An ERISA bond is a type of fidelity bond that is required by the Employee Retirement Income Security Act (ERISA) for employee benefit plans. The purpose of an ERISA bond is to protect the plan participants from losses resulting from fraudulent or dishonest acts committed by plan officials. These acts can include theft, embezzlement, misappropriation, or other criminal or fraudulent activities. The bond provides coverage up to a specified amount and typically must be equal to at least 10% of the plan's total assets, up to a maximum of $1,000,000 in some cases. An ERISA bond must be obtained by any person or entity that handles the funds or property of an employee benefit plan covered by ERISA, including plan administrators, trustees, and other fiduciaries. The responsibility for obtaining the bond typically falls on the plan sponsor or administrator, although the cost of the bond may be paid from plan assets. ERISA was enacted in 1974 to establish minimum standards for pension and welfare benefit plans offered by private employers in the United States. The legislation has undergone several amendments and key changes over the years, including the addition of various provisions that address the evolving needs of plan participants and beneficiaries. The main objectives of ERISA are to protect the interests of employees who participate in pension and welfare benefit plans and to establish minimum standards for the administration of these plans. This is achieved by providing clear guidelines for plan sponsors, administrators, and fiduciaries, as well as ensuring transparency and accountability. ERISA Bonds are required for most pension and welfare benefit plans. This includes defined benefit plans, defined contribution plans, and health and welfare plans. However, some plans, such as governmental and church plans, are exempt from ERISA Bond requirements. The required bond amount is generally equal to 10% of the plan's assets, with a minimum bond amount of $1,000 and a maximum bond amount of $500,000. In certain cases, the maximum bond amount may be increased to $1,000,000. Certain plans are exempt from ERISA Bond requirements, including non-qualifying plans, governmental plans, and church plans. These exemptions are based on the nature of the plan and its sponsoring organization. ERISA Bonds provide financial protection for plan participants and beneficiaries in the event of losses resulting from fraud or dishonest acts committed by plan officials. If a plan official's dishonest actions lead to a financial loss, the ERISA Bond ensures that the plan can recover those losses, providing financial security for plan participants and beneficiaries. By requiring ERISA Bonds, plan sponsors and administrators are encouraged to manage their plans responsibly, knowing that they may be held financially accountable for any fraudulent or dishonest actions. While ERISA Bonds play a crucial role in protecting the interests of plan participants and beneficiaries, there are also some drawbacks associated with these bonds. ERISA Bonds come with a financial cost in the form of premiums, which can be a burden for some plan sponsors and administrators, particularly small businesses or those with limited resources. The cost of obtaining and maintaining an ERISA Bond can be especially challenging when combined with other administrative and regulatory costs associated with managing employee benefit plans. ERISA Bonds provide coverage for losses resulting from fraud or dishonest acts committed by plan officials; however, they do not cover other types of losses, such as those due to market fluctuations, poor investment decisions, or negligence. Plan sponsors and administrators must still ensure that adequate risk management measures are in place to protect plan assets from other potential threats. The presence of an ERISA Bond may create a false sense of security for some plan sponsors and administrators, leading to complacency in implementing robust internal controls and monitoring systems. This over-reliance on the bond can increase the risk of undetected fraud or dishonest activity within the plan, ultimately causing harm to plan participants and beneficiaries. Navigating the process of obtaining and maintaining an ERISA Bond, as well as dealing with claims, can be complex and time-consuming. Plan sponsors and administrators must stay informed of changes in ERISA regulations and bond requirements, adding to the overall administrative burden associated with managing employee benefit plans. To secure an ERISA Bond, plan sponsors or administrators must first find a suitable surety company that provides ERISA Bonds. Next, they must complete an application, which typically includes providing information about the plan and its assets. The surety company will then assess the risk and determine the bond premium. Several factors may affect the bond premium, including the size of the plan, the plan's financial history, and the applicant's credit score. A higher-risk plan or applicant may result in a higher bond premium. If plan sponsors or administrators suspect a potential claim, they must promptly report the matter to the surety company. Timely reporting is crucial to ensure proper investigation and recovery of losses. Upon receiving a claim, the surety company will conduct a thorough investigation to determine the validity of the claim and assess the extent of the loss. If the investigation confirms that a valid claim exists, the surety company will compensate the plan for the losses incurred due to the fraudulent or dishonest actions of the plan official. The surety company may then pursue legal action against the responsible individual(s) to recover the funds paid out to the plan. The Department of Labor (DOL) plays a critical role in overseeing ERISA compliance and enforcement. The DOL's Employee Benefits Security Administration (EBSA) is responsible for ensuring that plan sponsors, administrators, and fiduciaries adhere to ERISA regulations, including the requirement to obtain an ERISA Bond. Failure to comply with ERISA Bond requirements can result in significant penalties imposed by the DOL. These may include fines, penalties, and even criminal charges in cases of severe non-compliance. To maintain ERISA Bond compliance, plan sponsors and administrators should: Ensure that the correct bond amount is in place, taking into account any changes in plan assets or ERISA regulations. Regularly review and update bond coverage to ensure it remains adequate. Keep accurate records of plan assets and transactions. Implement strong internal controls to prevent fraud or dishonest acts. Report any suspected fraudulent or dishonest activity to the surety company promptly. The ERISA Bond is an essential component of the Employee Retirement Income Security Act, providing financial security for plan participants and beneficiaries while encouraging responsible plan management. By understanding ERISA Bond requirements, benefits, and compliance measures, plan sponsors, administrators, and fiduciaries can better protect the interests of their employees and ensure the long-term success of their benefit plans. As the regulatory landscape evolves, staying informed of changes and developments in ERISA regulations is crucial for maintaining compliance and safeguarding the financial well-being of plan participants and beneficiaries.What Is an Employee Retirement Income Security Act (ERISA) Bond?

Background of ERISA

History of the Employee Retirement Income Security Act

Objectives of ERISA

ERISA Bond Requirements

Types of Plans That Require ERISA Bonds

Bond Amount Determination

Exceptions and Exemptions

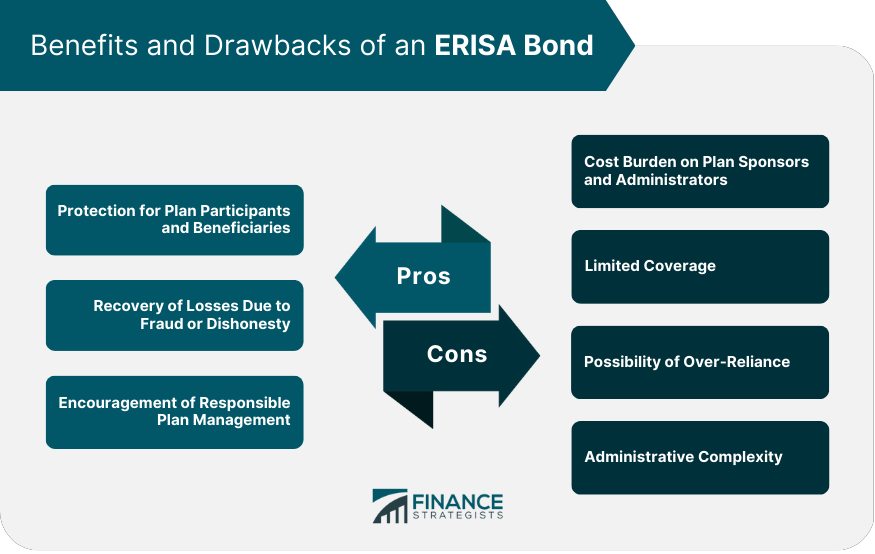

Benefits of ERISA Bonds

Protection for Plan Participants and Beneficiaries

Recovery of Losses Due to Fraud or Dishonesty

Encouragement of Responsible Plan Management

Drawbacks of ERISA Bonds

Cost Burden on Plan Sponsors and Administrators

Limited Coverage

Possibility of Over-Reliance

Administrative Complexity

Obtaining an ERISA Bond

Process of Securing an ERISA Bond

Factors Affecting Bond Premiums

ERISA Bond Claims

Identifying and Reporting Potential Claims

Investigation Process

Compensation and Recovery of Losses

Compliance and Enforcement

Role of the Department of Labor (DOL)

Penalties for Non-compliance

Best Practices for Maintaining ERISA Bond Compliance

Conclusion

Employee Retirement Income Security Act (ERISA) Bond FAQs

An ERISA bond is a type of fidelity bond that is required by the Employee Retirement Income Security Act (ERISA). This bond provides protection for employee benefit plans against losses caused by acts of fraud or dishonesty on the part of plan officials, such as theft or embezzlement.

Any person or entity that handles the funds or property of an employee benefit plan covered by ERISA is required to have an ERISA bond. This includes plan administrators, trustees, and other fiduciaries.

An ERISA bond provides coverage for losses resulting from fraudulent or dishonest acts committed by plan officials. This includes theft, embezzlement, misappropriation, or other fraudulent or criminal activities.

The amount of coverage required under ERISA varies depending on the size of the plan and the amount of assets it holds. Generally, the bond must provide coverage equal to at least 10% of the total assets of the plan, up to a maximum of $1,000,000.

The responsibility for obtaining an ERISA bond typically falls on the plan sponsor or administrator. However, the cost of the bond may be paid from plan assets, and plan officials may be held personally liable for any losses that are not covered by the bond.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.