A Targeted Accrual Redemption Note is a structured financial product that combines features of both an accrual note and a redemption note. It is designed to provide investors with a predetermined fixed income while offering the possibility of early redemption. The TARN's coupon payments are based on an accrual mechanism that calculates interest based on a reference rate, such as LIBOR, and predetermined coupon levels. If the reference rate stays within specified target ranges, the TARN continues to pay coupons until maturity. However, if the reference rate breaches these target ranges, the TARN is redeemed early. TARNs offer investors a balance between fixed income and the potential for early redemption based on specific market conditions. In a TARN transaction, the issuer is typically a financial institution that creates the note to sell to investors. The investor, in return, receives coupon payments from the issuer based on the performance of an underlying asset until the accrued coupons reach a specified target level. This is the principal amount the TARN's potential returns are calculated. The notional amount does not change over the life of the TARN. The coupon rate represents the potential return on the TARN. The actual coupon payments can vary based on the performance of the underlying asset. The accrual period is the time frame during which coupon payments are accumulated. Once the accumulated coupons reach the target level, the TARN is redeemed. This is a pre-determined level of the underlying asset's price. If the price falls below the barrier level, it may affect the accrual of coupon payments. This is a pre-set level at which the TARN is automatically redeemed, regardless of whether the target level of accrued coupons has been reached. Unlike traditional notes, TARNs offer a potentially higher return in exchange for greater risk. Their payoff structure is linked to the performance of an underlying asset, introducing elements of market risk that are not present in traditional fixed-income securities. A TARN begins with the issuer determining the note's parameters, including the notional amount, coupon rate, accrual period, barrier level, and knock-out level. The investor then purchases the TARN, which begins accruing coupon payments based on the performance of the underlying asset. If the asset's price remains above the barrier level, coupon payments continue to accrue until they reach the target level, at which point the TARN is redeemed. If the asset's price reaches the knock-out level, the TARN is redeemed immediately. A TARN's life cycle can be divided into three stages. The first is issuance, where the issuer creates the note and sells it to investors. The second is accrual, during which coupon payments are accumulated based on the performance of the underlying asset. The final stage is redemption, where the TARN is redeemed when the accrued coupons reach the target level or the underlying asset's price hits the knock-out level. In a regular scenario, the underlying asset's price remains above the barrier level, allowing the TARN to accrue coupons until they reach the target level, leading to redemption. In an early redemption scenario, the issuer may redeem the TARN before the target level is reached, usually under specified conditions outlined in the TARN's terms. In a knock-out scenario, the underlying asset's price hits the knock-out level, leading to the immediate redemption of the TARN, regardless of the accrued coupon payments. The valuation of a TARN is influenced by multiple factors, including the price of the underlying asset, market volatility, interest rates, and the specific terms of the TARN, such as the coupon rate, barrier level, and knock-out level. Interest rates play a crucial role in the valuation of TARNs. As the value of future coupon payments depends on the current interest rate, a rise in interest rates could decrease the present value of these payments, thereby reducing TARN's value. Volatility also significantly impacts the value of a TARN. Greater volatility in the price of the underlying asset increases the likelihood that the price will hit the barrier or knock-out level, which affects the expected return and, thus, the TARN's value. The current price and expected future price movements of the underlying asset are fundamental to a TARN's valuation. If the asset's price is expected to remain above the barrier level, the TARN's value will likely be higher, given the potential for accruing more coupon payments. Valuing a TARN involves complex mathematical models and techniques, including options pricing models and stochastic calculus. These methods incorporate factors such as the underlying asset's price, volatility, and interest rates to determine the present value of future coupon payments and the likelihood of hitting the barrier or knock-out level. Market risk refers to potential losses due to fluctuations in the price of the underlying asset. If the asset's price falls below the barrier level or hits the knock-out level, it can lead to lower returns or early redemption. Credit risk arises from the possibility that the issuer might default on its obligations. If the issuer becomes insolvent, it may be unable to make the promised coupon payments or redeem the TARN. Liquidity risk is the risk of not being able to sell the TARN without impacting its price significantly. TARNs are often less liquid than traditional securities, making them harder to sell quickly, especially in volatile markets. Knock-out risk is the risk of the TARN being redeemed early if the underlying asset's price hits the knock-out level. This could lead to lower-than-expected returns for the investor. Investors can manage these risks through diversification, investing only a portion of their portfolio in TARNs and conducting thorough due diligence on the issuer. Additionally, investors can use hedging strategies, such as buying options, to protect against potential losses. TARNs can add diversification to an investment portfolio due to their unique risk-return profile. The performance of a TARN is based on the underlying asset, which can be unrelated to other investments in the portfolio, providing a potential diversification benefit. TARNs can also be used as a hedging instrument. For instance, an investor with a long position in the underlying asset could use a TARN to hedge against potential price declines. If the asset's price falls, the TARN may still accumulate coupon payments, offsetting some of the losses from the asset's price decline. TARNs is often used in structured products, financial instruments designed to provide tailored risk-return characteristics. These products can combine a TARN with other financial instruments, such as bonds or options, to create a unique payoff structure that meets the specific needs of an investor. TARN transactions are typically overseen by financial regulatory bodies such as the Securities and Exchange Commission (SEC) in the United States, the Financial Conduct Authority (FCA) in the United Kingdom, and other similar entities worldwide. These organizations ensure transparency and fairness in the trading of TARNs and protect investors from potential fraud. TARNs are subject to various laws and regulations that govern securities transactions. These may include disclosure requirements, rules on fair trading, and regulations on the marketing of investment products. Issuers and investors must consider various legal factors when dealing with TARNs. For issuers, these may include compliance with disclosure requirements and other regulatory rules. For investors, understanding the terms of the TARN, including the rights and obligations it confers, is crucial to avoid potential legal pitfalls. Targeted Accrual Redemption Notes (TARNs) are hybrid financial products that combine features of accrual and redemption notes. They offer a fixed income with the potential for early redemption based on market conditions. TARNs have key components such as the notional amount, coupon rate, accrual period, barrier level, and knock-out level. The valuation of TARNs is influenced by factors like the underlying asset's price, volatility, and interest rates. Risks associated with TARNs include market, credit, liquidity, and knock-out risks. TARNs find application in diversifying investment portfolios, hedging against price declines, and structured products. The regulatory environment and legal considerations governing TARNs involve regulatory bodies, laws, and regulations that ensure transparency and protect investors. Investors can manage risks through diversification and hedging strategies.What Is a Targeted Accrual Redemption Note (TARN)?

Structure of a Targeted Accrual Redemption Note

Role of the Investor and the Issuer in TARN

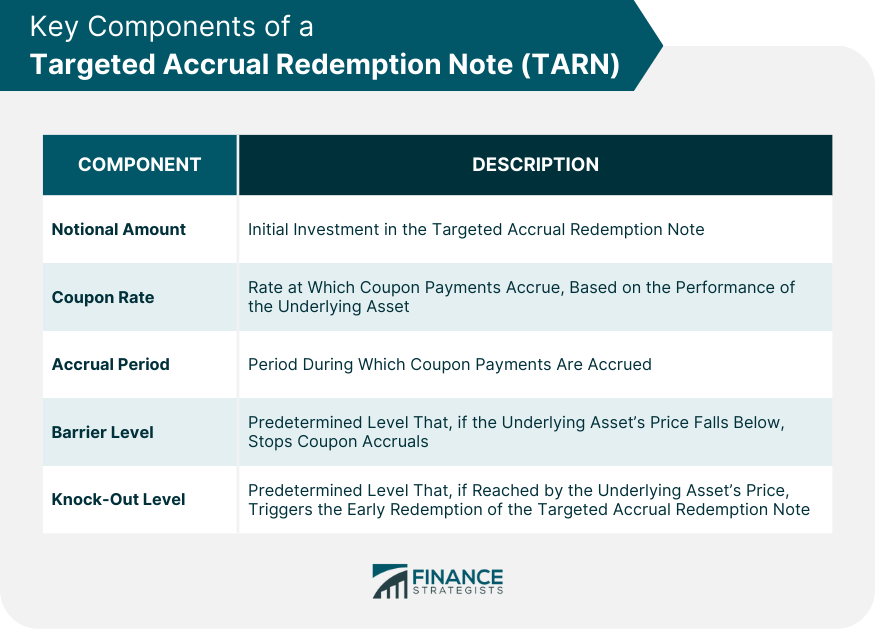

Key Components of a TARN

Notional Principal Amount

Coupon Rate

Accrual Period

Barrier Level

Knock-Out Level

How TARN Is Different From Traditional Notes

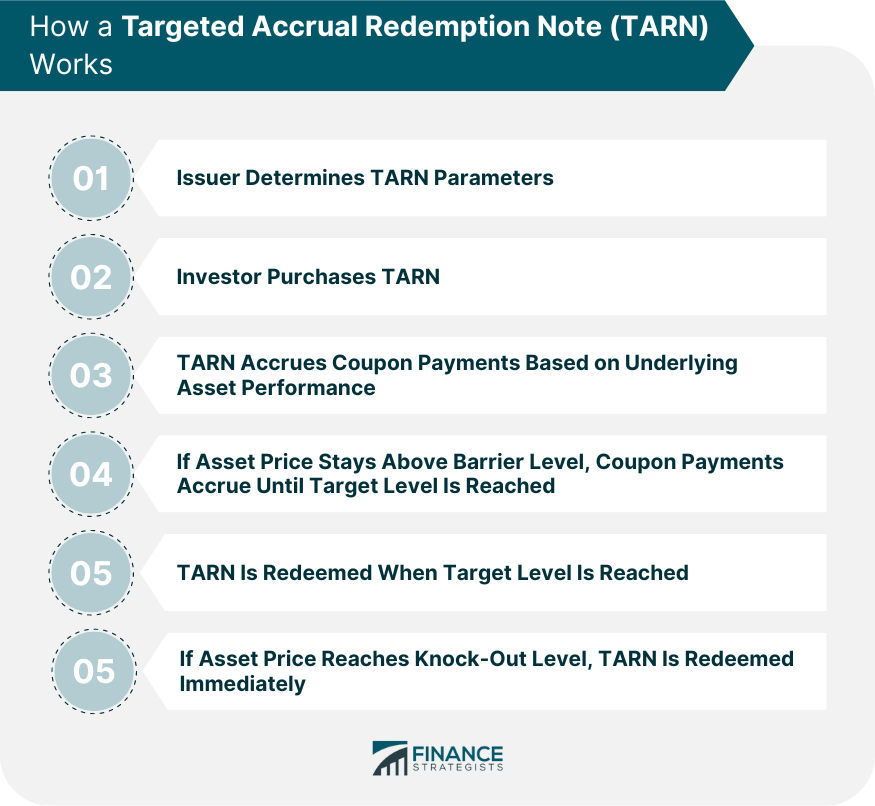

Understanding the Mechanics of a Targeted Accrual Redemption Note

How a TARN Works

Life Cycle of a TARN

Examples of TARN Scenarios

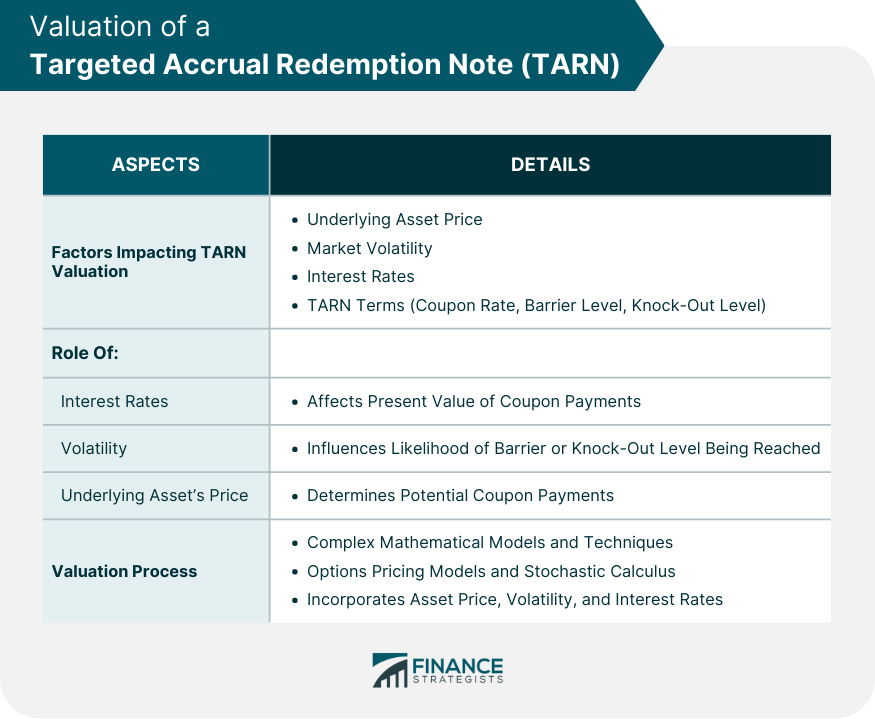

Valuation of a Targeted Accrual Redemption Note

Factors That Impact the Valuation of TARN

Role of Interest Rates

Role of Volatility

Role of the Underlying Asset's Price

Process of Valuing a TARN

Risks Associated With Targeted Accrual Redemption Note

Market Risk

Credit Risk

Liquidity Risk

Knock-Out Risk

How Investors Can Manage These Risks

Applications of Targeted Accrual Redemption Note (TARN) in Financial Markets

Role of TARN in Diversifying Investment Portfolios

How TARN Can Be Used for Hedging Purposes

Use of TARN in Structured Products

Regulatory Environment and Legal Considerations for Targeted Accrual Redemption Note (TARN)

Regulatory Bodies Overseeing Transactions

Key Laws and Regulations Impacting TARN

Legal Considerations for Issuers and Investors

Conclusion

Targeted Accrual Redemption Note (TARN) FAQs

A TARN is a type of structured product that offers potentially higher returns in exchange for greater risk. It accrues coupon payments based on the performance of an underlying asset until a predetermined target level is reached, at which point the note is redeemed.

The price of the underlying asset, market volatility, interest rates, and the specific parameters of the TARN, such as the coupon rate, barrier level, and knock-out level, influence the valuation of a TARN.

The main risks associated with investing in a TARN are market risk, credit risk, liquidity risk, and knock-out risk. Market risk arises from fluctuations in the price of the underlying asset, credit risk from the possibility of the issuer defaulting, liquidity risk from potential difficulty in selling the TARN, and knock-out risk from the TARN being redeemed early if the underlying asset's price hits the knock-out level.

TARNs can be used to diversify investment portfolios due to their unique risk-return profile. They can also be used as a hedging instrument against potential price declines in the underlying asset. Furthermore, TARNs are often used in structured products to create unique payoff structures that meet specific investor needs.

The TARN market is expected to grow as investors seek higher yields in a low-interest-rate environment. Technological advancements, such as AI and machine learning, could enhance the valuation and risk assessment of TARNs, making them more accessible to a wider range of investors. However, potential challenges include regulatory changes and market volatility.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.