The Zone of Resistance, in the context of financial markets, is a price area where an upward trend is expected to pause or reverse due to an abundance of supply or selling interest. It's a critical tool in trading strategies, allowing traders to identify potential sell points, manage risk, and anticipate potential market reversals. Traders often adopt selling strategies when prices reach this zone, while breakthroughs of resistance may signal to buy opportunities. However, the concept of the Zone of Resistance is not without its limitations and potential for misinterpretation. A common misconception is that price reversal is guaranteed at resistance zones, which is not always the case. Furthermore, resistance zones should not be used in isolation, but in conjunction with other technical analysis tools and fundamental analysis. Hence, understanding and properly employing the concept of the Zone of Resistance is paramount to successful trading. The Zone of Resistance is pivotal in trading as it aids in identifying potential selling points and market reversals. Traders utilize this concept to manage risk effectively and enhance their trading decisions. An accurate understanding of the Zone of Resistance enables traders to anticipate market behavior, offering valuable insights into when to enter or exit trades. Essentially, its proper application can contribute to more profitable trading strategies, making it a vital tool in the financial trading sphere. The Zone of Resistance is grounded in the fundamental principles of supply and demand. When a price enters a resistance zone, it indicates an abundance of supply or selling interest, which can halt or reverse an upward trend. Resistance zones often form around round numbers, which are psychologically significant. Traders might decide to sell once a price reaches a round number, creating selling pressure that forms a resistance zone. Additionally, if an asset has hit a certain price level several times without breaking through, traders may view that level as a resistance zone. Past performance can influence future trading decisions. If a stock's price has consistently struggled to surpass a certain level, that level could become a resistance zone. This happens because traders who have observed the historical pattern may decide to sell before the price reaches the resistance level, thereby reinforcing the pattern. Zones of resistance may form around price levels where a large volume of an asset has been traded in the past. At these levels, many traders may have bought the asset and would be likely to sell if the price reaches their entry point again, forming a resistance zone. Traders often use moving averages as signals for buying or selling decisions. If an asset's price is approaching a significant moving average from below, that level could become a resistance zone, particularly if the moving average has acted as resistance before. The Fibonacci sequence is a series of numbers in which each number is the sum of the two preceding ones. Traders use ratios derived from this sequence to predict resistance (and support) levels. If a price approaches a Fibonacci level from below, that level could act as a resistance zone. Major news events or changes in market conditions can create new resistance zones. For example, if a company reports worse-than-expected earnings, its stock price might fall and struggle to rise above the pre-announcement level. The pre-announcement level could then become a resistance zone. Market psychology plays a critical role in the formation of resistance zones. When a price reaches these levels, the collective sentiment of the market participants may turn bearish, contributing to the selling pressure. A variety of charting techniques can help identify a Zone of Resistance. These include trend lines, horizontal lines at previous highs, and candlestick patterns such as shooting stars or bearish engulfing patterns. Tools such as trend lines, moving averages, and Fibonacci retracement levels can help traders identify potential resistance zones. Additionally, technical indicators like the Relative Strength Index (RSI) and Bollinger Bands can also provide clues to potential resistance levels. While a single resistance level is a specific price at which selling is expected to increase, a Zone of Resistance represents a range of prices where increased selling pressure is anticipated. When a price reaches a Zone of Resistance, it often results in a pause or reversal of the upward trend due to increased selling pressure. This can lead to a pullback or even a trend reversal. Understanding Zones of Resistance can provide insights into the underlying strength of market trends. If a price repeatedly fails to break through a resistance zone, it may indicate a weakening upward trend. The strength of a resistance zone can be evaluated based on its historical significance, the volume of trading at these levels, and the behavior of technical indicators. The stronger the resistance zone, the more significant the potential reversal. Traders often look to sell or short sell when a price reaches a resistance zone. Conversely, if a price breaks through a resistance zone with high volume, it can signal a buying opportunity as it may indicate the beginning of a new upward trend. Proper risk management is crucial when trading around resistance zones. Traders may set stop-loss orders just above the resistance zone to limit potential losses if the price breaks through the resistance and continues to rise. A common strategy is to exit long positions or enter short positions as the price enters a resistance zone. By identifying the resistance zone in advance, traders can plan their entries and exit to optimize potential profits and minimize risk. The concept of resistance zones applies in all market conditions, including bull markets, bear markets, and sideways markets. Understanding how resistance zones work in different market conditions can help traders adapt their strategies accordingly. With the advent of algorithmic trading, resistance zones have become even more critical. Many trading algorithms are programmed to identify these zones and execute trades based on them, making understanding these zones essential for modern traders. Resistance zones often work in conjunction with other technical indicators. For example, an overbought reading on the RSI combined with a price entering a resistance zone could signal a potential selling opportunity. While resistance zones are useful tools, they should not be used in isolation. Other factors, such as overall market conditions and fundamental analysis, should also be considered. One common misconception is that a price will always reverse at a resistance zone. While resistance zones do indicate potential reversal areas, they are not a guarantee, and prices can sometimes break through these zones. To overcome these limitations, traders should use resistance zones in conjunction with other technical analysis tools and fundamental analysis. They should also employ proper risk management techniques to protect against potential losses. The Zone of Resistance, a fundamental aspect of technical analysis, is a price area where the upward trend may halt or reverse due to amplified selling interest. Effective trading strategies often incorporate this concept, identifying potential sell points, managing risk, and predicting market reversals. However, while resistance zones provide crucial insights, they should not be used in isolation. Misinterpretations, such as assuming that prices will always reverse at these zones, can lead to costly errors. It's essential to supplement them with other technical analysis tools and fundamental market understanding. Also, a comprehensive risk management strategy is paramount to safeguard against possible losses. What Is the Zone of Resistance?

Importance of the Zone of Resistance in Trading

Understanding the Concept of the Zone of Resistance

Theoretical Framework for the Zone of Resistance

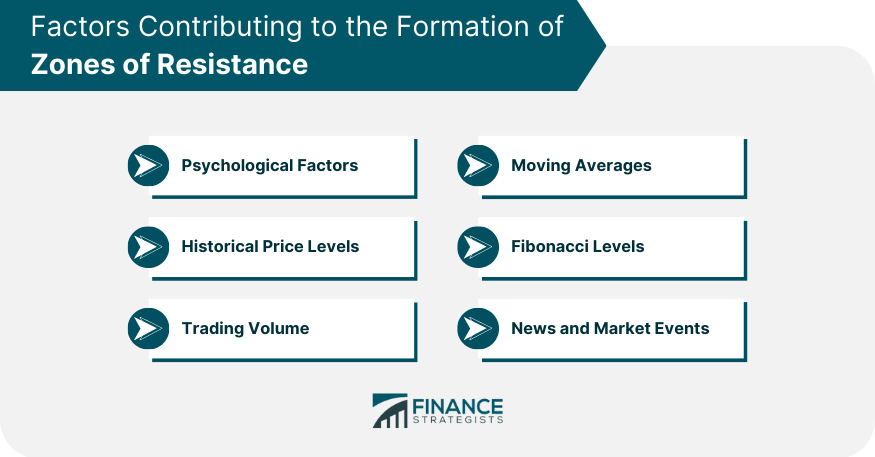

Factors Contributing to the Formation of Zones of Resistance

Psychological Factors

Historical Price Levels

Trading Volume

Moving Averages

Fibonacci Levels

News and Market Events

Role of Market Psychology in Zones of Resistance

Identifying the Zone of Resistance

Charting Techniques for Identifying Zones of Resistance

Tools and Indicators Helpful in Recognizing Zones of Resistance

Difference Between a Zone of Resistance and a Single Resistance Level

Interpreting the Zone of Resistance

Implication of Zones of Resistance on Price Movement

Zone of Resistance and Market Trends

Evaluating the Strength of Zones of Resistance

Trading Strategies Involving Zones of Resistance

Buying and Selling Strategies at Zones of Resistance

Risk Management in Zones of Resistance

Positioning and Exit Points Within Zones of Resistance

Advanced Topics in Zones of Resistance

Zone of Resistance in Different Market Conditions

Zone of Resistance and Algorithmic Trading

Interaction Between Zones of Resistance and Other Technical Indicators

Risk and Misinterpretations of Zones of Resistance

Potential Pitfalls in Utilizing Zones of Resistance

Common Misconceptions About Zones of Resistance

Solutions to Overcome These Limitations

Conclusion

Zone of Resistance FAQs

The Zone of Resistance is a price area in the financial markets where an upward price trend is likely to pause or reverse due to an increase in supply or selling interest.

The Zone of Resistance is critical for identifying potential sell points, managing risk, and anticipating market reversals. Traders often sell when the price reaches this zone, while a breakthrough may signal a buying opportunity.

A common misconception is that the price will always reverse at a resistance zone. While these zones do indicate potential reversal points, they are not a guarantee, and prices can sometimes break through these zones.

The Zone of Resistance is often identified using various charting techniques such as trend lines, horizontal lines at previous highs, and specific candlestick patterns. Tools like moving averages and Fibonacci retracement levels can also help identify potential resistance zones.

Market psychology plays a crucial role in the formation and strength of resistance zones. When prices reach these zones, market sentiment can shift towards selling, reinforcing the resistance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.