Cryptocurrency arbitrage refers to the practice of taking advantage of price discrepancies of a particular digital asset across different cryptocurrency exchanges. In essence, a trader buys a cryptocurrency at a lower price on one platform and sells it at a higher price on another, pocketing the difference as profit. This is made possible due to the decentralized nature of cryptocurrencies and the varying supply and demand dynamics on individual exchanges. Additionally, factors such as transaction fees, withdrawal limits, and transfer times can influence the success and profitability of an arbitrage strategy. Given the inherent volatility of the crypto market, arbitrage opportunities can be fleeting, necessitating swift actions and well-timed trades for maximal returns. A cryptocurrency arbitrage trading platform streamlines and automates the process of identifying and exploiting price differences of a digital asset across various exchanges. Here's a detailed breakdown of how these platforms operate: Utilizing APIs (Application Programming Interfaces) from various global cryptocurrency exchanges, it ensures that the data captured is in real-time, offering the freshest snapshot of prices, volumes, and other relevant metrics from multiple sources. This constant inflow of data means the platform is always updated, reflecting even the tiniest market fluctuations. With data at its disposal, the platform's core algorithms kick into action. They meticulously compare the prices of the same cryptocurrency across different exchanges. Discrepancies, even minute ones, are quickly identified. For instance, if Ethereum is priced at $2,500 on one exchange but $2,520 on another, the system flags this $20 gap as a potential arbitrage opportunity. The accuracy of this analysis is pivotal in ensuring profitability, as even minor oversights can lead to missed opportunities or losses. By continually comparing prices, the platform offers a competitive edge to its users. Upon identifying a viable arbitrage opportunity, the platform can act in one of two ways, depending on user preferences. If the user opts for notifications, they're promptly informed of the opportunity. However, if they've set up auto-trading, the platform automatically initiates the purchase on the cheaper exchange and a corresponding sell order on the pricier one, ensuring seamless trade execution. The speed of this process is vital, as crypto markets are known for their volatility. Delays in execution can sometimes mean missed profit margins or even potential losses. Profit in arbitrage is not just about the price difference; costs matter. The platform's algorithms are sophisticated enough to factor in various costs associated with trading. From transaction fees on exchanges to withdrawal fees and even potential taxes, the system ensures that what seems like a profitable trade on the surface doesn't turn into a loss once all fees are deducted. The transparent calculation of these fees ensures users are never caught off guard by unexpected costs. Proper fee accounting also allows traders to set realistic profit expectations. Cryptocurrency transfers between different exchanges can face varying processing times due to factors like network congestion. The platform assesses these potential delays. If a transfer is expected to take too long, potentially causing the price difference to vanish, the platform might decide to bypass that particular opportunity. Predicting and acting upon these transfer times are crucial in an environment where minutes or even seconds can make a significant difference in profitability. This real-time assessment ensures maximum profitability while minimizing potential risks. For an arbitrage strategy to work effectively, sufficient liquidity on both the buying and selling exchanges is paramount. The platform continuously checks the volume of trades on both sides to ensure that any arbitrage trade executed won't adversely affect the price, which could potentially reduce profits or even result in a loss. These checks are crucial in maintaining the stability and predictability of trades. Without ample liquidity, even the most promising arbitrage opportunities can quickly turn sour, negatively impacting a trader's portfolio. A robust cryptocurrency arbitrage trading platform integrates risk management tools that allow users to set specific parameters. This might include defining a maximum trade size, setting daily profit and loss thresholds, or avoiding certain exchanges deemed too volatile or unreliable. These features empower users, allowing them to define their risk appetite clearly and act accordingly. By establishing these boundaries, traders can operate with increased confidence, knowing that the system works within their predefined limits. Over time, several specific strategies have been developed by traders to optimize their profits. Here's a detailed breakdown of the predominant types: This is the most straightforward form of crypto arbitrage. Traders identify price discrepancies for the same crypto asset between two exchanges. Buy the cryptocurrency on the exchange where the price is lower and simultaneously sell it on the exchange where it's priced higher. While simple in concept, spatial arbitrage requires swift actions due to the highly volatile nature of cryptocurrency prices. Traders also need to account for transaction fees on both exchanges, transfer times, and potential liquidity issues. This strategy involves three different cryptocurrencies on a single exchange platform. Start with one cryptocurrency, trade it for a second one, then trade the second for a third cryptocurrency, and finally, trade the third one back to the initial cryptocurrency. If done correctly, the trader ends up with more of the initial cryptocurrency than they started with. Triangular arbitrage requires a keen understanding of exchange rates and fees associated with each trade on the platform. It's essential to calculate the potential profit quickly and accurately to ensure the strategy remains viable after all transactions. This strategy banks on the prediction that a price discrepancy between two exchanges will exist for a specific duration. If a trader believes that a particular crypto asset will be priced higher on Exchange A than Exchange B for the next few hours, they might decide to buy the asset on Exchange B and wait to sell it on Exchange A. This form of arbitrage is riskier as it relies on predicting future price movements. Factors like sudden news events or regulatory changes can disrupt the expected price behavior, leading to potential losses. This is a more complex and quantitative approach. Traders use mathematical models and historical price data to identify potential arbitrage opportunities. By analyzing price patterns and relationships between different cryptocurrencies or exchanges, traders can predict short-term price inefficiencies that they can exploit. As it heavily relies on algorithms and historical data, this method requires robust computational tools and a deep understanding of crypto market behavior. This strategy revolves around the concept of liquidity, where traders take advantage of the price differences caused by varying liquidity levels on different exchanges. On an exchange with low liquidity and a resulting higher price for a crypto asset, a trader might sell their holdings. Simultaneously, they can buy the same asset on another exchange with high liquidity and a lower price. While this strategy can be effective, it's essential to ensure that the price discrepancy is significant enough to cover potential slippage and transaction fees. This strategy is based on the idea that the price of a particular cryptocurrency will converge to a mean over time. If a crypto asset's price is significantly different on two exchanges, a trader can buy on the cheaper exchange and sell on the more expensive one, expecting that the prices will eventually converge to a middle ground. This strategy banks on the long-term equilibrium of prices, so it might require holding assets for more extended periods, exposing traders to other market risks. Here are some practical tips to navigate this endeavor with proficiency and minimize potential risks: Start Small: Begin with smaller amounts until you get a feel for the dynamics involved. This approach helps minimize potential losses as you learn, giving you a cushion to refine your strategies and tools without undue financial risk. Use Reliable Arbitrage Tools: Leverage dedicated software or platforms designed to identify and execute arbitrage opportunities. Automated tools can quickly pinpoint discrepancies, and execute trades in real-time. Factor in All Costs: Always account for transaction fees, withdrawal fees, taxes, and potential hidden charges. Overlooking these costs can turn what seems like a profitable arbitrage opportunity into a losing proposition. Diversify Your Exchanges: Different exchanges might offer varying arbitrage opportunities due to their unique liquidity, user base, and regional factors. Diversifying allows you to maximize potential profits. Prioritize Security: Ensure that the exchanges you use prioritize security features like two-factor authentication (2FA) and cold storage. Opting for secure exchanges minimizes the risk of hacks or unauthorized transactions. Maintain Adequate Liquidity: Always ensure you have enough liquidity in both fiat and crypto holdings. Adequate liquidity ensures swift execution of trades, especially in volatile markets where delays can be costly. Have an Exit Strategy: Set clear profit and loss targets for each arbitrage opportunity. This helps avoid emotional decision-making, ensuring you lock in profits when targets are hit and minimize losses if things don't go as planned. Monitor Transfer Times: Keep track of transfer times between exchanges, especially during times of network congestion. Stay Updated on Regulatory Changes: Being cognizant of regulatory changes can help you anticipate potential shifts in demand or supply across exchanges, especially if those changes impact large crypto markets. Cryptocurrency arbitrage trading exploits price disparities across exchanges to generate profits. This practice thrives on the decentralized nature of digital assets, where differing supply and demand dynamics create opportunities. To navigate this landscape effectively, traders rely on cryptocurrency arbitrage trading platforms that streamline the process. These platforms leverage real-time data aggregation from various exchanges through APIs, enabling accurate price comparison and analysis. Rapid trade execution, accounting for fees, timing considerations, liquidity checks, and risk management tools enhance the efficacy of arbitrage strategies. Various arbitrage types—spatial, triangular, time, statistical, liquidity, and convergence—offer diverse approaches to capitalizing on market inefficiencies. Essential tips encompass starting small, reliable tools, cost inclusion, diversified exchanges, security emphasis, liquidity maintenance, and exit plans. These strategies empower traders to seize opportunities while managing risks effectively, ensuring profitability in cryptocurrency arbitrage trading. What Is Cryptocurrency Arbitrage Trading?

How a Cryptocurrency Arbitrage Trading Platform Works

Data Aggregation

Price Comparison and Analysis

Trade Execution

Accounting for Fees

Transfer Timing Consideration

Liquidity Checks

Risk Management

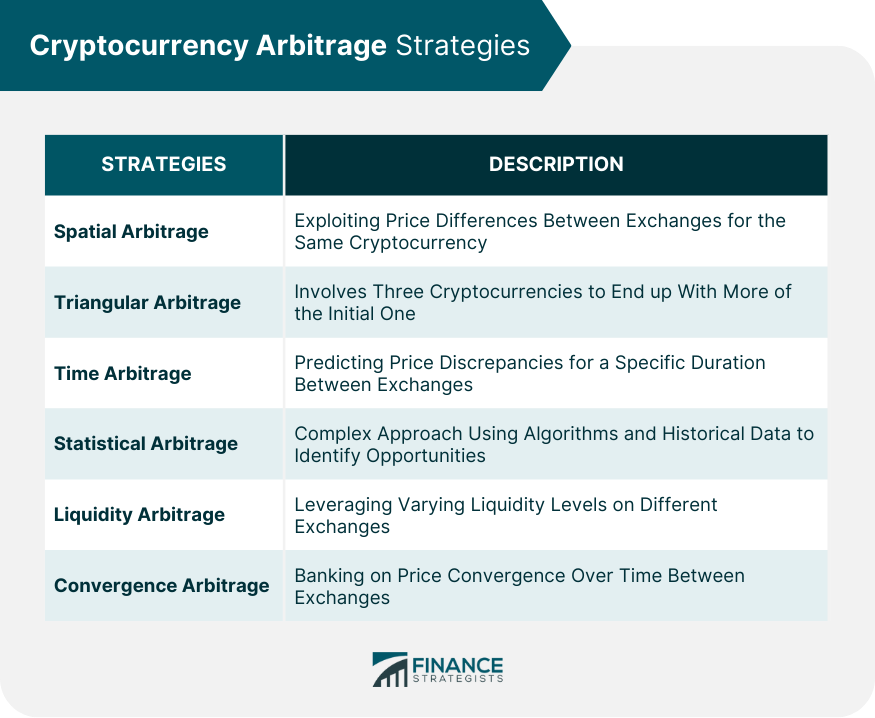

Cryptocurrency Arbitrage Strategies

Spatial Arbitrage

Triangular Arbitrage

Time Arbitrage

Statistical Arbitrage

Liquidity Arbitrage

Convergence Arbitrage

Practical Tips for Cryptocurrency Arbitrage

Conclusion

Cryptocurrency Arbitrage Trading Platform FAQs

A cryptocurrency arbitrage trading platform automates finding price differences across exchanges for specific digital assets, streamlining arbitrage trading for potential profits.

Such platforms gather real-time exchange data via APIs, compare prices, and notify users of arbitrage opportunities, enabling manual action or automatic execution.

These platforms offer up-to-date data, precise price analysis, quick trades, fee calculation, risk management tools, and liquidity checks, optimizing arbitrage strategies and minimizing risks.

Effective use involves starting small, relying on reputable tools, accounting for all costs, diversifying exchanges, prioritizing security, ensuring liquidity, and setting clear exit plans.

Yes, different platforms cater to specific arbitrage types—spatial, triangular, statistical, time, liquidity, and convergence. Some offer comprehensive solutions covering multiple strategies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.