Trust Indenture is a legally binding agreement created between a bond issuer and a trustee appointed to represent the bondholders' interests. This document establishes the terms and conditions of a bond issuance, including the principal amount, interest rate, maturity date, and the rights and responsibilities of each party. The purpose of a trust indenture is to provide a framework for the bond issue and ensure that all parties involved understand their rights, obligations, and limitations. It typically contains provisions related to the payment of principal and interest, the use of bond proceeds, the security pledged for the bond, and the rights of bondholders in case of default or other events. Trust indentures are important instruments that provide clarity, protection, and enforceability for both issuers and bondholders. They establish a contractual relationship that helps build confidence in the bond market and ensures that investors' interests are adequately safeguarded. The concept of trust indentures traces back to the late 19th and early 20th centuries when corporations began to issue bonds as a means of raising capital. Recognizing the need for an intermediary to protect the interests of bondholders, the role of a trustee was established, defined by a trust indenture. The pivotal moment in the history of trust indentures was the Trust Indenture Act of 1939. This legislation was enacted following the stock market crash of 1929, to protect the rights of bondholders. It mandated that all publicly offered bonds must be issued under a trust indenture, overseen by an independent trustee. The primary components of a trust indenture are the parties involved. These include the issuer, who issues the bonds to raise capital, the trustee, who ensures the issuer meets its obligations, and the bondholders, who provide the capital and expect a return on their investment. A trust indenture establishes the key terms and conditions for the bond issuance. These can include the bond’s maturity date, the principal amount to be paid at maturity, the interest rate, payment schedules, and any covenants or restrictions placed on the issuer. The issuer's role is to meet the bond's obligations as outlined in the trust indenture. The trustee ensures these obligations are met and can take action on behalf of bondholders if the issuer defaults. The bondholders, on the other hand, have the responsibility to comply with the terms of the trust indenture. The process begins with the issuer engaging a law firm to draft the trust indenture. Once it is drafted, an independent trustee is appointed to oversee the bond issuance and ensure that the issuer meets its obligations. When the bonds are issued, the issuer delivers the trust indenture to the trustee, laying out the terms of the issuance. The trustee holds the legal title to the bonds and ensures the issuer's compliance with the trust indenture. The trustee has the power to enforce the terms of the trust indenture. If the issuer defaults, the trustee can take action, such as suing the issuer or declaring a default and accelerating the bonds' due date. Trust indentures play a crucial role in corporate bonds. They serve as a contract between the issuer and the trustee on behalf of bondholders. They outline the obligations of the issuer and the rights of bondholders, helping to prevent any misunderstanding or dispute between the parties involved. Trust indentures ensure that the rights of bondholders are protected. They spell out the obligations of the issuer, such as regular interest payments and repayment of principal at maturity. They also give the trustee the power to take action if the issuer defaults. In secured bonds, the trust indenture outlines the collateral backing the bonds. If the issuer defaults, the trustee has the right to take control of this collateral and sell it to repay bondholders. The trust indenture will detail the procedures and conditions under which this can happen. Unsecured bonds are not backed by any collateral. In this case, the trust indenture typically includes negative covenants or restrictions on the issuer to protect bondholders, such as limits on the issuer's ability to incur additional debt. In both secured and unsecured bonds, trust indentures play a pivotal role. However, the difference lies in the level of protection for bondholders. Secured bonds offer a greater level of protection, thanks to the collateral outlined in the trust indenture, while unsecured bonds rely more heavily on the creditworthiness of the issuer. There are several legal implications tied to a trust indenture. For instance, the issuer is legally bound to meet all obligations as outlined in the trust indenture. Failure to do so could lead to legal consequences such as a lawsuit from the trustee. The Trust Indenture Act of 1939 has had a profound impact on the use of trust indentures. It brought in several regulatory measures, including the requirement that all publicly offered bonds must be issued under a trust indenture. When conflicts arise related to trust indentures, they are typically resolved through legal proceedings. For instance, if an issuer fails to meet its obligations, the trustee may sue the issuer to enforce the terms of the trust indenture. One of the significant risks is the potential for issuer default. If the issuer fails to meet its obligations, it could lead to losses for bondholders. Other risks include changes in interest rates and economic conditions that could affect the issuer's ability to fulfill its obligations. Some common challenges include disputes over the terms of the trust indenture and conflicts of interest between the issuer and bondholders. To mitigate these challenges, the trust indenture should be clearly drafted, and parties should engage in regular communication. Furthermore, an experienced and impartial trustee can help balance the interests of all parties. Trust indenture is a critical legal instrument in finance, primarily in the realm of corporate bonds. It serves as a contract between the bond issuer, the trustee, and the bondholders, detailing the obligations of each party. The mechanics of a trust indenture involve drafting the document, issuing the bonds, and enforcing the terms, with the trustee playing a pivotal role in safeguarding bondholders' interests. However, like any financial instrument, trust indentures come with risks and challenges. These include potential issuer default, disputes over terms, and conflicts of interest between the issuer and bondholders. By understanding these aspects of trust indentures, stakeholders can navigate the bond market more effectively, ensuring that financial transactions proceed smoothly and that the interests of all parties are duly upheld.Definition of Trust Indenture

Historical Background of Trust Indentures

Understanding the Components of a Trust Indenture

Involved Parties: Trustee, Issuer, and Bondholder

Essential Terms and Conditions

Roles and Responsibilities of Each Party

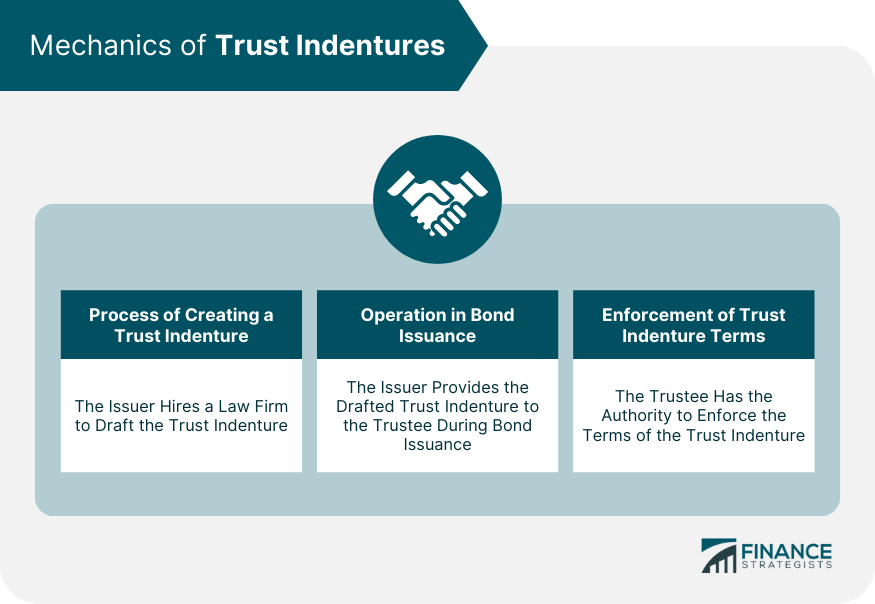

Mechanics of Trust Indentures

Process of Creating a Trust Indenture

How Trust Indentures Work in Bond Issuance

Enforcement of the Terms of the Trust Indenture

Trust Indentures and Corporate Bonds

Role of Trust Indentures in Corporate Bonds

How Trust Indentures Protect the Interests of Bondholders

Trust Indentures and Secured vs Unsecured Bonds

Trust Indentures in the Context of Secured Bonds

Trust Indentures in the Context of Unsecured Bonds

Secured and Unsecured Bonds in Relation to Trust Indentures

Legal Aspects of Trust Indentures

Legal Implications and Responsibilities Under a Trust Indenture

Impact of the Trust Indenture Act of 1939

Conflict Resolution and Litigation Related to Trust Indenture

Risks and Challenges of Trust Indentures

Potential Risks Associated With Trust Indentures

Common Challenges and How to Mitigate Them

Conclusion

Trust Indenture FAQs

A Trust Indenture is a legal document outlining the terms and conditions between a bond issuer and a trustee who represents bondholders' interests. It's crucial in finance as it safeguards bondholders' interests and ensures that issuers meet their obligations.

A Trust Indenture is created when the issuer engages a law firm to draft the document. During bond issuance, the issuer delivers the Trust Indenture to the trustee, outlining the terms of issuance. The trustee holds the legal title to the bonds and ensures the issuer's compliance with the Trust Indenture.

A Trust Indenture outlines the issuer's obligations such as regular interest payments and repayment of principal at maturity. If the issuer defaults, the trustee, empowered by the Trust Indenture, can take action on behalf of bondholders, such as suing the issuer.

Risks associated with a Trust Indenture mainly include potential issuer default and changes in economic conditions or interest rates. Challenges often stem from disputes over the interpretation of Trust Indenture terms and potential conflicts of interest between the issuer and bondholders.

The Trust Indenture Act of 1939 mandates that all publicly offered bonds must be issued under a Trust Indenture, overseen by an independent trustee. This has had a profound impact on the use of Trust Indentures, enhancing the protection of bondholders.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.