War bonds, also known as defense bonds or liberty bonds, refer to financial instruments issued by governments to finance military operations during times of war. These bonds are typically sold to the public and serve as a means for citizens to lend money to their government. War bonds are a form of government debt, with the promise of repayment plus interest at a specified future date. The funds raised through the sale of war bonds are used to support war efforts, such as purchasing weapons, funding military operations, and financing infrastructure development. War bonds have been utilized by many countries throughout history as a way to mobilize public support and generate financial resources during times of conflict. The primary purpose of war bonds is to finance war-related expenses without causing excessive inflation or depleting the nation's reserves. War bonds also serve to rally public support for the war effort, instilling patriotism and national pride. Liberty Bonds were the first war bonds issued by the United States during World War I. They were sold in four different series between 1917 and 1919, with the goal of raising funds to finance the nation's involvement in the war. Liberty Bonds were advertised through various means, including posters, parades, and celebrity endorsements, to encourage citizens to purchase them. The issuance of Liberty Bonds significantly impacted the US economy during World War I. The bonds helped finance the war effort, leading to increased government spending and economic growth. Additionally, they encouraged Americans to save money, which further stimulated the economy. During World War II, the US government introduced War Savings Bonds, also known as Series E bonds. These bonds were sold at a discount to their face value, and their value would increase over time until reaching maturity. Similar to Liberty Bonds, War Savings Bonds were promoted through various campaigns, such as the famous "Buy War Bonds" posters and advertisements. The issuance of War Savings Bonds played a crucial role in financing World War II for the United States. The bonds provided funds for the military, contributing to the nation's victory in the war. Furthermore, they helped control inflation and promote savings, leading to post-war economic prosperity. During both World Wars, the British government issued war bonds to help finance their military efforts. These bonds, known as War Loan stocks, were sold to the public and offered attractive interest rates. The funds raised through the sale of these bonds played a significant role in financing the British war effort. Similarly, the French government issued war bonds, known as "Bons de la Défense Nationale," during World War I and II. These bonds helped the French government raise funds to support their military campaigns and maintain their economic stability during times of conflict. Fixed-rate war bonds pay a fixed interest rate over the life of the bond. The interest payments are typically made semi-annually and remain unchanged until the bond reaches maturity. Inflation-indexed war bonds are designed to protect investors from the negative effects of inflation. The principal and interest payments of these bonds are adjusted based on changes in inflation rates, ensuring that the bond's real value remains constant over time. Zero-coupon war bonds do not pay regular interest. Instead, they are sold at a discount to their face value and appreciate over time. Upon reaching maturity, the bondholder receives the full face value of the bond. One of the main benefits of investing in war bonds is capital preservation. Since war bonds are backed by the government, they are generally considered a safe investment with a low risk of default. This can make them an attractive option for conservative investors looking to protect their principal. Investing in war bonds can also be a way for individuals to support their country's military efforts and contribute to the overall well-being of the nation. Purchasing war bonds can be seen as a patriotic act, fostering national pride and unity during times of conflict. One potential drawback of investing in war bonds is their limited liquidity. Depending on the specific bond and market conditions, it may be difficult for investors to sell their war bonds before maturity. This could make them a less suitable investment for those who require easy access to their funds. Another risk associated with war bonds is inflation. Fixed-rate war bonds, in particular, may lose value in real terms if inflation outpaces the bond's interest rate. Inflation-indexed war bonds can help mitigate this risk, but they may also offer lower returns compared to other fixed-income investments. As with other fixed-income securities, war bond prices are influenced by changes in interest rates. When interest rates rise, bond prices typically fall, as new bonds issued at higher rates become more attractive to investors. Conversely, when interest rates decline, bond prices generally increase. Although war bonds are backed by the government and considered relatively low-risk investments, changes in the issuing country's credit rating can impact bond prices. If a country's credit rating is downgraded, the perceived risk of holding its bonds may increase, leading to lower bond prices. The time remaining until a war bond's maturity can also affect its price. As a bond approaches maturity, its price generally converges with its face value, reflecting the fact that the bondholder will soon receive the full principal amount. The discounted cash flow (DCF) model is a common tool used to value fixed-income securities, including war bonds. This model calculates the present value of a bond's future cash flows, which include interest payments and the principal repayment at maturity. By discounting these cash flows to the present, the DCF model provides an estimate of the bond's intrinsic value. Yield curve analysis is another method used to value war bonds. This approach involves comparing the yield of a war bond to the yields of other government bonds with similar credit quality and maturities. By analyzing the differences in yields, investors can assess the relative value of war bonds and make informed investment decisions. In the primary market, governments issue new war bonds to raise funds for their military efforts. The issuance process typically involves setting the bond's terms, such as its maturity, interest rate, and face value. Once the terms are established, the government sells the bonds to investors, either through public auctions or private placements. Governments may use various distribution channels to sell war bonds in the primary market. These channels can include banks, brokers, and other financial institutions, as well as online platforms and direct sales to the public. The choice of distribution channels may depend on the specific bond offering and the government's marketing strategy. Once war bonds have been issued, they can be bought and sold in the secondary market. Trading platforms for war bonds may include over-the-counter (OTC) markets, electronic trading systems, or exchanges dedicated to government bonds. The liquidity and ease of trading war bonds in the secondary market may vary depending on factors such as the bond's maturity, credit quality, and market conditions. Participants in the secondary market for war bonds may include individual investors, institutional investors, market makers, and broker-dealers. These market participants trade war bonds for various reasons, such as portfolio rebalancing, speculation, or arbitrage opportunities. In recent years, the concept of war bonds has been adapted to finance humanitarian efforts in conflict-affected regions. These bonds, sometimes referred to as "humanitarian bonds," can help fund projects aimed at providing essential services, such as healthcare, education, and infrastructure, to affected populations. War bonds can also be used to support the welfare of military veterans and their families. Governments can issue bonds specifically designated for funding programs that provide medical care, housing assistance, and educational opportunities for veterans, ensuring that they receive the support they need after their service. Another modern application of war bonds is financing infrastructure development in post-conflict regions. Governments can issue bonds to raise funds for rebuilding damaged infrastructure, such as roads, bridges, and utilities, which are crucial for the economic recovery and long-term stability of these regions. War bonds have a long history of being used by governments to finance military efforts during times of war. They serve as a means for citizens to lend money to their government and support war-related expenses. War bonds have played a significant role in the economies of countries like the United States, where Liberty Bonds and War Savings Bonds helped finance both World Wars, contributing to increased government spending, economic growth, and post-war prosperity. Different types of war bonds, such as fixed-rate, inflation-indexed, and zero-coupon bonds, offer various benefits and risks to investors. Valuation of war bonds takes into account factors like interest rates, credit risk, and time to maturity, using pricing models and yield curve analysis. The war bond market includes both the primary market, where new bonds are issued, and the secondary market, where bonds are traded among participants. Modern applications of war bonds include financing humanitarian efforts, supporting military veterans, and infrastructure development in post-conflict regions.Definition of War Bonds

Purpose of War Bonds

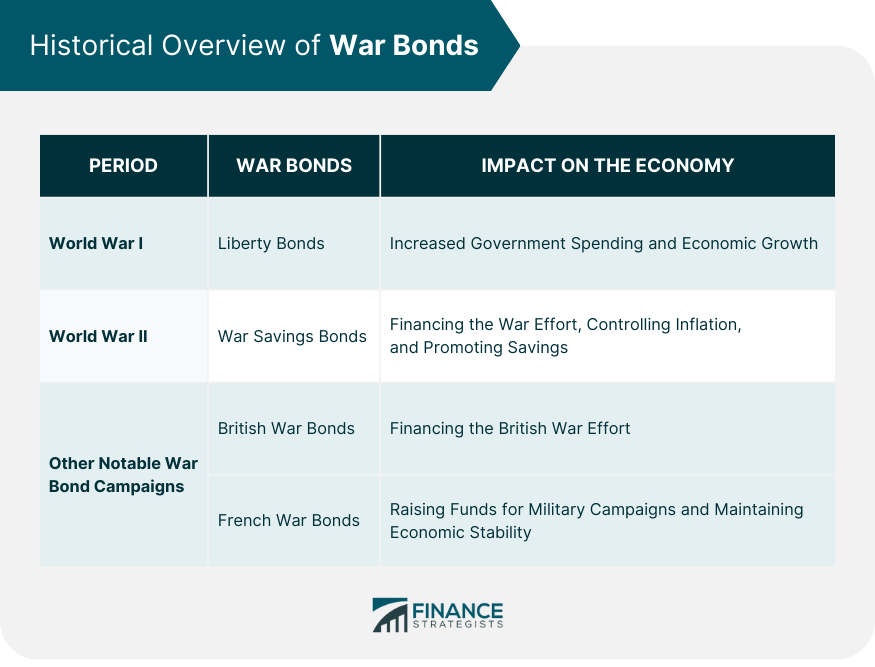

Historical Overview of War Bonds

World War I

Liberty Bonds

Impact on the US Economy

World War II

War Savings Bonds

Impact on the US Economy

Other Notable War Bond Campaigns

British War Bonds

French War Bonds

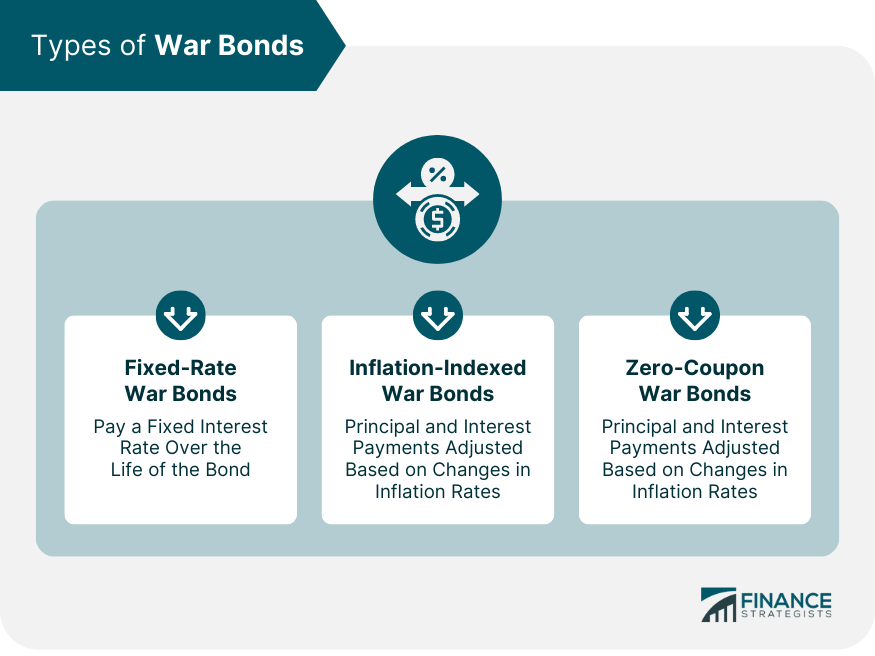

Types of War Bonds

Fixed-Rate War Bonds

Inflation-Indexed War Bonds

Zero-Coupon War Bonds

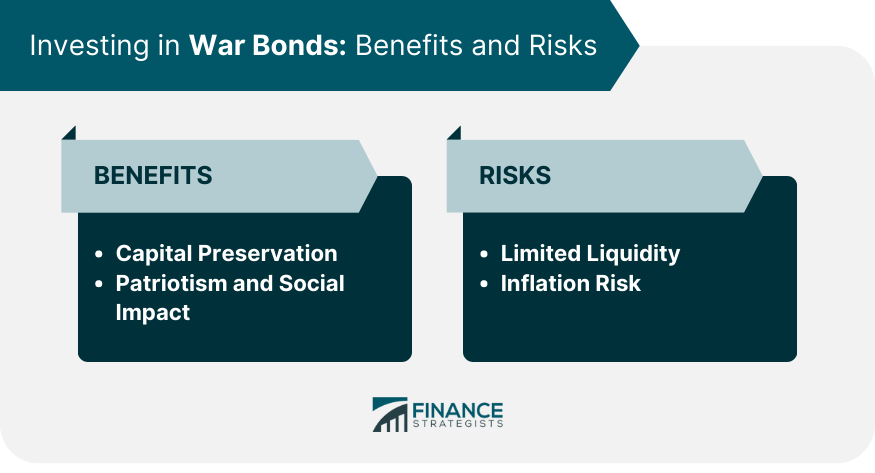

Investing in War Bonds

Benefits and Risks

Capital Preservation

Patriotism and Social Impact

Limited Liquidity

Inflation Risk

War Bond Valuation

Factors Affecting War Bond Prices

Interest Rates

Credit Risk

Time to Maturity

Pricing Models and Tools

Discounted Cash Flow Model

Yield Curve Analysis

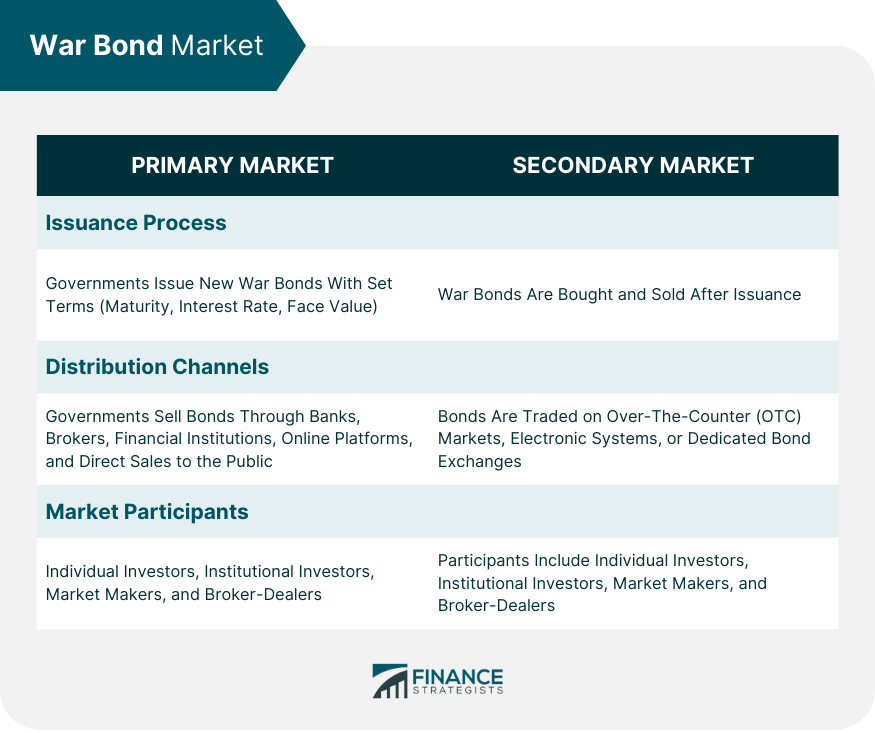

War Bond Market

Primary Market

Issuance Process

Distribution Channels

Secondary Market

Trading Platforms

Market Participants

Modern Applications of War Bonds

Financing Humanitarian Efforts

Supporting Military Veterans

Infrastructure Development

Final Thoughts

War Bonds FAQs

A War Bond is a debt security issued by governments to raise funds for financing military operations and other defense-related expenses during times of war or conflict. The primary purpose of War Bonds is to finance war-related expenses without causing excessive inflation or depleting the nation's reserves while rallying public support for the war effort.

During both World Wars, War Bonds played a significant role in financing the US military efforts. In World War I, Liberty Bonds helped finance the war effort and encouraged Americans to save money, leading to economic growth. In World War II, War Savings Bonds provided funds for the military, helped control inflation, and promoted savings, contributing to post-war economic prosperity.

There are three main types of War Bonds: fixed-rate, inflation-indexed, and zero-coupon war bonds. Fixed-rate War Bonds pay a fixed interest rate over the life of the bond. Inflation-indexed War Bonds have their principal and interest payments adjusted based on changes in inflation rates. Zero-coupon War Bonds do not pay regular interest; instead, they are sold at a discount to their face value and appreciated over time.

Investing in War Bonds offers benefits such as capital preservation, patriotism, and social impact. However, they also carry risks, including limited liquidity and inflation risk. Fixed-rate War Bonds, in particular, may lose value in real terms if inflation outpaces the bond's interest rate.

Modern applications of War Bonds can be used to finance humanitarian efforts in conflict-affected regions, support military veterans' welfare, and fund infrastructure development in post-conflict areas. Humanitarian bonds can fund essential services, while bonds designated for veterans can fund medical care, housing assistance, and educational opportunities. War Bonds can also raise funds for rebuilding damaged infrastructure, promoting economic recovery, and long-term stability.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.