Fund Flow refers to the net volume of money (capital) being transferred into or out of a specific financial product, such as a mutual fund, exchange-traded fund (ETF), or a stock, over a particular period. It is calculated by subtracting the total amount of money leaving the fund (outflows) from the total amount of money entering the fund (inflows). The concept of fund flow is significant in the financial sector as it helps to evaluate investor sentiment, the popularity of an investment vehicle, and the general trends in the market. Understanding fund flow is essential for several reasons: It provides insights into the popularity and performance of an investment vehicle. Fund flow can serve as an indicator of market sentiment and investor confidence. Analyzing fund flow helps identify trends and patterns that can inform investment decisions. It can also be used to assess the liquidity and stability of a financial instrument. Fund flow consists of two primary components: inflows and outflows. Inflows refer to the capital that investors contribute to a financial instrument or asset. This includes investments made by individuals, institutions, or other entities. On the other hand, outflows represent the capital that investors withdraw from a financial instrument or asset, which could be in the form of redemptions or disinvestments. Understanding these components is crucial in analyzing the movement of funds within the financial system and assessing investor behavior and sentiment toward specific investments. By monitoring and evaluating the inflows and outflows, market participants can gain insights into market trends, investor preferences, and potential shifts in investment strategies. Fund flow can be classified into two categories: positive fund flow and negative fund flow. Positive fund flow occurs when the inflows of capital to a financial instrument exceed the outflows. This typically indicates strong investor interest, confidence, and demand for the investment vehicle. Negative fund flow occurs when the outflows of capital from a financial instrument surpass the inflows. This generally suggests that investors are losing confidence in the asset and are reallocating their capital to other investment opportunities. Fund flow is a dynamic process that is influenced by various factors, such as investor sentiment, market conditions, and the performance of the underlying assets. The process begins with investors contributing or withdrawing capital from an investment vehicle. The net result of these inflows and outflows determines the fund flow for a specific period. Investors play a critical role in determining fund flow. Their decisions to invest or divest from a financial instrument are often based on factors such as their risk appetite, investment goals, and perception of the asset's performance. These decisions can have a significant impact on the overall fund flow and, consequently, the attractiveness and stability of the investment vehicle. Market conditions also have a substantial influence on fund flow. Factors such as economic growth, interest rates, inflation, and geopolitical events can shape investor sentiment and subsequently affect fund flow. For example, during periods of economic expansion and low-interest rates, investors may be more inclined to invest in riskier assets, resulting in positive fund flow. Conversely, during periods of economic contraction or high interest rates, investors may opt for safer investment options, leading to negative fund flow. A fund flow statement is a financial report that summarizes the sources and uses of funds for a specific period. It provides a comprehensive overview of an organization's financial activities, helping investors, analysts, and management evaluate its financial health, liquidity, and solvency. A fund flow statement is often used in conjunction with other financial statements, such as the balance sheet and income statement, to provide a holistic view of a company's financial performance. A fund flow statement is divided into two main sections: sources of funds and application of funds. Sources of funds represent the inflows of capital from various activities, such as: Operations: Profits generated from the company's core business activities. Financing: Capital raised through issuing debt, equity, or other financial instruments. Investing: Income or gains from the sale of assets, investments, or subsidiaries. Application of funds refers to the outflows of capital for various activities, such as: Operations: Expenses incurred in the course of the company's business activities. Financing: Repayment of debt, dividends to shareholders, or repurchase of equity. Investing: Expenditure on acquiring assets, investments, or subsidiaries. The preparation of a fund flow statement involves the following steps: Identification of changes in the working capital from the balance sheet. Classification of these changes into operating, investing, and financing activities. Preparation of the fund flow statement summarizing these activities. Consider a hypothetical company, ABC Corp, which reported a net increase in working capital of $200,000 in the financial year. This increase could be a result of several activities, such as a $300,000 profit from operations, a $50,000 capital injection, and a $150,000 inflow from the sale of an asset. Conversely, the company may have applied $200,000 towards debt repayment, $50,000 towards dividend payments, and $100,000 for a new asset purchase. By summarizing these activities in a fund flow statement, stakeholders can gain insights into the company's financial health and its management of funds. There are several metrics and ratios used to analyze fund flow data, such as: Net Fund Flow: This is the difference between the total inflows and outflows of a fund over a specific period. It is a crucial indicator of the fund's popularity and investor sentiment. Fund Flow Ratio: This ratio compares the net fund flow to the total Assets Under Management (AUM). It can provide insights into the relative significance of the fund flow. Fund Flow Volatility: This measures the variability of the fund flow over time. High volatility may indicate uncertainty or risk associated with the fund. Fund flow trends can provide valuable insights into market sentiment and investment patterns. For example, sustained positive fund flow towards a particular sector may indicate strong investor confidence and growing demand. Conversely, persistent negative fund flow from a sector could suggest weakening investor sentiment or a potential downturn. While fund flow and cash flow both provide insights into the inflows and outflows of capital, they serve different purposes and are used in different contexts. Fund flow primarily relates to investment vehicles and is used to gauge investor sentiment and market trends. On the other hand, cash flow refers to the inflows and outflows of cash in a business and is used to assess its financial health, liquidity, and operational efficiency. Despite these differences, both fund flow and cash flow can provide valuable insights into the financial health and performance of an investment or a business. They both can indicate the efficiency of capital management and the potential for growth or decline. Fund flow analysis is typically used when evaluating investment vehicles like mutual funds or ETFs. It can help investors understand market trends, investor sentiment, and the attractiveness of an investment. Cash flow analysis, in contrast, is used in corporate finance to assess a company's financial health, liquidity, and operational efficiency. It helps investors, creditors, and other stakeholders understand how a business generates cash, how it uses this cash, and its ability to meet its financial obligations and fund its future growth. Fund flow can significantly impact mutual fund performance. Positive fund flow, driven by new investor capital, can provide fund managers with more assets to invest, potentially leading to higher returns. However, it also increases the fund's size, which may make it more challenging to manage efficiently. Conversely, sustained negative fund flow can force fund managers to liquidate positions to meet redemption requests, potentially leading to suboptimal investment decisions and negatively impacting performance. It can also cause a decline in the fund's assets, affecting its operational efficiency and ability to diversify risk. Investors often consider fund flow as part of their mutual fund evaluation process. Consistently positive fund flow can indicate strong performance, good fund management, and investor confidence, all of which are attractive attributes for potential investors. However, investors should also consider other factors, such as the fund's investment strategy, risk profile, and expense ratio, as fund flow alone does not provide a complete picture of a mutual fund's potential for success. Fund flow can have a significant impact on stock prices. When there is a positive fund flow into equities, it can drive up stock prices due to increased demand. Conversely, a negative fund flow out of equities can exert downward pressure on stock prices due to increased supply. Fund flow also affect market liquidity. A market with positive fund flow is likely to have high liquidity, as the inflow of funds increases the volume of trading activity. This can make it easier for investors to buy or sell securities without significantly affecting their prices. On the other hand, a market experiencing negative fund flow may face liquidity issues, as the outflow of funds can reduce trading activity and make it more difficult for investors to execute trades without impacting prices. International fund flow refers to the movement of capital across national borders, influenced by factors such as interest rates, economic growth, political stability, and market opportunities. For instance, capital tends to flow from countries with low-interest rates to those with high-interest rates and from economies experiencing slow growth to those with robust growth. These international fund flows can have significant implications. They can drive economic growth and development, influence exchange rates, and affect the stability of financial markets. However, they can also create risks, such as asset bubbles, financial crises, and economic imbalances. Given these potential risks, international fund flow is subject to regulation. Regulatory bodies and central banks implement measures like capital controls, prudential regulation, and macroprudential policies to manage the risks associated with international fund flows. These measures aim to maintain financial stability, prevent economic crises, and ensure the smooth functioning of global financial markets. Fund flow is a vital concept in finance that encapsulates the net movement of capital in and out of various investment vehicles, such as mutual funds, ETFs, or stocks. It is essential to comprehend the two types of fund flow, positive and negative, to make informed investment decisions. Positive fund flow signifies a higher inflow of capital than outflow, often indicating strong investor confidence and demand. In contrast, negative fund flow denotes that outflows surpass inflows, reflecting diminishing investor interest in a specific investment. Understanding how fund flow works are crucial for grasping market sentiment and evaluating the performance and attractiveness of an investment opportunity. Fund flow is influenced by investor decisions, market conditions, and the performance of underlying assets. By continually monitoring fund flow, investors can identify emerging trends and make strategic adjustments to their portfolios, optimizing returns and minimizing risks in the ever-changing financial landscape.What Is Fund Flow?

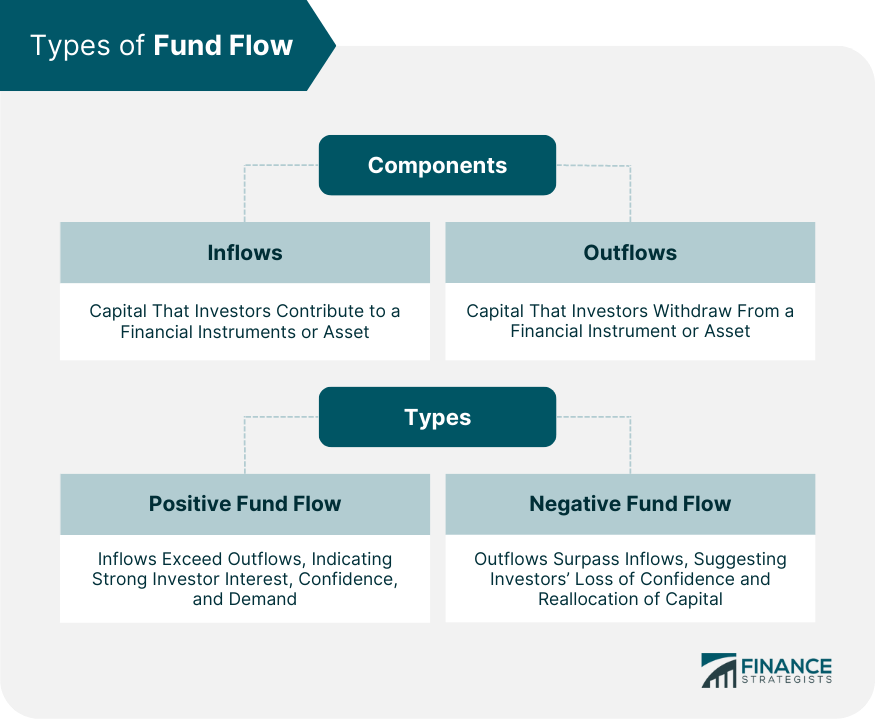

Components of Fund Flow

Types of Fund Flow

Positive Fund Flow

Negative Fund Flow

How Fund Flow Works

Overview of the Process

Role of Investors in Fund Flow

Impact of Market Conditions on Fund Flow

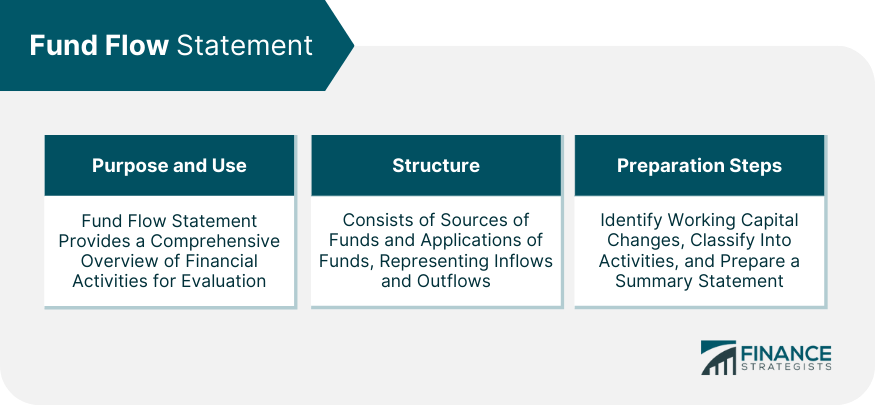

Fund Flow Statement

Purpose and Use of a Fund Flow Statement

Structure of a Fund Flow Statement

Sources of Funds

Application of Funds

Preparation of a Fund Flow Statement

Steps Involved

Practical Examples

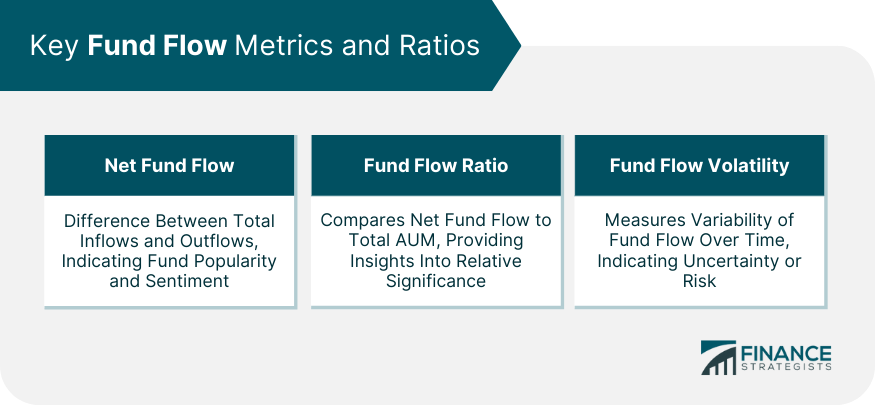

Interpreting Fund Flow Data

Key Fund Flow Metrics and Ratios

Understanding the Implications of Fund Flow Trends

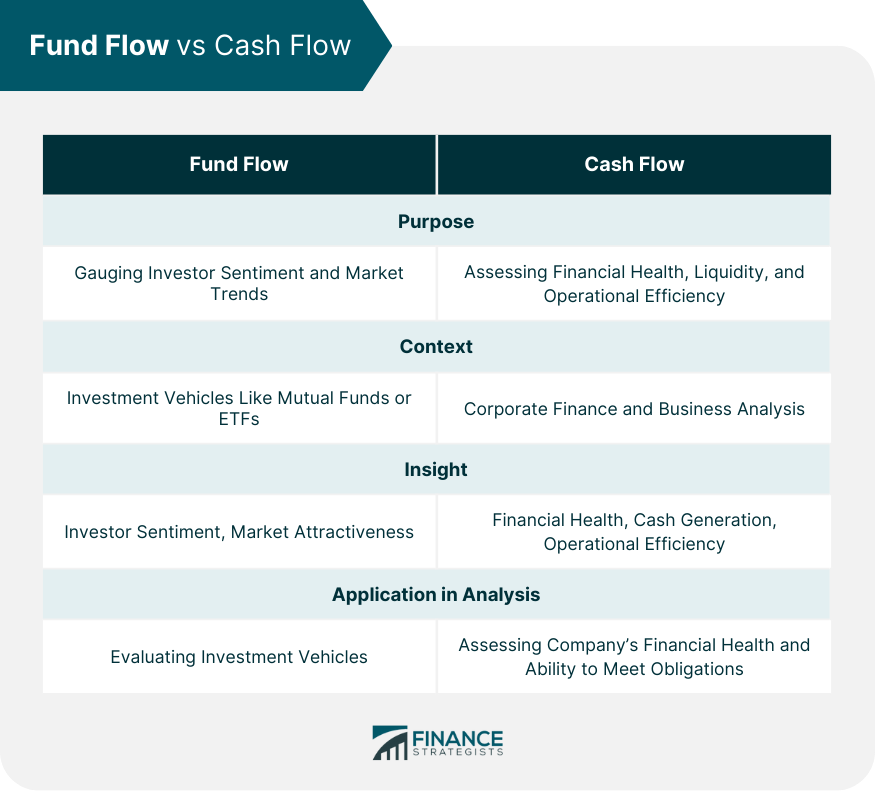

Fund Flow vs Cash Flow

Differences and Similarities

When to Use Each in Financial Analysis

Role of Fund Flow in Mutual Fund Investing

How Fund Flow Impacts Mutual Fund Performance

Evaluating Mutual Funds Based on Fund Flow

Fund Flow and Financial Markets

Effect of Fund Flow on Stock Prices

Fund Flow and Market Liquidity

Fund Flow in the Context of Global Finance

International Fund Flow: Causes and Consequences

Regulation of International Fund Flow

Bottom Line

Fund Flow FAQs

Fund flow refers to the net volume of money entering or exiting a financial product, such as a mutual fund or ETF, over a certain period. It's crucial in financial analysis as it helps gauge investor sentiment, the popularity of an investment, and overall market trends.

Fund flow can be either positive or negative. Positive fund flow occurs when more money is invested into a fund that is withdrawn, indicating strong investor confidence. Negative fund flow, on the other hand, happens when withdrawals exceed new investments, often signaling a lack of investor interest.

Fund flow operates on the principle of capital movement driven by investor decisions and market conditions. It's calculated by subtracting the total outflow of funds from the total inflow. The result helps in understanding the financial health and attractiveness of a particular investment.

While both fund flow and cash flow provide insights into the movement of capital, they serve different purposes. Fund flow relates to investment vehicles and gauges investor sentiment and market trends. Cash flow, on the other hand, refers to the movement of cash in a business, assessing its financial health, liquidity, and operational efficiency.

Fund flow significantly impacts mutual fund performance. A positive fund flow can provide fund managers with more assets to invest, potentially leading to higher returns. However, sustained negative fund flow may force fund managers to liquidate positions to meet redemptions, which could adversely affect performance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.