Backtesting refers to the process of testing a predictive model or a trading strategy on relevant historical data to ensure its viability before it is employed in a real-world scenario. Traders and investors use backtesting as a method to simulate their trading strategies on past data to gauge their effectiveness and robustness. Backtesting serves as a significant tool in the financial world, primarily for risk management and strategy formulation. It offers insights into the potential performance of a trading strategy, helping investors anticipate potential losses or gains. Backtesting gives traders confidence in their strategies and can help prevent costly mistakes in live trading. Backtesting in algorithmic trading involves testing trading strategies on historical data, assessing their performance, and making necessary adjustments to maximize profitability and minimize risk. In risk management, backtesting validates risk models by comparing predicted risk measures with actual historical outcomes, ensuring the reliability of these models in predicting potential losses and meeting regulatory capital requirements. Backtesting is applied to options pricing models like the Black-Scholes model, comparing the model's predictions with historical data to evaluate the accuracy and make necessary improvements in derivative instruments pricing. Backtesting in portfolio management involves testing investment strategies on historical data to assess potential returns, risks, and performance, thereby aiding in the identification and elimination of poorly performing strategies. Backtesting is fundamental in Basel regulations, as banks use it to validate their internal risk models, ensuring the accuracy and reliability required for regulatory compliance and capital adequacy. In backtesting, traders create hypothetical scenarios based on historical data and test their trading strategies under these scenarios. The main idea is to understand how a particular strategy would have performed under different market conditions. Historical data plays a crucial role in backtesting. It's used to simulate past market conditions and price movements to test a strategy's effectiveness. However, it's essential to select quality, comprehensive data to achieve meaningful results. Algorithms play a pivotal role in executing backtests, especially for complex strategies involving multiple assets and decision parameters. They enable quick calculations and scenario analysis, turning backtesting into an efficient and streamlined process. Walk forward backtesting is an iterative process where the trading system is optimized over a certain historical period and then tested on the next period. It's designed to simulate the 'real-life' application of the strategy, increasing its predictive performance. Monte Carlo simulation backtesting introduces randomness into the model, allowing a strategy to be tested under various simulated scenarios. It enhances the robustness of the strategy by preparing it for a wider range of possible market conditions. Out-of-sample backtesting involves testing a strategy on a data set that was not used during the strategy development and optimization process. This method provides a realistic performance assessment of a strategy by ensuring it's not merely fitted to the specific characteristics of the in-sample data. The first step involves defining the trading strategy, including identifying the financial instruments to be traded, the conditions for trade entry and exit, and risk management rules. After defining the strategy, it must be translated into a computer code that can execute trades and manage positions. Coding also allows traders to incorporate complex decision rules and automate the backtesting process. Obtaining high-quality, comprehensive historical data is a critical step. This data should cover a range of different market conditions to test the strategy thoroughly. The strategy code is then run against the historical data, and the backtesting software simulates trades based on the strategy rules. It's critical to note that the backtest should account for trading costs, such as slippage and commissions. The final step involves evaluating the backtest results. Traders assess the strategy's profitability, drawdowns, and risk-adjusted returns. They also perform statistical tests to ensure the strategy's performance is statistically significant and not due to luck. Popular backtesting tools include platforms such as TradeStation, MetaTrader, and Quantopian, among others. These platforms offer varying capabilities in terms of asset classes, coding languages supported, and data quality. While backtesting tools can expedite strategy testing, they also have drawbacks. For instance, while some platforms may offer extensive data, they may not support all asset classes or have limitations in coding complexity. Moreover, the quality and extent of data available can significantly impact backtest results. Overfitting refer to a situation where a strategy performs well on the historical data used for backtesting but performs poorly on new, unseen data. This is often the result of over-optimizing the strategy to the specific characteristics of the backtest data. Data snooping bias arises when a strategy is developed or fine-tuned based on the same data set used for backtesting. This can lead to overly optimistic backtest results that don't hold up in real trading. Market conditions can change over time due to macroeconomic factors, policy changes, and shifts in investor sentiment. A strategy that performed well in one market regime may perform poorly in another, creating a significant limitation for backtesting. Under Basel norms, banks are required to backtest their Value-at-Risk (VaR) models to ensure they accurately capture the risks inherent in their trading portfolios. These norms underscore the critical role backtesting plays in maintaining the stability of the financial system. In VaR models, backtesting is used to validate the model's predictions against actual losses. This is a crucial process, as an inadequate VaR model can lead to significant financial losses and regulatory penalties for banks. Multi-asset backtesting involves testing strategies that trade multiple asset classes. It requires sophisticated backtesting software capable of handling data for different types of assets and coding complex decision rules. High-frequency trading (HFT) backtesting presents unique challenges due to the sheer volume of data involved and the need for ultra-low latency. Backtesting tools used for HFT need to be capable of handling tick-level data and simulating orders in microseconds. Machine learning can enhance backtesting by optimizing trading strategies and identifying patterns in historical data that may be difficult to spot manually. However, it also raises concerns about overfitting and data snooping bias. Backtesting is a crucial practice in finance, involving the simulation of a trading strategy or predictive model on historical data to discern its viability. It plays an indispensable role by providing insights into potential strategy performance, offering the ability to predict gains or losses, thereby fostering trader confidence and reducing potential financial missteps. Various types of backtesting, including walk forward, Monte Carlo simulation, and out-of-sample, offer distinctive advantages in assessing strategy effectiveness across diverse market scenarios. The process of backtesting comprises several integral steps, such as defining and coding the strategy, obtaining historical data, running the backtest, and, crucially, evaluating the results. Ultimately, the proper execution of backtesting can lead to well-informed trading decisions, reduced risk, and improved financial outcomes.Definition of Backtesting

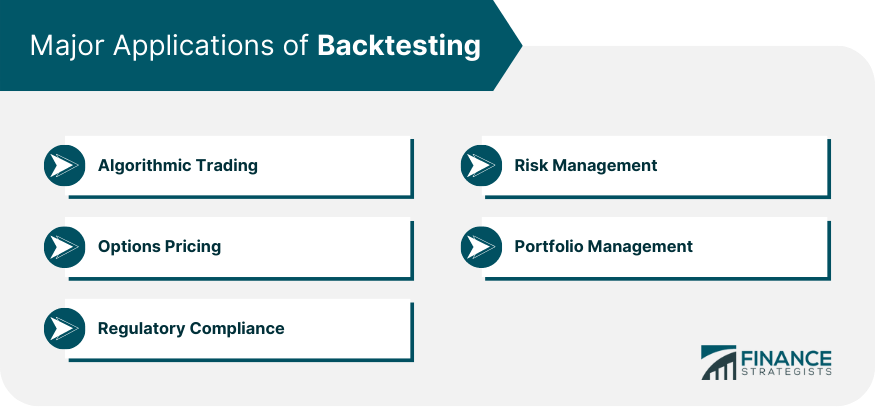

Major Applications of Backtesting

Algorithmic Trading

Risk Management

Options Pricing

Portfolio Management

Regulatory Compliance: Basel Norms

Understanding the Concept of Backtesting

Hypothetical Scenarios

Using Historical Data

Role of Algorithms

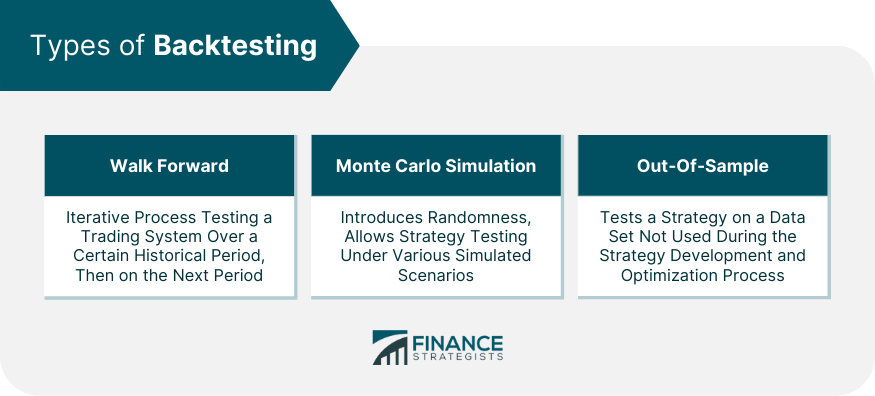

Types of Backtesting

Walk Forward

Monte Carlo Simulation

Out-Of-Sample

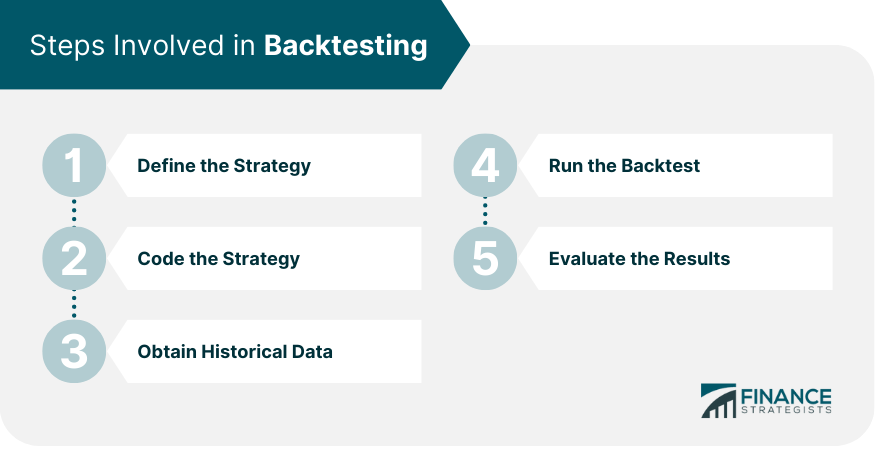

Steps Involved in Backtesting

Defining the Strategy

Coding the Strategy

Obtaining Historical Data

Running the Backtest

Evaluating the Results

Software and Tools for Backtesting

Discussion on Popular Backtesting Tools

Pros and Cons of Using Different Tools

Risks and Limitations of Backtesting

Overfitting

Data Snooping Bias

Market Regime Changes

Backtesting and Regulatory Compliance

Basel Norms and Backtesting

Backtesting in Value-at-Risk Models

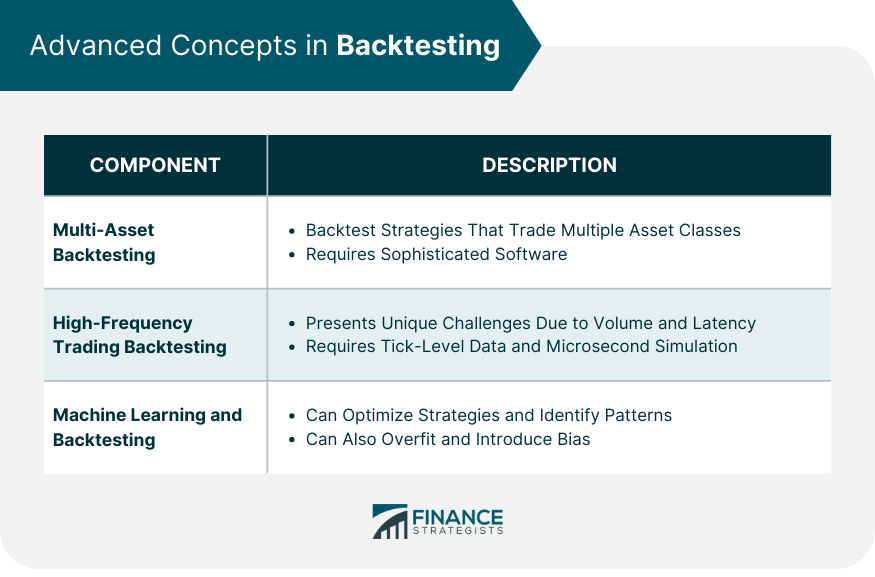

Advanced Concepts in Backtesting

Multi-Asset Backtesting

High-Frequency Trading Backtesting

Machine Learning and Backtesting

Final Thoughts

Backtesting FAQs

Backtesting refers to testing models or strategies on historical data to assess their viability before real-world use.

Backtesting is used in algorithmic trading, risk management, options pricing, portfolio management, and regulatory compliance.

The steps include defining the strategy, coding the strategy, obtaining historical data, running the backtest, and evaluating the results.

Risks include overfitting, data snooping bias, and the impact of market regime changes. Limitations include the need for quality data and the potential for backtest results not to hold up in real trading.

Yes, advanced concepts include multi-asset backtesting, high-frequency trading backtesting, and the integration of machine learning for optimization and pattern identification.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.