 3 is integral to this classification process, ensuring that assets and liabilities are appropriately categorized. 2. Dependence on Management Judgment: Level 3 assets and liabilities rely heavily on management's judgment and estimation due to their complex nature and the lack of observable market prices. This allows for a considerable degree of flexibility and discretion but also necessitates a high level of expertise and careful judgment. 3. Enhancing Market Confidence: The rigorous process of classifying assets and liabilities within the fair value hierarchy can enhance market confidence by demonstrating a firm's commitment to transparency and accuracy in its financial reporting. 4. Regulatory Compliance: Following the fair value hierarchy and appropriately classifying Level 3 assets and liabilities helps companies comply with regulatory requirements, which can prevent penalties and enhance their reputation in the market. Since Level 3 assets and liabilities lack observable market prices, they must be valued using complex mathematical models. These models often use assumptions about future cash flows, discount rates, and other unobservable inputs. Some common valuation techniques include the Black-Scholes model for options pricing, Monte Carlo simulations, and discounted cash flow analysis. The valuation of Level 3 financial instruments presents numerous challenges. The main one is the significant amount of unobservable inputs required. This means that the value of these instruments can be heavily influenced by the assumptions made, potentially leading to substantial inaccuracies. Furthermore, these valuations need more transparency, making it easier for investors and regulators to understand or validate them fully. Level 3 assets and liabilities can have a significant impact on the risk profile of a portfolio. Due these instruments can introduce considerable uncertainty and potential volatility due to their complexity and lack of liquidity. Therefore, understanding the nature and extent of Level 3 exposures is critical for risk assessment. In portfolio management, including Level 3 instruments can be a double-edged sword. On the one hand, these instruments provide the potential for high returns and diversification. On the other hand, their inherent complexity and valuation challenges can amplify risks. Portfolio managers must carefully weigh these considerations when making investment decisions involving Level 3 assets and liabilities. Regulatory bodies like the U.S. Securities and Exchange Commission (SEC) and the Financial Accounting Standards Board (FASB) require companies to disclose information about their Level 3 assets and liabilities. These disclosures must include information about the fair value measurements and about the valuation techniques and inputs used. This is intended to provide greater transparency and allow stakeholders to better understand the risks involved. Accurate and comprehensive reporting of Level 3 items can significantly impact investor confidence. By providing more information about these complex instruments, companies can demonstrate their ability to manage and control the associated risks, enhancing investor trust and confidence. Conversely, inadequate or opaque reporting can raise doubts about a company's risk management practices and harm investor confidence. Given the subjective nature of Level 3 valuations, there is a potential for manipulation. Some critics argue that companies might use the latitude provided by Level 3 rules to "massage" their financial results by making overly optimistic assumptions or by shifting items between Level 2 and Level 3. Level 3 instruments were at the heart of the 2008 financial crisis. Instruments such as mortgage-backed securities and collateralized debt obligations, initially classified as Level 1 or 2 due to their seemingly reliable valuations, were reclassified as Level 3 as market liquidity dried up. This event exposed the vulnerabilities and risks associated with these complex financial instruments and led to calls for improved regulation and transparency. Level 3 financial instruments represent a company's portfolio's most complex assets and liabilities. These are instruments for which no observable market prices exist, and thus their valuation relies on unobservable inputs and management's judgment. While Level 3 instruments can offer high returns, they also present considerable risks due to their complexity, lack of liquidity, and valuation challenges. Their reporting and disclosure are crucial for maintaining investor confidence, and their proper handling requires robust risk management practices. Financial instruments continue to evolve, becoming more complex as financial innovation advances. As this happens, the importance of understanding and managing Level 3 instruments will likely increase. In response to the challenges and controversies surrounding Level 3 instruments, regulatory bodies may introduce new rules and guidelines to enhance the transparency and reliability of Level 3 valuations and disclosures. Financial professionals need to stay updated on these regulatory changes. For individual investors, it is vital to understand the risks and potential returns of Level 3 assets when making investment decisions. Seeking advice from wealth management professionals can be beneficial in navigating this complex financial landscape.What Are Level 3 Financial Instruments?

Level 3 Assets and Liabilities

Explanation of Level 3 Assets

Explanation of Level 3 Liabilities

Differences and Similarities Between the Two

Importance of Level 3 Accounting

How it Contributes to Financial Reporting

Role in the Fair Value Hierarchy

Valuation of Level 3 Assets and Liabilities

Valuation Techniques Used

Challenges in Valuing Level 3 Financial Instruments

Role of Level 3 in Investment Decisions

Impact on Risk Assessment

Relevance to Portfolio Management

Level 3 Reporting and Disclosure Requirements

Regulatory Requirements

Impact on Investor Confidence

Controversies and Issues Surrounding Level 3

Potential for Manipulation

The 2008 Financial Crisis and Level 3 Instruments

Conclusion

Level 3 FAQs

Level 3 financial instruments are complex assets and liabilities that are not valued based on observable market prices. Their valuation is based on unobservable inputs and mathematical models.

Level 3 assets and liabilities are important because they can significantly impact a company's financial status and risk profile. They also represent potential sources of high returns, although they come with considerable risks due to their complexity and lack of liquidity.

The valuation of Level 3 instruments presents numerous challenges due to the need for observable market prices. Their value is heavily influenced by the assumptions made in mathematical models, which can lead to substantial inaccuracies. Their valuations also need more transparency, making it hard for investors and regulators to validate them.

Level 3 instruments can have a significant impact on investment decisions. They can offer high returns and diversification opportunities, but their inherent complexity, lack of liquidity, and valuation challenges can also amplify risks. Therefore, understanding these instruments is crucial for risk assessment and portfolio management.

Level 3 instruments, particularly mortgage-backed securities and collateralized debt obligations, played a significant role in the 2008 financial crisis. As the market liquidity dried up, these instruments, which were initially thought to have reliable valuations, were reclassified as Level 3. This event exposed the vulnerabilities and risks associated with these complex financial instruments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.