Variable costs are those expenses that vary in direct proportion to the volume of goods or services produced or consumed. In simpler terms, they change as the production or consumption volume changes. For instance, in the context of wealth management, if you decide to buy more stocks, the brokerage fees (a type of variable cost) you pay would likely increase proportionally. In the realm of finance and investments, variable costs can manifest in various ways. They can range from transaction fees when purchasing securities to performance fees charged by a hedge fund manager. These costs are of paramount importance to both individual and institutional investors, especially when evaluating the net returns on investments. Variable costs provide investors clarity on net returns after all costs. Small fees can compound, impacting investment yield. Recognizing the difference between fixed and variable costs enhances investment strategy efficiency and supports better decision-making. Whenever securities are bought or sold, transaction fees often come into play. They serve as compensation to the brokerage or platform facilitating the trade. These costs can be fixed, percentage-based, or a combination of both. Although they might seem inconspicuous, over time and with frequent trading, these fees can considerably erode an investor's returns. As a result, being conscious of transaction fees is crucial when selecting a trading platform or brokerage. Brokerage commissions are specific charges levied by broker-dealers for their role in facilitating trades. Typically, these commissions are either a flat fee or a percentage of the transaction value. It's not uncommon to find competitive rates among brokers, given the abundance of online trading platforms. With technology-driven disruptions in the financial sector, many brokerages now offer low or even commission-free trading. However, investors must approach with caution and ensure they aren't compensating through other hidden charges. Some investment vehicles, especially mutual funds, impose fees for short-term trading. This discourages investors from frequently buying and selling shares, which could disrupt the fund's management strategy. These fees are essential to consider, especially for active traders. Being unaware of or ignoring them can turn a seemingly profitable short-term trade into a financial setback. Financial institutions often charge fees for maintaining investment accounts. These charges cover administrative tasks and other associated services. While some institutions waive off these fees above a certain balance or with a specific number of transactions, others might charge them unconditionally. It's crucial for investors to be aware of such costs. Regularly evaluating these charges and comparing them with the services received can guide investors on whether it's worth continuing with their current institution or seeking alternatives. When investing in mutual funds or ETFs, the fund expense ratio is a key variable cost to consider. It encompasses management fees, administrative fees, and other operational costs. Expressed as a percentage, this ratio indicates the portion of the fund's assets used for its operation. An elevated expense ratio doesn't always translate to better fund performance. As such, it's prudent for investors to juxtapose a fund's expense ratio with its performance and other similar funds before making a decision. Financial advisors bring to the table their expertise in investment strategies, tax planning, and wealth management. For their services, they charge fees that could be flat, hourly, or a percentage of the assets under management. Selecting an advisor is not just about fees but also about the value they offer. Still, understanding the fee structure can ensure alignment with the investor's financial goals and preferences. Some advisors or fund managers charge fees based on the performance of the assets they manage. Such a structure aligns the interests of the advisor with those of the investor. If the assets perform well, both parties benefit. However, it's essential to establish clear benchmarks and understand the calculation of these fees. Performance-based fees can sometimes incentivize higher-risk strategies to achieve notable returns. Investors should be clear about their risk tolerance and ensure that the adopted strategies align with their long-term objectives. Fixed costs remain consistent, irrespective of the volume of transactions or assets under management. Examples include annual account maintenance fees or subscription fees for a financial software. Unlike variable costs, they don't fluctuate with the market's ebbs and flows. Their predictability is both a boon and a bane. While they provide clarity for financial planning, they can sometimes weigh down on an investor, especially during periods of low activity or market downturns. Variable costs in wealth management, as previously discussed, are dynamic. They change in relation to the volume of activity or assets. From brokerage commissions to performance fees, they encompass a wide array of charges. Their unpredictable nature makes them a crucial factor in investment decisions. Overlooking or misjudging these costs can significantly skew expected returns and lead to unforeseen financial implications. Grasping the distinctions between fixed and variable costs can profoundly impact investment strategy. While fixed costs might appear as the more burdensome of the two, especially during lean periods, variable costs can quickly accumulate during active trading or market booms. A keen understanding allows investors to plan better, allocate funds efficiently, and potentially mitigate unnecessary costs. It aids in making investment choices that align more closely with one's financial objectives. Being aware of variable costs sharpens decision-making. Investors can better gauge the cost-benefit of each investment or trade, ensuring that returns aren't disproportionately consumed by associated costs. A comprehensive view of these costs can also prevent hasty decisions. By considering all financial implications, investors are less likely to engage in impulsive trading, which often leads to sub-optimal outcomes. Minimizing variable costs has a compounding effect on investment returns. Each dollar saved on costs is a dollar that can be reinvested. Over extended periods, this can lead to substantially higher returns. For long-term investors, this is particularly significant. The seemingly minuscule differences in costs can, over decades, translate to vast disparities in the final wealth accumulated. A thorough understanding of variable costs brings clarity to wealth management strategies. Whether it's deciding between active and passive investment approaches or choosing between different investment vehicles, being aware of costs can steer decisions in a more profitable direction. Moreover, it prevents hidden costs from undermining an otherwise sound investment strategy. By ensuring that every cost is accounted for, investors can be more confident in their financial roadmap. Knowledge is power. Being conversant with variable costs and their implications equips investors to negotiate better with financial advisors and brokers. They can demand more transparency, better rates, and services that offer genuine value. This not only ensures that investors get the best deal but also fosters a more transparent and trustworthy relationship with financial professionals. The financial world is notorious for its myriad of hidden fees. Whether it's buried within the fine print or subtly embedded within a product's structure, these fees can catch investors off-guard. For instance, some funds might have a low management fee but carry high transaction costs, which are passed onto the investor. Such costs, while not explicitly mentioned, can significantly affect returns. Different financial institutions might have varied ways of reporting or disclosing fees. This inconsistency can make it challenging for investors to compare products or services accurately. For instance, while one institution might disclose all fees upfront, another might only reveal the basic charges, leaving out potential additional costs. Such discrepancies can lead to miscalculations and unintended financial implications. Global economic events can indirectly influence variable costs. For example, regulatory changes in one country can affect transaction fees or fund management charges in another. Moreover, geopolitical events or global financial crises can lead to increased volatility, potentially raising the costs associated with certain hedging strategies or investment products. While managing and reducing variable costs is crucial, it shouldn't come at the expense of quality. For instance, opting for the cheapest brokerage might mean sacrificing valuable research tools or customer service. Investors must strike a balance. It's about ensuring that the services or products chosen genuinely align with one's needs and that the costs involved offer genuine value. Passive investing, typically through index funds or ETFs, is often touted for its low costs. As these funds merely aim to replicate the performance of a specific market index, they usually have lower transaction fees and management costs. Active investing, on the other hand, involves attempting to outperform the market, which often requires frequent trading and, consequently, higher costs. While it offers the potential for higher returns, it also carries the risk of underperformance, especially after accounting for higher costs. Index funds and ETFs are staples in the world of passive investing. By design, they have lower expense ratios compared to actively managed funds. The reason being they're not seeking to beat the market but merely mirror its performance. Incorporating these into a portfolio can be a strategic move to access market returns while keeping costs low. It's a straightforward way to diversify investments and reduce the drag of high fees on overall performance. Open communication with financial professionals can lead to better fee structures. By expressing concerns and preferences, investors can sometimes secure more favorable rates or terms. Moreover, with the competitive landscape of financial services, many professionals are willing to adjust their fee structures to retain or acquire clients. However, always ensure that the quality of service remains uncompromised. While not directly a fee or charge, taxes can act as a variable cost on investments, especially when it comes to capital gains. Implementing tax-efficient strategies can reduce tax liability, effectively lowering the cost associated with investments. This might involve strategies like tax-loss harvesting or ensuring that investments are held long enough to qualify for lower long-term capital gains rates. The costs associated with investments, just like the returns, can compound over time. A 1% fee might seem inconsequential in a single year. However, over an extended period, that 1% can eat into potential earnings, especially when the lost potential returns are considered. Understanding this compounding effect is crucial, especially for those in the early stages of wealth accumulation. It underscores the importance of cost management in the grand scheme of financial planning. Variable costs, due to their unpredictable nature, can introduce complexities in long-term financial planning. Predicting returns without considering potential cost fluctuations can lead to inaccurate forecasts. It's essential to account for a range of potential costs when planning. By preparing for different scenarios, investors can ensure more resilient and flexible financial strategies. Cost-reduction doesn't imply compromising on quality or potential returns. It's about optimizing. This might involve leveraging technology to access low-cost trading platforms or diversifying into passive investment vehicles to mitigate high active management fees. Another effective strategy is continuous education. As the financial world evolves, new products, platforms, and strategies emerge. Staying informed allows investors to adapt and ensure that their approach to managing variable costs remains current and efficient. Understanding and managing variable costs is paramount in wealth management and investment decision-making. Variable costs, which vary in direct proportion to the volume of transactions or assets, can manifest as transaction fees, brokerage commissions, maintenance fees, and more. Investors must be vigilant about these costs, as they can compound over time and significantly impact overall returns. Differentiating between fixed and variable costs allows for efficient financial planning, as each has its implications on returns and financial stability. While fixed costs offer predictability, variable costs, due to their dynamic nature, can either weigh down returns during active trading periods or save during passive phases. It's imperative for investors to remain informed, continually assess the cost structures of their investments, and adopt strategies that maximize returns while minimizing unnecessary costs. Ensuring a comprehensive understanding of these costs ensures better alignment with one's financial goals, leading to optimized wealth management strategies.Overview of Variable Cost

Identifying Variable Costs in Investment

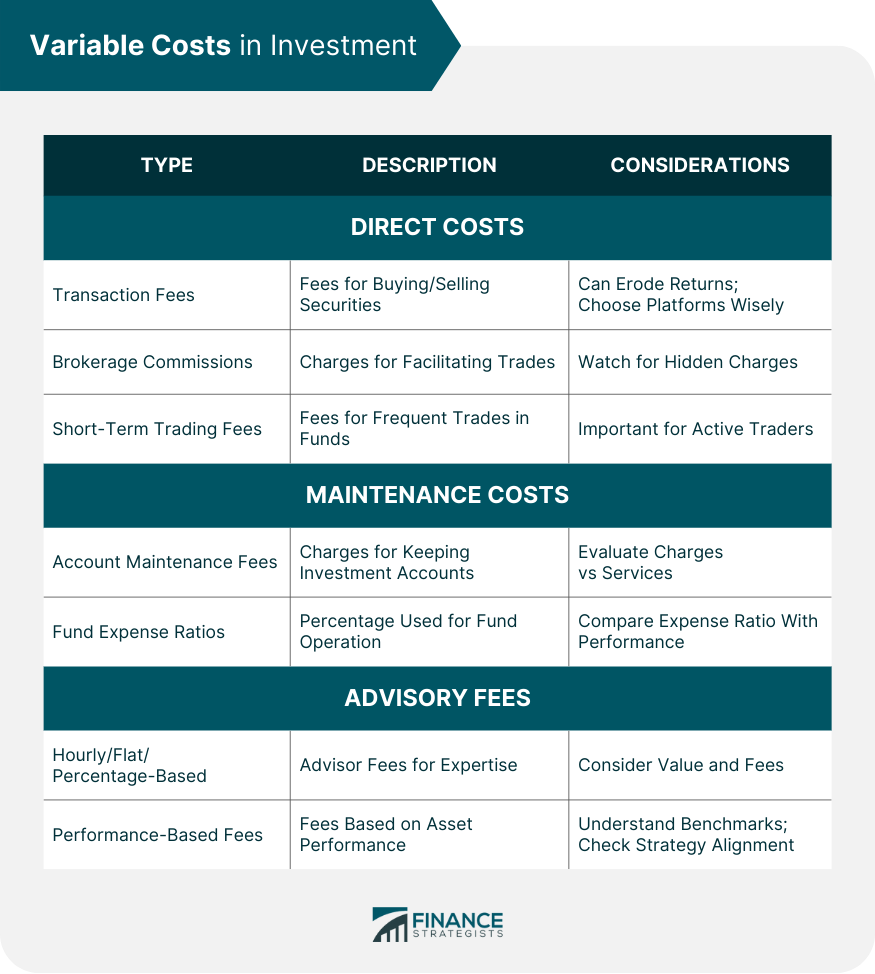

Direct Costs in Investment

Transaction Fees

Brokerage Commissions

Short-Term Trading Fees

Maintenance Costs

Account Maintenance Fees

Fund Expense Ratios

Advisory Fees

Flat, Hourly, or Percentage-Based Charges

Performance-Based Fees

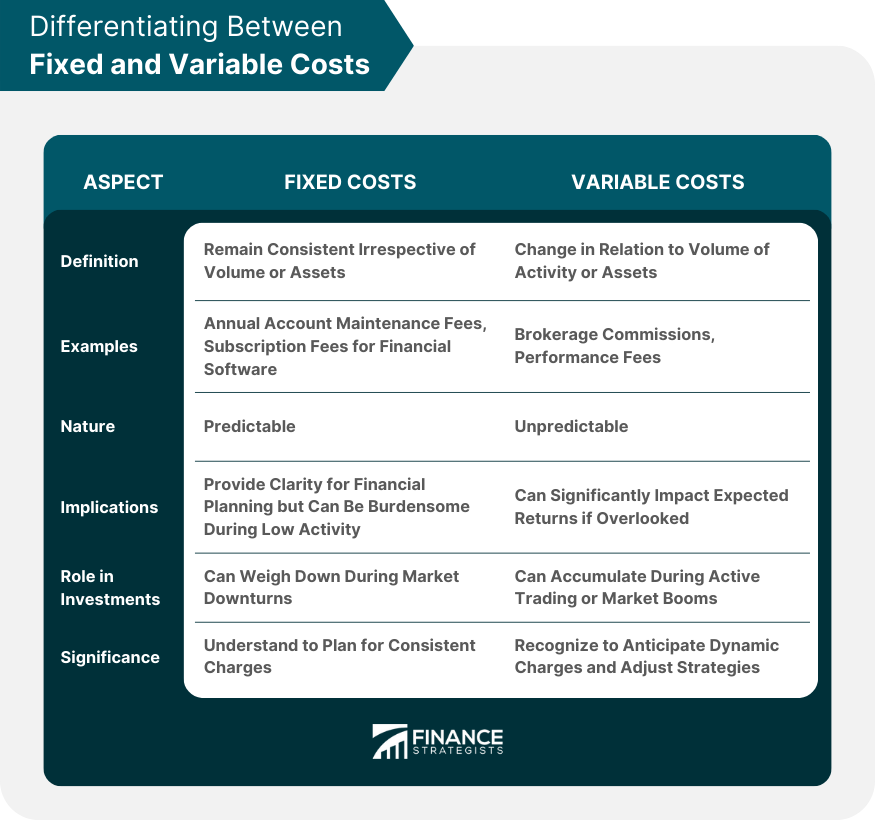

Differentiating Between Fixed and Variable Costs

Characteristics of Fixed Costs

Characteristics of Variable Costs

Importance of Recognizing the Differences

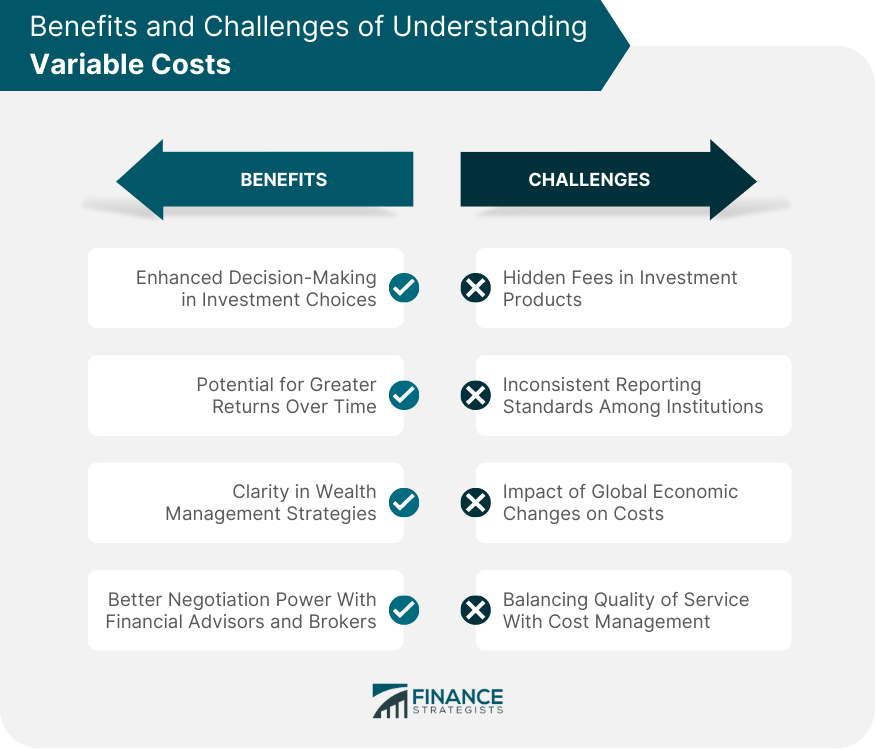

Benefits of Understanding Variable Costs

Enhanced Decision-Making in Investment Choices

Potential for Greater Returns Over Time

Clarity in Wealth Management Strategies

Better Negotiation Power With Financial Advisors and Brokers

Challenges in Identifying and Managing Variable Costs

Hidden Fees in Investment Products

Inconsistent Reporting Standards Among Institutions

Impact of Global Economic Changes on Costs

Balancing Quality of Service With Cost Management

Techniques to Minimize Variable Costs

Adopting Low-Cost Investment Strategies

Passive Investing vs Active Investing

Utilizing Index Funds and ETFs

Negotiating Fees With Advisors and Brokers

Utilizing Tax-Efficient Strategies

Impact of Variable Costs on Investment Returns

Effect of Compound Costs on Long-Term Wealth Accumulation

Long-Term Financial Planning and Forecasting Implications of Variable Costs

Strategies to Maximize Returns by Reducing Variable Costs

Bottom Line

How to Find Variable Costs FAQs

Variable costs are expenses that change based on investment activity, like transaction fees, brokerage commissions, and advisory fees.

Understanding variable costs is crucial as they can significantly affect net returns, guiding informed investment decisions.

Transaction fees, charged when buying or selling securities, can accumulate with frequent trading, affecting overall returns.

Yes, variable costs can compound over time, eroding potential earnings and affecting long-term financial planning.

Strategies include passive investing, using index funds and ETFs, negotiating fees, and implementing tax-efficient approaches.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.