Harmless warrants are contractual provisions in a bond's contract that requires bondholders to surrender their existing bond to the issuer if they want to buy another bond with similar features from the same issuer. Unlike traditional warrants, which grant the right to purchase a company's stock at a specific price and time, harmless warrants are not separate financial instruments. Instead, they are added to certain bonds to manage the issuer's debt level. In financial markets, harmless warrants play a crucial role in debt management for issuers. By discouraging bondholders from accumulating too many similar bonds, issuers can maintain manageable debt levels amidst the increasing frequency of bond issuance. Harmless warrants impact the bond market by promoting portfolio diversity among investors, as they are compelled to choose between bonds from different issuers. This dynamic choice enhances the bond market by encouraging a mix of terms and issuers in investors' portfolios. The operation of a harmless warrant is grounded in its contractual stipulations. When a bondholder decides to purchase another bond with similar features from the same issuer, the harmless warrant is triggered. The bondholder must then surrender their existing bond back to the issuer to complete the purchase. Importantly, this provision does not prevent bondholders from buying different types of bonds from the same issuer. The warrant only applies if the purchased bond's features closely mirror those of the bondholder's existing bond. Bondholders play an active part in the functioning of harmless warrants. The responsibility falls on them to decide which bond they prefer when they are considering purchasing a bond that would trigger a harmless warrant. This decision-making process requires the bondholder to thoroughly evaluate their current bond against the prospective bond. Such an evaluation might include comparing interest rates, the bond’s term, and other conditions. In the context of harmless warrants, the interaction between issuers and bondholders becomes crucial. For the issuer, the harmless warrant provides an opportunity to manage its debt levels by controlling the number of similar bonds held by a single bondholder. For the bondholder, the harmless warrant becomes a determinant in their bond purchase decisions. It forces the bondholder to evaluate their preference between similar bonds from the same issuer, prompting a more thoughtful investment decision process. While harmless warrants can be attached to any type of bond, they are most commonly found in municipal bonds and corporate bonds. For example, a company issuing new corporate bonds might include a harmless warrant to prevent a single investor from holding too many of its bonds. This application of the harmless warrant helps the company manage its debt and maintain financial stability. Likewise, municipal governments might use harmless warrants when issuing municipal bonds to fund public projects. By including a harmless warrant, the municipal government can ensure that its debt from bond issuance is controlled and manageable. When issuing bonds, corporate entities or municipal governments effectively take on debt, which they are obligated to repay at a future date. The influx of cash is beneficial for immediate funding needs but can become a burden if the debt level is unchecked. When bondholders decide to purchase a new bond of similar features from the same issuer, the warrant is activated. The bondholder must then surrender their current bond to the issuer, thereby allowing the issuer to maintain the debt at the original level instead of increasing it. In effect, the harmless warrant acts as a counterbalance, preventing issuers from drowning in their own debt. This makes the warrant an attractive tool for issuers, particularly those that frequently issue bonds as part of their financing strategy. Without a harmless warrant provision, a bondholder might hoard bonds of similar features from the same issuer. While this may suit the bondholder's investment strategy, it poses a risk to the issuer by concentrating too much of their debt in the hands of a single investor. The presence of a harmless warrant discourages this concentration. By necessitating a choice for the bondholder when they wish to purchase similar bonds from the same issuer, the warrant indirectly promotes diversification. This could drive bondholders to explore other bonds from the issuer that offer different features or even bonds from different issuers. Diversification is beneficial not only for the bondholder but also for the wider bond market. It encourages a healthier financial ecosystem, preventing the undue accumulation of debt, and fostering an environment conducive to the steady growth of bond issuers and attractive returns for bondholders. An issuer struggling under the weight of unmanageable debt can face serious consequences, including insolvency. By helping issuers control their debt, harmless warrants indirectly contribute to their financial stability. This stability, in turn, has a positive effect on market confidence. Investors, aware of the protective role of harmless warrants, might perceive the issuer as being more reliable and responsible, fostering increased trust in the issuer. This trust can translate into a stronger bond market, with more robust trading activity and potentially better rates for issuers. On the beneficial side, the existence of a harmless warrant can give investors confidence in the financial stability of the issuer, as it demonstrates their proactive approach to managing their debt levels. This confidence could potentially translate into a lower risk for the bondholder and could enhance the attractiveness of the bond as an investment. However, harmless warrants also impose certain restrictions on bondholders. The requirement to surrender an existing bond to purchase a similar one can limit the bondholder's flexibility and freedom in managing their investment portfolio. Moreover, this restriction could potentially lead to the loss of a profitable investment if the bondholder is forced to surrender a high-yielding bond for a new one with a lower yield. Harmless warrants can significantly impact the investment decisions of bondholders. The existence of these warrants can force bondholders to be more discerning and strategic in their bond selection. This could involve closely examining the terms and conditions of each bond, assessing their own investment objectives and risk tolerance, and making more informed decisions based on these factors. On the downside, this could potentially complicate the investment process for bondholders and require them to devote more time and resources to investment planning and decision-making. However, on the upside, it could lead to more sound investment strategies and potentially better investment outcomes. Harmless warrants also have a direct influence on the bond purchase choices of investors. By requiring the surrender of an existing bond for the purchase of a similar one, these warrants force bondholders to choose between bonds. This could lead to more diverse investment portfolios as bondholders may opt to purchase bonds with different features or from different issuers to avoid activating the harmless warrant. By shaping the investment strategies and choices of bondholders, harmless warrants indirectly influence market behavior. They can drive bondholders to diversify their investments, which can lead to more dynamic and varied trading activity in the bond market. This can enhance market liquidity and potentially lead to better pricing for bonds. Harmless warrants also play a crucial role in bond market dynamics. By helping to manage the debt levels of issuers, they contribute to the overall stability of the bond market. Moreover, their influence on the investment strategies and choices of bondholders can contribute to the dynamism and diversity of the market. While the direct impact of harmless warrants is confined to the bond market, their effects can potentially extend to other financial instruments and practices. For instance, the heightened scrutiny of bond terms and conditions prompted by harmless warrants can encourage more careful evaluation of other types of investments. Furthermore, the emphasis on diversification can spur broader adoption of diversification as an investment strategy. Thus, harmless warrants, while seemingly a small feature of bond contracts, can have far-reaching implications in the financial sector. Harmless warrants are bond contract provisions requiring bondholders to surrender an existing bond to purchase a similar one from the same issuer. These warrants aid issuers in managing debt levels and fostering a diverse bond market. Their use stems from the aim to maintain manageable debt, encourage market diversity, and ensure financial stability. While they impose restrictions on bondholders, harmless warrants foster thoughtful investment decisions and diverse bond portfolios. They also impact market behavior, influencing bond dynamics and potentially affecting other financial instruments. Their presence underscores the importance of careful investment planning and diversification. As a bondholder or prospective investor, understanding their implications is crucial. Seek professional wealth management services if unsure about how these provisions might impact your investment strategy. Experienced financial advisors can assist in navigating the complexities of bond investing and devising a strategy aligned with your financial goals.What Are Harmless Warrants?

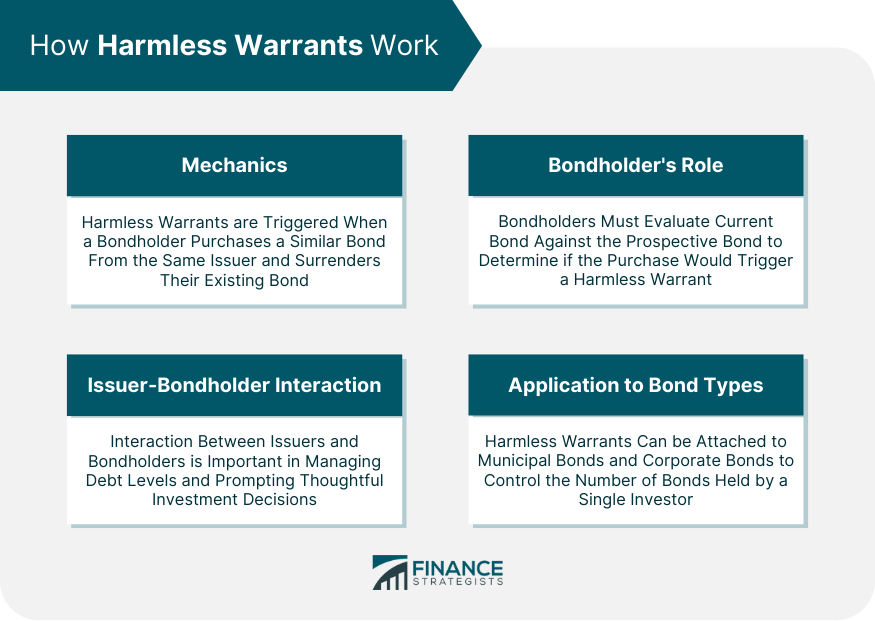

Understanding How Harmless Warrants Work

Mechanics of Harmless Warrants

Role of Bondholders in Harmless Warrants

Interaction Between Issuers and Bondholders Under Harmless Warrant Rules

Application of Harmless Warrants to Different Bond Types

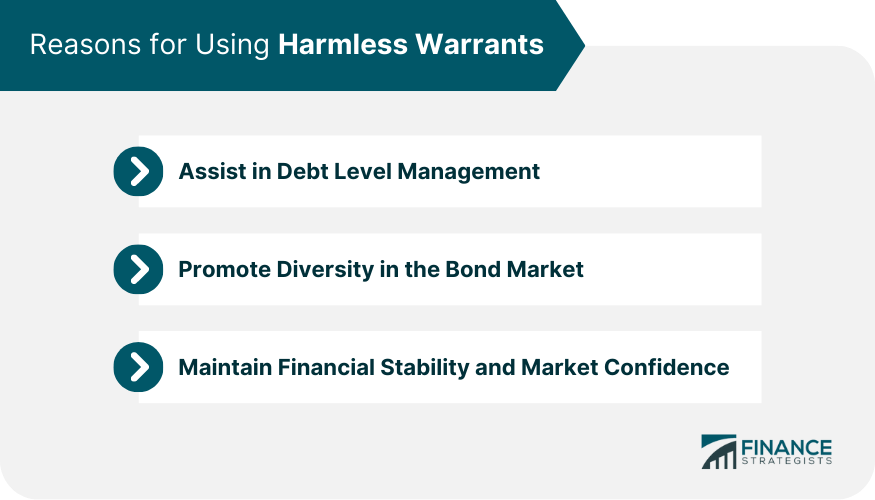

Reasons for Using Harmless Warrants

Assisting in Debt Level Management

Promoting Diversity in the Bond Market

Maintaining Financial Stability and Market Confidence

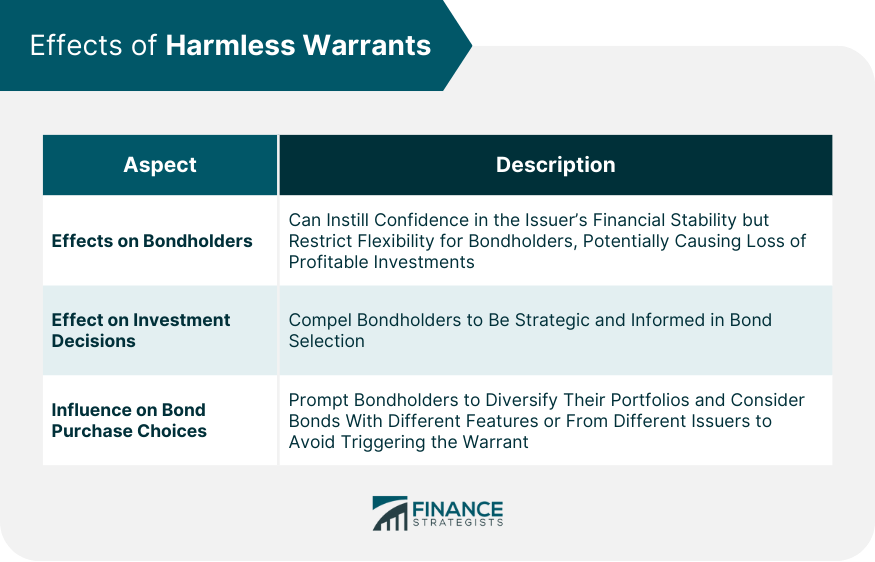

Effects of Harmless Warrants

Effects on Bondholders

Effect on Investment Decisions

Influence of Harmless Warrants on Bond Purchase Choices

Wider Implications of Harmless Warrants in the Financial Sector

Influence on Market Behavior

Role in Bond Market Dynamics

Effect on Other Financial Instruments and Practices

Final Thoughts

Harmless Warrants FAQs

Harmless warrants are provisions in bond contracts that require bondholders to surrender an existing bond if they wish to purchase a similar bond from the same issuer.

When a bondholder decides to purchase another bond of similar features from the same issuer, the harmless warrant is triggered. The bondholder must then surrender their existing bond back to the issuer.

Issuers use harmless warrants as a tool to manage their debt levels. It prevents an issuer from taking on too much debt by controlling the number of similar bonds held by a single bondholder.

Harmless warrants can both benefit and disadvantage bondholders. While they contribute to more informed investment decisions and diverse portfolios, they can also limit a bondholder's flexibility in their investment choices.

Yes, harmless warrants can indirectly influence market behavior, bond market dynamics, and potentially other financial instruments and practices.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.