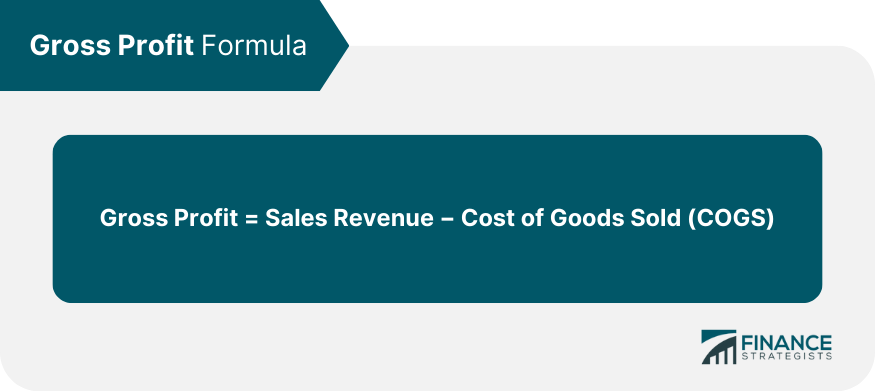

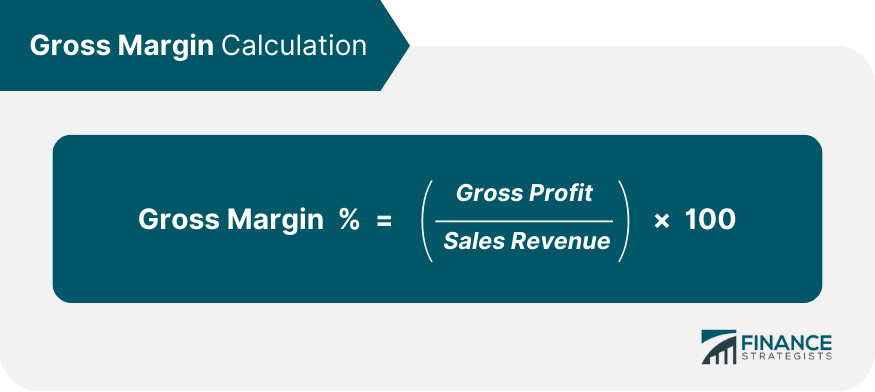

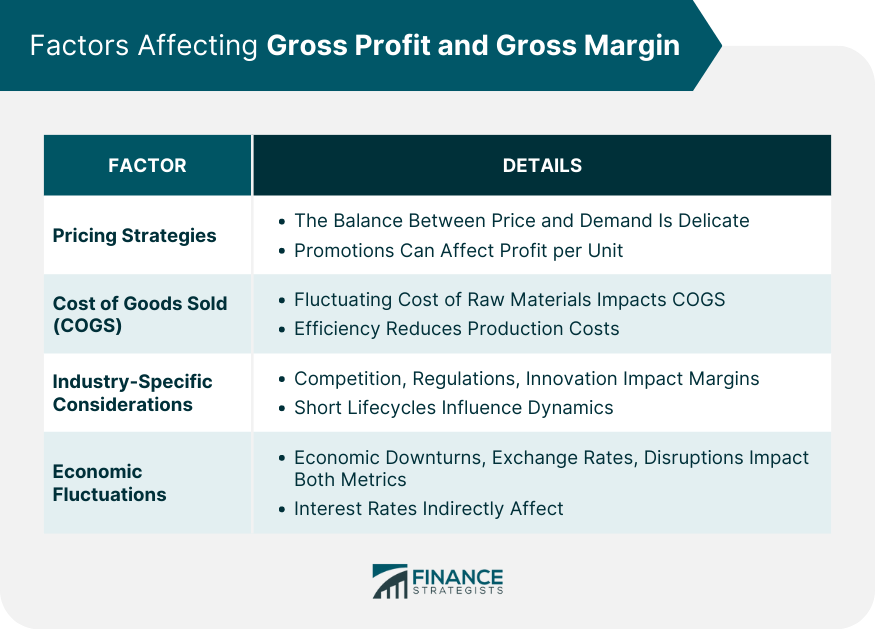

Although many people use the terms interchangeably, gross profit and gross margin are not the same. Gross profit is a currency amount, while margin is a ratio or percentage. It represents the total revenue from goods sold or services provided minus the direct costs associated with producing those goods or services. The resultant figure gives businesses an initial glance at their operational efficiency and the profitability of their core operations. Gross profit margin is the percentage left as gross profit after subtracting the cost of revenue from the revenue. It indicates the proportion of total sales revenue that exceeds the direct costs of producing the goods or services sold. In simple terms, it shows the percentage of sales revenue retained by a business after incurring the direct costs. You calculate it by dividing the gross profit by the revenue. Gross profit serves as a fundamental profit metric for businesses. It captures the essence of a company's operational performance by highlighting the surplus generated from sales after accounting for production costs. For retailers and manufacturers, it's a quick indicator of how effectively a company turns raw materials into profit. The formula for calculating gross profit is straightforward: This simple subtraction gives businesses an immediate snapshot of their earnings before any other operational or financial expenses are considered. The gross profit figure stands as a beacon for business efficiency. A higher gross profit suggests that a company is managing its production or procurement costs effectively. Moreover, consistent growth in gross profit over periods can signify sustainable operational practices, competitive advantage, or effective pricing strategies. However, relying solely on gross profit can be misleading. This metric doesn't account for other operational expenses, such as marketing, rent, and salaries. A company could have a high gross profit but still operate at a loss after considering all other expenses. Hence, while important, it's just one piece of the financial puzzle. Businesses often use gross profit to set performance benchmarks. It aids in budgeting, forecasting, and can be a focal point in strategy discussions, especially concerning production efficiency or pricing strategies. A company with steadily increasing gross profit is likely managing its production costs effectively. On the flip side, if gross profit starts dwindling, it could be a red flag, indicating rising production costs, declining sales, or a combination of both. Gross margin dives deeper into the profitability picture by expressing the gross profit as a percentage of sales revenue. It showcases how much of each sales dollar remains after covering the direct costs of production or procurement. The formula is: This percentage illuminates the efficiency of turning sales into actual profit, providing a more nuanced view than the gross profit figure alone. In a coffee shop example, the gross profit was $80,000 from revenue of $200,000. This gives a gross profit margin of $80,000 / $200,000 = 40%. Gross margin percentage holds significant weight in financial analysis. It provides a relative measure that can be compared across industries or against competitors, offering a standardized metric for assessing profitability. A business with a higher gross margin than its competitors may be operating more efficiently or have a stronger value proposition. While gross margin offers a percentage-based view of profitability, it still doesn't encompass all operational costs. A company with a high gross margin might still struggle with hefty administrative or marketing expenses, potentially leading to net losses. Gross margin is crucial in trend analysis and competitive benchmarking. It's a go-to metric for investors seeking to compare the operational efficiency of companies within the same sector or industry. A consistent or increasing gross margin percentage can signal effective cost management, pricing power, or both. Conversely, declining gross margins might indicate rising production costs, aggressive discounting, or increased competition. For every dollar in sales, the coffee shop has 40 cents in gross profit that it can use to pay for other business expenses (and hopefully have something left as net profit if it is a profitable business). The easiest way to remember the difference between profit and margin is: sales/Income: Dollar amount (as in $1,000) Margin: Percentage (as in 10%) If a company's gross margin increases, it means that the company is making more money per unit sold. In other words, the company is becoming more efficient and generating more profits for the same amount of labor and material cost. The best ways to increase gross margin are to raise prices or reduce the cost of producing the goods or services. The balance between price and demand is delicate. If a business sets its prices too high, it may deter potential customers, but if set too low, it might not cover costs or generate sufficient profit. Both gross profit and gross margin are directly influenced by pricing decisions. Seasonal discounts, loyalty programs, and promotional campaigns can boost sales volumes, but they can also eat into the gross profit per unit sold. This reduction can have a pronounced effect on the gross margin when the cost of goods remains fixed. The fluctuating cost of raw materials can significantly impact the COGS. For instance, a sudden spike in the price of steel might affect the automobile industry, while a rise in the cost of cocoa can impact chocolatiers. Changes in wage rates, whether due to regulatory changes, labor union negotiations, or market conditions, can affect COGS. Companies with higher labor-intensive processes might witness pronounced shifts in their gross profit and margin due to these changes. The ability of a company to produce goods efficiently, utilizing technologies or innovative processes, can reduce production costs. An efficient production line reduces waste, shortens production time, and often results in a lower COGS. In industries with fierce competition, companies might engage in price wars, which can compress margins. For example, in the smartphone industry, competition can lead to aggressive pricing strategies affecting the gross margin. Industries such as pharmaceuticals or energy are heavily regulated. Compliance with regulations or sudden regulatory changes can impact the cost structure and, subsequently, gross profit and margin. In industries where products have short lifecycles (like tech gadgets), the need to frequently innovate and upgrade can lead to varied costs and pricing strategies, influencing the profit and margin dynamics. Economic downturns can reduce consumers' disposable income, leading to decreased demand for non-essential products. In response, companies might reduce prices to spur demand, impacting their gross profit and margin. For businesses that rely on importing raw materials or exporting finished products, fluctuating exchange rates can affect the COGS and sales revenue. A strengthening domestic currency might increase the cost of exported goods, potentially reducing foreign sales and impacting margins. Economic crises, natural disasters, or global events like pandemics can disrupt supply chains. These disruptions can lead to increased costs or delays, affecting both the gross profit in absolute terms and the gross margin percentage. Economic fluctuations often lead to changes in interest rates. Higher interest rates can increase a company's borrowing costs, pushing them to adjust prices or cut down on other costs, indirectly influencing the gross profit and margin. Understanding the distinction between gross profit and gross margin is crucial for accurate financial analysis and strategic business planning. Gross profit, calculated as Sales Revenue minus Cost of Goods Sold (COGS), is a monetary value that provides an initial insight into a company's operational efficiency and profitability. It is a direct indicator of how well a company is managing its production or procurement costs and is essential for setting performance benchmarks and strategy formulation. On the other hand, gross margin, expressed as a percentage of sales revenue, offers a relative measure of profitability, allowing for comparisons across industries and competitors. It reflects the efficiency of converting sales into profit and is vital for trend analysis and competitive benchmarking. Both metrics, while insightful, have their limitations as they do not account for all operational expenses. Factors such as pricing strategies, COGS, industry-specific considerations, and economic fluctuations significantly impact these metrics. A higher gross profit margin generally indicates better efficiency and profitability. However, businesses must balance various factors to optimize both gross profit and gross margin, ensuring sustainable growth and competitiveness.Gross Profit vs Gross Margin

What Is Gross Profit?

Definition

Formula

Significance

Limitations

Application

Interpretation

What Is Gross Margin?

Definition

Gross Margin Calculation

Importance

Limitation

Application

Interpretation

Gross Profit Difference

A Higher Gross Profit Margin Is Better

Factors Affecting Gross Profit and Gross Margin

Pricing Strategies

Cost of Goods Sold (COGS)

Industry-Specific Considerations

Economic Fluctuations

Bottom Line

Gross Profit vs Gross Margin FAQs

Gross profit is the sum total of all income earned in a given year for an individual or a company.

Gross profit is a currency amount, while margin is a ratio or percentage. Gross profit margin is the percentage left as gross profit after subtracting the cost of revenue from the total revenue.

The best ways to increase gross margin are to raise prices or reduce the cost of producing the goods or services.

If a company’s gross margin increases, it means that the company is making more money per unit sold.

No, they are not always equal as gross profit is an absolute value in dollars while gross margin is expressed as a percentage.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.