Initial Coin Offerings is a novel fundraising method used by start-ups and projects within the blockchain and cryptocurrency space. In an ICO, a project creates a new digital token or cryptocurrency and offers it for sale to potential investors. The funds raised are typically used for the development and expansion of the project. ICOs have gained immense popularity in recent years due to their ability to provide early-stage funding for promising projects and the potential for high returns for investors. ICOs differs significantly from traditional fundraising methods such as Initial Public Offerings (IPOs), venture capital, and crowdfunding. While IPOs involve the sale of equity in a company, ICOs deal with the sale of digital tokens that may represent various rights or utilities within a project's ecosystem. Compared to venture capital, ICOs can provide a more democratic and accessible investment opportunity for retail investors. However, they may also carry higher risks due to factors such as regulatory uncertainty and market volatility. The first ICO took place in 2013 when Mastercoin, now known as Omni Layer, raised around 5,000 BTC (Bitcoin) for its project development. The following year, Ethereum conducted its ICO, raising approximately $18 million in Ether (ETH), which has since become one of the most successful and influential projects in the blockchain space. The success of these early ICOs led to an explosion of new projects conducting token sales in the years that followed. As ICOs gained prominence, they also attracted the attention of regulatory bodies worldwide. The lack of clear regulations and oversight led to several fraudulent ICOs, prompting authorities to intervene and establish guidelines for the new fundraising method. Countries such as the United States, through the Securities and Exchange Commission (SEC), have classified many ICO tokens as securities, subjecting them to stringent regulatory requirements. Other jurisdictions have taken a more lenient approach, fostering a more conducive environment for ICOs to thrive. Before an ICO can take place, a project must first be conceptualized and developed. This includes defining the project's goals, target market, and unique selling proposition. A thorough market analysis and competitive landscape assessment are also critical during this stage. A comprehensive whitepaper is essential for any ICO. The whitepaper serves as a blueprint for the project, outlining its vision, technical specifications, tokenomics, and roadmap. It should provide sufficient information for potential investors to assess the project's merits and risks. Assembling a competent team with relevant experience is crucial to the success of an ICO. Additionally, having a strong advisory board with industry experts and prominent figures can lend credibility to the project and help attract potential investors. A private sale is an early-stage token sale event targeting a select group of investors, often institutional or high-net-worth individuals. Following the private sale, a pre-sale may be conducted to offer tokens at a discounted rate to a wider audience before the public sale begins. The public sale, or crowdsale, is the main event of an ICO, where tokens are offered to the general public for purchase. This stage is crucial for raising funds and attracting a large number of investors to support the project's growth. After the token sale is complete, tokens are distributed to investors according to their respective contributions. Token distribution should be transparent and align with the project's goals and long-term vision. Following the ICO, the project team focuses on delivering the promised product or service. The funds raised during the ICO are used to achieve key milestones outlined in the project's roadmap. Regular updates and transparent communication with the investor community are crucial during this stage. To provide liquidity and trading opportunities for investors, the project team works on listing the token on various cryptocurrency exchanges. Listing on reputable exchanges can boost the project's credibility and attract more investors. Maintaining an active and engaged community is essential for the long-term success of any ICO project. This involves regular updates, prompt responses to inquiries, and the implementation of effective marketing strategies to create awareness and expand the project's user base. ICOs provide a unique opportunity for start-ups and projects to access early-stage funding, allowing them to bring their innovative ideas to life without relying on traditional funding sources. By enabling retail investors to participate in token sale, ICOs democratize investment opportunities, giving individuals the chance to invest in promising projects and potentially reap significant returns. ICOs can help create buzz and awareness around a project, attracting investors, users, and potential partners. The marketing efforts around an ICO can have a lasting impact on the project's success. For investors who can identify promising projects, ICOs offer the potential for high returns as the value of the tokens may increase substantially over time if the project succeeds. The regulatory landscape surrounding ICOs remains uncertain in many jurisdictions, posing legal challenges for both projects and investors. Compliance with various regulations, such as securities laws and anti-money laundering requirements, can be complex and costly. The lack of regulation and oversight in the ICO space has led to numerous fraudulent projects and scams, resulting in significant losses for investors. Conducting thorough due diligence is essential to minimize the risk of investing in a fraudulent ICO. The value of ICO tokens can be highly volatile, subjecting investors to substantial price fluctuations. Additionally, limited liquidity on exchanges may make it difficult for investors to buy or sell tokens when desired. Many ICO projects fail due to mismanagement, lack of funding, or an inability to deliver the promised product or service. Investing in ICOs carries the risk of project failure, which may result in the loss of the invested capital. Different countries have adopted varying regulatory approaches toward ICOs. Some jurisdictions, like the United States, have implemented strict regulations, while others, such as Malta and Switzerland, have taken a more supportive stance toward the emerging fundraising method. Many ICOs must comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations to prevent money laundering and terrorist financing. This involves collecting personal information from investors, which may pose privacy concerns and create additional administrative burdens for projects. The classification of ICO tokens as securities or utility tokens has significant implications for projects and investors. Securities tokens are subject to more stringent regulatory requirements, while utility tokens may have more lenient regulations, depending on the jurisdiction. As the ICO market continues to evolve, regulatory bodies worldwide are expected to develop clearer guidelines and frameworks to balance investor protection with innovation and growth in the blockchain ecosystem. Projects with a solid value proposition, innovative technology, and a clear market need are more likely to succeed and attract investor interest. A well-written and transparent whitepaper is crucial for gaining investor trust and showcasing the project's potential. The whitepaper should provide detailed information about the project's vision, technology, tokenomics, and roadmap. A competent and experienced team, along with a strong advisory board, is essential for a project's success. Investors are more likely to support projects led by individuals with relevant expertise and a proven track record in the industry. Successful ICOs often invest in effective marketing strategies and maintain an engaged community. This helps raise awareness, attract investors, and build a loyal user base for the project. Initial Coin Offerings have emerged as a powerful fundraising tool in the blockchain and cryptocurrency space, offering numerous advantages for both projects and investors. However, they also carry significant risks and challenges, including regulatory uncertainty and the potential for fraud. ICOs have played a critical role in the development and growth of the blockchain ecosystem, enabling countless projects to access early-stage funding and bring innovative solutions to market. As the ICO landscape continues to evolve, we can expect further regulatory clarity, the emergence of new fundraising methods, and a growing convergence with the DeFi ecosystem. These developments have the potential to reshape the way start-ups and innovative projects secure funding, democratizing access to capital and fostering continued innovation in the blockchain space.Definition of Initial Coin Offerings (ICOs)

Comparison to Traditional Fundraising Methods

History of ICOs

Emergence and Early Examples

Regulatory Responses and Legal Challenges

ICO Process

Pre-ICO Stage

Project Development

Whitepaper Creation

Team Formation and Advisory Board

Token Sale

Private Sale and Pre-sale

Public Sale and Crowdfunding

Token Distribution

Post ICO Stage

Project Development and Milestones

Token Listing and Exchanges

Community Management and Marketing

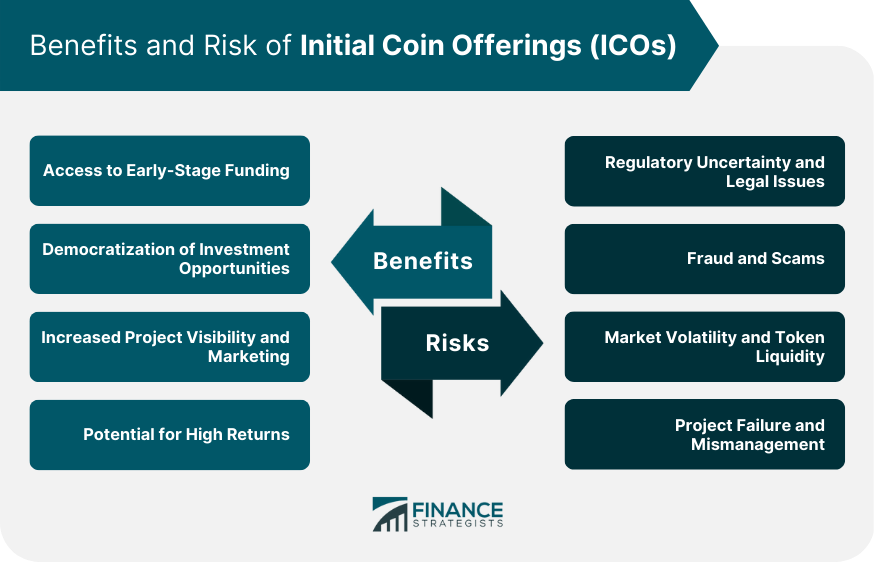

Benefits of ICOs

Access to Early-Stage Funding

Democratization of Investment Opportunities

Increased Project Visibility and Marketing

Potential for High Returns

Risks and Challenges Associated With ICOs

Regulatory Uncertainty and Legal Issues

Fraud and Scams

Market Volatility and Token Liquidity

Project Failure and Mismanagement

Regulatory Landscape and Compliance

Global Regulatory Approaches

Know Your Customer (KYC) and Anti-Money Laundering (AML) Requirements

Securities and Utility Tokens Classification

Future Trends in ICO Regulation

ICO Success Factors and Best Practices

Strong Project Fundamentals

Transparent and Comprehensive Whitepaper

Experienced Team and Advisors

Effective Marketing and Community Engagement

Conclusion

Initial Coin Offerings (ICOs) FAQs

Initial Coin Offerings (ICOs) are a fundraising method used by start-ups and projects in the blockchain and cryptocurrency space, where a new digital token or cryptocurrency is created and sold to potential investors. Unlike traditional fundraising methods like IPOs and venture capital, ICOs involve the sale of digital tokens that represent various rights or utilities within a project's ecosystem, providing a more democratic and accessible investment opportunity for retail investors.

The ICO process comprises three main stages: the pre-ICO stage, the token sale, and the post-ICO stage. In the pre-ICO stage, project development, whitepaper creation, and team formation occur. During the token sale, private sale, pre-sale, and public sale events take place to raise funds. In the post-ICO stage, project development and milestones are achieved, tokens are listed on exchanges, and community management and marketing efforts are carried out.

Advantages of ICOs include access to early-stage funding, democratization of investment opportunities, increased project visibility and marketing, and potential for high returns. However, ICOs also carry risks such as regulatory uncertainty, fraud and scams, market volatility, token liquidity issues, and project failure.

Regulatory bodies worldwide have varying approaches to ICOs. Some countries, like the United States, implement strict regulations and classify many ICO tokens as securities. Other jurisdictions, such as Malta and Switzerland, adopt a more supportive stance, fostering a conducive environment for ICOs. As the ICO market evolves, it is expected that regulatory frameworks will continue to develop to balance investor protection with innovation and growth.

Successful ICOs typically have strong project fundamentals, a transparent and comprehensive whitepaper, an experienced team and advisory board, and effective marketing and community engagement strategies. These factors help attract investor interest and support, increasing the likelihood of a successful token sale and project development.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.