PVBP is a pivotal metric in the financial sector. It permeates through the intricate dimensions of the financial landscape, finding its most significant application in the analysis, evaluation, and pricing of fixed-income securities, especially bonds. With its primary function of quantifying the shift in a bond's price against a one-basis point alteration in yield, PVBP provides an exact numerical representation of how interest rate fluctuations may influence a bond's value. It essentially furnishes financial analysts, investors, and traders with a reliable means to estimate potential risk exposure, aiding in more informed and strategic decision-making. The calculation of PVBP is both straightforward and nuanced. It is computed using a basic formula, yet it requires a nuanced understanding of its components: yield, maturity, and coupon rate. The PVBP can be estimated using the following formula: The key components in this formula are yield, maturity, and coupon rate. The yield is the rate of return the investor expects from the bond. The maturity is the remaining time until the bond's principal amount is paid back, and the coupon rate is the annual interest rate paid on the bond. To calculate the PVBP, follow these steps: 1. First, calculate the bond's price at the current yield. 2. Then, calculate the bond's price if the yield were to increase by one basis point. 3. Calculate the bond's price if the yield were to decrease by one basis point. 4. Finally, subtract the price at a higher yield from the price at a lower yield and divide by 2. Consider a bond with a face value of $1000, an annual coupon rate of 5%, a yield of 4%, and five years to maturity. Using a bond pricing model, the bond price at the current yield is $1043.59. If the yield increases by one basis point to 4.01%, the new bond price is $1043.39. Conversely, if the yield decreases by one basis point to 3.99%, the bond price increases to $1043.79. Thus, the PVBP for this bond is ($1043.79 - $1043.39) / 2 = $0.20. PVBP is a crucial measure that has extensive applications in the financial world. In the realm of bond pricing and yield analysis, PVBP is often used to estimate how much the price of a bond will change, given a change in the bond's yield. It enables investors and traders to make more informed decisions about buying and selling bonds. For instance, if the PVBP is high, it suggests that a small change in yield will have a significant impact on the bond price, indicating higher interest rate risk. Moreover, PVBP is also instrumental in yield curve analysis. By comparing the PVBP of different bonds across various maturities and yields, investors can form expectations about future interest rate movements and shape their investment strategies accordingly. In interest rate risk management, PVBP is used in conjunction with duration and convexity measures to provide a more comprehensive picture of a bond's interest rate risk. This use of PVBP is particularly relevant in devising hedging strategies. By knowing the PVBP of a bond, portfolio managers can more accurately assess the potential price impact of interest rate changes and thus devise more effective hedging strategies. Beyond bond pricing, PVBP is also applied in the pricing of other financial instruments, especially those related to fixed-income securities and interest-rate derivatives. For instance, the PVBP of an interest rate swap can provide insight into the swap's value sensitivity to changes in the swap rate. Like any financial measure, PVBP comes with its own assumptions, limitations, and considerations. The PVBP calculation assumes a linear relationship between bond price and yield. However, in reality, this relationship is not strictly linear but is instead convex. This means that the actual change in bond price for a given change in yield may differ slightly from the change predicted by PVBP. One limitation of PVBP is that it only measures the price sensitivity to small changes in yield. For larger changes in yield, the bond price's sensitivity might not be accurately reflected by the PVBP. Despite its limitations, PVBP remains a valuable tool in financial analysis. Its limitations can be mitigated by using it with other measures, such as duration and convexity. Moreover, more sophisticated PVBP measures can be derived to account for the bond price's non-linear sensitivity to yield changes, such as the second-order PVBP or the convexity-adjusted PVBP. PVBP has a crucial role in understanding financial market movements, especially those in bond markets. The PVBP can be a helpful tool in understanding market volatility. In times of market uncertainty, the yields of safe-haven assets like the U.S. Treasury bonds tend to decrease, leading to an increase in their prices. The PVBP can help quantify how much the bond prices are likely to increase, given the decrease in yields. Moreover, PVBP can shed light on the expected effects of monetary policy changes. When a central bank changes its policy rate, it causes a shift in the yield curve, which, in turn, impacts bond prices. The PVBP can help quantify these price impacts. There are several advanced concepts related to PVBP, such as its relationship with DV01, cross-currency PVBP, and PVBP in a multi-curve framework. DV01, or Dollar Value of 01, is a measure that is closely related to PVBP. It represents the absolute change in the price of a bond or a portfolio of bonds for a one basis point change in yield. In essence, DV01 is PVBP scaled by the face value of the bond or the portfolio's total value. Cross-currency PVBP refers to the PVBP of a bond denominated in a foreign currency. It takes into account the effects of foreign exchange rate movements on the bond's PVBP. In a multi-curve framework, different interest rate curves are used for different maturities or different types of bonds. In this context, PVBP can provide insights into how changes in different interest rate curves impact bond prices. Price Value of a Basis Point is a significant concept in the world of finance, primarily used in bond valuation and interest rate risk analysis. It quantifies the change in the price of a bond or a bond portfolio for a one basis point (0.01%) change in yield. PVBP is calculated using the price of the bond at a one basis point higher and lower yield, with the difference divided by two. The calculation provides a numerical representation of a bond's interest rate risk or the sensitivity of its price to changes in yield. This measure finds applications in a variety of financial contexts. It aids in bond pricing, yield analysis, interest rate risk management, and pricing of various financial instruments. Despite certain limitations, like the assumption of a linear relationship between bond price and yield, PVBP remains an invaluable tool for investors, traders, and financial analysts in navigating the complex landscape of financial markets.Price Value of a Basis Point (PVBP): Overview

Calculation of PVBP

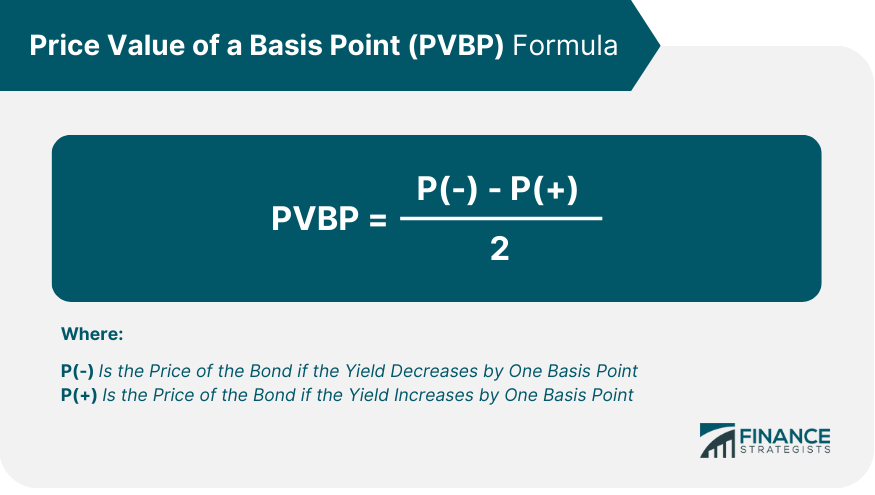

Formula and Its Components

Detailed Steps in the Calculation

Examples of PVBP Calculation

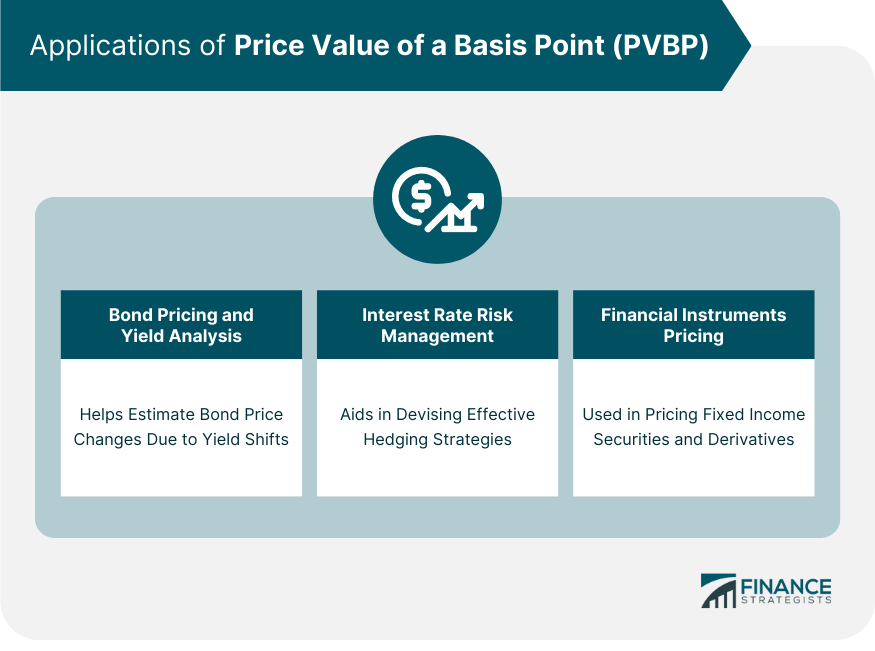

Applications of PVBP

Bond Pricing and Yield Analysis

Interest Rate Risk Management

Financial Instruments Pricing

Limitations and Considerations of PVBP

Assumptions in PVBP Calculation

Limitations of PVBP

How to Address the Limitations

Role of PVBP in Financial Market Movements

PVBP and Market Volatility

PVBP and Monetary Policy

Advanced Concepts Related to PVBP

Relationship Between PVBP and DV01

Cross-Currency PVBP

PVBP in a Multi-Curve Framework

Conclusion

Price Value of a Basis Point (PVBP) FAQs

The Price Value of a Basis Point (PVBP) is a measure used to estimate the change in the price of a bond for a one basis point change in yield. It's important because it enables investors, traders, and financial analysts to estimate the potential risk exposure to interest rate fluctuations.

PVBP is calculated using the formula PVBP = (P(-) - P(+)) / 2, where P(-) is the price of the bond if the yield decreases by one basis point, and P(+) is the price of the bond if the yield increases by one basis point.

PVBP has several applications, including bond pricing and yield analysis, interest rate risk management, and pricing of financial instruments, especially those related to fixed-income securities and interest rate derivatives.

PVBP assumes a linear relationship between bond price and yield, whereas the actual relationship is convex. This means that PVBP might not accurately reflect the bond price's sensitivity to larger changes in yield. Nonetheless, these limitations can be addressed using PVBP in conjunction with other measures, such as duration and convexity.

PVBP is a crucial measure for understanding financial market movements, particularly in bond markets. It can be used to study the impact of changes in yield on bond prices, thus providing insights into market volatility and the expected effects of monetary policy changes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.