A bill auction refers to the process of selling real estate properties through an auction format, where interested buyers bid on the properties to determine the final sale price. It is a method commonly used in real estate investment to facilitate the sale of properties in a competitive and transparent manner. Bill auctions play a significant role in real estate investment by providing investors with an opportunity to acquire properties at potentially favorable prices. These auctions create a competitive environment where buyers can submit their bids, which can lead to a fair market value determination for the property. Bill auctions also offer a streamlined transaction process, allowing investors to quickly complete the purchase of properties. Absolute auctions are a type of bill auction where the property is sold to the highest bidder, regardless of the bid amount. In this type of auction, there is no minimum bid or reserve price set. The property is awarded to the bidder with the highest offer, making it a highly competitive and potentially rewarding option for investors. Minimum bid auctions involve setting a minimum bid price for the property. Interested buyers must meet or exceed this minimum bid amount to participate in the auction. If the minimum bid is not met, the property may be withdrawn from the auction. Minimum bid auctions provide some level of assurance that the property will not be sold below a certain predetermined price. Reserve auctions are similar to minimum bid auctions, but with an additional feature known as a reserve price. The reserve price is the minimum amount that the seller is willing to accept for the property. If the highest bid does not meet or exceed the reserve price, the property may not be sold. Reserve auctions allow sellers to maintain some control over the final sale price while still benefiting from the competitive bidding process. One of the primary benefits of real estate investment through bill auctions is the potential for competitive bidding. Auctions attract a diverse pool of interested buyers, including experienced investors and individuals seeking investment opportunities. The competitive environment can drive up the final sale price, potentially leading to a higher return on investment for sellers and creating opportunities for investors to secure properties at favorable prices. Bill auctions provide investors with access to a diverse range of properties that may not be available through traditional purchase methods. These properties can include residential homes, commercial buildings, vacant land, and distressed properties. The variety of options allows investors to explore different investment strategies and diversify their portfolios by acquiring properties in various locations and sectors. Bill auctions offer an efficient and transparent transaction process. The auction format establishes a specific timeline for the sale, providing clarity for buyers and sellers. The bidding process is conducted openly, allowing participants to see the offers made by others. This transparency enhances the credibility of the transaction and helps ensure fair and equitable outcomes. Additionally, the auction process can expedite the sale, allowing investors to quickly complete the purchase and take possession of the property. One of the risks associated with bill auctions is the possibility of overpaying for properties. The competitive nature of the bidding process can sometimes lead to inflated prices, especially when multiple interested parties are vying for the same property. Investors must carefully evaluate the property's value and set a maximum bid amount that aligns with their investment goals to avoid overpaying and potentially eroding their potential returns. Bill auctions typically have a limited timeframe for due diligence, meaning investors must assess the property's condition, market value, and potential risks within a compressed period. This time constraint can pose challenges for thorough evaluation, especially for complex properties or those with hidden issues. Investors need to conduct comprehensive research, review available property information, and consider obtaining professional assistance to make informed investment decisions within the given timeframe. Bill auctions attract experienced investors who are well-versed in the auction process and have a keen eye for investment opportunities. This heightened competition can make it challenging for novice investors or those with limited experience to secure desirable properties. It is essential for investors to develop effective bidding strategies, conduct thorough research, and be prepared to compete with experienced bidders to increase their chances of success. Conducting thorough research and evaluation of the property is crucial before participating in a bill auction. Investors should assess the property's location, market value, potential for rental income or resale, and any associated risks or limitations. Understanding the property's condition, legal status, and potential for value appreciation will help investors make informed bidding decisions. Establishing a budget and investment criteria is essential to guide investors in setting their bidding limits. Determining the maximum bid amount, considering potential renovation or repair costs, and factoring in projected returns will help investors stay within their financial limits and align their investment strategy with their goals. Developing a well-thought-out bidding strategy is crucial in bill auctions. Investors should carefully analyze the market conditions, assess the competition, and determine their desired outcome. Strategies can include bidding aggressively to secure the property quickly or bidding strategically by entering the bidding process at different stages to gauge the competition and adjust the bid accordingly. Before participating in a bill auction, it is essential to thoroughly understand the terms and conditions set by the auction organizer. These may include registration requirements, bidding increments, deposit amounts, and any additional fees or obligations. Being familiar with these terms will help investors navigate the auction process smoothly. Evaluating the property's value and potential is crucial in determining its suitability for investment. Investors should review available property information, such as appraisals, inspections, and disclosures, if provided. Conducting independent assessments and seeking professional advice can help investors gain a comprehensive understanding of the property's value and potential returns. Investors should assess their financial capabilities, explore pre-approval or financing options, and ensure they have the necessary funds or financing in place to complete the purchase within the required timeframe. Understanding the financing requirements and ensuring financial readiness will contribute to a smooth and successful transaction. A bill auction refers to the sale of real estate properties through an auction format, where interested buyers bid on the properties to determine the final sale price. It is an important method in the real estate industry as it allows for a fair and efficient transaction process, providing benefits for both buyers and sellers. There are several types of bill auctions, including absolute auctions, minimum bid auctions, and reserve auctions. Incorporating bill auctions into investment strategies can offer unique advantages for real estate investors. These auctions provide opportunities for competitive bidding and offer access to a diverse range of properties. Bill auctions carry risks of competitive bidding and limited availability. In order to mitigate these risks, investors can set maximum bid prices, diversify bids, and monitor market conditions closely.What Is a Bill Auction?

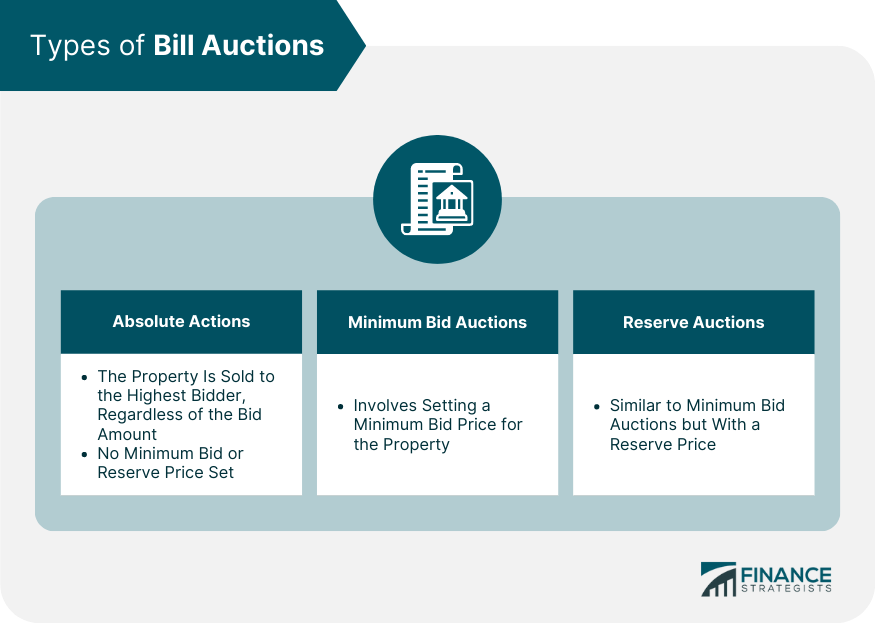

Types of Bill Auctions

Absolute Auctions

Minimum Bid Auctions

Reserve Auctions

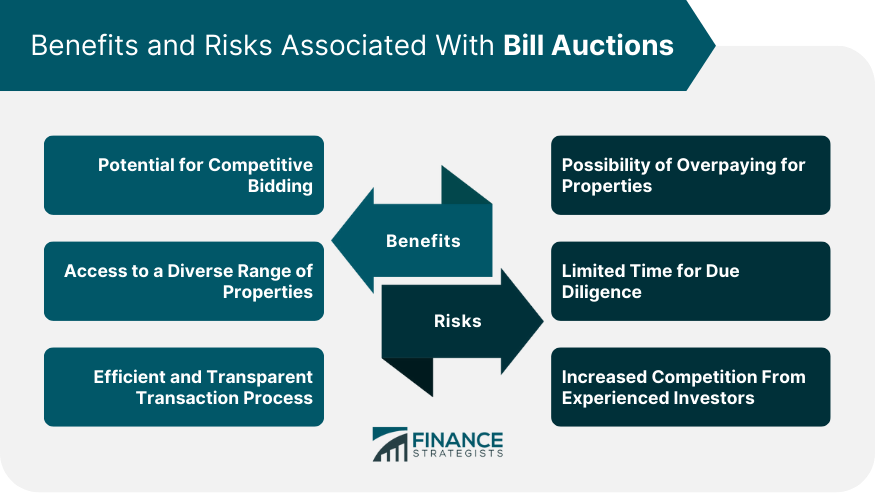

Benefits of Real Estate Investment Through Bill Auctions

Potential for Competitive Bidding

Access to a Diverse Range of Properties

Efficient and Transparent Transaction Process

Risks Associated With Bill Auctions

Possibility of Overpaying for Properties

Limited Time for Due Diligence

Increased Competition From Experienced Investors

Strategies for Successful Real Estate Investment in Bill Auctions

Thorough Property Research and Evaluation

Establishing a Budget and Investment Criteria

Developing a Bidding Strategy

Key Considerations for Participating in Bill Auctions

Understanding the Terms and Conditions

Assessing the Property's Value and Potential

Evaluating Financing Options

Conclusion

Bill Auction FAQs

Bill auctions in real estate investment involve the sale of properties through a bidding process. Interested buyers participate in the auction by submitting their bids, and the highest bidder wins the property. The auction can have different formats, such as absolute auctions, minimum bid auctions, or reserve auctions, each with its own rules and conditions.

No, bill auctions are open to all types of investors, including both experienced and novice investors. While experienced investors may have more familiarity with the auction process and strategies, newcomers can also participate and benefit from bill auctions by conducting thorough research, setting a budget, and developing a strategic bidding plan.

Assessing the value of a property before participating in a bill auction is essential for making informed bidding decisions. Investors can conduct a property appraisal, review market data and comparable sales, analyze the property's condition and potential for rental income or resale, and seek professional advice to gain a comprehensive understanding of its value.

If you win the bid in a bill auction, you become the buyer of the property. You will be required to fulfill the financial obligations, such as paying the purchase price and any applicable fees. It is important to carefully review the terms and conditions of the auction to understand the specific requirements and timeline for completing the purchase.

Yes, financing options are available for purchasing properties acquired through bill auctions. Investors can explore traditional mortgage financing or alternative financing methods, depending on their financial situation and the property's eligibility. It is advisable to pre-arrange financing or secure a pre-approval before participating in the auction to ensure a smooth and timely transaction.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.