Gross margin provides a helpful way for businesses to track production efficiency over time. For example, if the gross margin is decreasing, it could mean the cost of production has grown, or the company has offered more discounts recently. To raise gross margin, the business can cut labor costs, source cheaper materials, offer less discounts, or raise their prices. Gross margin differs from other metrics like net profit margin because it exclusively considers the costs directly tied to production. Since the cost of producing goods is an inevitable expense, some investors view gross margin as a measure of a company's overall ability to generate profit. The margin remaining after subtracting the cost of goods sold is used to pay for all other expenses, and if the company is profitable, the money left over is known as "net profit." A higher gross margin suggests that a firm generates a significant portion of revenue for each unit of product sold or service rendered. It acts as a litmus test, highlighting the company's ability to cover its operating costs and turn a profit. However, it's worth noting that a high gross margin doesn't always translate to net profitability. A company may have high operational or marketing expenses that can offset the benefits of a robust gross margin. But, as a general rule of thumb, a thriving gross margin is a positive indicator of a company's financial vigor. To truly gauge the effectiveness of its gross margin, a company must compare it against industry averages. This comparison allows businesses to benchmark their performance, identifying if they are leaders, laggards, or somewhere in between. For instance, a tech start-up might boast a gross margin of 60%. At face value, this seems impressive. But if the industry average is 80%, the start-up's margin suddenly seems less rosy. Such comparisons offer valuable insights, nudging companies towards introspection and improvement. Gross margin plays a pivotal role in guiding business strategies. If a company notices a decline in its gross margin, it might prompt them to reassess their production processes, supplier agreements, or pricing models. Furthermore, stakeholders, from investors to creditors, closely scrutinize gross margin. Its trends can influence investment decisions, credit terms, and even the company's valuation. Revenue, often hailed as the lifeblood of a business, represents the total income generated from sales before any costs are deducted. It’s the top line on the income statement and sets the stage for gross margin calculations. Healthy revenue streams are indicative of robust sales, effective marketing, and a product or service that resonates with the target audience. However, revenue alone doesn't paint the full picture. While high revenue can be a sign of flourishing sales, it's the interplay between revenue and costs that truly defines a company's financial health. This metric encapsulates the direct costs tied to the production of goods or delivery of services. From raw material costs to direct labor, COGS offers a microscopic view of the expenses incurred in bringing a product or service to market. Understanding COGS is paramount. If COGS rises disproportionately compared to revenue, it can squeeze the gross margin, signaling inefficiencies in the production or service delivery process. The pricing strategy a company adopts can significantly sway its gross margin. Premium pricing might elevate gross margins, reflecting a high perceived value. On the other hand, a penetration pricing strategy, where prices are set lower to capture market share, might result in slimmer margins, at least in the short term. The skeletal framework of a company's expenses, or its cost structure, plays a pivotal role in shaping gross margin. Factors like economies of scale, bulk purchasing advantages, and production efficiencies can lead to a more favorable cost structure, enhancing the gross margin. However, if a business grapples with rising material costs, wage inflations, or inefficient production processes, its COGS might escalate, exerting downward pressure on the gross margin. Fluctuations in currency values, changes in import-export regulations, or even global supply chain disruptions can influence both revenue and COGS, thereby affecting the gross margin. Past performance, while not an infallible predictor, offers invaluable insights. By delving into historical data, businesses can trace the trajectory of their gross margin. Such analysis can unearth patterns, providing clues about what strategies worked and which ones faltered. As businesses evolve, so do their financial metrics. Analyzing gross margin trends involves pinpointing periods of change. Identifying these inflection points can guide future strategies, enabling businesses to replicate successes and sidestep pitfalls. In the quest for financial mastery, businesses must look beyond their own boundaries. A comparative analysis, pitting a company's gross margin trends against those of competitors or the industry at large, can offer a panoramic view of its market standing. Elevating revenue can be a potent lever to enhance gross margin. This might involve tapping into new markets, launching innovative products, or refining the marketing strategy. By boosting sales, even if COGS remains constant, the gross margin can see a positive uptick. Taming the COGS beast can significantly amplify gross margins. This might entail renegotiating supplier contracts, adopting more efficient production techniques, or leveraging technology to reduce waste. Efficiency is the linchpin of profitability. By streamlining operations, reducing downtime, and optimizing resource utilization, businesses can extract more value from every dollar spent, enriching the gross margin. The definition of gross margin is the profitability of a business after subtracting the cost of goods sold from the revenue. It is a reflection of the amount of money a company retains for every incremental dollar earned. For example, say a company has a revenue of $1 million. The cost of goods sold, including materials and labor, totals $250,000. The company therefore has a gross profit of $750,000. This means they retained $0.75 in gross profit per dollar of revenue, for a gross margin of 75%. To define gross margin in simpler terms, it is simply gross profit, stated as a percentage of the revenue. Gross margin is a financial metric that provides essential insights into a company's production efficiency and overall profitability. By exclusively considering costs directly tied to production, it offers a clear picture of a company's ability to generate profit from its core operations. A higher gross margin indicates a firm's capability to cover operating expenses and turn a profit for each unit of product or service sold. However, it's crucial to remember that a robust gross margin doesn't guarantee overall net profitability, as other expenses can offset it. A company's gross margin should be compared against industry averages to benchmark performance and identify areas for improvement. Stakeholders should scrutinize gross margin trends, which can influence investment decisions, credit terms, and company valuation. Analyzing gross margin trends involves historical analysis, identifying changes, and conducting comparative analysis. Additionally, businesses can improve gross margins by increasing revenue, managing cost of goods sold, and implementing efficiency measures. What Is a Gross Margin?

What Does Gross Margin Mean?

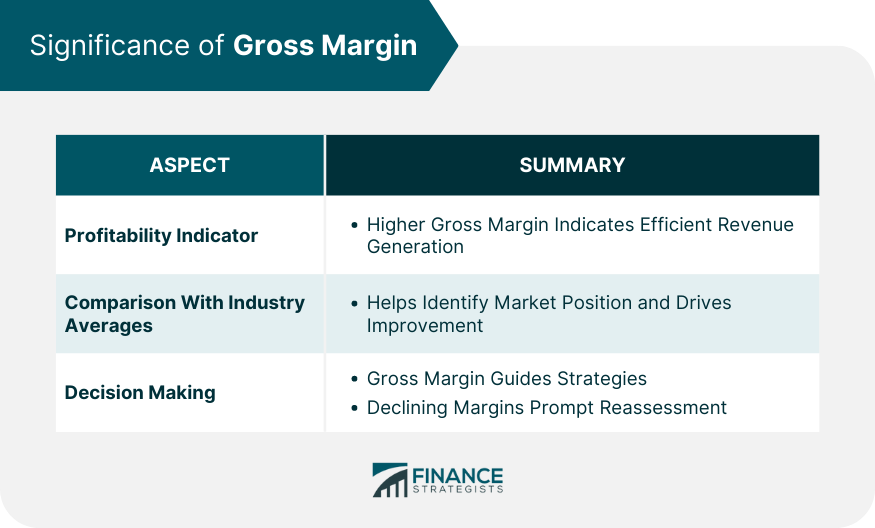

Significance of Gross Margin

Profitability Indicator

Comparison With Industry Averages

Decision Making

Components of Gross Margin

Revenue

Cost of Goods Sold (COGS)

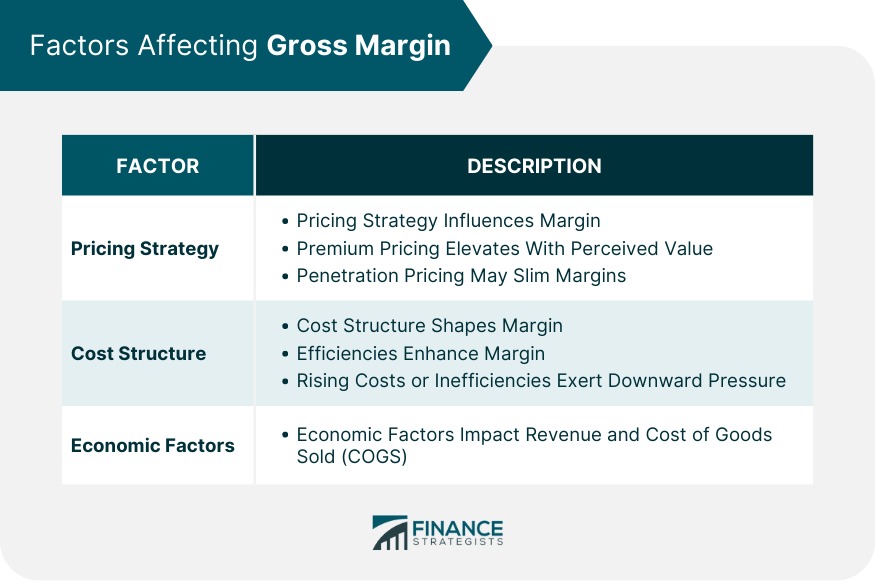

Factors Affecting Gross Margin

Pricing Strategy

Cost Structure

Economic Factors

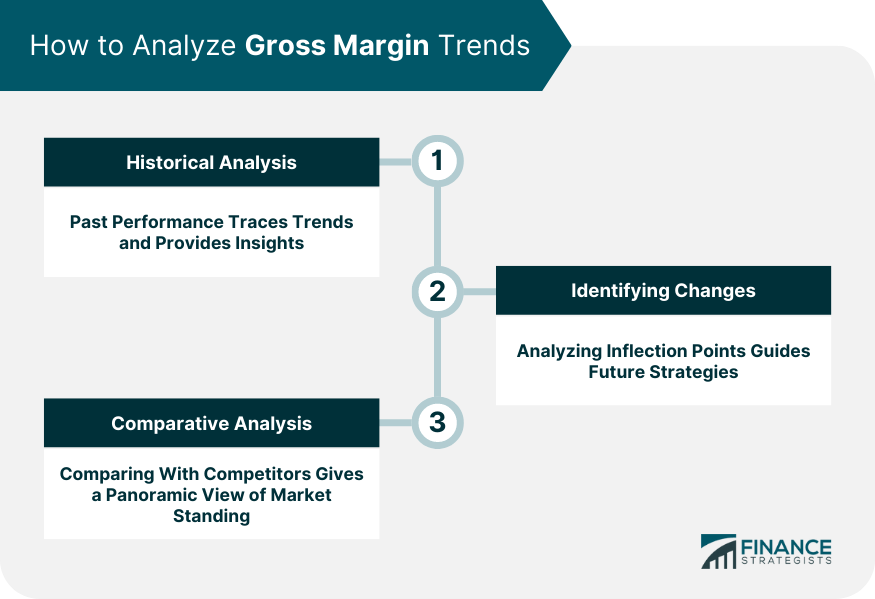

How to Analyze Gross Margin Trends

Historical Analysis

Identifying Changes

Comparative Analysis

How to Improve Gross Margin

Increase Revenue

Manage Cost of Goods Sold

Implement Efficiency Measures

Gross Margin Accounting Concept Around Profitability

Conclusion

Gross Margin FAQs

Gross Margin is the profitability of a business after subtracting the cost of goods sold from the revenue. It is a reflection of the amount of money a company retains for every incremental dollar earned.

Gross margin provides a helpful way for businesses to track production efficiency over time.

Gross margin differs from other metrics like net profit margin because it exclusively considers the costs directly tied to production.

Gross margin provides a helpful way for businesses to track production efficiency over time.

Improving gross margin can be done by increasing sales price, reducing costs of goods sold, and improving product or service design.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.