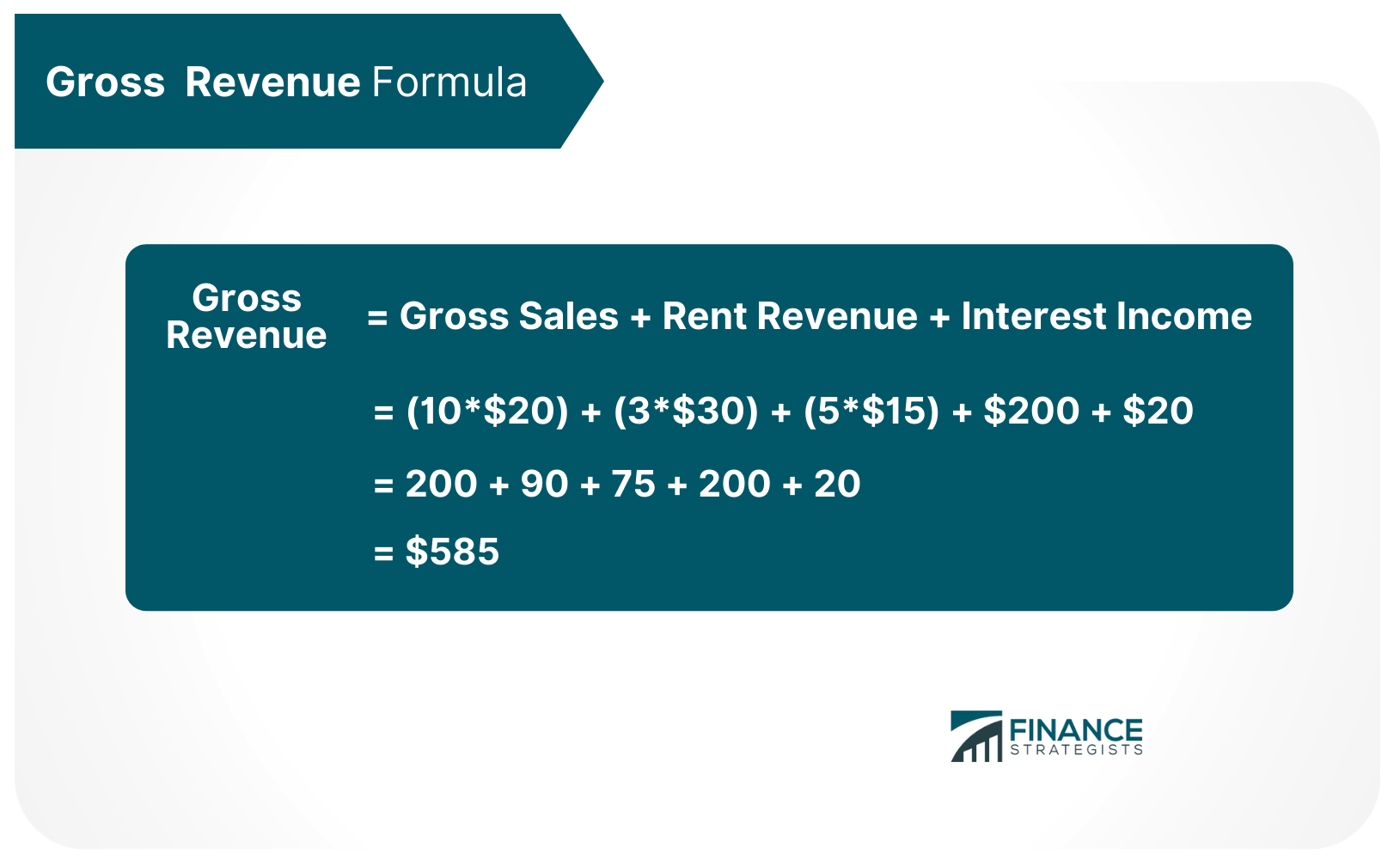

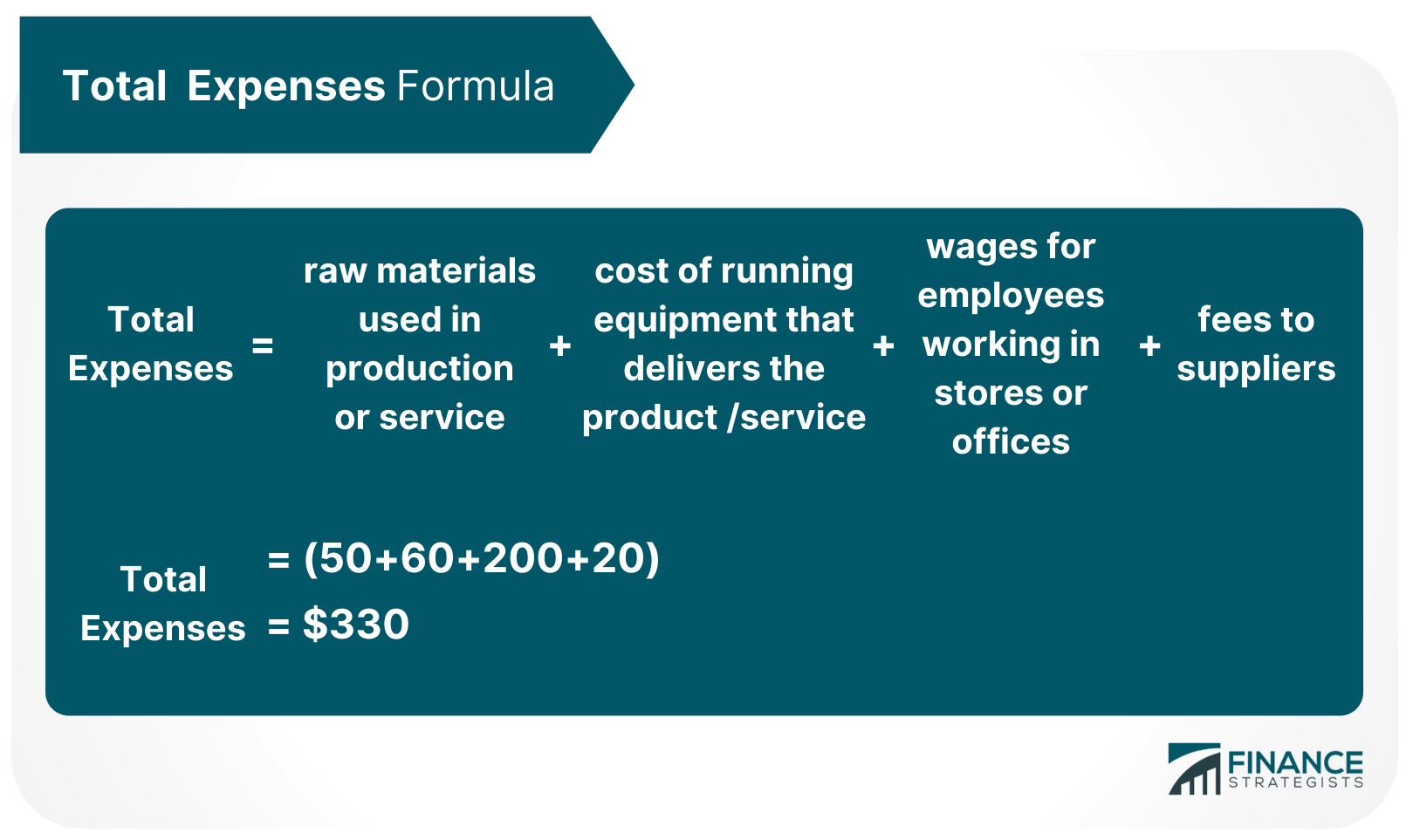

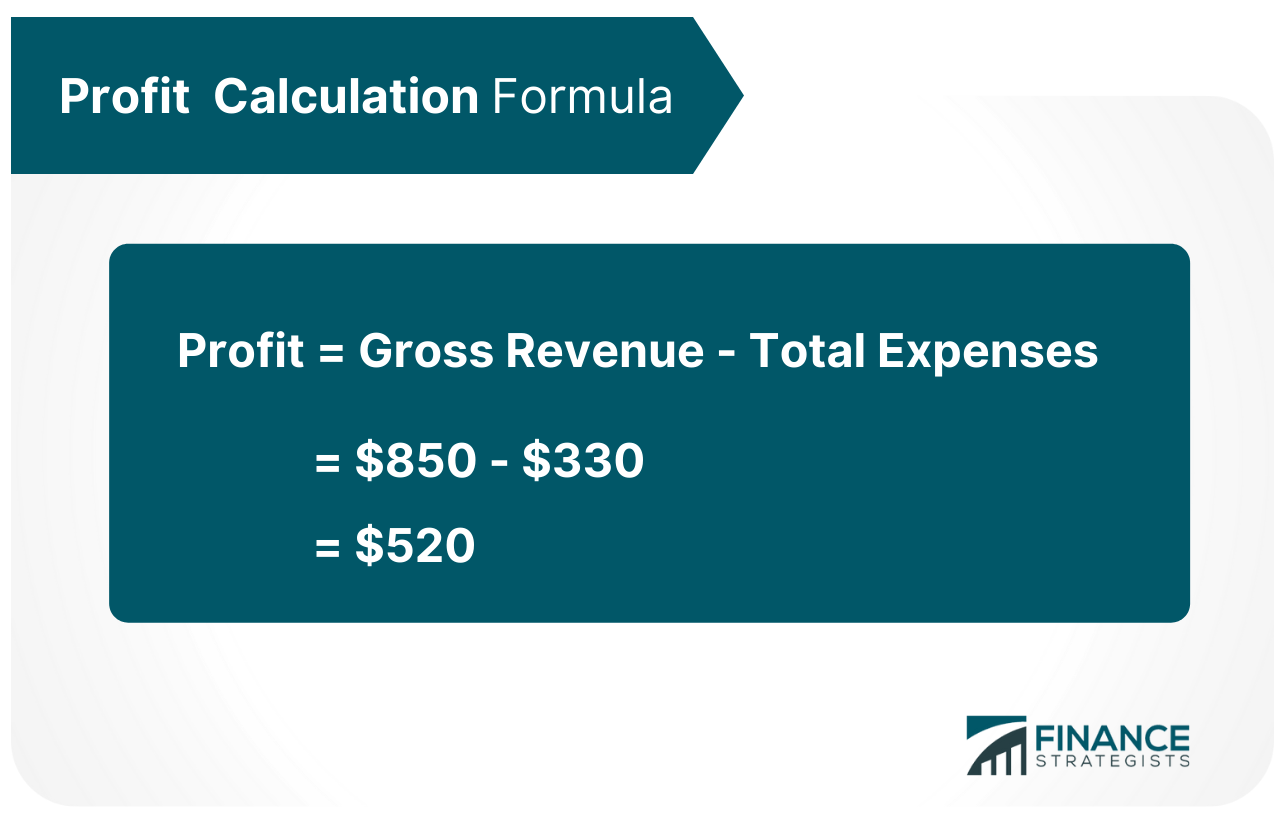

Revenue and profit are both important to businesses, but they're two different things. Where does your business get its revenue (money) from? That's your revenue. What is the difference between that number and how much money you actually made after expenses? That's your profit! Let's get into the nitty-gritty of these two elements. Revenue is the total amount of income for a good or service. It includes all incoming cash through sales (turnover). Revenue can also be called turnover - especially if it's used in relation to finance or bookkeeping. Revenue must be greater than zero for the business to stay open. Sources of revenue include sales of products or services, interest on loans, dividends from a company's ownership in another business venture, rent from property the business owns, income from investments made by the business (stocks, bonds, etc). To calculate revenue, you just need to add up all the money taken in by sales and other sources of income mentioned above. For example, say a particular company has the following transactions. In a particular month, it sold 10 souvenir t-shirts at $20 each, 3 hats at $30 each, and 5 scarves for $15. It also was able to earn an amount of $200 for rent revenue, and $20 interest income from its bank savings. The gross revenue for that particular month will be calculated as follows: Gross revenue is equal to the total of all sales before any deductions of discounts and returns, plus other sources of revenue such as rent and interest from savings. Profit is what's left after you pay all your expenses. Expenses are costs involved in making or selling something. They're also called 'outgoings' or 'costs'. They include things like raw materials (clothes), utilities (electricity), office supplies (pens & paper). Profit is very important because it tells you how much money your business is actually making. Sources of expenses include raw materials used in production or service, cost of running equipment that delivers the product/service (e.g. a taxi), wages for employees working in stores or offices, fees to suppliers, depreciation on fixed assets such as vehicles and buildings, and interest paid to finance your business or buy property. To calculate profit, you need to take the revenue from above, subtract all expenses, then take away any deductions. This difference is the final amount of money that was gained after all transactions were completed. For example, let's say a particular company has the following transactions. In one month, it had sales of $850 but it also had costs of producing its products that consisted mainly of raw materials ($50), depreciation on equipment used in production ($60), wages for employees ($200), and an administrative fee ($20). The total expenses will be calculated as follows: Profit will be calculated as follows: Profit is the amount after expenses were deducted from gross revenue. Profit and revenue are actually related concepts. Profit can help us to understand how much money has been made after all costs have been subtracted from sales. Revenue tells us about the total amount of money that has been taken in by sales, either domestically or globally - the total income for the month. The most obvious effect is that a business won't stay open longer if it's not making any money. If there's no revenue, then there's no money to pay expenses or other costs associated with running the business. Profit tells you something about the efficiency of your business - how much money do you need to make in order for an activity to be profitable? When a company makes a small profit, it means they probably have certain areas where they can improve their efficiency and save on some expenses. A high profit means that the business is efficient and able to generate a lot of revenue without many expenses. If there's no profit but there is revenue, then this means that there haven't been any deductions but something else must have occurred that caused transactions to result in an overall loss for the company. This could be due to marketing initiatives or selling discounted items at a lower margin than usual for example. If there's no revenue but there is profit, then the expenses must have been really low for this time frame. There are many other costs that affect profit, but these are some of the more common ones. Profit is vital for businesses of all sizes and shapes to know how much money is being made at any given time period. It's important not only for knowing whether or not you're making ends meet financially, but it also tells you what your business is worth if someone were to buy it from you. Revenue, on the other hand, tells you how much money you're generating for your business. It's calculated as the sum of all sales and it can be an indicator of future potential profits. As with profit, there are many other factors that contribute to revenue such as discounts and freebies. Revenue is also important for businesses, but sometimes expenses can outweigh revenue and result in a loss for the company. While both profit and revenue affect your business, they do so in different ways so it's necessary to know how they both work together to help you run your successful business. What Is Revenue?

How to Calculate Revenue

What Is Profit?

How to Calculate Profit

How Do Revenue and Profit Affect the Business?

Final Thoughts

Revenue vs Profit FAQs

Revenue can be calculated as the sum of all sales, including discounts and freebies. It doesn't take into account costs and expenses.

Profit can be calculated by taking gross revenue and subtracting costs associated with producing goods/services such as raw materials, depreciation of equipment used in the process, the wage of employees working on-site or at offices, etc. It will include any fees to suppliers or other resources that you use to deliver products/services to customers. Profits are affected by costs but not necessarily by what type of price was set when delivering products/services - for example, if a discount coupon was used in the process of delivery.

Profit gives you an idea of how much money needs to be made per activity in order for it to be profitable. If no profit was made, then this means that there were no comparisons done to see if the amount of expenses/costs associated with an activity outweighed the revenue generated by that same activity. It's hard to say whether or not the company will remain open without knowing more information about what would make certain costs outweigh revenue - which is why knowing both profit and revenue are important for daily decision-making within your business.

Revenue measures how much money is being generated by your business while profit measures how much money you've kept after paying all expenses and comparing them to revenue.

No, expenses are not always equal to revenue. This means that while you're making a lot of money there might be many costs too high for the amount of revenue you're generating.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.