A fidelity bond is a type of insurance policy that protects businesses from financial losses caused by fraudulent activities committed by their employees. These activities may include embezzlement, theft, forgery, or other types of dishonest behavior. These bonds provide coverage for losses resulting from employee dishonesty and can help businesses recover from these losses by providing financial compensation. Fidelity bonds are particularly important for businesses with employees who handle money, have access to sensitive data, or are in a position of trust. There are different types of fidelity bonds that businesses can purchase depending on their specific needs. The most common types of fidelity bonds include: These are the most common types of fidelity bonds that businesses purchase. They cover losses caused by dishonest or fraudulent activities committed by employees, such as theft, embezzlement, or forgery. These are fidelity bonds specifically designed for financial institutions such as banks, credit unions, and insurance companies. They cover losses resulting from fraudulent activities such as theft of securities, forgery, or embezzlement. These bonds are required by the Employee Retirement Income Security Act (ERISA) for businesses that manage employee benefit plans. They provide protection against losses caused by fraudulent activities committed by plan fiduciaries. Fidelity bonds are different from other types of insurance policies, such as general liability or property insurance. While general liability insurance covers losses resulting from accidents or injuries that occur on a business's premises, fidelity bonds provide protection against losses caused by employee dishonesty or fraudulent activities. One of the most significant benefits of fidelity bonds is protection against employee dishonesty. Employee dishonesty can lead to significant financial losses for businesses, especially for small businesses that may not have the resources to recover from such losses. Fidelity bonds can help businesses recover from these losses by providing financial compensation for losses resulting from employee dishonesty, embezzlement, or theft. By having a fidelity bond in place, businesses can protect themselves from financial ruin and ensure that their operations continue uninterrupted. Fidelity bonds provide business owners with financial security and peace of mind knowing that their business is protected against losses resulting from employee dishonesty. This protection can be particularly valuable for small business owners who may not have the resources to recover from significant financial losses. Fidelity bonds can also provide protection against losses caused by other forms of fraudulent activities, such as forgery or cybercrime. For example, if an employee forges a check, a fidelity bond can provide financial compensation for the resulting loss. Similarly, if an employee steals sensitive data or causes damage to a business's computer systems, a fidelity bond can provide coverage for these losses. Businesses that handle cash or other financial instruments, such as checks or credit card information, should consider purchasing a fidelity bond. These businesses include retail stores, banks, financial institutions, and any other business that deals with money on a regular basis. Fidelity bonds can provide protection against employee theft or embezzlement of funds. Businesses that handle sensitive data, such as personal information, trade secrets, or intellectual property, should also consider purchasing a fidelity bond. Employees who have access to this type of information may be tempted to sell it or use it for personal gain. Fidelity bonds can provide protection against losses resulting from these activities. Non-profit organizations are also vulnerable to losses resulting from employee dishonesty. These organizations may have volunteers or employees who handle donations, which can be susceptible to theft or embezzlement. Fidelity bonds can provide financial protection for these organizations, ensuring that donations are used as intended. To obtain a fidelity bond, businesses must first determine the coverage they need and the amount of coverage required. Fidelity bond coverage typically ranges from $25,000 to $1 million or more, depending on the size of the business and the risks involved. Once the coverage amount is determined, businesses must find a reputable insurance company that offers fidelity bonds. The insurance company will typically require a completed application, financial statements, and other documentation to determine the business's risk level and premium rate. Once the application is approved, the business must pay the premium, and the insurance company will issue the fidelity bond. The bond will outline the coverage and limitations of the bond, as well as the premium rate and any deductibles. Fidelity bonds typically cover losses resulting from employee dishonesty, theft, or embezzlement. However, there are limitations to what is covered by the bond. For example, most fidelity bonds do not cover losses resulting from errors or omissions, such as accidental damage to property or mistakes in financial reporting. Fidelity bonds also have limits on the amount of coverage provided. The amount of coverage is determined by the premium paid, and businesses must ensure that the coverage amount is sufficient to cover potential losses. If a loss occurs, the business must file a claim with the insurance company. The claim process typically involves providing documentation of the loss, such as police reports or financial statements. Once the claim is approved, the insurance company will provide financial compensation for the loss, up to the coverage limit of the fidelity bond. The cost of a fidelity bond varies depending on several factors, including the amount of coverage needed, the type of business, and the risk level of the business. For example, a business that handles large sums of money may have a higher risk level and, therefore, a higher premium rate. Other factors that may influence the cost of a fidelity bond include the number of employees, the business's financial stability, and the level of security measures in place to prevent losses. While the cost of a fidelity bond may seem high, it is important to consider the potential cost of losses resulting from employee dishonesty. According to the Association of Certified Fraud Examiners, businesses lose an average of 5% of their annual revenue to fraud each year. For example, a business with $1 million in revenue could potentially lose $50,000 to fraud each year. In this scenario, the cost of a fidelity bond, which typically ranges from 0.5% to 2% of the coverage amount, would be significantly less than the potential losses due to employee dishonesty. Fidelity bonds are often compared to commercial crime insurance, as both types of insurance provide protection against losses resulting from employee dishonesty or fraud. However, there are some key differences between the two types of insurance. Fidelity bonds are specific types of insurance policies that are designed to cover losses resulting from employee dishonesty. They are typically purchased by businesses with employees who handle money or have access to sensitive data. Fidelity bonds provide coverage for losses resulting from theft, embezzlement, forgery, or other types of fraudulent activities committed by employees. Commercial crime insurance, on the other hand, is a broader type of insurance that provides coverage for a wide range of criminal activities, including theft, burglary, and robbery. Commercial crime insurance can provide coverage for losses resulting from external or internal theft, and it can be customized to meet the specific needs of a business. While fidelity bonds and commercial crime insurance are different types of insurance policies, they can work together to provide complete coverage for a business. By purchasing both types of insurance, businesses can ensure that they are protected against a wide range of criminal activities. For example, a business may purchase a fidelity bond to provide protection against losses resulting from employee dishonesty, while also purchasing commercial crime insurance to provide coverage for losses resulting from external theft or other criminal activities. Fidelity bonds are a vital aspect of risk management for businesses of all sizes. These insurance policies provide protection against financial losses resulting from employee dishonesty, embezzlement, and other fraudulent activities. Companies that handle money or have employees with access to sensitive information should strongly consider purchasing a fidelity bond to protect against potential financial losses. While the cost of a fidelity bond may seem high, it is essential to consider the potential cost of losses resulting from employee dishonesty or fraud. The average business loses about 5% of its revenue each year due to fraud. Investing in a fidelity bond is a wise decision to protect against these potential losses and ensure business continuity. As businesses continue to face new types of risks, such as cybercrime, we can expect to see more advanced forms of fidelity bonds. It is crucial for businesses to stay up to date on these developments and adjust their insurance policies accordingly. In summary, fidelity bonds are an important tool for businesses to protect against financial losses, and businesses should carefully consider their need for such insurance.What Is a Fidelity Bond?

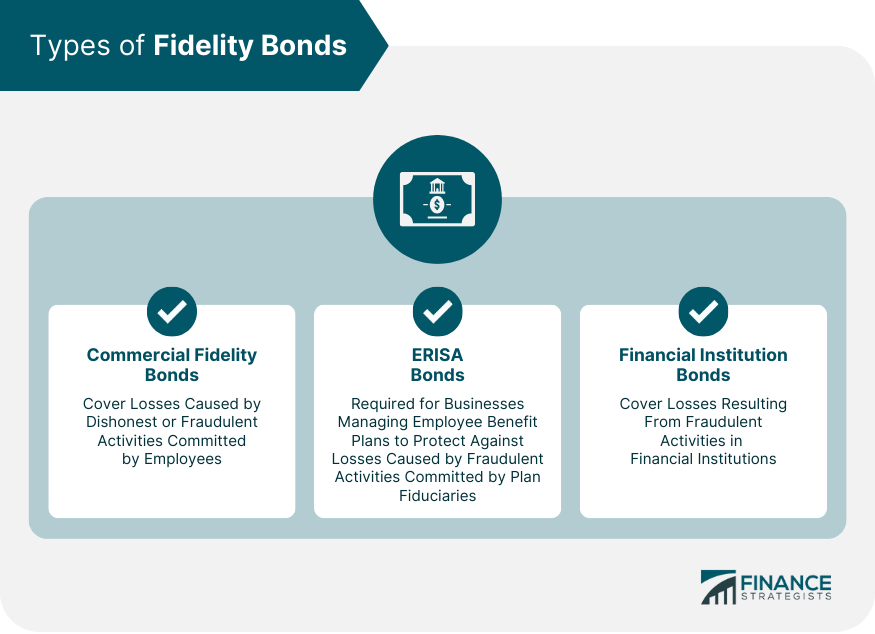

Types of Fidelity Bonds

Commercial Fidelity Bonds

Financial Institution Bonds

ERISA Bonds

Differences Between Fidelity Bonds and Other Types of Insurance

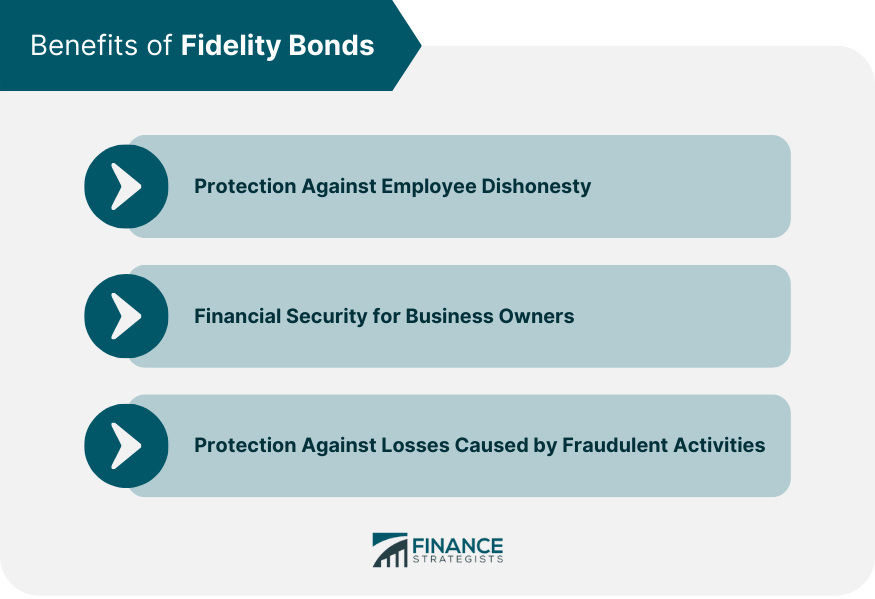

Benefits of Fidelity Bonds

Protection Against Employee Dishonesty

Financial Security for Business Owners

Protection Against Losses Caused by Fraudulent Activities

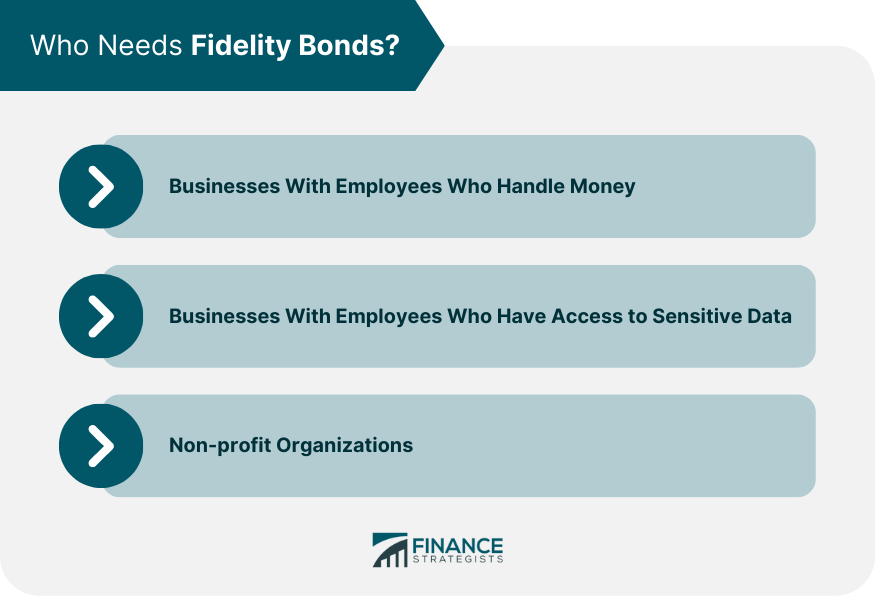

Who Needs Fidelity Bonds

Businesses With Employees Who Handle Money

Businesses With Employees Who Have Access to Sensitive Data

Non-profit Organizations

How Fidelity Bonds Work

Steps to Obtaining a Fidelity Bond

Coverage and Limitations of a Fidelity Bond

Claim Process for Fidelity Bonds

Cost of Fidelity Bonds

Factors that Influence the Cost of a Fidelity Bond

Cost of a Fidelity Bond vs Cost of Losses Due to Employee Dishonesty

Fidelity Bond vs Insurance

Differences Between Fidelity Bonds and Commercial Crime Insurance

How They Can Work Together to Provide Complete Coverage

Conclusion

Fidelity Bond FAQs

A fidelity bond is a type of insurance policy that protects a business from financial losses resulting from fraudulent or dishonest acts committed by employees.

Any business that employs individuals who handle money or valuable assets should consider purchasing a fidelity bond to protect against losses due to employee dishonesty.

If an employee covered by a fidelity bond commits a fraudulent or dishonest act that results in financial loss for the business, the insurance company will provide compensation up to the limit of coverage specified in the policy.

A fidelity bond typically covers losses resulting from employee theft, embezzlement, forgery, and other fraudulent or dishonest acts committed by employees.

The amount of coverage needed for a fidelity bond varies depending on the size of the business, the number of employees, and the amount of money or valuable assets being handled. A business owner should consult with an insurance agent to determine the appropriate level of coverage.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.